Us Inflation In January Still Above Forecast

US Inflation In January Still Above Forecast

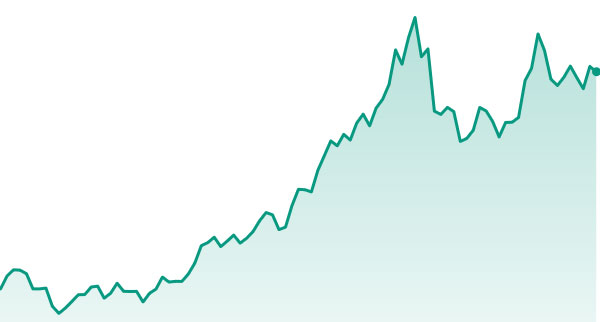

We finally have the CPI data for January 2023, and it seems that inflation is still above the forecasts. However, the growth rate of inflation has slowed down a little bit during January, but it is still high.

And after the recent CPI readings, it seems that the Fed still has a lot of work to do to tame inflation in the country.

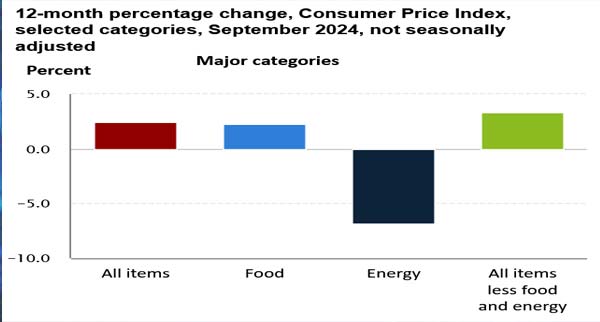

CPI Reading Was 6.4% In January

According to the data from the labor department, the CPI reading was 6.4% in January. When compared with a reading of 6.5% last month (December), it seems that inflation has indeed slowed down.

Overall, this marks the 7th month of deceleration in inflation, but the current reading of 6.4% was still higher than the expected value of 6.2%.

In other words, inflation is slowing down, but its pace is not what the market was expecting it to be... As a result, we might have to wait for more time before we can see any rate cuts from the Fed!

If we look at the yearly core inflation data, it is around 5.6%, which is a 0.1% reduction from the earlier reading of 5.7%. However, even that was higher than the market's expectations of 5.5%!

As far as Fed officials are concerned, core inflation provides a very accurate assessment of the current inflation situation in the country.

And if we look at inflation on a monthly basis, an increase of 0.5% was witnessed, which is similar to the market expectations.

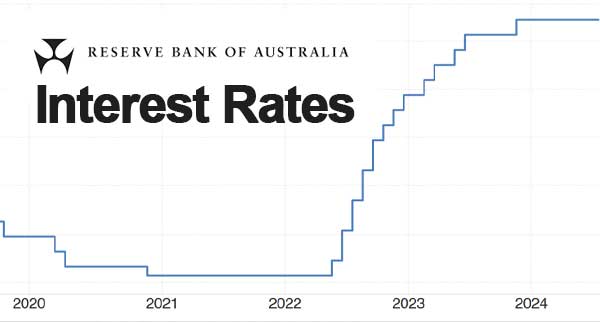

So far, the Fed is on an aggressive path where the interest rate was raised from a near-zero value to around 4.75% in a short span of time. And the sole reason behind this action by the Fed is to control the rising prices of different items.

However, the current readings have made it clear that inflation has peaked and is now on its way down. But the question still remains on how long the Fed will keep the rates at high levels. And more importantly, how long we will have to wait to see the first rate cut?

