Top Forex Brokers for 2025

We found 11 online brokers that are appropriate for Trading Forex.

Best Forex Brokers Guide

Analysis by Andrew Blumer, Updated and fact-checked by Senad Karaahmetovic, Last updated – June 17, 2025

Forex Brokers

Compare Brokers is a comprehensive platform designed to help traders evaluate and choose the most suitable Forex brokers for their individual trading needs, especially in light of recent surges in trading volume and volatility.

Forex (currency market), is a global international marketplace where traders buy and sell different country currencies for another 24 hours a day, five days a week. Foreign currency exchange the most liquid and dynamic markets in the world, driven by international trade, investment flows, and macroeconomic trends. Recent events—such as the Swiss franc’s 7% surge on January 15, 2025, following an unexpected SNB intervention; the U.S. dollar’s 3.2% rally in early March 2025 amid fresh Fed rate-hike speculation after stronger-than-forecast CPI data; and the yen’s wild 4% trading range on April 22, 2025 around the BOJ’s surprise widening of its yield-curve control bands—have only amplified volatility and trading opportunities. Forex brokers play a critical role in giving retail and institutional traders access to this market through various platforms and trading tools.

This guide on Forex brokers is not intended for residents and users in the USA.

Whether you're a beginner or an experienced trader, selecting the right Forex broker is essential for success. Forex brokers provide access to currency pairs, leverage options, trading platforms, charting tools, and risk management features that directly impact your trading performance. In Q1 2025 alone, daily average turnover reached $7.2 trillion, fueled by USD strength following the March Fed rate decision and the euro’s 400-pip swing around the ECB’s April meeting. For example, EUR/USD fell from 1.1200 to 1.0800 within two days after the ECB minutes revealed a hawkish tilt, while GBP/JPY rallied 350 pips on surprise dovish comments from the Bank of Japan. As a novice, it's wise to start with a demo account or small capital and gradually scale your trades as you gain experience and confidence in analyzing market movements using technical and fundamental indicators.

It's important to recognize that trading Forex CFDs (Contracts for Difference) carries a high level of risk. These are leveraged products, which means your potential gains and losses are both magnified—especially during sharp currency moves like the 5% spike in USD/JPY after Japan’s April 2025 policy announcement or the 300-pip drop in AUD/USD on unexpected Australian jobs data. Between 67% and 80% of retail investors lose money when trading CFDs, according to the latest broker-reported figures for Q1 2025. Make sure you fully understand how CFDs work, and never trade with funds you cannot afford to lose.

Best Forex Brokers and Platforms

Anyone can open a Forex trading account, but long-term success depends on education, strategy, and selecting a reliable broker. While trading the FX markets carries risk, especially for beginners, the best Forex brokers and platforms provide essential tools such as demo accounts, market analysis, and educational resources to support traders at all levels. Whether you're starting out or aiming to refine your strategy, choosing a reputable platform is key to navigating the market effectively.

Trading Forex with IC Markets

IC Markets is a globally recognized Forex broker offering access to top-tier trading platforms, including MetaTrader 4 and MetaTrader 5. Known for its low spreads, high-speed execution, and transparent trading environment, IC Markets is a preferred choice among both retail and professional traders.

What sets IC Markets apart is its commitment to providing traders with the tools they need to succeed. From advanced algorithmic trading options to automated software and educational support, IC Markets caters to both beginner and experienced traders alike. Its multicurrency trading environment ensures flexibility, while its straightforward interface makes data and trading tools easily accessible.

Key Advantages of Trading Forex with IC Markets:

- Low spreads and fees: IC Markets consistently offers some of the lowest spreads in the industry, making it cost-effective for high-frequency traders looking to maximize profits.

- Fast execution: Built with cutting-edge technology, IC Markets ensures ultra-fast trade execution an essential feature for Forex traders reacting to real-time market movements.

- Diverse trading instruments: Traders can access Forex, commodities, indices, cryptocurrencies, and more, giving them the ability to diversify and seize multiple market opportunities.

- Advanced trading tools: The platform supports automated and algorithmic trading, enabling traders to execute precise strategies using expert advisors (EAs) and custom indicators.

Overall, IC Markets stands out as a top-tier Forex broker thanks to its highly competitive trading conditions, broad asset selection, institutional-grade technology, and strong regulatory framework.

RoboForex Forex Broker

RoboForex is a globally trusted Forex broker offering access to multiple platforms, including MetaTrader 4 and MetaTrader 5. In addition to Forex trading, it also provides CFDs on stocks, indices, bonds, and commodities. With over a decade of operational history and a strong global presence, RoboForex has built a reputation for reliability and service quality among retail and professional traders alike.

As a subsidiary of RoboForex Ltd, the broker delivers high-leverage trading solutions across various markets and account types. Whether you're a beginner starting with minimal capital or an advanced trader seeking ECN execution, RoboForex caters to a wide spectrum of trading needs with innovative tools and consistent support.

Key Advantages of Trading Forex with RoboForex:

- Low minimum deposit: With a starting deposit of just $10, RoboForex is accessible to traders with limited capital, making it beginner-friendly.

- Variety of account types: Choose from ECN, STP, Cent, and other account options tailored to suit different trading strategies and risk profiles.

- Competitive spreads and low fees: The broker offers tight spreads and minimal commissions, helping traders reduce costs and improve profitability.

- Fast and reliable execution: Advanced trading infrastructure ensures quick order processing, which is crucial in fast-moving markets.

- Diverse trading instruments: Access a broad range of assets including Forex, stocks, commodities, indices, and cryptocurrencies to diversify your strategy.

- Bonus programs and promotions: Enjoy deposit bonuses, cashback offers, and other promotional rewards that enhance your trading potential.

RoboForex stands out for its low entry threshold, flexible account options, advanced tools, and generous promotional offerings, making it a solid choice for traders looking for a well-rounded Forex trading experience.

