How To Buy Shaftesbury Plc Stock (SHB)

How to buy, sell or trade Shaftesbury PLC SHB stocks and shares.

Steps To Buying Or Selling Shaftesbury PLC Stocks and Shares

- Decide how you want to buy, sell or trade Shaftesbury PLC SHB stocks and shares.

Do you want to to trade in Shaftesbury PLC CFD Stocks, Fractional Shaftesbury PLC shares or traditional Shaftesbury PLC Stocks. - Register with an Shaftesbury PLC SHB broker that suits your needs. Register with multiple to see which you prefer.

- Research Shaftesbury PLC financial reports. Use brokerage research tools and resources.

- Decide your budget for Shaftesbury PLC stock and how many Shaftesbury PLC SHB shares you want to buy.

- Buy or Sell your Shaftesbury PLC shares with your broker by placing an order.

The content on a page is not intended for the residents and users in the USA.

Buy or Sell Shaftesbury PLC (SHB) Stock for 0.00 GBP

Shaftesbury PLC (SHB) in Detail

The highest price Shaftesbury PLC stock has been at in the last year is 0.00 GBP and its lowest price the last year was 0.00 GBP.

Looking to buy or sell Shaftesbury PLC shares? You have options! Consider the following brokers based on your preferred type of trading:

- eToro: This broker offers commission-free stock trading in the UK and Europe, making it a great choice for buying shares. Plus, with eToro, clients can buy fractional shares (where available).

- XTB: If you're interested in trading Shaftesbury PLC CFDs, XTB is a good option to consider.

Keep in mind that eToro offers some unique benefits for buying Shaftesbury PLC shares. For example, clients can buy the underlying stock with zero commission and trade with leverage. Additionally, eToro allows for fractional shares and has a minimum trade of $10 and a minimum deposit in the UK of $50. These perks make eToro one of the cheapest places to buy stocks like Shaftesbury PLC, especially for small investors.

| Broker |

IC Markets

|

Roboforex

|

eToro

|

XTB

|

XM

|

Pepperstone

|

|---|---|---|---|---|---|---|

| Rating | ||||||

| Used By | 200,000+ | 730,000+ | 40,000,000+ | 1,000,000+ | 10,000,000+ | 400,000+ |

| Share Dealing |

USA stocks : UK shares : CFD trading : |

USA stocks : UK shares : CFD trading : |

USA stocks : UK shares : CFD trading : |

USA stocks : UK shares : CFD trading : |

USA stocks : UK shares : CFD trading : |

USA stocks : UK shares : CFD trading : |

When trading Shaftesbury PLC stock CFDs, it's important to understand the risks involved. While there is potential for profits, there is also a high risk of losing money. Losses can sometimes exceed deposits, so it's crucial to proceed cautiously. CFDs (Contract for Difference) are complex instruments that use leverage to amplify gains and losses based on up or down Shaftesbury PLC price. No real Shaftesbury PLC stock assets are exchanged with Shaftesbury PLC CFD trading. Even small fluctuations in the stock's price can lead to significant profits or losses. Up to 80% of retail investor accounts are estimated to lose money when trading CFDs. If you're considering trading Shaftesbury PLC stock CFDs, it's essential to assess your risk tolerance and financial situation carefully. Ensure you fully understand how CFDs work and the potential risks involved before investing any money. If you're unsure about any aspect of CFD trading, consider seeking advice from a financial professional. Remember, while there is potential for profits, there is also a real possibility of losing your investment. Scroll down to read our in-depth article on How To Buy Shaftesbury Plc Stock. What you should know, Types of Shaftesbury PLC stock trading. Pros and Cons, everything is explained below.

How To Buy Or Sell Shaftesbury PLC SHB Stocks & Shares

You can purchase Shaftesbury PLC shares directly through a brokerage account or one of the various investment applications available. These systems allow you to buy, trade, and keep Shaftesbury PLC stocks from your home or smartphone. The primary distinctions between different Shaftesbury PLC stock trading brokers are primarily in fees and resources supplied. Many of the best Shaftesbury PLC stock trading platforms offer zero commission trading. Ensure you only buy Shaftesbury PLC stock with a well-financially regulated Shaftesbury PLC stock broker. It would be best if you also spent some time conducting quantitative research (analyse the revenue of Shaftesbury PLC, their net income and earnings) and qualitative research (find out what the Shaftesbury PLC management is like, the competition they face, and how they make money).

Choosing An Shaftesbury PLC Stock Broker

When choosing a Shaftesbury PLC stock broker, make sure you consider the variety of exchanges that the broker offers through which to buy and sell individual Shaftesbury PLC stocks and securities, the commissions and fees charged by the broker for conducting trading in Shaftesbury PLC, and what margin rates the broker offers. You will also need to check that you can open a brokerage account with the broker considering your citizenship status.

Several brokers can be extremely expensive for certain types of citizens if they wish to buy Shaftesbury PLC shares once in a while, whereas other brokers offer their services for free. Not every broker you find online will allow you to buy shares of Shaftesbury PLC; this is because they do not have access to the all stock exchanges like NASDAQ, S&P, FTSE and others.

You will need a SHB stock broker that provides you with access to SHB stock exchanges. In addition, you should consider the types of research, educational materials, and account types the online broker offers to help you meet your SHB stock investing goals.

If you are hoping to invest in fulfilling long-term goals, such as a child's college education or your retirement, you may want to buy SHB through a tax-advantaged account, such as an individual retirement account (IRA), 529 or pension. On the other hand, if you require money for larger short-term purposes, such as investment property, a taxable investment account may be a more suitable choice.

Finally, consider the broker's reputation and safety features, which are highly important when buying and selling SHB related financial instruments. Choose a broker with good reviews, or one trusted and regulated by a financial regulator.

Full Service Shaftesbury PLC Stock Broker

Full-service Shaftesbury PLC stock brokers personalise their recommendations and charge extra fees, service fees, and commissions. Because of the research and tools that these companies give, most investors are ready to pay these higher costs.

Shaftesbury PLC Discount Broker

With a Shaftesbury PLC stock discount broker, the investor is responsible for the majority of their own Shaftesbury PLC SHB research. The broker only provides a trading platform and customer support when necessary.

Steps to Trading Shaftesbury PLC SHB Stocks & Shares

How To Buy Sell Or Trade Shaftesbury PLC Stock Guide

How to buy Shaftesbury PLC Stocks & Shares Risks Trading Shaftesbury PLC SHB

Investing in Shaftesbury PLC stocks can be risky, as there is always a potential for your investment not to perform as expected, resulting in lower returns or even loss of your original investment. Risk is increased, especially for leveraged trades on Shaftesbury PLC stock, which can result in losses exceeding your initial deposit.

Before investing in Shaftesbury PLC, it is important to conduct proper research on the company and its stock price history. Stocks are exposed to credit risk and fluctuations in the value of their investment portfolio, which can be influenced by factors such as Shaftesbury PLC credit deterioration, liquidity, political risk, financial results, interest rate fluctuations, market and economic conditions, and sovereign risk.