Trending Stories

-

Best Chip Stock For Long Term

Feb 22 2026

By Andrew Blumer

Best Chip Stock For Long Term

Feb 22 2026

By Andrew Blumer

-

Best Ev Stocks

Feb 22 2026

By Ashly Chole

Best Ev Stocks

Feb 22 2026

By Ashly Chole

-

Bt Shares Are Undervalued

Feb 21 2026

By Emily Clark

Bt Shares Are Undervalued

Feb 21 2026

By Emily Clark

-

Aston Marin Share Price Analysis

Feb 21 2026

By Andrew Blumer

Aston Marin Share Price Analysis

Feb 21 2026

By Andrew Blumer

-

Apple Stock Is Under Pressure

Feb 20 2026

By Adam Rosen

Apple Stock Is Under Pressure

Feb 20 2026

By Adam Rosen

-

Applied Digital Stock Worth Buying

Feb 20 2026

By Adam Rosen

Applied Digital Stock Worth Buying

Feb 20 2026

By Adam Rosen

-

Amd Stock To Remain Bullish

Feb 19 2026

By Andrew Blumer

Amd Stock To Remain Bullish

Feb 19 2026

By Andrew Blumer

-

Adobe Cheap Growth Stock

Feb 19 2026

By Andrew Blumer

Adobe Cheap Growth Stock

Feb 19 2026

By Andrew Blumer

-

A Cheap Ftse Stock

Feb 18 2026

By Adam Rosen

A Cheap Ftse Stock

Feb 18 2026

By Adam Rosen

-

Ai Stocks Owned By Peter Thiel

Feb 18 2026

By Andrew Blumer

Ai Stocks Owned By Peter Thiel

Feb 18 2026

By Andrew Blumer

-

Will Us Market Crash This Year

Feb 12 2026

By Andrew Blumer

Will Us Market Crash This Year

Feb 12 2026

By Andrew Blumer

-

Xrp Forecast For Year End

Feb 12 2026

By Ashly Chole

Xrp Forecast For Year End

Feb 12 2026

By Ashly Chole

-

Usdzar Forecast Natixis

Feb 11 2026

By Ashly Chole

Usdzar Forecast Natixis

Feb 11 2026

By Ashly Chole

-

Two Hypergrowth Tech Stocks

Feb 11 2026

By Andrew Blumer

Two Hypergrowth Tech Stocks

Feb 11 2026

By Andrew Blumer

-

Tesla Stock Forecast

Feb 10 2026

By Andrew Blumer

Tesla Stock Forecast

Feb 10 2026

By Andrew Blumer

-

Two Cheap Us Stocks

Feb 10 2026

By Andrew Blumer

Two Cheap Us Stocks

Feb 10 2026

By Andrew Blumer

-

Silver And Gold Forecast Ubs

Feb 09 2026

By Adam Rosen

Silver And Gold Forecast Ubs

Feb 09 2026

By Adam Rosen

-

Tesco Share Price Analysis

Feb 09 2026

By Andrew Blumer

Tesco Share Price Analysis

Feb 09 2026

By Andrew Blumer

-

Should You Buy Dogecoin

Feb 08 2026

By Emily Clark

Should You Buy Dogecoin

Feb 08 2026

By Emily Clark

-

Should You Buy Nextpower Stock

Feb 08 2026

By Emily Clark

Should You Buy Nextpower Stock

Feb 08 2026

By Emily Clark

-

Shield Therapeutics Stock

Feb 07 2026

By Andrew Blumer

Shield Therapeutics Stock

Feb 07 2026

By Andrew Blumer

-

Rolls Royce Share Forecast

Feb 07 2026

By Andrew Blumer

Rolls Royce Share Forecast

Feb 07 2026

By Andrew Blumer

-

Reasons To Buy Ibm Stock

Feb 06 2026

By Adam Rosen

Reasons To Buy Ibm Stock

Feb 06 2026

By Adam Rosen

-

Reasons For Buying Microsoft Stock

Feb 06 2026

By Adam Rosen

Reasons For Buying Microsoft Stock

Feb 06 2026

By Adam Rosen

-

Oil Price Will Decline Rabobank

Feb 05 2026

By Andrew Blumer

Oil Price Will Decline Rabobank

Feb 05 2026

By Andrew Blumer

-

Predictions For Stock Market

Feb 05 2026

By Ashly Chole

Predictions For Stock Market

Feb 05 2026

By Ashly Chole

-

Is Oklo Stock A Buy

Feb 04 2026

By Andrew Blumer

Is Oklo Stock A Buy

Feb 04 2026

By Andrew Blumer

-

Ocado Share Price Is Down

Feb 04 2026

By Adam Rosen

Ocado Share Price Is Down

Feb 04 2026

By Adam Rosen

-

Is Apple Stock Worth Buying

Feb 03 2026

By Emily Clark

Is Apple Stock Worth Buying

Feb 03 2026

By Emily Clark

-

Ionq Stock Is Expensive

Feb 03 2026

By Emily Clark

Ionq Stock Is Expensive

Feb 03 2026

By Emily Clark

-

Hsbc Silver Price Foreast

Feb 02 2026

By Adam Rosen

Hsbc Silver Price Foreast

Feb 02 2026

By Adam Rosen

-

Home Depot Vs Costco

Feb 02 2026

By Emily Clark

Home Depot Vs Costco

Feb 02 2026

By Emily Clark

-

Gold Forecast Westpac

Feb 01 2026

By Andrew Blumer

Gold Forecast Westpac

Feb 01 2026

By Andrew Blumer

-

Greggs Share Price Will Recover

Feb 01 2026

By Ashly Chole

Greggs Share Price Will Recover

Feb 01 2026

By Ashly Chole

-

Gbpusd Will Move Lower Uob

Jan 31 2026

By Ashly Chole

Gbpusd Will Move Lower Uob

Jan 31 2026

By Ashly Chole

-

Ftse Shares And Commodities Boom

Jan 31 2026

By Ashly Chole

Ftse Shares And Commodities Boom

Jan 31 2026

By Ashly Chole

-

Eurusd Can Drop Citigroup

Jan 30 2026

By Andrew Blumer

Eurusd Can Drop Citigroup

Jan 30 2026

By Andrew Blumer

-

Eurusd To Reach Higher Danske

Jan 30 2026

By Andrew Blumer

Eurusd To Reach Higher Danske

Jan 30 2026

By Andrew Blumer

-

Coca Cola Vs Uber Stock

Jan 29 2026

By Adam Rosen

Coca Cola Vs Uber Stock

Jan 29 2026

By Adam Rosen

-

Costco Share Price Forecast

Jan 29 2026

By Emily Clark

Costco Share Price Forecast

Jan 29 2026

By Emily Clark

-

Carnival Stock Forecast 2026

Jan 28 2026

By Emily Clark

Carnival Stock Forecast 2026

Jan 28 2026

By Emily Clark

-

Cheap Stock Can Double This Year

Jan 28 2026

By Ashly Chole

Cheap Stock Can Double This Year

Jan 28 2026

By Ashly Chole

-

Can Ford Stock Make You Rich

Jan 27 2026

By Ashly Chole

Can Ford Stock Make You Rich

Jan 27 2026

By Ashly Chole

-

Can Ups Stock Outperform Market

Jan 27 2026

By Adam Rosen

Can Ups Stock Outperform Market

Jan 27 2026

By Adam Rosen

-

Buy Bae Systems Shares

Jan 26 2026

By Emily Clark

Buy Bae Systems Shares

Jan 26 2026

By Emily Clark

-

Bitcoin Worth In Next Five Years

Jan 26 2026

By Andrew Blumer

Bitcoin Worth In Next Five Years

Jan 26 2026

By Andrew Blumer

-

Best Tech Stocks For Long Term

Jan 25 2026

By Adam Rosen

Best Tech Stocks For Long Term

Jan 25 2026

By Adam Rosen

-

Bitcoin Forecast For Three Years

Jan 25 2026

By Ashly Chole

Bitcoin Forecast For Three Years

Jan 25 2026

By Ashly Chole

-

Best Space Stock To Buy

Jan 24 2026

By Adam Rosen

Best Space Stock To Buy

Jan 24 2026

By Adam Rosen

-

Best Hydrogen Stock To Buy

Jan 24 2026

By Ashly Chole

Best Hydrogen Stock To Buy

Jan 24 2026

By Ashly Chole

-

Best Growth Stock

Jan 23 2026

By Andrew Blumer

Best Growth Stock

Jan 23 2026

By Andrew Blumer

-

Best Chip Stock To Buy

Jan 23 2026

By Emily Clark

Best Chip Stock To Buy

Jan 23 2026

By Emily Clark

-

Best Ai Stocks

Jan 22 2026

By Andrew Blumer

Best Ai Stocks

Jan 22 2026

By Andrew Blumer

-

Alphabet Stock Forecast

Jan 22 2026

By Adam Rosen

Alphabet Stock Forecast

Jan 22 2026

By Adam Rosen

-

Ai Stocks 2026

Jan 21 2026

By Ashly Chole

Ai Stocks 2026

Jan 21 2026

By Ashly Chole

-

Adobe Stock Has Potential

Jan 21 2026

By Ashly Chole

Adobe Stock Has Potential

Jan 21 2026

By Ashly Chole

-

Xrp Vs Dogecoin

Jan 12 2026

By Andrew Blumer

Xrp Vs Dogecoin

Jan 12 2026

By Andrew Blumer

-

Xrp Will Drop

Jan 12 2026

By Ashly Chole

Xrp Will Drop

Jan 12 2026

By Ashly Chole

-

What Next For Palantir Stock

Jan 11 2026

By Ashly Chole

What Next For Palantir Stock

Jan 11 2026

By Ashly Chole

-

Why National Grid Shares Are Up

Jan 11 2026

By Ashly Chole

Why National Grid Shares Are Up

Jan 11 2026

By Ashly Chole

-

Walmart Will Outperform Tesla

Jan 10 2026

By Emily Clark

Walmart Will Outperform Tesla

Jan 10 2026

By Emily Clark

-

Walmart Vs Coca Cola Stock

Jan 10 2026

By Andrew Blumer

Walmart Vs Coca Cola Stock

Jan 10 2026

By Andrew Blumer

-

Us Stock Market Crash

Jan 09 2026

By Emily Clark

Us Stock Market Crash

Jan 09 2026

By Emily Clark

-

Walmart Stock Forecast

Jan 09 2026

By Emily Clark

Walmart Stock Forecast

Jan 09 2026

By Emily Clark

-

Unstoppable Growth Stock

Jan 08 2026

By Andrew Blumer

Unstoppable Growth Stock

Jan 08 2026

By Andrew Blumer

-

Unilever Stock Forecast

Jan 08 2026

By Ashly Chole

Unilever Stock Forecast

Jan 08 2026

By Ashly Chole

-

Undervalued Pharma Stock

Jan 07 2026

By Adam Rosen

Undervalued Pharma Stock

Jan 07 2026

By Adam Rosen

-

Two Best Ai Stocks

Jan 07 2026

By Ashly Chole

Two Best Ai Stocks

Jan 07 2026

By Ashly Chole

-

Top Quantum Computing Stocks

Jan 06 2026

By Ashly Chole

Top Quantum Computing Stocks

Jan 06 2026

By Ashly Chole

-

Tsmc Best Ai Stock

Jan 06 2026

By Ashly Chole

Tsmc Best Ai Stock

Jan 06 2026

By Ashly Chole

-

The Best Defensive Stock

Jan 05 2026

By Ashly Chole

The Best Defensive Stock

Jan 05 2026

By Ashly Chole

-

This Penny Stock Could Rise

Jan 05 2026

By Adam Rosen

This Penny Stock Could Rise