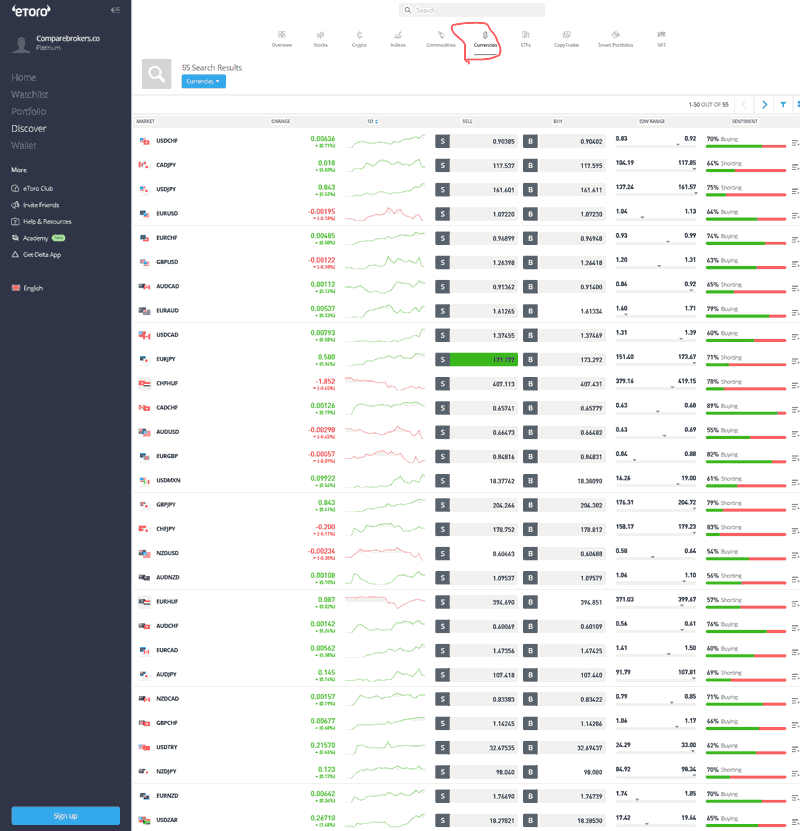

eToro for Social Forex Trading

eToro is a leading social trading platform that allows Forex traders to connect, copy, and learn from one another in a transparent and user-friendly environment. Its unique combination of social features and intuitive trading tools makes it especially appealing for beginners and intermediate traders looking to follow successful strategies in real time.

Key Advantages of Forex Trading with eToro:

- User-friendly interface: eToro’s platform is designed for ease of use, allowing traders of all levels to navigate markets, find top performers, and execute trades efficiently.

- Copy trading features: The CopyTrader tool lets users automatically replicate the trades of seasoned investors, eliminating the need for extensive market analysis and manual execution.

- Active social community: eToro maintains a vibrant community where users can discuss trading strategies, ask questions, and learn through shared experiences.

- Transparent performance metrics: Each trader’s profile includes detailed stats like past performance, risk score, and trading history, helping users make informed decisions about whom to follow.

- Strong regulatory framework: eToro is regulated by top-tier financial authorities and adheres to rigorous compliance and auditing standards to safeguard user funds.

eToro is a top choice for those interested in social Forex trading due to its accessible platform, powerful copy trading capabilities, active user base, and strong regulatory backing.

Recently, eToro introduced a strategy builder tool that allows traders to test and refine their strategies in a risk-free environment. This interactive software helps users better understand trading dynamics and gain confidence before committing real capital, making it a valuable feature for both learning and experimentation.

Trading Forex with AvaTrade

AvaTrade is an established name in the Forex trading world, known for combining strong regulatory credentials with a highly accessible and user-friendly trading experience. With years of industry presence, the platform is designed to accommodate both new and experienced traders through robust tools, global market access, and educational support.

What sets AvaTrade apart is its flexibility you can manage all your trades and investments from a single account, accessible via any device with an internet connection. The platform enables instant market orders and provides prompt confirmations via email, making execution seamless and transparent.

AvaTrade also includes a valuable demo mode, allowing traders to test the platform and strategies risk-free before committing real funds. This is especially beneficial for beginners seeking to build confidence while learning how the system works.

Key Benefits of Trading Forex with AvaTrade:

- Regulatory strength: AvaTrade is licensed by reputable bodies including the Central Bank of Ireland, ASIC, and the FSC of the British Virgin Islands, offering traders a high level of safety and transparency.

- Diverse trading instruments: In addition to major, minor, and exotic Forex pairs, AvaTrade gives users access to commodities, indices, stocks, and cryptocurrencies ideal for those looking to diversify their portfolios.

- User-friendly platforms: AvaTrade’s trading interface includes advanced charting tools, risk management features, and supports both desktop and mobile access, making trading convenient from anywhere.

- Educational content: The platform offers rich educational material including webinars, trading guides, and video tutorials to help traders enhance their market knowledge and decision-making skills.

- Responsive customer support: AvaTrade provides multilingual customer service 24/5 via live chat, phone, and email, ensuring traders get assistance when needed.

AvaTrade stands out as a well-regulated, intuitive, and flexible Forex trading platform that caters to a broad range of trading needs. Whether you’re just starting or looking to expand your trading approach, AvaTrade offers the tools and infrastructure to support your goals.

Trading Forex with XM

XM is a globally recognized Forex broker that has built a strong reputation since its founding in 2009, now serving over 5 million clients worldwide. With a focus on accessibility, transparency, and education, XM offers a comprehensive trading environment suitable for both beginner and experienced traders alike. The platform supports CFDs, spread betting (where applicable), and a wide range of Forex services, all delivered through powerful and user-friendly platforms.

One of XM's core strengths lies in its commitment to customer service, paired with a wealth of educational resources and advanced market research tools. Traders benefit from the flexibility to access markets via desktop or mobile devices, all while enjoying seamless execution and institutional-grade trading conditions.

Why Trade Forex with XM?

- Strong regulatory backing: XM is licensed by reputable authorities including the UK's Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC), ensuring that the broker operates in a transparent and secure manner.

- Diverse instrument offering: Traders can access a wide array of currency pairs major, minor, and exotic along with other financial instruments such as commodities, indices, and shares for portfolio diversification.

- Robust trading platforms: XM supports MetaTrader 4 and MetaTrader 5, both equipped with powerful features such as technical indicators, advanced charting tools, and integrated risk management functionality. Platforms are available across web, desktop, and mobile.

- Educational tools and market analysis: The broker offers an extensive learning center, including webinars, video tutorials, trading guides, and daily market updates ideal for those looking to sharpen their skills and stay informed.