To mitigate some of these risks, it is recommended to review the documents that Shaftesbury PLC is required to file regularly, such as the annual reports (Form 10-K) and quarterly reports (Form 10-Q), which disclose detailed financial information. Monitoring your investments by following your established investment strategy and reviewing your Shaftesbury PLC position is also important.

If you plan on holding Shaftesbury PLC shares for the long term, attending the Shaftesbury PLC company's annual meeting and analyzing any news and information about the company can help you make informed decisions regarding your investment.

Shaftesbury PLC SHB Trading Fees

Investors looking to trade Shaftesbury PLC stocks may be interested in taking advantage of current promotional offers from certain stock brokers. These Shaftesbury PLC stock brokers may offer low or no trading fees and may not require an account minimum. It's important to note that these offers can vary between brokers offering various Shaftesbury PLC financial instruments and may be subject to specific terms and conditions.

For example, eToro is currently offering commission-free Shaftesbury PLC stock trading for new users who sign up for a trading account. It's always a good idea to carefully review promotional offers and their terms before investing in Shaftesbury PLC stock or any other financial instrument.

How much does it cost to buy or sell Shaftesbury PLC SHB Stock

At the time of writing SHB is worth 0.00 GBP per share.

How can I buy or sell Shaftesbury PLC SHB Stock

If you want to buy or sell Shaftesbury PLC shares, you have two options available: placing a SHB market order or a SHB limit order. A SHB market order is executed immediately at the prevailing market price, while a SHB limit order allows you to specify the maximum price you are willing to pay.

Deciding how many Shaftesbury PLC shares to buy can be a challenging task, and will depend on various factors such as your Shaftesbury PLC investment strategy and budget. It is important to carefully consider these factors before placing a live Shaftesbury PLC stock order.

Trade Real Shaftesbury PLC Shares

Buying real Shaftesbury PLC shares means you are buy a 100% of each single Shaftesbury PLC SHB share you buy. When you buy a real Shaftesbury PLC stock you own the Shaftesbury PLC stock in your name as an underlying asset. You will have to make sure your trading account has adequete funding to for your Shaftesbury PLC stock bid price.

When you purchase a share of stock in Shaftesbury PLC, you are effectively becoming a part owner of that company. Depending on the volume of Shaftesbury PLC shares you own it may entitle you to certain benefits offered by Shaftesbury PLC. Some companies may choose to pay dividends to shareholders or reinvest income in order to expand further.

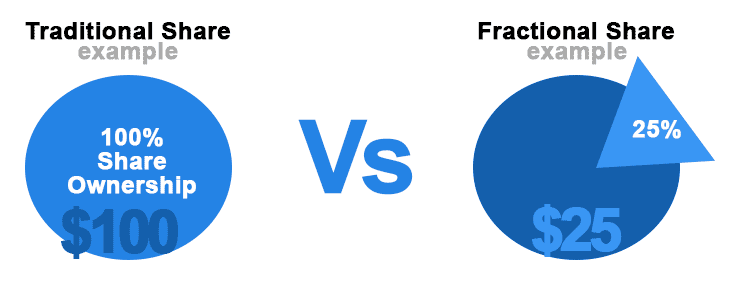

Trade Shaftesbury PLC Fractional Shares

When you buy real Shaftesbury PLC shares, you become a direct owner of the underlying asset. Trading real Shaftesbury PLC stock means that you own 100% of each Shaftesbury PLC SHB share that you purchase, and it is held in your name. To buy the shares, you will need adequate funds in your trading account to cover the stock's bid price.

Owning a share of Shaftesbury PLC stock means you become a part-owner of the company. Depending on the number of shares you own, you may be entitled to certain benefits offered by Shaftesbury PLC. For example, some companies like Shaftesbury PLC may pay shareholders dividends to share profits, while others may reinvest income to expand their business further.

Pros and Cons of Investing in Shaftesbury PLC Fractional Shares

When considering investing in Shaftesbury PLC, fractional shares offer both advantages and disadvantages to investors.

Disadvantages of Shaftesbury PLC Fractional Shares

One potential disadvantage of buying Shaftesbury PLC fractional shares is that they can be more difficult to sell. Shaftesbury PLC fractional shares can only be sold within the same brokerage account they were purchased from, and demand for them may not always be high. Additionally, fractional shares come in various increments, which may make it harder to find a buyer for a specific fraction of Shaftesbury PLC stock.

Advantages of Shaftesbury PLC Fractional Shares

On the other hand, fractional shares offer investors increased control over their portfolios. By allowing investors to buy a portion of a stock based on a dollar amount rather than a whole share, fractional shares enable investors to diversify their portfolio even with small amounts of money. Affordability can help investors achieve the balance of different stocks, including Shaftesbury PLC and create a more diversified portfolio.

Fractional shares also offer the advantage of proportionate dividends. If you own a percentage of a Shaftesbury PLC share, you will receive a proportionate percentage of the dividends paid by the company. Finally, some brokers allow investors to start investing in Shaftesbury PLC with as little as $5 when using a fractional share investing strategy.

Additionally, fractional shares can also help investors to invest in high-priced stocks such as Shaftesbury PLC, which may otherwise be unaffordable. Fractional Shaftesbury PLC shares allow investors to benefit from these stocks' growth potential without committing to buying a full share. Fractional shares also provide flexibility, as investors can purchase or sell any amount they wish without being restricted to whole numbers of shares. Shaftesbury PLC, stock accessibility enables investors to fine-tune their portfolios and make smaller adjustments without committing to buying or selling whole shares.

Considerations When Investing in Shaftesbury PLC Fractional Shares

While Shaftesbury PLC, fractional shares can offer several advantages to investors, it's important to understand the potential downsides of trading Shaftesbury PLC as fractional shares as well. In addition to the difficulty in selling Shaftesbury PLC fractional shares, some brokers may charge higher fees for Shaftesbury PLC fractional share transactions, which could eat into your investment returns. Furthermore, fractional shares may not always be available for certain stocks, including Shaftesbury PLC, so checking with your broker before investing is important. Additionally, it's important to ensure that your broker is reputable and has a strong track record of providing reliable services to Shaftesbury PLC stock investors.

You can buy Shaftesbury PLC fractional shares with eToro. Your capital is at risk.