Jan 05 2026

By Adam Rosen

-

Tesco Shares Are Worth Buying

Jan 04 2026

By Emily Clark

Tesco Shares Are Worth Buying

Jan 04 2026

By Emily Clark

-

Tesco Shares Worth Buying

Jan 04 2026

By Ashly Chole

Tesco Shares Worth Buying

Jan 04 2026

By Ashly Chole

-

Strategy Stock In Trouble

Jan 03 2026

By Emily Clark

Strategy Stock In Trouble

Jan 03 2026

By Emily Clark

-

Stocks With Strong Upside Potential

Jan 03 2026

By Adam Rosen

Stocks With Strong Upside Potential

Jan 03 2026

By Adam Rosen

-

Smci Stock Forecast

Jan 02 2026

By Ashly Chole

Smci Stock Forecast

Jan 02 2026

By Ashly Chole

-

Silver Stocks At Record Lows

Jan 02 2026

By Adam Rosen

Silver Stocks At Record Lows

Jan 02 2026

By Adam Rosen

-

Should You Hold Airbnb Stock

Jan 01 2026

By Adam Rosen

Should You Hold Airbnb Stock

Jan 01 2026

By Adam Rosen

-

Silver Forecast For Year Ubs

Jan 01 2026

By Emily Clark

Silver Forecast For Year Ubs

Jan 01 2026

By Emily Clark

-

Should You Buy Tesla Stock

Dec 31 2025

By Adam Rosen

Should You Buy Tesla Stock

Dec 31 2025

By Adam Rosen

-

Should You Buy Nio Stock

Dec 31 2025

By Ashly Chole

Should You Buy Nio Stock

Dec 31 2025

By Ashly Chole

-

Should You Buy Ionq Stock

Dec 30 2025

By Andrew Blumer

Should You Buy Ionq Stock

Dec 30 2025

By Andrew Blumer

-

Should You Buy Meta Stock

Dec 30 2025

By Ashly Chole

Should You Buy Meta Stock

Dec 30 2025

By Ashly Chole

-

Should You Buy Expensive Stocks

Dec 29 2025

By Ashly Chole

Should You Buy Expensive Stocks

Dec 29 2025

By Ashly Chole

-

Should You Buy Btc Or Not

Dec 29 2025

By Emily Clark

Should You Buy Btc Or Not

Dec 29 2025

By Emily Clark

-

Rolls Royce Stock Faces Threats

Dec 28 2025

By Adam Rosen

Rolls Royce Stock Faces Threats

Dec 28 2025

By Adam Rosen

-

Rolls Royce Shares Price Jumped

Dec 28 2025

By Andrew Blumer

Rolls Royce Shares Price Jumped

Dec 28 2025

By Andrew Blumer

-

Robinhood Stock Analysis

Dec 27 2025

By Adam Rosen

Robinhood Stock Analysis

Dec 27 2025

By Adam Rosen

-

Raspberry Pi Stock Analysis

Dec 27 2025

By Emily Clark

Raspberry Pi Stock Analysis

Dec 27 2025

By Emily Clark

-

Ocado Share Price At Record Lows

Dec 26 2025

By Emily Clark

Ocado Share Price At Record Lows

Dec 26 2025

By Emily Clark

-

Pfizer Stock Forecast For Long Term

Dec 26 2025

By Ashly Chole

Pfizer Stock Forecast For Long Term

Dec 26 2025

By Ashly Chole

-

Nvidia Stock Forecast

Dec 25 2025

By Ashly Chole

Nvidia Stock Forecast

Dec 25 2025

By Ashly Chole

-

Nvidia Share Price

Dec 25 2025

By Adam Rosen

Nvidia Share Price

Dec 25 2025

By Adam Rosen

-

Nebius Stock Gained Upside

Dec 24 2025

By Emily Clark

Nebius Stock Gained Upside

Dec 24 2025

By Emily Clark

-

Natixis Bullish Eurusd Forecast

Dec 24 2025

By Adam Rosen

Natixis Bullish Eurusd Forecast

Dec 24 2025

By Adam Rosen

-

Must Buy Ai Stocks

Dec 23 2025

By Ashly Chole

Must Buy Ai Stocks

Dec 23 2025

By Ashly Chole

-

Micron Technology Stock Forecast

Dec 23 2025

By Andrew Blumer

Micron Technology Stock Forecast

Dec 23 2025

By Andrew Blumer

-

Meta Platforms Stock Is Bearish

Dec 22 2025

By Ashly Chole

Meta Platforms Stock Is Bearish

Dec 22 2025

By Ashly Chole

-

Major Stock Market Crash

Dec 22 2025

By Andrew Blumer

Major Stock Market Crash

Dec 22 2025

By Andrew Blumer

-

Is Nvidia Stock Undervalued

Dec 21 2025

By Emily Clark

Is Nvidia Stock Undervalued

Dec 21 2025

By Emily Clark

-

Is Asml Stock A Buy

Dec 21 2025

By Ashly Chole

Is Asml Stock A Buy

Dec 21 2025

By Ashly Chole

-

Home Depot Stock Forecast

Dec 20 2025

By Adam Rosen

Home Depot Stock Forecast

Dec 20 2025

By Adam Rosen

-

Goldman Sachs Gbpeur Bearish

Dec 20 2025

By Andrew Blumer

Goldman Sachs Gbpeur Bearish

Dec 20 2025

By Andrew Blumer

-

Gold Forecast Morgan Stanley

Dec 19 2025

By Adam Rosen

Gold Forecast Morgan Stanley

Dec 19 2025

By Adam Rosen

-

Gold And Copper To Trend Higher

Dec 19 2025

By Ashly Chole

Gold And Copper To Trend Higher

Dec 19 2025

By Ashly Chole

-

Gbpeur Forecast End 2026 Jp Morgan

Dec 18 2025

By Ashly Chole

Gbpeur Forecast End 2026 Jp Morgan

Dec 18 2025

By Ashly Chole

-

Ethereum Will Reach 9k

Dec 18 2025

By Ashly Chole

Ethereum Will Reach 9k

Dec 18 2025

By Ashly Chole

-

D Wave Quantum A Buy Or Not

Dec 17 2025

By Adam Rosen

D Wave Quantum A Buy Or Not

Dec 17 2025

By Adam Rosen

-

Eli Lilly Stock Valuation Forecast

Dec 17 2025

By Emily Clark

Eli Lilly Stock Valuation Forecast

Dec 17 2025

By Emily Clark

-

Can Game Workshop Stock Rise

Dec 16 2025

By Andrew Blumer

Can Game Workshop Stock Rise

Dec 16 2025

By Andrew Blumer

-

Cheap Uk Stock That Is Undervalued

Dec 16 2025

By Emily Clark

Cheap Uk Stock That Is Undervalued

Dec 16 2025

By Emily Clark

-

Can Bitcoin Recover

Dec 15 2025

By Adam Rosen

Can Bitcoin Recover

Dec 15 2025

By Adam Rosen

-

Brent Crude Oil Forecast Anz

Dec 15 2025

By Adam Rosen

Brent Crude Oil Forecast Anz

Dec 15 2025

By Adam Rosen

-

Best Tech Stocks To Buy

Dec 14 2025

By Emily Clark

Best Tech Stocks To Buy

Dec 14 2025

By Emily Clark

-

Boa Gbpusd Forecast

Dec 14 2025

By Ashly Chole

Boa Gbpusd Forecast

Dec 14 2025

By Ashly Chole

-

Best Flying Car Stock

Dec 13 2025

By Emily Clark

Best Flying Car Stock

Dec 13 2025

By Emily Clark

-

Best Cryptocurrencies To Buy

Dec 13 2025

By Adam Rosen

Best Cryptocurrencies To Buy

Dec 13 2025

By Adam Rosen

-

Bae Systems Stock Is A Bargain

Dec 12 2025

By Adam Rosen

Bae Systems Stock Is A Bargain

Dec 12 2025

By Adam Rosen

-

Bearish Outlook For Gbp

Dec 12 2025

By Andrew Blumer

Bearish Outlook For Gbp

Dec 12 2025

By Andrew Blumer

-

Amazon Stock Analysis

Dec 11 2025

By Adam Rosen

Amazon Stock Analysis

Dec 11 2025

By Adam Rosen

-

Amd More Growth Ahead

Dec 11 2025

By Ashly Chole

Amd More Growth Ahead

Dec 11 2025

By Ashly Chole

-

Alphabet Forecast For One Year

Dec 10 2025

By Emily Clark

Alphabet Forecast For One Year

Dec 10 2025

By Emily Clark

-

Amazon Is A Better Stock

Dec 10 2025

By Adam Rosen

Amazon Is A Better Stock

Dec 10 2025

By Adam Rosen

-

Is Xrp Etf Worth Buying

Dec 09 2025

By Adam Rosen

Is Xrp Etf Worth Buying

Dec 09 2025

By Adam Rosen

-

Lng Supply Keeps Gas Prices Low

Dec 09 2025

By Emily Clark

Lng Supply Keeps Gas Prices Low

Dec 09 2025

By Emily Clark

-

Is Tesla Stock A Buy

Dec 08 2025

By Andrew Blumer

Is Tesla Stock A Buy

Dec 08 2025

By Andrew Blumer

-

Is It Time To Buy Bitcoin

Dec 08 2025

By Andrew Blumer

Is It Time To Buy Bitcoin

Dec 08 2025

By Andrew Blumer

-

Gold Demand Remains Weak

Dec 07 2025

By Ashly Chole

Gold Demand Remains Weak

Dec 07 2025

By Ashly Chole

-

Gold Forecast Natixis

Dec 07 2025

By Andrew Blumer

Gold Forecast Natixis

Dec 07 2025

By Andrew Blumer

-

Gbpusd To Reach Higher

Dec 06 2025

By Adam Rosen

Gbpusd To Reach Higher

Dec 06 2025

By Adam Rosen

-

Glencore Share Price Rally

Dec 06 2025

By Adam Rosen

Glencore Share Price Rally

Dec 06 2025

By Adam Rosen

-

Gbp To Stay Bearish Goldman

Dec 05 2025

By Ashly Chole

Gbp To Stay Bearish Goldman

Dec 05 2025

By Ashly Chole

-

Gbpeur Target Mufg

Dec 05 2025

By Ashly Chole

Gbpeur Target Mufg

Dec 05 2025

By Ashly Chole

-

Games Workshop Stock

Dec 04 2025

By Adam Rosen

Games Workshop Stock

Dec 04 2025

By Adam Rosen

-

Eurusd Forecast For One Year

Dec 04 2025

By Andrew Blumer

Eurusd Forecast For One Year

Dec 04 2025

By Andrew Blumer

-

Eth Forecast Standard Chartered

Dec 03 2025

By Adam Rosen

Eth Forecast Standard Chartered

Dec 03 2025

By Adam Rosen

-

Dogecoin Is It Worth Buying

Dec 03 2025

By Adam Rosen

Dogecoin Is It Worth Buying

Dec 03 2025

By Adam Rosen

-

Can Rolls Royce Shares Go Higher

Dec 02 2025

By Andrew Blumer

Can Rolls Royce Shares Go Higher

Dec 02 2025

By Andrew Blumer

-

Cheap Ai Shares To Buy

Dec 02 2025

By Adam Rosen

Cheap Ai Shares To Buy

Dec 02 2025

By Adam Rosen

-

Buy Nvidia Stock At The Dip

Dec 01 2025

By Emily Clark

Buy Nvidia Stock At The Dip

Dec 01 2025

By Emily Clark

-

Can Jd Sports Share Price Recover

Dec 01 2025

By Emily Clark

Can Jd Sports Share Price Recover

Dec 01 2025

By Emily Clark

-

Bt Share Forecast For One Year

Nov 30 2025

By Ashly Chole

Bt Share Forecast For One Year