- Multilingual customer support: XM provides 24/5 customer service in multiple languages, accessible via live chat, email, and phone, helping traders resolve queries efficiently and effectively.

Whether you’re just beginning your Forex journey or looking to upgrade to a broker with strong regulatory oversight and comprehensive educational resources, XM stands out as a reliable and trader-friendly option with global reach.

Forex Market Growth and Trends in 2025 and 2026

Forex trading has expanded rapidly in 2025 and 2026, driven by the post-pandemic shift to online financial services and broader access to real-time market data. The heightened volatility following the COVID-19 crisis created new trading opportunities, prompting a surge in retail trader participation and increased broker volumes worldwide.

Market dynamics continue to evolve as global economic recovery shapes currency movements. The US dollar remains under pressure, with potential fluctuations of 5–10% tied to monetary policy shifts and geopolitical instability. The Australian dollar has held firm on strong commodity demand and consistent interest rates, while the UK pound struggles under inflation and post-Brexit adjustments. Meanwhile, the Euro has strengthened amid positive economic indicators and investor optimism.

Technological innovation and regulatory changes are reshaping Forex trading strategies. With more efficient platforms and enhanced data analytics, traders are adapting quickly to a fast-changing environment. The trend of growth and innovation in Forex is expected to continue well into the future.

What Is Forex Trading?

Forex trading is the exchange of currencies in a 24-hour global market. Traders engage in buying and selling currencies to capitalize on price movements, aiming to profit while managing risk effectively. Understanding market operations and strategies is crucial for success in Forex trading.

The Forex market determines international exchange rates, where currencies are bought and sold at current or agreed prices. While banks often play a central role in setting these rates on behalf of clients, Forex trading fosters constant competition among traders to create a dynamic market environment.

Forex brokers act as intermediaries between traders, banks, and investors, identifying potential opportunities and executing buy and sell orders. Operating as an over-the-counter global market, Forex trading involves purchasing, selling, and speculating on currencies at fluctuating values.

The market operates on margins, meaning that traders can leverage smaller amounts of capital to control larger positions. However, unfavorable market conditions can lead to losses, making it vital for traders to manage risks appropriately.

What Is a Forex Broker?

A Forex broker is an intermediary who buys and sells currencies on behalf of clients. Operating in a decentralized, over-the-counter global market, Forex brokers determine exchange rates based on supply and demand dynamics. The three main types of Forex brokers are banks, private traders, and online brokers.

Forex brokers should offer a range of trading tools and options such as day trading, managed accounts, and leveraged trading. They also provide valuable market insights, tips, and trade updates via various media, helping traders make informed decisions.

Demo accounts are available at most brokers, allowing new traders to practice without risk. It's important to research and choose a reputable broker. Checking local stock exchanges and reading online reviews can help identify top brokers suited to individual needs.

Professional traders may not rely on brokers for portfolio management but still require access to advanced instruments and tools. As long as brokers are regulated by authorities like the FCA, trading remains secure and transparent.

How Forex Trading Works

Forex trading involves the buying and selling of currencies globally. It is conducted by banks, central banks, multinational companies, institutional investors, and individual traders for various reasons, such as profit generation, global trade facilitation, and market stabilization. The value of a currency is determined by interest rates; if a currency is expected to rise, traders may purchase it, and if it is expected to fall, they can sell.

To enable this trading, banks, governments, and financial institutions establish Forex marketplaces where currencies are exchanged, such as the London Stock Exchange or proprietary trading platforms. Major Forex pairs include USD, GBP, Euro, Swiss Franc, and Japanese Yen. Unlike stocks, currencies only increase or decrease in value based on factors like economic conditions or geopolitical events. Currency interest rates are typically higher than US dollar rates, reflecting the differences in economic power across countries.

To trade Forex, you need an account on a reputable platform. Retail traders can use brokers' trading platforms to trade major currency pairs like USD/JPY, USD/EUR, AUD/CAD, and more. It's essential to only trade with regulated brokers backed by a financial services authority to ensure safety. Regulatory bodies like the UK Financial Conduct Authority and the US Securities and Exchange Commission ensure market integrity and protect investors from unregistered brokers.

Example Forex Trade EUR/USD

Here’s an example of a EUR/USD Forex trade.

Foreign exchange (Forex) trading carries a high level of risk and can result in significant losses. Before deciding to trade Forex, carefully consider your financial objectives, risk tolerance, and experience level.

Trade Details

Currency Pair: EUR/USD

Trade Price: 1.07524

Amount: 10,000 USD

Risks Involved

Forex trading carries significant risk due to the high volatility in currency markets. Traders can lose their entire investment or more, especially when using leverage. Key risks include market risk, leverage risk, interest rate risk, and political/economic risks.

Possible Outcomes

| Scenario | EUR/USD Price | Profit/Loss |

|---|---|---|

| Price Goes Up | 1.08524 | Profit of $100 |

| Price Goes Down | 1.06524 | Loss of $100 |

If the EUR/USD price goes up to 1.08524, the trader makes a profit of $100. On the other hand, if the price drops to 1.06524, the trader incurs a loss of $100.

Types of Forex Accounts

When starting out in Forex trading, choosing the right account type is essential to manage risk and gain experience. The three main types of accounts micro, mini, and standard offer different benefits depending on your experience level and risk tolerance. Here's a breakdown of each account type:

Micro Forex Account

A micro account is ideal for beginners who wish to trade with a small initial deposit. These accounts typically have lower minimum deposit requirements and smaller contract sizes, often around $1,000. This allows traders to get a feel for the market and experiment with strategies without risking significant capital.

Risks: While the financial stakes are lower, the emotional and psychological impact of losses can still be significant. New traders should use a micro account to build confidence and refine strategies before moving to larger positions.

Mini Forex Account

A mini account is a good option for those who are comfortable with slightly more risk than a micro account but don't want to commit a large amount of capital. Mini accounts have higher minimum deposit requirements and contract sizes compared to micro accounts, offering a balance between risk and reward.

Risks: Mini accounts expose traders to more substantial market movements compared to micro accounts. It's crucial to manage your trades carefully and ensure you're prepared for the increased financial commitment and potential volatility.