Buy Sell or Trade Shaftesbury PLC CFD Shares

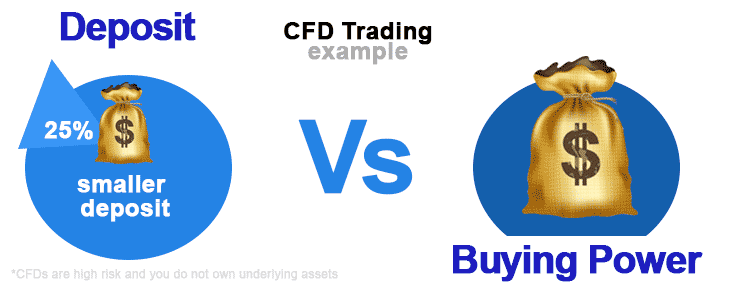

CFDs, or contracts for difference, are financial instruments that allow Shaftesbury PLC traders to speculate on the price movements of various markets, including Shaftesbury PLC stocks, Forex, indices, and commodities. Unlike traditional investments, CFDs do not require ownership of the underlying Shaftesbury PLC stock asset but instead offer traders the opportunity to profit from the price movements of these assets without physically owning them. With CFD trading, you can trade on Shaftesbury PLC share prices without buying or owning SHB stock. However, it is important to note that CFDs are complex investment products with a high level of risk, as there is a potential for unlimited losses if Shaftesbury PLC stock price positions go wrong. Despite this risk, CFD trading can be advantageous for traders with a short-term outlook, enabling them to speculate on Shaftesbury PLC asset prices by going either long (buying) or short (selling).

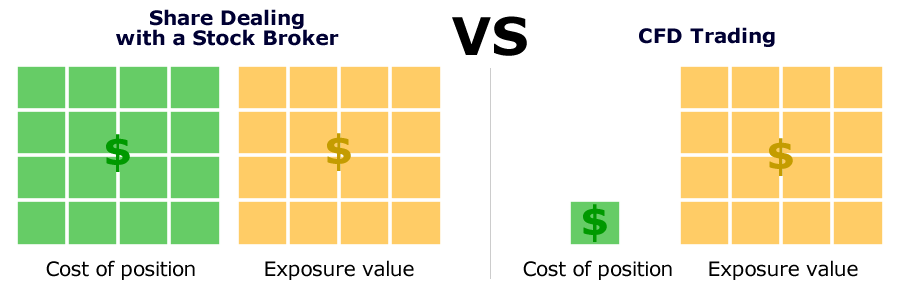

Shaftesbury PLC CFD Trading vs Traditional Share Dealing

What is CFD trading, and why would you buy Shaftesbury PLC as a CFD instead of a share? Let's explore the differences between the two methods of trading.

CFD trading, or contracts for difference, allows traders to speculate on the price movements of financial markets, including stocks, forex, indices, and commodities, without owning the underlying assets. When trading CFDs, traders have an agreement with their CFD broker and are speculating that the Shaftesbury PLC price will change up or down.

In contrast, when buying Shaftesbury PLC shares with a stock broker, you own a share of Shaftesbury PLC. If you bought 100 Shaftesbury PLC shares at 0.00 GBP a share with a stock broker, you would own 0 GBP of Shaftesbury PLC.

The main difference between trading Shaftesbury PLC CFDs and buying Shaftesbury PLC shares is that contracts for difference offer increased leverage. Shaftesbury PLC CFDs are traded on margin, meaning you do not need to invest the full amount on Shaftesbury PLC upfront. Instead, you could invest a fraction of the amount on Shaftesbury PLC, known as the CFD margin, to hold a similar position in Shaftesbury PLC. Trading an Shaftesbury PLC CFD allows investors to hold larger positions than their invested amount. However, be aware that investing in an Shaftesbury PLC CFD amplifies potential profits but also exaggerates potential losses, which may exceed the amount invested.

Investing in an Shaftesbury PLC share with a stock broker means you would only lose the amount you invested, as you pay the total cost of your position to your broker upfront. There is no leverage.

CFD trading enables traders to profit from both upward and downward price movements of Shaftesbury PLC on the financial exchange. A long CFD position hopes to profit from a rise in the Shaftesbury PLC share price, while a short Shaftesbury PLC CFD position aims to profit from a fall in the Shaftesbury PLC share price. Trading Shaftesbury PLC CFDs allows traders to move with the financial markets in both directions, giving them greater chances to profit.

It's important to note that Shaftesbury PLC CFDs are complex investment products and present a high risk to any trader. There is an ever-present threat of very high losses for Shaftesbury PLC positions that go wrong. If you are a trader with a short-term outlook, buying Shaftesbury PLC as a CFD can be advantageous. However, it's crucial to thoroughly research and understand the risks involved before engaging in Shaftesbury PLC CFD trading.

If you invested in an Shaftesbury PLC share with a stock broker you would only lose the amount you invested as you pay the total cost of your position to your broker upfront. There is no leverage.

An Shaftesbury PLC CFD long hopes to profit from a rise in the Shaftesbury PLC share price. An Shaftesbury PLC CFD short would aim to profit from a fall in the Shaftesbury PLC stock price. Trading CFDs allows traders to profit from both directions of the Shaftesbury PLC price on the financial exchange. Giving traders a greater chance to move with the financial markets.With traditional Shaftesbury PLC shares you can only profit from a rise in the Shaftesbury PLC stock price. You can trade Shaftesbury PLC CFD stocks and tradional stocks with eToro or XTB. Your capital is at risk.

Trading Shaftesbury PLC Stocks and CFDs

If you're considering investing in Shaftesbury PLC It's important to know your options. You can choose to buy or sell traditional Shaftesbury PLC shares through one of our listed brokers, or you can trade Shaftesbury PLC using CFDs (contracts for difference).

It's worth taking the time to understand the difference between these two investment options. When buying Shaftesbury PLC shares with a broker, you own a physical share of the company and can profit if the value of the stock goes up. However, buying shares also involves paying the full cost of the share upfront.

On the other hand, CFD trading offers a way to speculate on the value of Shaftesbury PLC without actually owning the shares. CFDs are traded on margin, meaning you can hold a position with only a fraction of the total value, which offers increased leverage compared to buying shares outright.

Trading Shaftesbury PLC CFDs can be advantageous for traders with a short-term outlook as it enables you to speculate on the Shaftesbury PLC price of the asset by going long (buying) or going short (selling). However, it's important to note that CFDs are complex investment products and present a high risk to traders, as potential losses can exceed the initial Shaftesbury PLC investment.

In summary, whether you choose to buy traditional Shaftesbury PLC shares or trade Shaftesbury PLC using CFDs depends on your investment goals, risk tolerance, and trading strategy. Understanding the benefits and risks of each Shaftesbury PLC trading option can help you make an informed decision about which approach is right for you.

Example Cost of Buying Shaftesbury PLC as a CFD Trade and Shares Side by Side

*All values below are estimates and are for illustrative purposes only. Please visit a broker for correct prices. Your capital is at risk.

CFD and Share deals differ from broker to broker so check you are aware of the actual costs with your brokers.

| Shaftesbury PLC stock examples | Shaftesbury PLC CFD trade example | Shaftesbury PLC Share deal example |

|---|---|---|

| Market price | $0.00 | $0.00 |

| Broker Deal | Invest $0 at 1:5 Margin (20%) | Buy at $0.00 a share |

| Deal size | 100 shares | 100 shares |

| Initial outlay | $0 (Margin = exposure x 20% margin factor) |

$0 (100 shares at $0.00) |

| Stamp duty | No | £20 |

| Close price | Sell at $0 | Sell at $0 |

| Estimated Profit |

(0 point increase x 100 shares = $0) *Not including commission fees and taxes |

($0 - $0 = $0) *Not including commission fees and taxes |

| Trade Shaftesbury PLC CFDs now with XTB | Trade Shaftesbury PLC Shares now with eToro |

Your capital is at risk. Other fees apply.