Nov 30 2025

By Ashly Chole

-

Btc Or Eth Which Is Better

Nov 30 2025

By Andrew Blumer

Btc Or Eth Which Is Better

Nov 30 2025

By Andrew Blumer

-

Bitcoin To Reach 200k

Nov 29 2025

By Andrew Blumer

Bitcoin To Reach 200k

Nov 29 2025

By Andrew Blumer

-

Brent Will Decline Goldman Sachs

Nov 29 2025

By Andrew Blumer

Brent Will Decline Goldman Sachs

Nov 29 2025

By Andrew Blumer

-

Beyond Meat Stock Declines

Nov 28 2025

By Adam Rosen

Beyond Meat Stock Declines

Nov 28 2025

By Adam Rosen

-

Best Tech Stock To Buy

Nov 28 2025

By Adam Rosen

Best Tech Stock To Buy

Nov 28 2025

By Adam Rosen

-

Aston Martin Share Forecast

Nov 27 2025

By Ashly Chole

Aston Martin Share Forecast

Nov 27 2025

By Ashly Chole

-

Apple Stock Forecast For One Year

Nov 27 2025

By Emily Clark

Apple Stock Forecast For One Year

Nov 27 2025

By Emily Clark

-

Amd Stock To Move Higher

Nov 26 2025

By Adam Rosen

Amd Stock To Move Higher

Nov 26 2025

By Adam Rosen

-

Will Tesla Stock Reach New High

Nov 23 2025

By Emily Clark

Will Tesla Stock Reach New High

Nov 23 2025

By Emily Clark

-

Xrp Forecast For Next Year

Nov 23 2025

By Adam Rosen

Xrp Forecast For Next Year

Nov 23 2025

By Adam Rosen

-

Why Is Nike Stock Down

Nov 22 2025

By Emily Clark

Why Is Nike Stock Down

Nov 22 2025

By Emily Clark

-

Usdtry Forecast Ing

Nov 22 2025

By Ashly Chole

Usdtry Forecast Ing

Nov 22 2025

By Ashly Chole

-

Us Healthcare Stock With Potential

Nov 21 2025

By Adam Rosen

Us Healthcare Stock With Potential

Nov 21 2025

By Adam Rosen

-

Usdcnh To Drop Uob

Nov 21 2025

By Emily Clark

Usdcnh To Drop Uob

Nov 21 2025

By Emily Clark

-

Uk Stock Market And Rate Cuts

Nov 20 2025

By Andrew Blumer

Uk Stock Market And Rate Cuts

Nov 20 2025

By Andrew Blumer

-

Top Stocks To Buy For Medium Term

Nov 20 2025

By Adam Rosen

Top Stocks To Buy For Medium Term

Nov 20 2025

By Adam Rosen

-

Small Cap Stocks

Nov 19 2025

By Adam Rosen

Small Cap Stocks

Nov 19 2025

By Adam Rosen

-

This Tech Stock Will Rise

Nov 19 2025

By Ashly Chole

This Tech Stock Will Rise

Nov 19 2025

By Ashly Chole

-

Silver Will Be Bullish Bofa

Nov 18 2025

By Adam Rosen

Silver Will Be Bullish Bofa

Nov 18 2025

By Adam Rosen

-

Silver Stocks On The Rise

Nov 18 2025

By Andrew Blumer

Silver Stocks On The Rise

Nov 18 2025

By Andrew Blumer

-

Silver Prices Face Risks Tds

Nov 17 2025

By Andrew Blumer

Silver Prices Face Risks Tds

Nov 17 2025

By Andrew Blumer

-

Should You Buy Tesla Shares

Nov 17 2025

By Andrew Blumer

Should You Buy Tesla Shares

Nov 17 2025

By Andrew Blumer

-

Rolls Royce Stock Analysis

Nov 16 2025

By Ashly Chole

Rolls Royce Stock Analysis

Nov 16 2025

By Ashly Chole

-

Rare Earth Stocks Keep Rising

Nov 16 2025

By Adam Rosen

Rare Earth Stocks Keep Rising

Nov 16 2025

By Adam Rosen

-

Rabobank Forecast Usdcny

Nov 15 2025

By Andrew Blumer

Rabobank Forecast Usdcny

Nov 15 2025

By Andrew Blumer

-

Qualcomm Undervalued Stock

Nov 15 2025

By Adam Rosen

Qualcomm Undervalued Stock

Nov 15 2025

By Adam Rosen

-

Nvidia Stock Will Crash

Nov 14 2025

By Adam Rosen

Nvidia Stock Will Crash

Nov 14 2025

By Adam Rosen

-

Nvidia Stock Price Target Hsbc

Nov 14 2025

By Andrew Blumer

Nvidia Stock Price Target Hsbc

Nov 14 2025

By Andrew Blumer

-

Nvidia Stock In Bubble

Nov 13 2025

By Adam Rosen

Nvidia Stock In Bubble

Nov 13 2025

By Adam Rosen

-

No Need For Quarterly Rate Cuts

Nov 13 2025

By Emily Clark

No Need For Quarterly Rate Cuts

Nov 13 2025

By Emily Clark

-

Iea Warns Of Oil Glut

Nov 12 2025

By Ashly Chole

Iea Warns Of Oil Glut

Nov 12 2025

By Ashly Chole

-

Ing Bearish Forecast Gbpeur

Nov 12 2025

By Andrew Blumer

Ing Bearish Forecast Gbpeur

Nov 12 2025

By Andrew Blumer

-

Gold Will Be Bullish Jp Morgan

Nov 11 2025

By Ashly Chole

Gold Will Be Bullish Jp Morgan

Nov 11 2025

By Ashly Chole

-

Gold Rally Because Of Fomo

Nov 11 2025

By Ashly Chole

Gold Rally Because Of Fomo

Nov 11 2025

By Ashly Chole

-

Gold Prices Will Drop

Nov 10 2025

By Ashly Chole

Gold Prices Will Drop

Nov 10 2025

By Ashly Chole

-

Gbpusd Forecast Natwest

Nov 10 2025

By Adam Rosen

Gbpusd Forecast Natwest

Nov 10 2025

By Adam Rosen

-

Gbpeur Will Decline Next Year

Nov 09 2025

By Ashly Chole

Gbpeur Will Decline Next Year

Nov 09 2025

By Ashly Chole

-

Fx Market Remains Indifferent

Nov 09 2025

By Emily Clark

Fx Market Remains Indifferent

Nov 09 2025

By Emily Clark

-

Eurusd Will Climb Next Year

Nov 08 2025

By Andrew Blumer

Eurusd Will Climb Next Year

Nov 08 2025

By Andrew Blumer

-

Eurusd Forecast Cibc

Nov 08 2025

By Andrew Blumer

Eurusd Forecast Cibc

Nov 08 2025

By Andrew Blumer

-

Copper Bull Run Ing

Nov 07 2025

By Ashly Chole

Copper Bull Run Ing

Nov 07 2025

By Ashly Chole

-

Cisco Strong Growth Potential

Nov 07 2025

By Ashly Chole

Cisco Strong Growth Potential

Nov 07 2025

By Ashly Chole

-

China Gdp Growth Slowed

Nov 06 2025

By Ashly Chole

China Gdp Growth Slowed

Nov 06 2025

By Ashly Chole

-

Buy Coca Cola Stock Or No

Nov 06 2025

By Emily Clark

Buy Coca Cola Stock Or No

Nov 06 2025

By Emily Clark

-

Buy Asml Holding Long Term

Nov 05 2025

By Ashly Chole

Buy Asml Holding Long Term

Nov 05 2025

By Ashly Chole

-

Buffett Is Buying This Stock

Nov 05 2025

By Ashly Chole

Buffett Is Buying This Stock

Nov 05 2025

By Ashly Chole

-

Bitcoin Will Crash

Nov 04 2025

By Emily Clark

Bitcoin Will Crash

Nov 04 2025

By Emily Clark

-

Boj Is Likely To Hike Rates

Nov 04 2025

By Ashly Chole

Boj Is Likely To Hike Rates

Nov 04 2025

By Ashly Chole

-

Best Quantum Computing Stock

Nov 03 2025

By Adam Rosen

Best Quantum Computing Stock

Nov 03 2025

By Adam Rosen

-

Bitcoin Price Forecast

Nov 03 2025

By Emily Clark

Bitcoin Price Forecast

Nov 03 2025

By Emily Clark

-

Applied Materials Stock Analysis

Nov 02 2025

By Ashly Chole

Applied Materials Stock Analysis

Nov 02 2025

By Ashly Chole

-

Best Gold Mining Stock

Nov 02 2025

By Adam Rosen

Best Gold Mining Stock

Nov 02 2025

By Adam Rosen

-

Amazon Stock Forecast

Nov 01 2025

By Andrew Blumer

Amazon Stock Forecast

Nov 01 2025

By Andrew Blumer

-

Ai Stocks To Buy

Nov 01 2025

By Emily Clark

Ai Stocks To Buy

Nov 01 2025

By Emily Clark

-

2 Best Growth Stocks

Oct 31 2025

By Andrew Blumer

2 Best Growth Stocks

Oct 31 2025

By Andrew Blumer

-

Ai Boom Boosted Gdp Growth

Oct 31 2025

By Ashly Chole

Ai Boom Boosted Gdp Growth

Oct 31 2025

By Ashly Chole

-

Why Buy Alphabet Stock

Oct 30 2025

By Adam Rosen

Why Buy Alphabet Stock

Oct 30 2025

By Adam Rosen

-

Wgc To Introduce Digital Gold

Oct 29 2025

By Andrew Blumer

Wgc To Introduce Digital Gold

Oct 29 2025

By Andrew Blumer

-

Wayfair Stock Jumps From Bottom

Oct 29 2025

By Emily Clark

Wayfair Stock Jumps From Bottom

Oct 29 2025

By Emily Clark

-

Vodafone Share Forecast

Oct 28 2025

By Ashly Chole

Vodafone Share Forecast

Oct 28 2025

By Ashly Chole

-

Usdjpy To Remain Bearish Scotiabank

Oct 28 2025

By Ashly Chole

Usdjpy To Remain Bearish Scotiabank

Oct 28 2025

By Ashly Chole

-

Usdjpy Long Term Target

Oct 27 2025

By Adam Rosen

Usdjpy Long Term Target

Oct 27 2025

By Adam Rosen

-

Usdcnh To Trade In Range

Oct 27 2025

By Andrew Blumer

Usdcnh To Trade In Range

Oct 27 2025

By Andrew Blumer

-

Usdcad Long Term Forecast

Oct 26 2025

By Andrew Blumer

Usdcad Long Term Forecast

Oct 26 2025

By Andrew Blumer

-

Usdcnh To Consolidate

Oct 26 2025

By Emily Clark

Usdcnh To Consolidate

Oct 26 2025

By Emily Clark

-

Us Stock Market Will Crash

Oct 25 2025

By Ashly Chole

Us Stock Market Will Crash

Oct 25 2025

By Ashly Chole

-

Us Stocks Doubled Their Value

Oct 25 2025

By Andrew Blumer

Us Stocks Doubled Their Value

Oct 25 2025

By Andrew Blumer

-

Us Growth Stocks To Buy

Oct 24 2025

By Adam Rosen

Us Growth Stocks To Buy

Oct 24 2025

By Adam Rosen

-

Unitedhealth Group Stock Analysis

Oct 24 2025

By Adam Rosen

Unitedhealth Group Stock Analysis

Oct 24 2025

By Adam Rosen

-

This Uk Stock Has Low Pe Ratio

Oct 23 2025

By Emily Clark

This Uk Stock Has Low Pe Ratio

Oct 23 2025

By Emily Clark

-

Top Stocks From Ftse

Oct 23 2025

By Emily Clark

Top Stocks From Ftse

Oct 23 2025

By Emily Clark

-

Tech Stocks To Buy

Oct 22 2025