Standard Forex Account

The standard account is the most popular type of Forex account and is suitable for a wider range of traders. These accounts require higher minimum deposits and have larger contract sizes than micro and mini accounts. They are ideal for traders who have gained experience and are ready to trade larger positions.

Risks: Trading with a standard account involves significant capital, amplifying both potential profits and losses. It is important to have a solid trading plan and risk management strategy in place to handle the increased stakes.

Choosing the Right Forex Trading Account

Choosing the right type of Forex account depends on your experience level, risk tolerance, and initial investment. If you are a new trader, starting with a micro account is a smart choice.

Remember, the key to successful trading is continuous learning, disciplined risk management, and patience. Happy trading!

Why Forex Trading Is Popular

Forex trading is widely popular among investors, with a daily average trading volume of approximately $5 trillion. Here are the key reasons for its popularity:

Forex Market Liquidity

Forex trading is highly liquid, allowing traders to capitalize on daily currency market fluctuations in the Forex market. In recent months, daily Forex volumes have surged especially during the March 2025 Federal Reserve meeting, when USD liquidity spiked as Forex traders repositioned around a surprise rate pause. The large volume of currency traded in the Forex market ensures plenty of liquidity, making it easier to enter and exit Forex trades quickly, even during sudden Forex volatility.

Forex Leveraged Trading

Forex leverage allows traders to control larger Forex positions with a smaller initial investment, enhancing potential Forex returns. With the rise of retail Forex platforms and zero-commission Forex brokers, leverage usage jumped over 20% in Q1 2025. This ability to trade on margin in the Forex market is a key attraction for many Forex traders but recent swings in GBP/JPY around UK inflation data have underscored both the upside and downside of high Forex leverage.

Forex Short Selling Strategy

Forex short selling is simpler than in other markets, as Forex currencies are traded in pairs. This provides Forex traders with an easy way to profit from falling Forex prices. For example, during the surprise ECB dovish turn in April 2025, many Forex traders shorted EUR/USD in the Forex market and saw rapid Forex gains as the euro slid nearly 1.5% in a single Forex session.

Forex Spread Analysis

The Forex spread is the difference between the Forex buying and selling price set by the Forex broker. Forex spreads can widen dramatically during high Forex volatility events: during the March 2025 US payroll report release, EUR/GBP Forex spreads jumped from 0.8 to over 3 pips. A smaller Forex spread typically indicates a more efficient Forex market, but Forex traders should be prepared for spread blowouts around major Forex news.

Forex Trading Strategies

Forex traders use various Forex strategies to navigate the Forex market. Here are some popular Forex strategies especially useful given the recent rise in Forex volatility and record retail Forex participation:

Forex Scalping

Forex scalping is an advanced Forex strategy that involves making quick Forex trades based on low time frame Forex charts, commonly used on Forex platforms like MetaTrader 4. With the uptick in Forex micro-volatility driven by algorithmic Forex order flow around US CPI releases Forex scalpers have seen both more Forex opportunities and more Forex risk in grabbing small, rapid Forex profits.

Forex News Trading Strategy

Forex news trading takes advantage of Forex market volatility triggered by Forex news releases. This Forex strategy was front and center during the Swiss National Bank’s surprise Forex intervention in January 2025, when CHF Forex pairs swung wildly. Forex traders who correctly anticipated the SNB’s Forex move were able to lock in significant Forex profits amid the chaos.

Forex Swing Trading

Forex swing trading uses Forex trend analysis to capture Forex price movements over a longer period. In the wake of emerging-market Forex turbulence such as the 8% drop in ZAR/USD during South Africa’s election week Forex swing traders have capitalized on medium-term Forex reversals, holding Forex positions for days to ride Forex market corrections.

Beginner Forex Trading Checklist

Understand Forex Trading Risk

Risk management is crucial in Forex trading. Learn to use tools like stop-loss and limit orders to minimize potential losses and protect your capital.

Learn Forex Technical Analysis

Technical analysis helps traders interpret market data and price trends. Educate yourself on how the Forex market operates, and stay updated with economic news and financial reports to make informed decisions.

Why Forex Traders Fail

There are several reasons why Forex traders, particularly retail CFD accounts, fail. Below are key factors contributing to failure:

Not Having a Forex Trading Plan

Trading without a plan is a primary reason for losses. A solid trading plan should include technical analysis, historical research, and effective risk management tools such as stop-loss orders.

Not Testing Your Forex Trading Plan

Once you define your trading strategy, including entry and exit points and capital risk, testing your plan is crucial to ensure its feasibility before live trading.

Emotional Trading

Emotional trading can be detrimental, especially for beginners. Controlling your emotions, knowing when to limit or increase trades, is essential for long-term success in Forex trading.

Not Using Forex Stop-Loss and Limit Orders

Many Forex traders make the mistake of underestimating the importance of stop-loss and limit orders, often thinking they can manage big moves or losses without them. However, neglecting to use these orders can lead to significant losses, especially in day trading, which requires skill and experience. A stop-loss order automatically closes positions at a predetermined price, often below the initial investment, helping limit potential losses and safeguard capital.

Unrealistic Trading Expectations

Setting unrealistic expectations can lead to disappointment. While ambition is important, it’s essential to set achievable, realistic goals instead of aiming for quick wealth.

How to Choose a Forex Broker

Choosing the right Forex broker is crucial due to the market's liquidity and volatility. Here’s what to consider:

Look for a broker regulated by the US Commodity Futures Trading Commission (CFTC) or other reputable financial authorities. Ensure the broker aligns with your trading needs.

Also, check whether the broker is regulated by bodies like the FCA or FSA. Regulation ensures compliance with guidelines and provides accountability, safeguarding your interests.

Consider Your Forex Trading Needs

Forex brokers vary in their services. Some cater to large companies, while others serve smaller, private traders. Consider whether you need a broker who offers detailed analysis, independent trading, or quick market execution. Choose a broker that aligns with your trading style and objectives.

Forex Broker Customer Service

Good customer support is essential when choosing a Forex broker. Ensure the broker provides responsive and accessible support channels to resolve any issues promptly. Look for brokers that offer:

- Forex Broker Live Chat Support – Instant communication for quick issue resolution.

- Forex Broker Email Support – Reliable support for less urgent queries.

- Forex Broker Phone Support – Direct and personal assistance when needed.