Shaftesbury PLC CFD and Stock Market Times

Trading traditional Shaftesbury PLC shares is limited to the hours when the LSE (The London Stock Exchange) stock exchange is open, which is typically 8:00am to 12:00pm GMT on trading days. This means that you can only buy or sell shares through your broker during these hours. However, with CFD trading, you can deal 24/7, allowing you to trade Shaftesbury PLC shares around the clock.

Buying or Selling Shaftesbury PLC Shares with a Broker

When you buy Shaftesbury PLC shares through a broker, your risk is limited to your initial investment, as brokers require you to pay for the full amount of your investment upfront. Unlike CFD trading, brokers do not offer leverage or loans when buying Shaftesbury PLC shares, meaning that your risk is limited to the initial amount invested. Additionally, buying Shaftesbury PLC shares through a broker can make you eligible to receive company dividends if applicable. However, owning shares in Shaftesbury PLC through a CFD does not provide shareholder privileges, as you do not actually own any underlying assets in Shaftesbury PLC.

Another benefit of buying Shaftesbury PLC shares through a broker is the possibility of receiving shareholder perks and benefits, such as voting rights at Shaftesbury PLC shareholder general meetings. However, eligibility for these benefits may require you to own a certain amount of stock for a set period.

Shaftesbury PLC Shares and CFDs and Tax

It is important to confirm with your local tax office, but in the United Kingdom, CFDs are free from capital gains and stamp duty taxes. Additionally, when trading CFDs, losses can be offset against profits when submitting your tax return. In contrast, investment in Shaftesbury PLC stocks and shares is only exempt from tax if the shares were bought through an ISA (Individual Savings Accounts) or SIPP (Self Invested Personal Pensions).

Should I trade Shaftesbury PLC Stocks and Shares or Shaftesbury PLC CFDs?

There are pros and cons to both trading in Shaftesbury PLC stocks and shares and trading Shaftesbury PLC CFDs. The decision on which to choose depends on the individual investor and a few factors. For long-term investments, buying Shaftesbury PLC shares and stocks is typically better suited, as they historically provide better returns over a 10-year period. In contrast, Shaftesbury PLC CFD trading is more appropriate for intra-day and mid-term traders, who aim to profit on the fluctuating highs and lows of the Shaftesbury PLC price throughout the day or a few days.

Shaftesbury PLC CFD trading is more suited to intra day and mid term traders. Wth intra day trading on an Shaftesbury PLC share investors aim to profit on the fluctuating highs and lows of the Shaftesbury PLC price throughout the day. Day trading as you can imagine focuses on profiting from the daily Shaftesbury PLC stock price change.

Both types of Shaftesbury PLC trading have different benefits and risks. Make sure you have a good understanding of what you are doing before you invest in Shaftesbury PLC stocks.

With CFD trading as you can short or long an Shaftesbury PLC stock you can hedge a trade against another trade.

A hedge is an investment that protects the money you have invested from risk. Traders hedge to minimize or offset a loss in value of an Shaftesbury PLC share price for example to a known amount.

How Shaftesbury PLC SHB Fits In Your Portfolio

If you are considering investing in Shaftesbury PLC stock, assessing the level of exposure it would give you to the company is essential. Investing a large percentage of your portfolio in a single stock can be risky, especially if the company's performance deteriorates. Furthermore, it is crucial to understand the benefits of diversification that come with investing in various equities, including stocks, bonds, funds, and alternative assets, if you are new to investing in Shaftesbury PLC or any financial market, it is advisable to develop a well-diversified portfolio.

Before investing in Shaftesbury PLC or other financial markets, ensure that you have an emergency fund that can cover at least three months of costs and have paid off any high-interest debt. It is also essential to remember that even the most successful stock stories, like Shaftesbury PLC, can turn sour. Consumer preferences can change, and competition can emerge, challenging the company's success.

Therefore, it is wise to focus on investing in the market rather than only picking individual stocks like Shaftesbury PLC. This approach has proven to be a successful long-term strategy. Lastly, it is important to remember that past performance does not always indicate future Shaftesbury PLC stock price performance. Seeking guidance from a financial expert before making significant changes to your portfolio or investing in Shaftesbury PLC is always a good idea.

Is Shaftesbury PLC A Buy Or Sell

Shaftesbury PLC total volume in the stock market refers to the number of shares, contracts, or lots traded on a given day. This Shaftesbury PLC volume is comprised of buying volume and selling volume.

The buying volume of Shaftesbury PLC refers to the cumulative amount of shares, contracts, or lots associated with purchasing trades, whereas selling volume refers to the total amount of shares, contracts, or lots associated with selling trades. The buying and selling volumes can provide investors with insights into the market demand and supply for Shaftesbury PLC, which can help make informed investment decisions.

When deciding to invest in Shaftesbury PLC stock, it is crucial to conduct appropriate research and analysis to determine whether the stock's price will rise in the short or long term. Investors should not base their decision solely on the Shaftesbury PLC stock's past performance but evaluate the company's financial health, Shaftesbury PLC management team, industry trends, and other relevant factors.

If an investor feels confident that the price of Shaftesbury PLC stock will increase, they may choose to buy the stock. However, it's important to note that the right time to buy Shaftesbury PLC stock may vary depending on the investor's strategy and investment goals. Some investors may hold the Shaftesbury PLC stock for a long time, while others may prefer to sell Shaftesbury PLC once they've made a profit.

Is Shaftesbury PLC Over or Under Valued?

One way to assess the valuation of Shaftesbury PLC stock is to use the P/E ratio. The profit-earning ratio is found by dividing Shaftesbury PLC stock price per share by per Shaftesbury PLC share earnings. A profit earning ratio that is high suggests that the stock may be overvalued, while a low P/E ratio may be undervalued. Before investing in Shaftesbury PLC stock, it is advisable to analyze its P/E ratio, which can provide valuable insights into the stock's current market valuation.

A Shaftesbury PLC stock may be considered overvalued if its current market price does not match its P/E ratio or forecast on earnings. For example, if Shaftesbury PLC stock price is 50 times higher than its earnings, it is likely to be an overvalued stock compared to one that is trading for 10 times its earnings. Other factors to consider when deciding whether Shaftesbury PLC stock is over or undervalued is the change in SHB fundamentals, the amount of free cash flow that Shaftesbury PLC has, and their price to book ratio. Shaftesbury PLC has a P/E ratio of 0.00.

Shaftesbury PLC SHB Financials 2025

Founded in 1986, Shaftesbury PLC has a 52 week high price of 0.00 and a 52 week low price of 0.00. Shaftesbury PLC has a marketcap of 0 and an average trading volume of 0. Shaftesbury PLC has 0 shares on the LSE (The London Stock Exchange). Shaftesbury PLC has a P/E ratio of 0.00 and a EPS of 0.00.