By Adam Rosen

Tech Stocks To Buy

Oct 22 2025

By Adam Rosen

-

Tesco Share Price Forecast

Oct 22 2025

By Emily Clark

Tesco Share Price Forecast

Oct 22 2025

By Emily Clark

-

Swiss Gold Exports Declines

Oct 21 2025

By Adam Rosen

Swiss Gold Exports Declines

Oct 21 2025

By Adam Rosen

-

Should You Buy Reddit Stock

Oct 21 2025

By Andrew Blumer

Should You Buy Reddit Stock

Oct 21 2025

By Andrew Blumer

-

Should You Buy Jd Sports Shares

Oct 20 2025

By Andrew Blumer

Should You Buy Jd Sports Shares

Oct 20 2025

By Andrew Blumer

-

Russia Cuts Its Oil Production

Oct 19 2025

By Andrew Blumer

Russia Cuts Its Oil Production

Oct 19 2025

By Andrew Blumer

-

Should You Buy Costco Stock

Oct 19 2025

By Andrew Blumer

Should You Buy Costco Stock

Oct 19 2025

By Andrew Blumer

-

Rolls Royce Stock Moves

Oct 18 2025

By Ashly Chole

Rolls Royce Stock Moves

Oct 18 2025

By Ashly Chole

-

Oil Falls On Supply Hike Talk

Oct 18 2025

By Ashly Chole

Oil Falls On Supply Hike Talk

Oct 18 2025

By Ashly Chole

-

Nvidia Will Be The Next Apple

Oct 17 2025

By Emily Clark

Nvidia Will Be The Next Apple

Oct 17 2025

By Emily Clark

-

Nvidia Stock Jumps

Oct 17 2025

By Ashly Chole

Nvidia Stock Jumps

Oct 17 2025

By Ashly Chole

-

Nvidia Share Price Forecast

Oct 16 2025

By Ashly Chole

Nvidia Share Price Forecast

Oct 16 2025

By Ashly Chole

-

Nike Stock Rebounds

Oct 16 2025

By Ashly Chole

Nike Stock Rebounds

Oct 16 2025

By Ashly Chole

-

Newsmax Stock Forecast

Oct 15 2025

By Ashly Chole

Newsmax Stock Forecast

Oct 15 2025

By Ashly Chole

-

Nextracker Vs Oklo Stock

Oct 15 2025

By Emily Clark

Nextracker Vs Oklo Stock

Oct 15 2025

By Emily Clark

-

How To Survive Market Crash

Oct 14 2025

By Adam Rosen

How To Survive Market Crash

Oct 14 2025

By Adam Rosen

-

Gold Will Reach New Highs

Oct 13 2025

By Emily Clark

Gold Will Reach New Highs

Oct 13 2025

By Emily Clark

-

Gold Moves Lower Commerzbank

Oct 13 2025

By Andrew Blumer

Gold Moves Lower Commerzbank

Oct 13 2025

By Andrew Blumer

-

Gbpeur Will Be Bearish

Oct 12 2025

By Ashly Chole

Gbpeur Will Be Bearish

Oct 12 2025

By Ashly Chole

-

Gbpusd Forecast Scotiabank

Oct 12 2025

By Ashly Chole

Gbpusd Forecast Scotiabank

Oct 12 2025

By Ashly Chole

-

Ftse Forecast For Next Year

Oct 11 2025

By Adam Rosen

Ftse Forecast For Next Year

Oct 11 2025

By Adam Rosen

-

Filtronic Stock Price Will Jump

Oct 11 2025

By Andrew Blumer

Filtronic Stock Price Will Jump

Oct 11 2025

By Andrew Blumer

-

Eurusd Forecast Wells Fargo

Oct 10 2025

By Ashly Chole

Eurusd Forecast Wells Fargo

Oct 10 2025

By Ashly Chole

-

Fears About Alphabet Stock

Oct 10 2025

By Emily Clark

Fears About Alphabet Stock

Oct 10 2025

By Emily Clark

-

Ethereum Vs Bnb

Oct 09 2025

By Emily Clark

Ethereum Vs Bnb

Oct 09 2025

By Emily Clark

-

Euro Is Underperforming

Oct 09 2025

By Ashly Chole

Euro Is Underperforming

Oct 09 2025

By Ashly Chole

-

Domino Pizza Stock Analysis

Oct 08 2025

By Andrew Blumer

Domino Pizza Stock Analysis

Oct 08 2025

By Andrew Blumer

-

Datadog Stock Forecast

Oct 08 2025

By Emily Clark

Datadog Stock Forecast

Oct 08 2025

By Emily Clark

-

Buy This Stock When Markets Crash

Oct 07 2025

By Emily Clark

Buy This Stock When Markets Crash

Oct 07 2025

By Emily Clark

-

Coinbase Global Stock Forecast

Oct 07 2025

By Adam Rosen

Coinbase Global Stock Forecast

Oct 07 2025

By Adam Rosen

-

Buy Gold Mining Stocks

Oct 06 2025

By Andrew Blumer

Buy Gold Mining Stocks

Oct 06 2025

By Andrew Blumer

-

Bullish Forecast For Eurusd

Oct 06 2025

By Andrew Blumer

Bullish Forecast For Eurusd

Oct 06 2025

By Andrew Blumer

-

Bae Systems Stock Analysis

Oct 05 2025

By Emily Clark

Bae Systems Stock Analysis

Oct 05 2025

By Emily Clark

-

Bp Share Price Forecast

Oct 05 2025

By Ashly Chole

Bp Share Price Forecast

Oct 05 2025

By Ashly Chole

-

Asml Forecast For Eight Years

Oct 04 2025

By Adam Rosen

Asml Forecast For Eight Years

Oct 04 2025

By Adam Rosen

-

Aviva Share Forecast

Oct 04 2025

By Andrew Blumer

Aviva Share Forecast

Oct 04 2025

By Andrew Blumer

-

Ups Stock Forecast

Oct 03 2025

By Emily Clark

Ups Stock Forecast

Oct 03 2025

By Emily Clark

-

Us Dollar To Weaken

Oct 03 2025

By Emily Clark

Us Dollar To Weaken

Oct 03 2025

By Emily Clark

-

Uk Share To Benefit From Weak Gbp

Oct 02 2025

By Ashly Chole

Uk Share To Benefit From Weak Gbp

Oct 02 2025

By Ashly Chole

-

Two Growth Stocks To Consider

Oct 02 2025

By Andrew Blumer

Two Growth Stocks To Consider

Oct 02 2025

By Andrew Blumer

-

Tips For Buying Penny Shares

Oct 01 2025

By Ashly Chole

Tips For Buying Penny Shares

Oct 01 2025

By Ashly Chole

-

Two Ftse Stocks With Gains

Oct 01 2025

By Adam Rosen

Two Ftse Stocks With Gains

Oct 01 2025

By Adam Rosen

-

Tesla Stock Soared

Sep 30 2025

By Ashly Chole

Tesla Stock Soared

Sep 30 2025

By Ashly Chole

-

Taylor Wimpey To Exit Ftse

Sep 30 2025

By Ashly Chole

Taylor Wimpey To Exit Ftse

Sep 30 2025

By Ashly Chole

-

Russia To Export More Oil

Sep 29 2025

By Adam Rosen

Russia To Export More Oil

Sep 29 2025

By Adam Rosen

-

Stock Market Is Overbought

Sep 29 2025

By Andrew Blumer

Stock Market Is Overbought

Sep 29 2025

By Andrew Blumer

-

Solanato Target Resistance

Sep 28 2025

By Adam Rosen

Solanato Target Resistance

Sep 28 2025

By Adam Rosen

-

Snowflake Stock Analysis

Sep 27 2025

By Adam Rosen

Snowflake Stock Analysis

Sep 27 2025

By Adam Rosen

-

Robotaxis Will Save Tesla Stock

Sep 26 2025

By Emily Clark

Robotaxis Will Save Tesla Stock

Sep 26 2025

By Emily Clark

-

Opec To Increase Production

Sep 25 2025

By Emily Clark

Opec To Increase Production

Sep 25 2025

By Emily Clark

-

Roblox Stock Analysis

Sep 25 2025

By Emily Clark

Roblox Stock Analysis

Sep 25 2025

By Emily Clark

-

Nzdusd Long Term Forecast

Sep 24 2025

By Ashly Chole

Nzdusd Long Term Forecast

Sep 24 2025

By Ashly Chole

-

Nvidia Vs Palantir

Sep 24 2025

By Emily Clark

Nvidia Vs Palantir

Sep 24 2025

By Emily Clark

-

Nvidia Buyback Plan Is Good

Sep 23 2025

By Adam Rosen

Nvidia Buyback Plan Is Good

Sep 23 2025

By Adam Rosen

-

No Hurdle For Low Rates

Sep 23 2025

By Emily Clark

No Hurdle For Low Rates

Sep 23 2025

By Emily Clark

-

Monero To Rally Higher

Sep 22 2025

By Andrew Blumer

Monero To Rally Higher

Sep 22 2025

By Andrew Blumer

-

Marks And Spencer Stock Analysis

Sep 22 2025

By Ashly Chole

Marks And Spencer Stock Analysis

Sep 22 2025

By Ashly Chole

-

Jpy Under Pressure Rabobank

Sep 21 2025

By Ashly Chole

Jpy Under Pressure Rabobank

Sep 21 2025

By Ashly Chole

-

Iron Ore Prices Jump Ing

Sep 21 2025

By Emily Clark

Iron Ore Prices Jump Ing

Sep 21 2025

By Emily Clark

-

How Ai Affected Adobe Stock

Sep 20 2025

By Adam Rosen

How Ai Affected Adobe Stock

Sep 20 2025

By Adam Rosen

-

Intel Is Good Ai Stock

Sep 20 2025

By Emily Clark

Intel Is Good Ai Stock

Sep 20 2025

By Emily Clark

-

Growth Stocks To Double Money

Sep 19 2025

By Andrew Blumer

Growth Stocks To Double Money

Sep 19 2025

By Andrew Blumer

-

Greggs Is It Worth Buying

Sep 19 2025

By Emily Clark

Greggs Is It Worth Buying

Sep 19 2025

By Emily Clark

-

Gold Rises Due To Conflict

Sep 18 2025

By Adam Rosen

Gold Rises Due To Conflict

Sep 18 2025

By Adam Rosen

-

Gbpeur To Fall Ubs

Sep 18 2025

By Adam Rosen

Gbpeur To Fall Ubs

Sep 18 2025

By Adam Rosen

-

Ftse Forecast For Year End

Sep 17 2025

By Andrew Blumer

Ftse Forecast For Year End

Sep 17 2025

By Andrew Blumer

-

Gbpeur To Decline Ubs

Sep 17 2025

By Andrew Blumer

Gbpeur To Decline Ubs

Sep 17 2025

By Andrew Blumer

-

Eurusd Will Slump Lower

Sep 16 2025

By Emily Clark

Eurusd Will Slump Lower

Sep 16 2025

By Emily Clark

-

Filtronic Stock Analysis

Sep 16 2025

By Emily Clark

Filtronic Stock Analysis

Sep 16 2025

By Emily Clark

-

Eurusd To Cross Resistance

Sep 15 2025

By Andrew Blumer

Eurusd To Cross Resistance

Sep 15 2025

By Andrew Blumer

-

Eurusd To Rally Higher Goldman

Sep 15 2025

By Ashly Chole

Eurusd To Rally Higher Goldman

Sep 15 2025

By Ashly Chole

-

Dollar General Stock Analysis

Sep 14 2025

By Ashly Chole

Dollar General Stock Analysis

Sep 14 2025

By Ashly Chole

-

China Will Import More Gas