Transaction Costs

Forex brokers charge fees based on the spread or a commission per trade. These fees can vary, so it’s essential to understand the costs before committing to a broker. High transaction costs may eat into your profits, so choose a broker with reasonable fees.

Forex Deposit and Withdrawal

Ensure your broker offers easy and reliable withdrawal methods. Avoid brokers with unnecessary delays or excuses when processing withdrawals.

Forex Order Execution

When placing a trade, your broker should execute orders at the quoted price with minimal slippage. Ensure the broker fills your order as expected.

Forex Broker Negative Balance Protection

Leverage trading can lead to losses greater than your account balance, potentially resulting in a negative balance. Negative balance protection helps prevent this by ensuring that your losses do not exceed your account balance. It is a crucial risk management feature to consider when trading with leverage.

Forex Broker Financial Regulation and Supervision

Choose a broker that is regulated by a reputable authority. Financial regulation provides protection and ensures accountability. If a broker faces issues, regulation can help you recover your funds.

Forex Broker Awards

A broker’s awards and recognitions highlight their strengths. Accolades show that the broker is respected within the industry and offers reliable services.

What Are Forex Broker Fees?

Before selecting a broker, ensure there are no hidden fees or unexpected costs.

Check if your broker charges additional fees such as withdrawal fees, inactivity fees, or deposit fees. Be mindful of the commissions your broker may impose on trades, as these can impact your overall profitability.

Minor and Major Forex Currency Pairs

In the foreign exchange market, many currencies are actively traded. Major currency pairs typically involve the most traded currencies worldwide, such as the USD, and have the largest trading volumes in the market.

Minor currency pairs, on the other hand, do not include the USD. However, they may involve currencies like the GBP. For example, a pair consisting of the Yen and Euro is considered a minor pair.

Minor pairs are named for their comparatively lower market value, as these currencies are not as widely traded as the major ones. These pairs do not feature the USD as either the base or quote currency.

What You Need to Open a Forex Broker Account

When registering for a Forex broker account, you will be required to provide certain personal documentation. This typically includes a copy of your passport, driver's license, or national identification card to verify your identity. Additionally, you will need to submit a bank statement or utility bill from the past three months, which clearly shows your address. These documents help ensure that the broker complies with regulatory requirements and can verify your identity and address.

Along with these documents, you will also need to answer compliance-related questions that assess your trading experience and financial situation. This is a necessary step for brokers to ensure that they are dealing with clients who understand the risks involved in trading. It is advisable to take your time and complete the registration process carefully to avoid any delays in account approval.

The Advantages of Forex Trading

Forex trading is an international market known for its significant liquidity and has recently seen a surge in daily volume topping $7 trillion driven by heightened volatility around Fed interest‐rate decisions, ECB rate cuts, and BoJ policy tweaks. For example, the yen plunged past ¥155 to the dollar in late April, while EUR/USD oscillated sharply after US–China trade-deal optimism. While Forex offers numerous benefits, it is not recommended for inexperienced traders. However, once mastered, the Forex market presents advantages that make it a superior choice compared to other forms of trading.

Forex High Liquidity

Liquidity refers to an asset's ability to convert quickly into cash. In Forex, high liquidity means large amounts of cash can be moved in and out of currencies with smaller spreads. Spreads are the differences between bid rates (buyers) and ask prices (sellers), and the higher the liquidity, the smaller these spreads, making trading more efficient. Quick example: During the recent G7 meeting chatter, EUR/USD maintained sub-1 pip spreads even as markets digested mixed US jobs data.

Forex Leverage

The ability to use leverage is one of the most attractive benefits in Forex trading. Leverage allows traders to open large positions with minimal capital. For example, with a leverage of 10:1, a trader can control up to 10 times the amount of their deposit, allowing them to trade assets worth 10 USD for every 1 USD in their account. Quick example: A trader using 20:1 leverage on USD/ARS saw a 5% peso rally after Argentina’s Fitch upgrade translate to a 100% move on their position.

While leverage presents opportunities to maximize profits, it also increases the risk of significant losses. Traders must carefully consider the level of risk and use leverage cautiously to avoid excessive exposure.

Forex Twenty-Four-Hour Market

Unlike most stock exchanges, which operate within set hours, Forex markets are open twenty-four hours a day, five days a week. This flexibility allows traders to enter or exit trades at any time, regardless of their location, providing greater control over their trading schedule. Quick example: When India’s Forex reserves unexpectedly dipped by $2 billion in early May, USD/INR spiked sharply at the Asian market open.

Forex Low Trading Costs with Zero Commissions

Many popular Forex brokers offer zero commissions for standard accounts, covering trading fees themselves. Traders do not have to pay extra for withdrawals, deposits, transfers, or currency exchanges. Some brokers may charge small commission fees for pro accounts, but generally, trading costs are low and transparent. This makes Forex trading an affordable option for many traders. Quick example: During last month’s volatility, traders executed dozens of USD/JPY round-trip trades without incurring any commission fees.

Forex Technical Analysis

Understanding technical analysis is invaluable in Forex trading. Using charts and indicators, traders can analyze currency pairs in real time and make informed decisions. Tools like the Fibonacci retracement and resistance levels allow traders to identify potential price levels and make predictions. While it's impossible to predict every market move, these tools help provide a clearer understanding of trends and price movements. Quick example: A 100-pip pullback in USD/JPY found support exactly at the 61.8% Fibonacci level, offering a clear long entry during April’s flash crash.

Forex Free Trading Platforms

Many brokers offer free access to trading platforms like MT4 or MT5 when traders open live accounts. These platforms provide access to a range of currency pairs, commodities, precious metals, and even digital currencies. They can be used on computers, mobile devices, or through web browsers via WebTrader. Additionally, social trading platforms allow traders to follow and copy strategies from others, further enhancing trading opportunities. Quick example: Using MT5’s built-in volatility scanner, a trader spotted USD/CAD’s unusually high ATR and timed a profitable breakout.

The Drawbacks of Forex Trading

Forex trading has its drawbacks, and even professional traders can lose capital due to the unpredictable nature of the market. Below are some of the main disadvantages of Forex trading.