Shaftesbury PLC Stock P/E Ratio

The (PE) ratio helps in understand the Shaftesbury PLC stock value compared to Shaftesbury PLC earnings. A Shaftesbury PLC high (PE) ratio shows that a stock's price is higher than its earnings and may be overvalued. A Shaftesbury PLC low (PE), on the other hand, may imply that the present stock price is cheap compared to earnings.

To simplify, you can estimate how much the market may pay for Shaftesbury PLC stock based on previous and prospective Shaftesbury PLC earnings.

When looking at Shaftesbury PLC, its current share price of (0.00) divided by its per-share earnings (EPS 0.00) over a period of 12 months results in a 0.00 (trailing price / earnings ratio) of approximately 0.00. Meanin Shaftesbury PLC shares are trading at 0.00 times the recent declared 0.00 earnings.

Investors in Shaftesbury PLC often use the P/E ratio to determine the company's market value relative to its earnings. A high P/E ratio may suggest that Shaftesbury PLC is overvalued as the stock price exceeds the earnings. On the other hand, a low Shaftesbury PLC P/E ratio may indicate that the current Shaftesbury PLC stock price is cheaper than the Shaftesbury PLC earnings, which could be an opportunity for Shaftesbury PLC investors to buy. For comparison, the trailing 12-month P/E ratio for the NASDAQ 100 was around 23.72 at the end 2022.

Shaftesbury PLC Trading Volume and PE

Shaftesbury PLC currently has 0 active shares in circulation traded through the LON exchange.

Shaftesbury PLC market capitalization is $0 with an average daily trading volume of 0 shares.

Trading volume is the amount of security traded over a certain duration. Regarding shares, volume refers to the number of shares bought and sold during a given day.

Shaftesbury PLC has a Price Earning Ratio ( PE ) of 0.00 and earning per share ( EPS ) of 0.00. Generally speaking, Shaftesbury PLC having a high P/E ratio means that Shaftesbury PLC investors foresee increased growth with Shaftesbury PLC in the future. Companies that are losing money do not have a P/E ratio.

Shaftesbury PLC earnings per share is company profit allocated to every Shaftesbury PLC common stock. Earnings per share are calculated by taking the difference between Shaftesbury PLC's net earnings and dividends paid for preferred stock and dividing that amount by the average amount of Shaftesbury PLC shares outstanding.

Whats A Good Shaftesbury PLC P/E Ratio?

The P/E ratio for Shaftesbury PLC is not necessarily classified as "good" based solely on a high or low ratio. In fact, a higher Shaftesbury PLC P/E ratio than the market average could be considered unfavourable, while a lower Shaftesbury PLC P/E ratio may be positive.

Typically, average P/E ratio on financial markets ranges around 20 to 25. Therefore, a higher P/E ratio above this range with Shaftesbury PLC could be unfavourable, indicating that investors are willing to pay a premium for Shaftesbury PLC shares despite Shaftesbury PLC earnings. In contrast, a lower Shaftesbury PLC P/E ratio may be better, suggesting that the current Shaftesbury PLC stock price is more aligned with its earnings, making Shaftesbury PLC shares more attractive to potential investors.

Shaftesbury PLC EPS (Earnings Per Share)

Investors are always looking for ways to measure the value of a stock. One widely used indicator is earnings per share (EPS), which measures a company's profitability. Shaftesbury PLC stock price is often evaluated using EPS as it is an indicator for the profit Shaftesbury PLC each share of its stock makes in potential profit. This information is useful for Shaftesbury PLC investors because they are willing to pay more for a Shaftesbury PLC share if they believe that Shaftesbury PLC is earning more than the stock price.

Currently, Shaftesbury PLC has an EPS value of 0.00. This information indicates how much profit Shaftesbury PLC has made for each share of its stock. EPS is a critical metric for investors as it helps them evaluate the company's financial health and potential for growth.

Shaftesbury PLC Investors also look for EPS growth rates to indicate the future potential of Shaftesbury PLC. An Shaftesbury PLC EPS growth rate of at least 25% over the previous year indicates that a Shaftesbury PLC products or services are in high demand. If the Shaftesbury PLC EPS growth rate has been increasing in recent quarters and years. It's even better. The increased EPS trend indicates that Shaftesbury PLC is on a path to greater profitability and could provide a good return on investment.

Shaftesbury PLC PEG Ratio

The Shaftesbury PLC PEG ratio, or Shaftesbury PLC (price / earnings to growth) ratio, is a measure that helps Shaftesbury PLC investors value the Shaftesbury PLC business by taking into consideration the Shaftesbury PLC stock market price, earnings, and future growth potential of Shaftesbury PLC as a business. The Shaftesbury PLC PEG ratio can show if Shaftesbury PLC stock is potentially over or under market value.

Shaftesbury PLC share price/earnings-to-growth ratio is computed by dividing its P/E ratio by its growth. A PEG ratio greater than one indicates that shares are overvalued at their current growth rate or that they may predict a faster growth rate.

The PEG ratio, rather just the P/E ratio, provides a more comprehensive picture of Shaftesbury PLC's potential profitability. It could also assist you in comparing the share prices of different high-growth firms by accounting for growth.

Shaftesbury PLC Trading Volume

Shaftesbury PLC stock trading volume can assist an investor in determining the strength of Shaftesbury PLC stock price momentum and confirming a trend. Shaftesbury PLC stock prices tend to move in the same direction as Shaftesbury PLC trade volume increases. If a Shaftesbury PLC stock price continues to rise in an uptrend, Shaftesbury PLC stock trading volume should rise, and vice versa.

Shaftesbury PLC has a trading volume of 0

The sentiment driving Shaftesbury PLC stock price movement is measured by Shaftesbury PLC trading volume. It informs you of the number of persons involved in the Shaftesbury PLC stock price movement. When Shaftesbury PLC stock trades on low volume, it signifies that only a small number of people are involved in Shaftesbury PLC stock buying and selling transactions. The market interest in Shaftesbury PLC stock can be measured by its trading volume.

Shaftesbury PLC Stock Price Volatility

The Shaftesbury PLC stock price has fluctuated in value during the last year, ranging from 0.00 GBP to 0.00 GBP. The larger the range between the 52 week low and 52 week high price is a prominent metric for determining its volatility.

Investing In Shaftesbury PLC Stocks

After selecting your preferred Shaftesbury PLC stock broker, opening an account, and funding it, you are now ready to start investing in Shaftesbury PLC stocks. You can do this by accessing the stock through your trading app or web browser, then indicating the number of shares or the amount you wish to invest with fractional shares. Additionally, you must select the type of order you prefer, such as market or limit order, then execute the trade.

If you desire greater control over your money and Shaftesbury PLC shares, using a limit order is advisable. This type of order allows you to specify the price you wish to pay for Shaftesbury PLC stock, while market orders execute automatically at prevailing Shaftesbury PLC prices. Limit orders could benefit thinly traded securities with large bid-ask spreads since executing Shaftesbury PLC market orders might increase prices.