Sep 14 2025

By Adam Rosen

China Will Import More Gas

Sep 14 2025

By Adam Rosen

-

Can Adidas Stock Recover

Sep 13 2025

By Adam Rosen

Can Adidas Stock Recover

Sep 13 2025

By Adam Rosen

-

Buy This Stock To Avoid Ai Crash

Sep 13 2025

By Emily Clark

Buy This Stock To Avoid Ai Crash

Sep 13 2025

By Emily Clark

-

Bnb Rally Towards 1k

Sep 12 2025

By Emily Clark

Bnb Rally Towards 1k

Sep 12 2025

By Emily Clark

-

Amd Stock Surge Higher

Sep 11 2025

By Adam Rosen

Amd Stock Surge Higher

Sep 11 2025

By Adam Rosen

-

Audusd To Move Higher

Sep 11 2025

By Adam Rosen

Audusd To Move Higher

Sep 11 2025

By Adam Rosen

-

Nzdusd Unlikely To Break Support Uob

Sep 02 2025

By Adam Rosen

Nzdusd Unlikely To Break Support Uob

Sep 02 2025

By Adam Rosen

-

Etoro Traders Copy Scientists Trades

Sep 02 2025

By Ashly Chole

Etoro Traders Copy Scientists Trades

Sep 02 2025

By Ashly Chole

-

Etoro Lists Apecoin

Sep 01 2025

By Andrew Blumer

Etoro Lists Apecoin

Sep 01 2025

By Andrew Blumer

-

Etoro Launches Nft Fund

Sep 01 2025

By Emily Clark

Etoro Launches Nft Fund

Sep 01 2025

By Emily Clark

-

Etoro 10 Billion Nasdaq Listing

Aug 31 2025

By Ashly Chole

Etoro 10 Billion Nasdaq Listing

Aug 31 2025

By Ashly Chole

-

Etoro Copytraders Average Profit

Aug 31 2025

By Andrew Blumer

Etoro Copytraders Average Profit

Aug 31 2025

By Andrew Blumer

-

Xrp Vs Pepeto

Aug 30 2025

By Ashly Chole

Xrp Vs Pepeto

Aug 30 2025

By Ashly Chole

-

Wti Moves Lower

Aug 30 2025

By Andrew Blumer

Wti Moves Lower

Aug 30 2025

By Andrew Blumer

-

Wells Fargo Gbpusd Forecast

Aug 29 2025

By Emily Clark

Wells Fargo Gbpusd Forecast

Aug 29 2025

By Emily Clark

-

Why You Should Buy Dogecoin

Aug 29 2025

By Adam Rosen

Why You Should Buy Dogecoin

Aug 29 2025

By Adam Rosen

-

Usdmxn Forecast Rabobank

Aug 28 2025

By Ashly Chole

Usdmxn Forecast Rabobank

Aug 28 2025

By Ashly Chole

-

Usdjpy Moves Higher Rabobank

Aug 28 2025

By Emily Clark

Usdjpy Moves Higher Rabobank

Aug 28 2025

By Emily Clark

-

Usdjpy Bullish Trend Paused

Aug 27 2025

By Andrew Blumer

Usdjpy Bullish Trend Paused

Aug 27 2025

By Andrew Blumer

-

Us Tariffs Causes Risk Aversion

Aug 27 2025

By Andrew Blumer

Us Tariffs Causes Risk Aversion

Aug 27 2025

By Andrew Blumer

-

Us Healthcare Stock To Consider

Aug 26 2025

By Andrew Blumer

Us Healthcare Stock To Consider

Aug 26 2025

By Andrew Blumer

-

Us Copper Tariffs Commerzbank

Aug 25 2025

By Adam Rosen

Us Copper Tariffs Commerzbank

Aug 25 2025

By Adam Rosen

-

Us Dollar Remains Weak

Aug 25 2025

By Adam Rosen

Us Dollar Remains Weak

Aug 25 2025

By Adam Rosen

-

Unilever And Games Workshop

Aug 24 2025

By Adam Rosen

Unilever And Games Workshop

Aug 24 2025

By Adam Rosen

-

Uk Stocks That Are Still Cheap

Aug 24 2025

By Adam Rosen

Uk Stocks That Are Still Cheap

Aug 24 2025

By Adam Rosen

-

Two Us Stocks For Long Term

Aug 23 2025

By Emily Clark

Two Us Stocks For Long Term

Aug 23 2025

By Emily Clark

-

Two Cybersecurity Stocks

Aug 23 2025

By Ashly Chole

Two Cybersecurity Stocks

Aug 23 2025

By Ashly Chole

-

Three Ai Stocks To Buy

Aug 22 2025

By Ashly Chole

Three Ai Stocks To Buy

Aug 22 2025

By Ashly Chole

-

Three Crypto Tokens To Watch

Aug 22 2025

By Emily Clark

Three Crypto Tokens To Watch

Aug 22 2025

By Emily Clark

-

This Penny Stock Is Down

Aug 21 2025

By Emily Clark

This Penny Stock Is Down

Aug 21 2025

By Emily Clark

-

Tesla Stock Looks Expensive

Aug 21 2025

By Ashly Chole

Tesla Stock Looks Expensive

Aug 21 2025

By Ashly Chole

-

Should You Buy Nvidia

Aug 20 2025

By Emily Clark

Should You Buy Nvidia

Aug 20 2025

By Emily Clark

-

Slowdown In Global Growth

Aug 20 2025

By Ashly Chole

Slowdown In Global Growth

Aug 20 2025

By Ashly Chole

-

Oil Market Stay Cautious

Aug 19 2025

By Emily Clark

Oil Market Stay Cautious

Aug 19 2025

By Emily Clark

-

Shiba Inu Performance Over Years

Aug 19 2025

By Adam Rosen

Shiba Inu Performance Over Years

Aug 19 2025

By Adam Rosen

-

Nvidia After Stock Split

Aug 18 2025

By Ashly Chole

Nvidia After Stock Split

Aug 18 2025

By Ashly Chole

-

Negative Development For Try

Aug 18 2025

By Adam Rosen

Negative Development For Try

Aug 18 2025

By Adam Rosen

-

Meta Platforms Market Forecast

Aug 17 2025

By Emily Clark

Meta Platforms Market Forecast

Aug 17 2025

By Emily Clark

-

Meta Platforms Stock Analysis

Aug 17 2025

By Andrew Blumer

Meta Platforms Stock Analysis

Aug 17 2025

By Andrew Blumer

-

Manufacturing Sector Shows Weakness

Aug 16 2025

By Andrew Blumer

Manufacturing Sector Shows Weakness

Aug 16 2025

By Andrew Blumer

-

Memecoins To Consider

Aug 16 2025

By Andrew Blumer

Memecoins To Consider

Aug 16 2025

By Andrew Blumer

-

Is Uber Stock Expensive

Aug 15 2025

By Andrew Blumer

Is Uber Stock Expensive

Aug 15 2025

By Andrew Blumer

-

Long Term Forecast For Eurusd

Aug 15 2025

By Andrew Blumer

Long Term Forecast For Eurusd

Aug 15 2025

By Andrew Blumer

-

Is The Ftse Index Overvalued

Aug 14 2025

By Ashly Chole

Is The Ftse Index Overvalued

Aug 14 2025

By Ashly Chole

-

Is Ripple A Buy

Aug 14 2025

By Adam Rosen

Is Ripple A Buy

Aug 14 2025

By Adam Rosen

-

Gold Is Running Out Of Steam

Aug 13 2025

By Andrew Blumer

Gold Is Running Out Of Steam

Aug 13 2025

By Andrew Blumer

-

Is Market In A Bubble

Aug 13 2025

By Ashly Chole

Is Market In A Bubble

Aug 13 2025

By Ashly Chole

-

Ftse Shares With Low Pe Ratios

Aug 12 2025

By Adam Rosen

Ftse Shares With Low Pe Ratios

Aug 12 2025

By Adam Rosen

-

Forecast For Bae Systems

Aug 12 2025

By Adam Rosen

Forecast For Bae Systems

Aug 12 2025

By Adam Rosen

-

Exxonmobil The Best Oil Stock

Aug 11 2025

By Adam Rosen

Exxonmobil The Best Oil Stock

Aug 11 2025

By Adam Rosen

-

Fed To Cut Rates Rabobank

Aug 11 2025

By Adam Rosen

Fed To Cut Rates Rabobank

Aug 11 2025

By Adam Rosen

-

Eth To Reach New Highs

Aug 10 2025

By Emily Clark

Eth To Reach New Highs

Aug 10 2025

By Emily Clark

-

Euro Remains Strong

Aug 10 2025

By Adam Rosen

Euro Remains Strong

Aug 10 2025

By Adam Rosen

-

Central Bank Warns On Overspending

Aug 09 2025

By Emily Clark

Central Bank Warns On Overspending

Aug 09 2025

By Emily Clark

-

Dcc Stock Price Analysis

Aug 09 2025

By Adam Rosen

Dcc Stock Price Analysis

Aug 09 2025

By Adam Rosen

-

Best Dividend Stocks

Aug 08 2025

By Emily Clark

Best Dividend Stocks

Aug 08 2025

By Emily Clark

-

Carr Group Stock Is Worth Watching

Aug 08 2025

By Andrew Blumer

Carr Group Stock Is Worth Watching

Aug 08 2025

By Andrew Blumer

-

A Look At The Us Debt Spiral

Aug 07 2025

By Ashly Chole

A Look At The Us Debt Spiral

Aug 07 2025

By Ashly Chole

-

Altria High Dividend Yield

Aug 07 2025

By Ashly Chole

Altria High Dividend Yield

Aug 07 2025

By Ashly Chole

-

Zulutrade Partners With Hextra Prime

Aug 06 2025

By Andrew Blumer

Zulutrade Partners With Hextra Prime

Aug 06 2025

By Andrew Blumer

-

Zoom Shares Turn Higher

Aug 06 2025

By Adam Rosen

Zoom Shares Turn Higher

Aug 06 2025

By Adam Rosen

-

Yen Gains While Japanese Stocks Down

Aug 05 2025

By Andrew Blumer

Yen Gains While Japanese Stocks Down

Aug 05 2025

By Andrew Blumer

-

Yen To Gain Against Usd Socgen

Aug 05 2025

By Ashly Chole

Yen To Gain Against Usd Socgen

Aug 05 2025

By Ashly Chole

-

Yen Downside Remains Capped

Aug 04 2025

By Andrew Blumer

Yen Downside Remains Capped

Aug 04 2025

By Andrew Blumer

-

Yen Drops Under Pressure Aud Slips After Inflation Report

Aug 04 2025

By Andrew Blumer

Yen Drops Under Pressure Aud Slips After Inflation Report

Aug 04 2025

By Andrew Blumer

-

Xrp Will Skyrocket This Year

Aug 03 2025

By Ashly Chole

Xrp Will Skyrocket This Year

Aug 03 2025

By Ashly Chole

-

Xrp Trades High

Aug 03 2025

By Ashly Chole

Xrp Trades High

Aug 03 2025

By Ashly Chole

-

Xrp Trades Above Support

Aug 02 2025

By Ashly Chole

Xrp Trades Above Support

Aug 02 2025

By Ashly Chole

-

Xrp Stages An Impressive Recovery

Aug 02 2025

By Ashly Chole

Xrp Stages An Impressive Recovery

Aug 02 2025

By Ashly Chole

-

What Usd Reversal Means For Gold

Aug 01 2025

By Emily Clark

What Usd Reversal Means For Gold

Aug 01 2025

By Emily Clark

-

Vodafone Forecast For Next Year

Aug 01 2025