Forex High Leverage Risk

Leverage allows traders to use minimal capital to control larger positions, but it can also work against them. For example, traders using leverage as high as 500:1 could lose their entire investment with a single unfavorable trade. High leverage can also lead to significant debt, making it a double-edged sword for traders who aren't cautious. Quick example: During the yen flash crash, a leveraged long USD/JPY position magnified a 3% move into a total account wipeout.

Forex Regulation Challenges

The Forex market is less regulated compared to other financial markets, which increases the risk for traders. Regulatory bodies in one country lack the authority to enforce their rules in another, leaving traders vulnerable to scams and dishonest brokers. When brokers engage in unfair practices, they are often not held accountable due to the lack of global regulation. As a result, traders are at the mercy of their brokers, with limited options to address unethical behavior. Quick example: A rogue offshore broker halted withdrawals after a client saw substantial profits, with no clear recourse.

Forex Risk Management Tools

Some Forex brokers include Forex options as part of their services, allowing traders to buy or sell currencies based on set prices. Brokers may also offer commodity futures trading commissions, which are regulated by the Commodity Futures Trading Commission. Recent events such as the spike in EUR/USD volatility following the latest ECB rate decision have shown the importance of robust risk tools as Forex trading volumes continue to rise globally. Quick example: A trader buys a EUR/USD put option ahead of a central bank announcement to cap potential losses during sudden rate-driven swings.

Effective risk management systems are essential in helping traders avoid significant losses. One common pitfall for traders is allowing emotions to influence their decisions. This can lead to impulsive buying or selling, resulting in unfavorable outcomes. A disciplined approach to trading, along with sound risk management, is crucial for success especially given the recent uptick in volatility across major currency pairs. Quick example: Setting automated stop-loss levels at 1% of account equity prevents deep drawdowns during flash crashes.

Forex Automated Robots

Many day traders use Forex automated robots, which are integrated into trading systems and can run continuously throughout the day. These robots analyze the Forex market and make decisions based on real-time data. By entering multiple trades with one click, they can increase the chances of profit, automating the trading process and reducing manual effort. With the rise of volatility such as the recent yen fluctuations after geopolitical news automated strategies have seen a surge in adoption. Quick example: An EAs (Expert Advisor) algorithm spots a rapid USD/JPY spike and executes a hedge position within milliseconds to lock in gains.

Can I Trade Forex Without A Broker?

No, you cannot trade Forex without a broker. Forex brokers provide the platforms that allow investors to place trades in the Forex market. These platforms often offer features like setting stop loss and take profit amounts directly from the platform, making it easier to manage trades. Reputable brokers also provide web-based customer service to guide clients in making informed investment decisions. Given the recent surge in retail Forex participation and heightened volatility, attempting to trade without a regulated intermediary exposes you to extreme slippage and counterparty risk. Quick example: During a sudden GBP/CHF flash rally, traders using peer-to-peer platforms experienced slippage of over 2%, underscoring the need for broker safeguards.

Forex trading involves buying or selling contracts with specific dates, prices, and values. While most commodity futures trading happens on over-the-counter (OTC) markets, where buyers and sellers can trade directly, Forex trading typically requires brokers to facilitate these transactions.

Though you can start trading Forex with a demo account to practice, you must open a registered live account to trade real funds. The minimum deposit required to open a live account varies depending on the broker you choose.

Is Forex Trading Safe?

Forex trading can be a viable option for diversifying your portfolio, but security is paramount. To minimize risk, always trade within your net asset value and be mindful of your exposure. Using leverage, if not carefully managed, can lead to significant losses particularly during volatile periods like the recent USD/CAD swings triggered by oil price shocks. Quick example: Reducing leverage to 10:1 during high-volatility news releases helped one trader avoid a 50% loss in a single session.

If you're new to trading or want to test your strategies without risk, consider using a demo account. It allows you to practice without committing real money, providing a secure environment to learn.

Additionally, ensure that you choose a reputable trading platform. Do thorough research, read reviews, and participate in online forums to find platforms with strong security measures. Only use brokers that offer regulated platforms to protect your funds.

Is Forex Better Than Stocks?

Many investors prefer the Forex market over the stock market due to its high volume and multiple risk/reward scenarios. The Forex market offers enormous liquidity daily trade volumes recently topped $7 trillion, reflecting a continued rise in global participation. Additionally, the profit potential in Forex is virtually unlimited, and the leverage available allows investors to control large positions with just a fraction of their account balance, sometimes as low as 0.1%. Quick example: Capturing a 0.5% move in USD/TRY during a sudden rate-decision announcement yielded returns comparable to stock trades requiring far larger capital.

One of the key advantages of Forex trading is execution speed. Factors like news and financial reports influence the speed at which trades are executed, making Forex more responsive than stocks. Unlike stocks, where execution can be slower due to complex rules, Forex allows quicker adjustments to market changes.

To trade stocks successfully, traders need expertise in identifying favorable stocks, while Forex trading often focuses on highly liquid and safe currencies. However, currency pairs like USD/JPY can be volatile, offering opportunities for traders who understand market movements.

For day traders, Forex is an attractive option due to its low margin requirements and the ability to use leverage. These factors allow traders to potentially achieve profits faster than in the stock market.

How Technology Is Changing and Affecting Forex Trading

The Internet has significantly transformed the Forex market, creating new opportunities for both novice and experienced traders. With advanced technology, traders now have greater access to real-time data, faster execution, and sophisticated tools for analysis, all of which enhance their ability to make informed trading decisions and increase revenue potential. The rise of AI-powered analytics and high-frequency trading has also amplified market volatility, as algorithms react in milliseconds to economic releases. Quick example: Using an AI sentiment-analysis tool, one trader predicted and profited from a rapid NZD/USD reversal within minutes of a surprise jobs report.

Forex Brokers Verdict

Forex brokers serve as the gateway to the global Forex market, allowing traders to execute trades and access the necessary tools and resources to engage in currency trading. As a Forex trader, your choice of broker is fundamental to your success. A broker is responsible for executing your trades, managing your orders, and providing access to market conditions. They charge fees for their services, which can vary based on the platform and the type of account you choose. It's crucial to ensure that the broker you select aligns with your trading style, goals, and risk tolerance.

It's crucial to assess the trading conditions provided by the broker. Factors such as spreads, leverage options, and available trading tools can make a significant difference in your overall trading experience. Some brokers offer more favorable conditions for beginners, while others are tailored to experienced traders who require advanced charting tools and market analysis features. Make sure the broker offers a platform that supports your trading strategy and provides all the necessary resources to manage risk effectively.