To ensure that you get the best price possible, you can request to buy SHB stock at the current best price on your brokerage platform or use a more advanced Shaftesbury PLC order type like limit or stop orders. These will help you purchase or sell Shaftesbury PLC shares once the stock price falls below a specified threshold. Investing in Shaftesbury PLC stocks requires patience and knowledge, but the potential rewards can be substantial.

Shaftesbury PLC is traded on the LSE (The London Stock Exchange) exchange meaning that it can be bought or sold between the LSE (The London Stock Exchange) trading hours which are 8:00am to 12:00pm GMT.

You can access this service through your online Shaftesbury PLC brokerage. The LSE (The London Stock Exchange) pre-market trading hours terms are 5:05 a.m. and 7:50 a.m. GMT, and after-hours trading conditions are 4:40 p.m. to 5:15 p.m. GMT. If you place an Shaftesbury PLC stock order outside of available LSE (The London Stock Exchange) trading hours it will be processed once LSE (The London Stock Exchange) trading resumes.

Why Shaftesbury PLC Stocks Fluctuate

In the world of finance, the law of supply and demand has a significant impact on the Shaftesbury PLC stock market. The simple concept is that when the demand for Shaftesbury PLC stock exceeds its supply, its price tends to increase. On the other hand, when there is an excess supply of Shaftesbury PLC stock that surpasses demand, the SHB stock price typically goes down.

The severity of the demand-supply gap has a direct correlation with the Shaftesbury PLC stock price, with a more significant gap resulting in a higher price for Shaftesbury PLC stock. Consequently, when the number of Shaftesbury PLC stocks available for sale is less than the number of people wanting to buy them, the price of Shaftesbury PLC stock tends to rise.

Conversely, when there are more Shaftesbury PLC stocks than buyers, the Shaftesbury PLC stock price tends to fall. The Shaftesbury PLC stock price constantly fluctuates based on the number of buyers versus the available supply of Shaftesbury PLC stocks.

In addition to supply and demand, innovative and revenue-generating products or services released by Shaftesbury PLC can also impact the valuation of SHB stock. Keeping an eye on such developments could provide insights into the future performance of Shaftesbury PLC stock and help investors make informed decisions.

Shaftesbury PLC Stock Market Capitalisation

The market capitalisation of a Shaftesbury PLC stock is a critical metric in finance. It is calculated by multiplying the total number of outstanding shares of Shaftesbury PLC stock by its current market price. For instance, if a company has one million outstanding shares priced at $50 per share, the market cap of that company would be $50 million. It's worth noting that Shaftesbury PLC has a market cap of 0.

Knowing the market cap of Shaftesbury PLC enables investors to analyse the company in the context of other similar-sized companies in the same industry. The Shaftesbury PLC market cap is considered more meaningful than the share price because it considers company's total value. For example, a small-cap firm with a market cap of $500 million should not be compared to a large-cap corporation with a market value of $10 billion. Therefore, understanding the market cap of Shaftesbury PLC can provide valuable insights for investors making informed investment decisions.

Shaftesbury PLC Stock Volume Explained

The Shaftesbury PLC stock's trading volume is the total number of shares bought and sold within a specified period, usually one trading day. It measures the overall market activity and liquidity of Shaftesbury PLC shares. However, remember that the same Shaftesbury PLC shares can be traded multiple times a day, so the trading volume counts each transaction.

The higher the volume of Shaftesbury PLC stocks traded, the more active the market is for that stock. It is usually viewed as a sign of financial strength when an increasing trading volume accompanies a rising market. On the other hand, low trading volume can indicate a lack of market interest in Shaftesbury PLC.

Volume is a crucial indicator of the money flow in Shaftesbury PLC stock. When Shaftesbury PLC stock appreciates on high volume, it shows that more investors are buying the stock, which is usually a good sign to invest in. However, if Shaftesbury PLC stock is appreciating on low volume, it could be a sign of weak market interest, and investing in it may not be wise. Therefore, paying attention to the trading volume of Shaftesbury PLC stock can help investors make more informed decisions about buying, selling, or holding Shaftesbury PLC shares.

Shaftesbury PLC Stock Splits

It is important to understand that the value of a company and the price of its Shaftesbury PLC stock are not necessarily the same thing. Simply looking at the Shaftesbury PLC share price does not provide a complete picture of its worth.

To truly determine whether a Shaftesbury PLC stock is overvalued or undervalued, investors should consider the relationship between its price-to-earnings ratio and net assets. Additionally, while some companies may artificially inflate their Shaftesbury PLC stock prices by avoiding stock splits, this does not necessarily reflect the true underlying value of the company. Therefore, it is important not to base investment decisions solely on Shaftesbury PLC stock pricing.

Shaftesbury PLC Dividends Explained

Shaftesbury PLC offers its shareholders a portion of the company's earnings, known as Shaftesbury PLC dividends. Investing in Shaftesbury PLC dividend stocks means investing in companies that pay regular dividends over time, providing a consistent source of passive income that can be beneficial during retirement.

However, Shaftesbury PLC investors should not solely rely on a company's dividend payments to make Shaftesbury PLC investment decisions. Sometimes companies may increase their dividend payouts to attract more Shaftesbury PLC investors, even when the company's financial stability is in question. Therefore, it's crucial to consider the financial health of Shaftesbury PLC, including factors such as earnings, assets, and liabilities, when making Shaftesbury PLC investment decisions.

Shaftesbury PLC Stock Value Vs Shaftesbury PLC Stock Price

The difference between the value and price of Shaftesbury PLC stock is significant and crucial to understand. The price of a stock is simply the current market value at which it trades between a buyer and a seller. However, the intrinsic value of Shaftesbury PLC is the actual worth of the company in dollars, which is often determined by factors such as its assets, liabilities, earnings, and growth prospects.

While Shaftesbury PLC price is essential for traders looking to buy and sell SHB, the value of Shaftesbury PLC is more critical for investors who seek to hold onto the stock for an extended period. Understanding the intrinsic value of SHB helps investors determine whether it is overvalued, undervalued, or fairly valued. A high stock price may not necessarily mean that Shaftesbury PLC is an excellent investment if its underlying fundamentals do not justify the price.

How Many Shaftesbury PLC Stocks Should I Own

While there is no definitive answer to how many Shaftesbury PLC stocks an investor should own, diversification is crucial in minimizing risk. Diversifying your portfolio across various asset classes, sectors, and regions can help mitigate losses due to fluctuations in Shaftesbury PLC stock prices and optimize returns. The number of Shaftesbury PLC stocks to hold in a portfolio will vary depending on individual preferences, investment objectives, and risk tolerance levels. A general rule of thumb is to own at least 20 to 30 stocks across diverse sectors and industries to ensure adequate diversification, which may or may not include Shaftesbury PLC stock. However, the specific number may differ based on the Shaftesbury PLC investor's financial situation and investment strategy.