By Emily Clark

Vodafone Forecast For Next Year

Aug 01 2025

By Emily Clark

-

Us Market Headed For Trouble

Jul 31 2025

By Adam Rosen

Us Market Headed For Trouble

Jul 31 2025

By Adam Rosen

-

Us Borrowing Remain High

Jul 31 2025

By Adam Rosen

Us Borrowing Remain High

Jul 31 2025

By Adam Rosen

-

Two Uk Shares To Hold

Jul 30 2025

By Adam Rosen

Two Uk Shares To Hold

Jul 30 2025

By Adam Rosen

-

Uncertainty Over Us Chip Tariffs

Jul 30 2025

By Ashly Chole

Uncertainty Over Us Chip Tariffs

Jul 30 2025

By Ashly Chole

-

Top Cybersecurity Stocks To Buy

Jul 29 2025

By Emily Clark

Top Cybersecurity Stocks To Buy

Jul 29 2025

By Emily Clark

-

Trump Calls For Lower Rates

Jul 29 2025

By Ashly Chole

Trump Calls For Lower Rates

Jul 29 2025

By Ashly Chole

-

Stock Markets Will Crash

Jul 28 2025

By Andrew Blumer

Stock Markets Will Crash

Jul 28 2025

By Andrew Blumer

-

Stocks To Win From Stablecoins

Jul 28 2025

By Adam Rosen

Stocks To Win From Stablecoins

Jul 28 2025

By Adam Rosen

-

Stablecoins Volume Jumps

Jul 27 2025

By Ashly Chole

Stablecoins Volume Jumps

Jul 27 2025

By Ashly Chole

-

Softbank Invests In Ai Platforms

Jul 27 2025

By Adam Rosen

Softbank Invests In Ai Platforms

Jul 27 2025

By Adam Rosen

-

Serco Stock Hits Multi Year High

Jul 26 2025

By Emily Clark

Serco Stock Hits Multi Year High

Jul 26 2025

By Emily Clark

-

Rgti Forecast For Five Years

Jul 25 2025

By Emily Clark

Rgti Forecast For Five Years

Jul 25 2025

By Emily Clark

-

Rolls Royce Share Price Forecast

Jul 25 2025

By Ashly Chole

Rolls Royce Share Price Forecast

Jul 25 2025

By Ashly Chole

-

Pepe Forecast Shows Upside

Jul 24 2025

By Emily Clark

Pepe Forecast Shows Upside

Jul 24 2025

By Emily Clark

-

Platinum Catching Up With Gold

Jul 24 2025

By Ashly Chole

Platinum Catching Up With Gold

Jul 24 2025

By Ashly Chole

-

Ocado Group Shares Are Struggling

Jul 23 2025

By Andrew Blumer

Ocado Group Shares Are Struggling

Jul 23 2025

By Andrew Blumer

-

Nvidia Vs Amd

Jul 23 2025

By Ashly Chole

Nvidia Vs Amd

Jul 23 2025

By Ashly Chole

-

Most Shorted Stock On Ftse

Jul 22 2025

By Adam Rosen

Most Shorted Stock On Ftse

Jul 22 2025

By Adam Rosen

-

Natural Gas Inventories Rise

Jul 22 2025

By Emily Clark

Natural Gas Inventories Rise

Jul 22 2025

By Emily Clark

-

Lessons To Learn From Stock Market

Jul 21 2025

By Adam Rosen

Lessons To Learn From Stock Market

Jul 21 2025

By Adam Rosen

-

Japan Inflation Pressure Eases

Jul 21 2025

By Andrew Blumer

Japan Inflation Pressure Eases

Jul 21 2025

By Andrew Blumer

-

Is Greggs Share A Buy

Jul 20 2025

By Ashly Chole

Is Greggs Share A Buy

Jul 20 2025

By Ashly Chole

-

Is Rolls Royce Rally Ending

Jul 20 2025

By Ashly Chole

Is Rolls Royce Rally Ending

Jul 20 2025

By Ashly Chole

-

Gbpusd To Move Higher

Jul 19 2025

By Adam Rosen

Gbpusd To Move Higher

Jul 19 2025

By Adam Rosen

-

Ibm Tech Stock With Potential

Jul 19 2025

By Ashly Chole

Ibm Tech Stock With Potential

Jul 19 2025

By Ashly Chole

-

Gbpeur To Move Lower Danske Bank

Jul 18 2025

By Andrew Blumer

Gbpeur To Move Lower Danske Bank

Jul 18 2025

By Andrew Blumer

-

Gbpchf To Move Higher Ubs

Jul 18 2025

By Emily Clark

Gbpchf To Move Higher Ubs

Jul 18 2025

By Emily Clark

-

Ftse 100 Industrial Stock

Jul 17 2025

By Andrew Blumer

Ftse 100 Industrial Stock

Jul 17 2025

By Andrew Blumer

-

Four Undervalued Stocks

Jul 17 2025

By Ashly Chole

Four Undervalued Stocks

Jul 17 2025

By Ashly Chole

-

Eu Gas Market Shows Easing Signs

Jul 16 2025

By Andrew Blumer

Eu Gas Market Shows Easing Signs

Jul 16 2025

By Andrew Blumer

-

Copper Market Under Tension

Jul 16 2025

By Emily Clark

Copper Market Under Tension

Jul 16 2025

By Emily Clark

-

Central Banks Will Buy Gold

Jul 15 2025

By Adam Rosen

Central Banks Will Buy Gold

Jul 15 2025

By Adam Rosen

-

Cheap Tech Stocks

Jul 15 2025

By Adam Rosen

Cheap Tech Stocks

Jul 15 2025

By Adam Rosen

-

Bt Stock Price Forecast

Jul 14 2025

By Andrew Blumer

Bt Stock Price Forecast

Jul 14 2025

By Andrew Blumer

-

Btc Forecast For Q3 And Q4

Jul 14 2025

By Emily Clark

Btc Forecast For Q3 And Q4

Jul 14 2025

By Emily Clark

-

Bofa Forecast For Eurusd

Jul 13 2025

By Andrew Blumer

Bofa Forecast For Eurusd

Jul 13 2025

By Andrew Blumer

-

Bp Vs Shell Stock Comparison

Jul 13 2025

By Andrew Blumer

Bp Vs Shell Stock Comparison

Jul 13 2025

By Andrew Blumer

-

Best International Stocks To Buy

Jul 12 2025

By Ashly Chole

Best International Stocks To Buy

Jul 12 2025

By Ashly Chole

-

Bitcoin To Hit 200k

Jul 12 2025

By Emily Clark

Bitcoin To Hit 200k

Jul 12 2025

By Emily Clark

-

Best Growth Stocks To Watch

Jul 11 2025

By Andrew Blumer

Best Growth Stocks To Watch

Jul 11 2025

By Andrew Blumer

-

Apple Stock Is A Sleeping Giant

Jul 11 2025

By Adam Rosen

Apple Stock Is A Sleeping Giant

Jul 11 2025

By Adam Rosen

-

Ai Stocks To Hold Long Term

Jul 10 2025

By Adam Rosen

Ai Stocks To Hold Long Term

Jul 10 2025

By Adam Rosen

-

Apple Looks Overvalued

Jul 10 2025

By Emily Clark

Apple Looks Overvalued

Jul 10 2025

By Emily Clark

-

A Cheap Stock From Lse

Jul 09 2025

By Adam Rosen

A Cheap Stock From Lse

Jul 09 2025

By Adam Rosen

-

Ai Stocks From Ftse 100

Jul 09 2025

By Andrew Blumer

Ai Stocks From Ftse 100

Jul 09 2025

By Andrew Blumer

-

Xauusd Steady On Rate Cut Hopes

Jul 08 2025

By Emily Clark

Xauusd Steady On Rate Cut Hopes

Jul 08 2025

By Emily Clark

-

Xrp Receives Flare Upgrade

Jul 08 2025

By Adam Rosen

Xrp Receives Flare Upgrade

Jul 08 2025

By Adam Rosen

-

Xai Buys X Billions Of Dollars

Jul 07 2025

By Adam Rosen

Xai Buys X Billions Of Dollars

Jul 07 2025

By Adam Rosen

-

Xagusd Trades Near Resistance

Jul 07 2025

By Andrew Blumer

Xagusd Trades Near Resistance

Jul 07 2025

By Andrew Blumer

-

Xagusd Jumps Above Resistance

Jul 06 2025

By Adam Rosen

Xagusd Jumps Above Resistance

Jul 06 2025

By Adam Rosen

-

Xagusd Faces Strong Resistance

Jul 06 2025

By Emily Clark

Xagusd Faces Strong Resistance

Jul 06 2025

By Emily Clark

-

Xrp Ripple Still Growing In Asia

Jul 05 2025

By Emily Clark

Xrp Ripple Still Growing In Asia

Jul 05 2025

By Emily Clark

-

Xrp Price Drops By 12 As Investors Turn Cautious

Jul 05 2025

By Ashly Chole

Xrp Price Drops By 12 As Investors Turn Cautious

Jul 05 2025

By Ashly Chole

-

Xrp Forecast Next Target Is 44 As Bulls Show Promise

Jul 04 2025

By Ashly Chole

Xrp Forecast Next Target Is 44 As Bulls Show Promise

Jul 04 2025

By Ashly Chole

-

Xrp Is Under Pressure Amidst Rally In Crypto Market

Jul 04 2025

By Adam Rosen

Xrp Is Under Pressure Amidst Rally In Crypto Market

Jul 04 2025

By Adam Rosen

-

Xrp Could Rally Up To 20 Under Fresh Bullish Momentum

Jul 03 2025

By Andrew Blumer

Xrp Could Rally Up To 20 Under Fresh Bullish Momentum

Jul 03 2025

By Andrew Blumer

-

Xm One Of The Best Metatrader 5 Brokers In Uk

Jul 03 2025

By Ashly Chole

Xm One Of The Best Metatrader 5 Brokers In Uk

Jul 03 2025

By Ashly Chole

-

Xagusd Challenges A Major Sma

Jul 02 2025

By Ashly Chole

Xagusd Challenges A Major Sma

Jul 02 2025

By Ashly Chole

-

Xauusd Bulls Will Likely Pause Near 2k

Jul 02 2025

By Ashly Chole

Xauusd Bulls Will Likely Pause Near 2k

Jul 02 2025

By Ashly Chole

-

Wti Returns Back Lower

Jul 01 2025

By Andrew Blumer

Wti Returns Back Lower

Jul 01 2025

By Andrew Blumer

-

Wti Weak On Bearish Bias

Jul 01 2025

By Adam Rosen

Wti Weak On Bearish Bias

Jul 01 2025

By Adam Rosen

-

Wti Jumps Despite Stronger Usd

Jun 30 2025

By Andrew Blumer

Wti Jumps Despite Stronger Usd

Jun 30 2025

By Andrew Blumer

-

Wti Jumps On Declining Us Inventories

Jun 30 2025

By Ashly Chole

Wti Jumps On Declining Us Inventories

Jun 30 2025

By Ashly Chole

-

Wti Declines On Economic Woes

Jun 29 2025

By Andrew Blumer

Wti Declines On Economic Woes

Jun 29 2025

By Andrew Blumer

-

World Largest Exchange Binance Will Not Buy Ftx In A Megadeal

Jun 29 2025

By Emily Clark

World Largest Exchange Binance Will Not Buy Ftx In A Megadeal

Jun 29 2025

By Emily Clark

-

Will Elon Musk Largest Social Media Owner

Jun 28 2025

By Adam Rosen

Will Elon Musk Largest Social Media Owner

Jun 28 2025

By Adam Rosen

-