Another key aspect to consider is the customer support offered by the broker. A broker with efficient and responsive customer service can make a big difference, especially when you encounter issues or need assistance during live trading. Check if they offer multiple communication channels such as live chat, email, or phone support. A broker that is easily accessible and willing to assist when necessary is invaluable for traders who rely on quick resolutions in fast-paced market conditions.

When choosing a Forex broker, ensure that they operate in a well-regulated environment. Regulation provides an added layer of protection and ensures that the broker adheres to industry standards and maintains ethical business practices. Trading with a regulated broker can provide peace of mind, knowing that the broker is held accountable for their actions. You should also consider the availability of risk management tools, such as stop-loss and limit orders, which can help protect your investments and minimize potential losses.

Lastly, always remember that the Forex market can be unpredictable, and trading carries inherent risks. A good broker will help mitigate some of these risks by providing you with the tools and resources necessary to trade wisely. However, it is ultimately up to you as the trader to manage your risk effectively and make informed decisions. Take your time in selecting the right broker, as this decision will have a lasting impact on your trading journey.

We have conducted extensive research and analysis on over multiple data points on Forex Brokers to present you with a comprehensive guide that can help you find the most suitable Forex Brokers. Below we shortlist what we think are the best forex brokers after careful consideration and evaluation. We hope this list will assist you in making an informed decision when researching Forex Brokers.

Reputable Forex Brokers Checklist

Selecting a reliable and reputable online Forex trading brokerage involves assessing their track record, regulatory status, customer support, processing times, international presence, and language capabilities. Considering these factors, you can make an informed decision and trade Forex more confidently.

Selecting the right online Forex trading brokerage requires careful consideration of several critical factors. Here are some essential points to keep in mind:

- Ensure your chosen Forex broker has a solid track record of at least two years in the industry.

- Verify that the Forex broker has a customer support team of at least 15 members responsive to queries and concerns.

- Check if the Forex broker operates under the regulatory framework of a jurisdiction that can hold it accountable for any misconduct or resolve disputes fairly and impartially.

- Ensure that the Forex broker can process deposits and withdrawals within two to three days, which is crucial when you need to access your funds quickly.

- Look for Forex brokers with an international presence in multiple countries, offering its clients local seminars and training programs.

- Ensure the Forex broker can hire staff from diverse locations worldwide who can communicate fluently in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Compare Key Features of Forex Brokers in Our Brokerage Comparison Table

When choosing a broker for forex trading, it's essential to compare the different options available to you. Our forex brokerage comparison table below allows you to compare several important features side by side, making it easier to make an informed choice.

- Minimum deposit requirement for opening an account with each forex broker.

- The funding methods available for forex with each broker.

- The types of instruments you can trade with each forex broker, such as forex, stocks, commodities, and indices.

- The trading platforms each forex broker provides, including their features, ease of use, and compatibility with your devices.

- The spread type (if applicable) for each forex broker affects the cost of trading.

- The level of customer support each forex broker offers, including their availability, responsiveness, and quality of service.

- Whether each forex broker offers Micro, Standard, VIP, or Islamic accounts to suit your trading style and preferences.

By comparing these essential features, you can choose a forex broker that best suits your needs and preferences for forex. Our forex broker comparison table simplifies the process, allowing you to make a more informed decision.

Top 15 Forex Brokers of 2025 compared

Here are the top Forex Brokers.

Compare forex brokers for min deposits, funding, used by, benefits, account types, platforms, and support levels. When searching for a forex broker, it's crucial to compare several factors to choose the right one for your forex needs. Our comparison tool allows you to compare the essential features side by side.

All brokers below are forex brokers. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more forex brokers that accept forex clients.

| Broker |

IC Markets

|

Roboforex

|

eToro

|

XTB

|

XM

|

Pepperstone

|

AvaTrade

|

FP Markets

|

EasyMarkets

|

SpreadEx

|

FXPro

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rating | |||||||||||

| Regulation | Seychelles Financial Services Authority (FSA) (SD018) | RoboForex Lid is regulated by Belize FSC, License No. 000138/7, reg. number 000001272. RoboForex Ltd, which is an (A category) member of The Financial Commission, also is a participant of its Compensation Fund | FCA (Financial Conduct Authority) eToro (UK) Ltd (FCA reference 583263), eToro (Europe) Ltd CySEC (Cyprus Securities Exchange Commission), ASIC (Australian Securities and Investments Commission) eToro AUS Capital Limited ASIC license 491139, CySec (Cyprus Securities and Exchange Commission under the license 109/10), FSAS (Financial Services Authority Seychelles) eToro (Seychelles) Ltd license SD076 | FCA (Financial Conduct Authority reference 522157), CySEC (Cyprus Securities and Exchange Commission reference 169/12), FSCA (Financial Sector Conduct Authority), XTB AFRICA (PTY) LTD licensed to operate in South Africa, KPWiG (Polish Securities and Exchange Commission), DFSA (Dubai Financial Services Authority), DIFC (Dubai International Financial Center), CNMV (Comisión Nacional del Mercado de Valores), KNF (Komisja Nadzoru Finansowego), IFSC (Belize International Financial Services Commission license number IFSC/60/413/TS/19) | Financial Services Commission (FSC) (000261/4) XM ZA (Pty) Ltd, Cyprus Securities and Exchange Commission (CySEC) (license 120/10) Trading Point of Financial Instruments Ltd, Australian Securities and Investments Commission (ASIC) (number 443670) Trading Point of Financial Instruments Pty Ltd | Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217 | Australian Securities and Investments Commission (ASIC) Ava Capital Markets Australia Pty Ltd (406684), South African Financial Sector Conduct Authority (FSCA) Ava Capital Markets Pty Ltd (45984), Financial Services Agency (Japan FSA) Ava Trade Japan K.K. (1662), Financial Futures Association of Japan (FFAJ),, FFAJ, Abu Dhabi Global Markets (ADGM)(190018) Ava Trade Middle East Ltd (190018), Polish Financial Supervision Authority (KNF) AVA Trade EU Ltd, Central Bank of Ireland (C53877) AVA Trade EU Ltd, British Virgin Islands Financial Services Commission (BVI) BVI (SIBA/L/13/1049), Israel Securities Association (ISA) (514666577) ATrade Ltd, Financial Regulatory Services Authority (FRSA) | CySEC (Cyprus Securities and Exchange Commission) (371/18), ASIC AFS (Australian Securities and Investments Commission) (286354), FSP (Financial Sector Conduct Authority in South Africa) (50926), Financial Services Authority Seychelles (FSA) (130) | Cyprus Securities and Exchange Commission (CySEC) (079/07) Easy Forex Trading Ltd, Australian Securities and Investments Commission (ASIC) (Easy Markets Pty Ltd 246566), British Virgin Islands Financial Services Commission (BVI) EF Worldwide Ltd (SIBA/L/20/1135), Financial Sector Conduct Authority South Africa (FSA) EF Worldwide (PTY) Ltd (54018), FSC (Financial Services Commission) (SIBA/L/20/1135), FSCA (Financial Sector Conduct Authority) (54018) | FCA (Financial Conduct Authority) (190941), Gambling Commission (Great Britain) (8835) | FCA (Financial Conduct Authority) (509956), CySEC (Cyprus Securities and Exchange Commission) (078/07), FSCA (Financial Sector Conduct Authority) (45052), SCB (Securities Commission of The Bahamas) (SIA-F184), FSA (Financial Services Authority of Seychelles) (SD120) |