Selling Shaftesbury PLC Stocks & Shares

When to sell Shaftesbury PLC stocks are just as important as when to buy them. While some investors opt for a "buy high, sell low" approach by selling when the market falls, savvy Shaftesbury PLC investors have a personalized plan based on their financial goals. It's important not to panic during market downturns such as Shaftesbury PLC corrections or crashes. These events are usually temporary, and historical trends suggest that the market may eventually recover. Instead of selling your Shaftesbury PLC assets, it's often wise to ride out the downturn and wait for them to increase over the long term.

Shaftesbury PLC Stock For Retirement

Stock market investments have historically provided much higher returns than savings accounts, making them the favoured method for increasing your retirement savings. Some stocks are more volatile than others, so if you want to buy a specific stock like Shaftesbury PLC as part of your retirement portfolio, you must research its long-term volatility. Stocks can provide tax-advantaged growth for your investment funds, but you can choose whether you want a tax cut now or later. Investing in any stock like Shaftesbury PLC as a retirement strategy in a long-term investment strategy. At least over 10 years.

Shaftesbury PLC Stock Order Types

To become an informed investor in Shaftesbury PLC stocks, understanding the different types of stock orders and their appropriate usage is crucial. Here are the primary Shaftesbury PLC stock orders you should know before buying or selling on live financial markets.

Shaftesbury PLC Stock Market order

A Shaftesbury PLC market order instructs the broker to purchase or sell a stock at the current best price available on the market. This order guarantees execution almost immediately but doesn't guarantee a specific price. It is the most efficient order type for executing Shaftesbury PLC trades when speed is the main priority.

Advantages of a Shaftesbury PLC Market Order

The most significant benefit of a Shaftesbury PLC market order is its ability to let an investor enter the market at any time without waiting for order fulfilment. This order has a high chance of being executed as long as buyers and sellers are in the market. It is an effective way to make fast trades.

Disadvantages of a Shaftesbury PLC Market Order

The biggest drawback of a Shaftesbury PLC market order is that it cannot specify the stock's price. If the stock price moves too fast, the trade could be executed at a price far from the intended amount. High volatility or low liquidity of Shaftesbury PLC stock can affect the order's outcome.

Shaftesbury PLC Stock Limit order

Shaftesbury PLC Limit Orders: What You Need to Know

Limit orders traders use to buy or sell a stock at a specific price or better. For example, a Shaftesbury PLC stock buy limit order executes only lower than or at the set Shaftesbury PLC order price. The Shaftesbury PLC sell limit order executes on limit order price or above. It's important to note that a Shaftesbury PLC limit order is not guaranteed to execute, and it will only be filled if the market reaches the trader's specified price.

A Shaftesbury PLC stock limit order is especially useful when trading in a thinly traded market, a highly volatile market, or a market with a wide Shaftesbury PLC bid-ask spread. In such markets, Shaftesbury PLC stock prices can move quickly, and a limit order helps to ensure that the trader's order is executed at a specific price or better.

Advantages of a Shaftesbury PLC Limit Order

A Shaftesbury PLC limit order is an effective way to ensure that the trader receives the desired price for their Shaftesbury PLC stock. It is also beneficial when the market is thinly traded or highly volatile and the Shaftesbury PLC bid-ask spread is wide. The order helps traders wait for their desired price and execute the trade on their terms.

Disadvantages of a Shaftesbury PLC Limit Order

The biggest disadvantage of a Shaftesbury PLC limit order is that the order may not execute. Limit orders may not execute if the Shaftesbury PLC stock never reaches the set limit price or if insufficient demand or supply exists to fill the order. It is more likely to occur for small and illiquid stocks than Shaftesbury PLC stock.

Shaftesbury PLC Stock Stop Order

Shaftesbury PLC Stop Orders: Minimizing Risk in the Stock Market

Shaftesbury PLC stop orders, also known as stop-loss orders, are instructions given to brokers to purchase or sell Shaftesbury PLC stock once the Shaftesbury PLC price is at a specific threshold. The stop order changes to a live Shaftesbury PLC market order, and the trade is executed.

Advantages of a Shaftesbury PLC Stop Order

The main advantage of using a stop order when purchasing or selling Shaftesbury PLC stock is that it provides you with the ability to enter or exit your Shaftesbury PLC stock trades at a future stop price which you can set. The primary benefit of a stop-limit order on your Shaftesbury PLC stock is that you can control the price at which the SHB order can be executed. Investors should use a stop order to limit a loss on their Shaftesbury PLC stock or to protect a profit that they have sold short.

Disadvantages of a Shaftesbury PLC Stop Order

One of the most significant disadvantages of a Shaftesbury PLC stop order is that it does not guarantee the trade will be executed at the stop price. When the Shaftesbury PLC stop price is reached, the stop order becomes a market order, meaning the trade is executed at the current Shaftesbury PLC market price. The trade may be executed at a price significantly different from the Shaftesbury PLC stop price. Another disadvantage of stop orders is that they can be triggered by short-term market fluctuations or temporary Shaftesbury PLC price movements, resulting in an unnecessary trade execution and a potential loss for the Shaftesbury PLC trader. Therefore, it is important to set Shaftesbury PLC stop prices carefully and to monitor the market closely to avoid unnecessary trade executions.

Shaftesbury PLC Stock Buy Or Sell Stop Order

Understanding Buy and Sell Stop Orders for Shaftesbury PLC Stock

A buy-stop order for Shaftesbury PLC stock is an order that is placed at a price above the current market price. Using stop orders is a technique that investors often use to limit losses or protect profits on a stock they have sold short. In simpler terms, it is an order placed by a trader to buy Shaftesbury PLC stock at a certain price in the future.

On the other hand, a sell-stop order for Shaftesbury PLC stock is an order placed at a price below the current market price. Traders use stop orders to minimize potential losses on a stock they own. A sell-stop order is also the price level set by a trader when they wish to sell Shaftesbury PLC assets in the future.

Both buy and sell-stop orders are essential tools that traders use to protect their investments and limit potential losses. Understanding how they work and when to use them to make informed investment decisions is important.

Monitor Your Shaftesbury PLC Stock Portfolio

It is crucial to periodically review your Shaftesbury PLC investment portfolio and its performance. Once you have bought your Shaftesbury PLC stock alongside other suitable investments, you can use stock tracking apps to follow its progress over time.

Investors can assess the performance of their Shaftesbury PLC stock by analyzing its annual percentage return. This evaluation enables them to compare their Shaftesbury PLC investment's growth with other investments and determine their performance over time. Additionally, investors can revisit the earlier fundamental data to analyze how the Shaftesbury PLC stock has developed. Investors can compare their findings on Shaftesbury PLC stocks to other stocks or benchmarks like the S&P 500 and NASDAQ Index to gain more perspective on their investment. These tools allow investors to make informed decisions and optimize their Shaftesbury PLC stock in their investment portfolio.

Investors can gain insight into the performance of their Shaftesbury PLC investment by analyzing various benchmarks that reflect specific industries or the market as a whole. By doing so, investors can determine how well their Shaftesbury PLC investment performs relative to the broader market. Additionally, investors can participate in Shaftesbury PLC annual meetings to learn about any important news or upcoming developments related to the company. This approach is especially beneficial for investors who intend to hold Shaftesbury PLC shares for an extended period. By staying informed about the company's progress and strategy, investors can make informed decisions and adjust their Shaftesbury PLC investment strategy accordingly.