With New Uk Prime Minister Stocks Become Attractive

Jun 28 2025

By Emily Clark

With New Uk Prime Minister Stocks Become Attractive

Jun 28 2025

By Emily Clark

-

Will Bitcoin Bounce

Jun 27 2025

By Ashly Chole

Will Bitcoin Bounce

Jun 27 2025

By Ashly Chole

-

Will Elon Buy Facebook

Jun 27 2025

By Ashly Chole

Will Elon Buy Facebook

Jun 27 2025

By Ashly Chole

-

Why Retail Investors Are So Concerned

Jun 26 2025

By Andrew Blumer

Why Retail Investors Are So Concerned

Jun 26 2025

By Andrew Blumer

-

Why Trading Is Hard

Jun 26 2025

By Andrew Blumer

Why Trading Is Hard

Jun 26 2025

By Andrew Blumer

-

Why Nike Is A Strong Buy

Jun 25 2025

By Ashly Chole

Why Nike Is A Strong Buy

Jun 25 2025

By Ashly Chole

-

Why Is Good Idea To Buy Salesforce Stocks

Jun 25 2025

By Andrew Blumer

Why Is Good Idea To Buy Salesforce Stocks

Jun 25 2025

By Andrew Blumer

-

Why Google Is A Good Investment

Jun 24 2025

By Ashly Chole

Why Google Is A Good Investment

Jun 24 2025

By Ashly Chole

-

Why Cryptocurrency Crime At All Time High

Jun 24 2025

By Adam Rosen

Why Cryptocurrency Crime At All Time High

Jun 24 2025

By Adam Rosen

-

Westpac Rba To Start Cutting Cycle

Jun 23 2025

By Andrew Blumer

Westpac Rba To Start Cutting Cycle

Jun 23 2025

By Andrew Blumer

-

Weekly Initial Jobless Claims Jumps

Jun 23 2025

By Emily Clark

Weekly Initial Jobless Claims Jumps

Jun 23 2025

By Emily Clark

-

Weak Cad Will Not Stop Boc Divergence

Jun 22 2025

By Emily Clark

Weak Cad Will Not Stop Boc Divergence

Jun 22 2025

By Emily Clark

-

Weak Us Cpi Is Bad For Stocks Rbc

Jun 22 2025

By Adam Rosen

Weak Us Cpi Is Bad For Stocks Rbc

Jun 22 2025

By Adam Rosen

-

Walmart Vs Target Which Is Better

Jun 21 2025

By Andrew Blumer

Walmart Vs Target Which Is Better

Jun 21 2025

By Andrew Blumer

-

Walmart Stock Analysis

Jun 21 2025

By Andrew Blumer

Walmart Stock Analysis

Jun 21 2025

By Andrew Blumer

-

Wall Street Moves Higher

Jun 20 2025

By Ashly Chole

Wall Street Moves Higher

Jun 20 2025

By Ashly Chole

-

Wall Street To Open Higher

Jun 20 2025

By Emily Clark

Wall Street To Open Higher

Jun 20 2025

By Emily Clark

-

Vodafone Sells Its Share In Vantage Towers

Jun 19 2025

By Adam Rosen

Vodafone Sells Its Share In Vantage Towers

Jun 19 2025

By Adam Rosen

-

Vodafone Stock Value

Jun 19 2025

By Emily Clark

Vodafone Stock Value

Jun 19 2025

By Emily Clark

-

Usdt Market Cap Reaches New High

Jun 18 2025

By Emily Clark

Usdt Market Cap Reaches New High

Jun 18 2025

By Emily Clark

-

Usdjpy Turns Higher

Jun 18 2025

By Ashly Chole

Usdjpy Turns Higher

Jun 18 2025

By Ashly Chole

-

Usdjpy Trades Strong On Boj Rumors

Jun 17 2025

By Ashly Chole

Usdjpy Trades Strong On Boj Rumors

Jun 17 2025

By Ashly Chole

-

Usdjpy To To Move Higher Uob

Jun 17 2025

By Emily Clark

Usdjpy To To Move Higher Uob

Jun 17 2025

By Emily Clark

-

Usdjpy Trades On Sticky Inflation

Jun 16 2025

By Adam Rosen

Usdjpy Trades On Sticky Inflation

Jun 16 2025

By Adam Rosen

-

Usdjpy Trades Low On Risk Aversion

Jun 15 2025

By Andrew Blumer

Usdjpy Trades Low On Risk Aversion

Jun 15 2025

By Andrew Blumer

-

Usdjpy Trades Green Before Fedspeak

Jun 14 2025

By Adam Rosen

Usdjpy Trades Green Before Fedspeak

Jun 14 2025

By Adam Rosen

-

Usdjpy To Trade Lower Citi

Jun 13 2025

By Emily Clark

Usdjpy To Trade Lower Citi

Jun 13 2025

By Emily Clark

-

Usdjpy To Trade In Range Uob

Jun 12 2025

By Adam Rosen

Usdjpy To Trade In Range Uob

Jun 12 2025

By Adam Rosen

-

Usdcnh Eyes Next Support

Jun 11 2025

By Andrew Blumer

Usdcnh Eyes Next Support

Jun 11 2025

By Andrew Blumer

-

Usdcad To Stay Bearish Scotiabank

Jun 11 2025

By Emily Clark

Usdcad To Stay Bearish Scotiabank

Jun 11 2025

By Emily Clark

-

Try Faces Risks Commerzbank

Jun 10 2025

By Andrew Blumer

Try Faces Risks Commerzbank

Jun 10 2025

By Andrew Blumer

-

Usdcad To Move Higher Ing

Jun 10 2025

By Andrew Blumer

Usdcad To Move Higher Ing

Jun 10 2025

By Andrew Blumer

-

Should You Buy Smci

Jun 09 2025

By Andrew Blumer

Should You Buy Smci

Jun 09 2025

By Andrew Blumer

-

Tesla Is A Bargain Or Overrated

Jun 09 2025

By Adam Rosen

Tesla Is A Bargain Or Overrated

Jun 09 2025

By Adam Rosen

-

Scotiabank Usdcad Fair Value

Jun 08 2025

By Adam Rosen

Scotiabank Usdcad Fair Value

Jun 08 2025

By Adam Rosen

-

Rolls Royce Forecast For Two Years

Jun 07 2025

By Emily Clark

Rolls Royce Forecast For Two Years

Jun 07 2025

By Emily Clark

-

Rivian Forecast For 3 Years

Jun 07 2025

By Adam Rosen

Rivian Forecast For 3 Years

Jun 07 2025

By Adam Rosen

-

Rgti Is The Next Nvidia

Jun 06 2025

By Adam Rosen

Rgti Is The Next Nvidia

Jun 06 2025

By Adam Rosen

-

Pi Coin Moves Lower

Jun 06 2025

By Ashly Chole

Pi Coin Moves Lower

Jun 06 2025

By Ashly Chole

-

Nebius Group Ai Data Center Stock

Jun 05 2025

By Emily Clark

Nebius Group Ai Data Center Stock

Jun 05 2025

By Emily Clark

-

Meta Or Alphabet Which Is Best

Jun 05 2025

By Adam Rosen

Meta Or Alphabet Which Is Best

Jun 05 2025

By Adam Rosen

-

Is Ai A Threat To Big Tech

Jun 04 2025

By Adam Rosen

Is Ai A Threat To Big Tech

Jun 04 2025

By Adam Rosen

-

Is Aston Martin A Buy

Jun 04 2025

By Adam Rosen

Is Aston Martin A Buy

Jun 04 2025

By Adam Rosen

-

Gold Stays Strong

Jun 03 2025

By Andrew Blumer

Gold Stays Strong

Jun 03 2025

By Andrew Blumer

-

Goldman Forecasts Decline

Jun 03 2025

By Adam Rosen

Goldman Forecasts Decline

Jun 03 2025

By Adam Rosen

-

Gbpeur Will Touch Higher Ing

Jun 02 2025

By Emily Clark

Gbpeur Will Touch Higher Ing

Jun 02 2025

By Emily Clark

-

Gbpusd Forecast For End 2025

Jun 02 2025

By Emily Clark

Gbpusd Forecast For End 2025

Jun 02 2025

By Emily Clark

-

Gbpeur To Move Higher Barclays

Jun 01 2025

By Ashly Chole

Gbpeur To Move Higher Barclays

Jun 01 2025

By Ashly Chole

-

Gbpaud To Slip Nomura

Jun 01 2025

By Ashly Chole

Gbpaud To Slip Nomura

Jun 01 2025

By Ashly Chole

-

Eurchf To Jump Higher Socgen

May 31 2025

By Emily Clark

Eurchf To Jump Higher Socgen

May 31 2025

By Emily Clark

-

Forecast For Sp 500 Index

May 31 2025

By Andrew Blumer

Forecast For Sp 500 Index

May 31 2025

By Andrew Blumer

-

Dogecoin Forecast Shows Bullish Target

May 30 2025

By Adam Rosen

Dogecoin Forecast Shows Bullish Target

May 30 2025

By Adam Rosen

-

Deutsche Bank Bullish On Tesco

May 30 2025

By Andrew Blumer

Deutsche Bank Bullish On Tesco

May 30 2025

By Andrew Blumer

-

Danske Forecast For Eurusd

May 29 2025

By Andrew Blumer

Danske Forecast For Eurusd

May 29 2025

By Andrew Blumer

-

Copa Holdings Underrated Stock

May 29 2025

By Emily Clark

Copa Holdings Underrated Stock

May 29 2025

By Emily Clark

-

Commodities Bull Run

May 28 2025

By Ashly Chole

Commodities Bull Run

May 28 2025

By Ashly Chole

-

China Copper Imports Commerzbank

May 28 2025

By Andrew Blumer

China Copper Imports Commerzbank

May 28 2025

By Andrew Blumer

-

Cheap Stocks Trading At Lows

May 27 2025

By Emily Clark

Cheap Stocks Trading At Lows

May 27 2025

By Emily Clark

-

Chegg Stock Is Down Due To Ai

May 27 2025

By Ashly Chole

Chegg Stock Is Down Due To Ai

May 27 2025

By Ashly Chole

-

Bp Plc Stock A Buy Or Not

May 26 2025

By Andrew Blumer

Bp Plc Stock A Buy Or Not

May 26 2025

By Andrew Blumer

-

Bnb To Move Higher

May 26 2025

By Ashly Chole

Bnb To Move Higher

May 26 2025

By Ashly Chole

-

Ashtead Tech A Bargain Stock

May 25 2025

By Andrew Blumer

Ashtead Tech A Bargain Stock

May 25 2025

By Andrew Blumer

-

Best Cybersecurity Stocks To Buy

May 25 2025

By Adam Rosen

Best Cybersecurity Stocks To Buy

May 25 2025

By Adam Rosen

-

Amazon Is A Good Pick

May 24 2025

By Emily Clark

Amazon Is A Good Pick

May 24 2025

By Emily Clark

-

Apple Best Buffett Stock

May 24 2025

By Adam Rosen

Apple Best Buffett Stock

May 24 2025

By Adam Rosen

-

Alphabet The Best Ai Stock To Buy

May 23 2025

By Emily Clark

Alphabet The Best Ai Stock To Buy

May 23 2025

By Emily Clark

-

Amazon A Stock To Buy

May 23 2025

By Ashly Chole

Amazon A Stock To Buy

May 23 2025

By Ashly Chole

-

A Good Uk Medical Stock

May 22 2025

By Emily Clark

A Good Uk Medical Stock

May 22 2025

By Emily Clark

-

Ai Market To Enjoy Massive Growth

May 22 2025

By Andrew Blumer