| Min Deposit | 200 | 10 | 50 | No minimum deposit | 5 | No minimum deposit | 100 | 100 | 25 | No minimum deposit | 100 |

| Funding |

|

|

|

|

|

|

|

|

|

|

|

| Used By | 200,000+ | 730,000+ | 35,000,000+ | 1,000,000+ | 10,000,000+ | 400,000+ | 400,000+ | 200,000+ | 250,000+ | 60,000+ | 7,800,000+ |

| Benefits |

|

|

|

|

|

|

|

|

|

|

|

| Accounts |

|

|

|

|

|

|

|

|

|

|

|

| Platforms | MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading Central | MT4, MT5, R Mobile Trader, R StocksTrader, WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), Windows | eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, Web | MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play) | MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile Apps | MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play) | easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5 | Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingView | MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play) |

| Support |

|

|

|

|

|

|

|

|

|

|

|

| Learn More |

Sign

Up with icmarkets |

Sign

Up with roboforex |

Sign

Up with etoro |

Sign

Up with xtb |

Sign

Up with xm |

Sign

Up with pepperstone |

Sign

Up with avatrade |

Sign

Up with fpmarkets |

Sign

Up with easymarkets |

Sign

Up with spreadex |

Sign

Up with fxpro |

| Risk Warning | Losses can exceed deposits | Losses can exceed deposits | 61% of retail investor accounts lose money when trading CFDs with this provider. | 69% - 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.12% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | 75-95 % of retail investor accounts lose money when trading CFDs | 71% of retail investor accounts lose money when trading CFDs with this provider | Losses can exceed deposits | Your capital is at risk | 65% of retail CFD accounts lose money | 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider |

| Demo |

IC Markets Demo |

Roboforex Demo |

eToro Demo |

XTB Demo |

XM Demo |

Pepperstone Demo |

AvaTrade Demo |

FP Markets Demo |

easyMarkets Demo |

SpreadEx Demo |

FxPro Demo |

| Excluded Countries | US, IR, CA, NZ, JP | AU, BE, BQ, BR, CA, CW, CZ, DE, ES, EE, EU, FM, FR, FI, GW, ID, IR, JP, LR, MP, NL, PF, PL, RU, SE, SJ, SS, SL, SI, TL, TR, DO, US, IT, AT, PT, BG, HR, CY, DK, FL, GR, IE, LV, LT, MT, RO, SK, CH | ZA, ID, IR, KP, BE, CA, JP, SY, TR, IL, BY, AL, MD, MK, RS, GN, CD, SD, SA, ZW, ET, GH, TZ, LY, UG, ZM, BW, RW, TN, SO, NA, TG, SL, LR, GM, DJ, CI, PK, BN, TW, WS, NP, SG, VI, TM, TJ, UZ, LK, TT, HT, MM, BT, MH, MV, MG, MK, KZ, GD, FJ, PT, BB, BM, BS, AG, AI, AW, AX, LB, SV, PY, HN, GT, PR, NI, VG, AN, CN, BZ, DZ, MY, KH, PH, VN, EG, MN, MO, UA, JO, KR, AO, BR, HR, GL, IS, IM, JM, FM, MC, NG, SI, | US, IN, PK, BD, NG , ID, BE, AU | US, CA, IL, IR | AF, AS, AQ, AM, AZ, BY, BE, BZ, BT, BA, BI, CM, CA, CF, TD, CG, CI, ER, GF, PF, GP, GU, GN, GW, GY, HT, VA, IR, IQ, JP, KZ, LB, LR, LY, ML, MQ, YT, MZ, MM, NZ, NI, KP, PS, PR, RE, KN, LC, VC, WS, SO, GS, KR, SS, SD, SR, SY, TJ, TN, TM, TC, US, VU, VG, EH, ES, YE, ZW, ET | BE, BR, KP, NZ, TR, US, CA, SG | US, JP, NZ | US, IL, BC, MB, QC, ON, AF, BY, BI, KH, KY, TD, KM, CG, CU, CD, GQ, ER, FJ, GN, GW, HT, IR, IQ, LA, LY, MZ, MM, NI, KP, PW, PA, RU, SO, SS, SD, SY, TT, TM, VU, VE, YE | US, TR | US, CA, IR |

All Forex brokers in more detail

You can compare Forex Brokers ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options, regulation and account types side by side.

We also have an indepth Top Forex Brokers for 2025 article further below. You can see it now by clicking here

We have listed top Forex brokers below.

Forex Brokers List

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading CentralCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, R Mobile Trader, R StocksTrader, WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), WindowsCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Funding methods

Bank transfer Credit Card PaypalPlatforms

eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, WebCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile AppsCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account XM Swap-Free account (XM Ultra Low Account) VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account Pro Account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingViewCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Learn more

Losses can exceed deposits

Losses can exceed deposits

Losses can exceed deposits