Investors who plan to sell their Shaftesbury PLC stock shortly after observing a price increase may utilize various position management tools to maximize their profits or minimize their losses. For example, investors can set a target price at which they aim to sell their Shaftesbury PLC share for financial gain or employ a limit order, to manage risk with Shaftesbury PLC stocks. Such risk management tools allow Shaftesbury PLC investors to make informed decisions and manage their Shaftesbury PLC positions effectively.

Below, you will find a list of Shaftesbury PLC brokers that meet your requirements. Our team has compiled a comprehensive comparison table that summarizes all relevant Shaftesbury PLC brokerage data to assist you in making an informed decision. This table will provide a clear overview of the options, enabling you to select the most suitable Shaftesbury PLC broker that aligns with your investment objectives.Scroll down.

Shaftesbury PLC Financial Details

Financial Details

| Shaftesbury PLC Stock symbol | SHB |

|---|---|

| Shaftesbury PLC Sector and Industry | Consumer Goods Residential & Commercial REIT |

| Shaftesbury PLC Exchange | LON |

| Current Shaftesbury PLC Stock Price (*delayed) | $0.00 |

| Stock Open Price | $0.00 |

| 52 Week High | $0.00 |

| 52 Week Low | $0.00 |

| Shaftesbury PLC Market Capitalisation | 0 |

| Shaftesbury PLC Average Volume | 0 |

| Shaftesbury PLC PE | 0.00 |

| Shaftesbury PLC EPS | 0.00 |

| Stock Currency | USD |

Overview of Shaftesbury PLC

Shaftesbury PLC is an American Consumer Goods Residential & Commercial REIT company currently traded on the LON.

Shaftesbury PLC trades under the stock symbol SHB on the LON.

Shaftesbury PLC shares are exchanged in USD on the LON.

Shaftesbury PLC has a current share price of $0.00 USD dated 31/01/2020.

The highest Shaftesbury PLC share price over the last 52 weeks was $0.00 USD and its lowest price over the last 52 weeks was $0.00 USD. That is a 52 week price range of $0.00 - $0.00.

Shaftesbury PLC Information

Shaftesbury PLC Location & Information

| Shaftesbury PLC Employees | 38 |

|---|---|

| Year Founded | 1986 |

| Shaftesbury PLC IPO | |

| Shaftesbury PLC Head Quarters | 22 Ganton Street, LONDON, UNITED KINGDOM-NA, W1F 7FD GB |

| Shaftesbury PLC Industry | Consumer Goods - Residential & Commercial REIT |

| Website URL | http://www.shaftesbury.co.uk |

Shaftesbury PLC Executives and Board Members

| CEO | Mr. Brian Bickell F.C.A., FCA |

Compare Brokers: Shaftesbury PLC Shares and CFDs

Our table below lets you compare the features offered by brokers who trade Shaftesbury PLC shares and CFDs.

Compare the Shaftesbury PLC fees, commissions, and other essential aspects that may affect your Shaftesbury PLC trading experience with our easy-to-use table.

Make informed decisions on your trading strategies by comparing the various brokers' platforms and features.

- Minimum deposit requirement to open an account with each Shaftesbury PLC stock brokerage, helping you plan your initial investment.

- A comprehensive list of funding methods available with each Shaftesbury PLC stock broker, making it easier to deposit and withdraw funds according to your preferences.

- Details on the range of trading instruments available with each Shaftesbury PLC stock broker, including stocks, CFDs, and any other assets you can trade.

- Comparison of the trading platforms provided by each Shaftesbury PLC stock broker, such as web-based platforms, mobile apps, and downloadable software.

- Information on the spreads offered by each Shaftesbury PLC stock brokerage, whether they offer fixed spreads, variable spreads or both.

- An overview of the customer support channels provided by each Shaftesbury PLC stock broker, including email, phone, live chat, and other support options.

- We provide details on the types of trading accounts offered by each Shaftesbury PLC stock brokerage, including Micro, Standard, VIP, and Islamic accounts. Multiple account options makes choosing the account type that suits your Shaftesbury PLC trading needs and preferences easier.

How To Buy Shaftesbury Plc Stock Table of Contents

- Steps To Buying Or Selling Shaftesbury PLC Stocks and Shares

- Buy Shaftesbury PLC (SHB) Stock for 0.00 GBP

- How To Buy or Sell Shaftesbury PLC SHB Stocks & Shares

- Steps to Trading Shaftesbury PLC SHB Stocks & Shares

- How To Buy Sell Or Trade Shaftesbury PLC Stock Guide

- Shaftesbury PLC SHB Trading Fees

- How much does it cost to buy or sell Shaftesbury PLC SHB Stock

- How can I buy or sell Shaftesbury PLC SHB Stock

- Trade Real Shaftesbury PLC Shares

- Trade Shaftesbury PLC Fractional Shares

- Buy sell or trade Shaftesbury PLC CFD Shares

- Trading Shaftesbury PLC Stocks and CFDs

- Buying or selling Shaftesbury PLC Shares with a Broker

- Shaftesbury PLC Shares and CFDs Tax

- Should I trade Shaftesbury PLC Stocks and Shares or Shaftesbury PLC CFDs?

- How Shaftesbury PLC SHB Fits In Your Portfolio

- Is Shaftesbury PLC A Buy Or Sell

- Is Shaftesbury PLC Over or Under Valued?

- Shaftesbury PLC SHB Financials 2025

- Shaftesbury PLC Stock P/E Ratio

- Shaftesbury PLC Trading Volume and PE

- Shaftesbury PLC Stock Price Volatility

- Investing In Shaftesbury PLC Stocks

- Why Shaftesbury PLC Stocks Fluctuate

- Shaftesbury PLC Stock Market Capitalisation

- Shaftesbury PLC Stock Volume Explained

- Shaftesbury PLC Stock Splits

- Shaftesbury PLC Dividends Explained

- Shaftesbury PLC Stock Value Vs Shaftesbury PLC Stock Price

- How Many Shaftesbury PLC Stocks Should I Own

- Selling Shaftesbury PLC Stocks & Shares

- Shaftesbury PLC Stock For Retirement

- Shaftesbury PLC Stock Order Types

- Monitor Your Shaftesbury PLC Stock Portfolio

- Shaftesbury PLC Financial Details

- Overview of Shaftesbury PLC

- Shaftesbury PLC Information

- How To Buy Shaftesbury Plc Stock Or Sell With A Broker

- 6 Factors to Consider when Choosing Shaftesbury PLC Stock Brokers

- How To Buy Shaftesbury Plc Stock Frequently Asked Questions

- Brokers Reviews That You Can buy/sell Shaftesbury PLC With

- Alternative Brokers That You Can buy/sell Shaftesbury PLC With

- Shaftesbury PLC (LON) Related Guides

Learn more

Losses can exceed deposits

Losses can exceed deposits