How To Buy Lam Research Stock (LRCX)

How to buy, sell or trade Lam Research Corp LRCX stocks and shares.

Steps To Buying Or Selling Lam Research Corp Stocks and Shares

- Decide how you want to buy, sell or trade Lam Research Corp LRCX stocks and shares.

Do you want to to trade in Lam Research Corp CFD Stocks, Fractional Lam Research Corp shares or traditional Lam Research Corp Stocks. - Register with an Lam Research Corp LRCX broker that suits your needs. Register with multiple to see which you prefer.

- Research Lam Research Corp financial reports. Use brokerage research tools and resources.

- Decide your budget for Lam Research Corp stock and how many Lam Research Corp LRCX shares you want to buy.

- Buy or Sell your Lam Research Corp shares with your broker by placing an order.

The content on a page is not intended for the residents and users in the USA.

Buy or Sell Lam Research Corp (LRCX) Stock for 690.46 USD

Lam Research Corp (LRCX) in Detail

The highest price Lam Research Corp stock has been at in the last year is 726.53 USD and its lowest price the last year was 299.59 USD.

Looking to buy or sell Lam Research Corp shares? You have options! Consider the following brokers based on your preferred type of trading:

- eToro: This broker offers commission-free stock trading in the UK and Europe, making it a great choice for buying shares. Plus, with eToro, clients can buy fractional shares (where available).

- XTB: If you're interested in trading Lam Research Corp CFDs, XTB is a good option to consider.

Keep in mind that eToro offers some unique benefits for buying Lam Research Corp shares. For example, clients can buy the underlying stock with zero commission and trade with leverage. Additionally, eToro allows for fractional shares and has a minimum trade of $10 and a minimum deposit in the UK of $50. These perks make eToro one of the cheapest places to buy stocks like Lam Research Corp, especially for small investors.

| Broker |

IC Markets

|

Roboforex

|

eToro

|

XTB

|

XM

|

Pepperstone

|

|---|---|---|---|---|---|---|

| Rating | ||||||

| Used By | 200,000+ | 730,000+ | 35,000,000+ | 1,000,000+ | 10,000,000+ | 400,000+ |

| Share Dealing |

USA stocks : UK shares : CFD trading : |

USA stocks : UK shares : CFD trading : |

USA stocks : UK shares : CFD trading : |

USA stocks : UK shares : CFD trading : |

USA stocks : UK shares : CFD trading : |

USA stocks : UK shares : CFD trading : |

When trading Lam Research Corp stock CFDs, it's important to understand the risks involved. While there is potential for profits, there is also a high risk of losing money. Losses can sometimes exceed deposits, so it's crucial to proceed cautiously. CFDs (Contract for Difference) are complex instruments that use leverage to amplify gains and losses based on up or down Lam Research Corp price. No real Lam Research Corp stock assets are exchanged with Lam Research Corp CFD trading. Even small fluctuations in the stock's price can lead to significant profits or losses. Up to 80% of retail investor accounts are estimated to lose money when trading CFDs. If you're considering trading Lam Research Corp stock CFDs, it's essential to assess your risk tolerance and financial situation carefully. Ensure you fully understand how CFDs work and the potential risks involved before investing any money. If you're unsure about any aspect of CFD trading, consider seeking advice from a financial professional. Remember, while there is potential for profits, there is also a real possibility of losing your investment. Scroll down to read our in-depth article on How To Buy Lam Research Stock. What you should know, Types of Lam Research Corp stock trading. Pros and Cons, everything is explained below.

How To Buy Or Sell Lam Research Corp LRCX Stocks & Shares

You can purchase Lam Research Corp shares directly through a brokerage account or one of the various investment applications available. These systems allow you to buy, trade, and keep Lam Research Corp stocks from your home or smartphone. The primary distinctions between different Lam Research Corp stock trading brokers are primarily in fees and resources supplied. Many of the best Lam Research Corp stock trading platforms offer zero commission trading. Ensure you only buy Lam Research Corp stock with a well-financially regulated Lam Research Corp stock broker. It would be best if you also spent some time conducting quantitative research (analyse the revenue of Lam Research Corp, their net income and earnings) and qualitative research (find out what the Lam Research Corp management is like, the competition they face, and how they make money).

Choosing An Lam Research Corp Stock Broker

When choosing a Lam Research Corp stock broker, make sure you consider the variety of exchanges that the broker offers through which to buy and sell individual Lam Research Corp stocks and securities, the commissions and fees charged by the broker for conducting trading in Lam Research Corp, and what margin rates the broker offers. You will also need to check that you can open a brokerage account with the broker considering your citizenship status.

Several brokers can be extremely expensive for certain types of citizens if they wish to buy Lam Research Corp shares once in a while, whereas other brokers offer their services for free. Not every broker you find online will allow you to buy shares of Lam Research Corp; this is because they do not have access to the all stock exchanges like NASDAQ, S&P, FTSE and others.

You will need a LRCX stock broker that provides you with access to LRCX stock exchanges. In addition, you should consider the types of research, educational materials, and account types the online broker offers to help you meet your LRCX stock investing goals.

If you are hoping to invest in fulfilling long-term goals, such as a child's college education or your retirement, you may want to buy LRCX through a tax-advantaged account, such as an individual retirement account (IRA), 529 or pension. On the other hand, if you require money for larger short-term purposes, such as investment property, a taxable investment account may be a more suitable choice.

Finally, consider the broker's reputation and safety features, which are highly important when buying and selling LRCX related financial instruments. Choose a broker with good reviews, or one trusted and regulated by a financial regulator.

Full Service Lam Research Corp Stock Broker

Full-service Lam Research Corp stock brokers personalise their recommendations and charge extra fees, service fees, and commissions. Because of the research and tools that these companies give, most investors are ready to pay these higher costs.

Lam Research Corp Discount Broker

With a Lam Research Corp stock discount broker, the investor is responsible for the majority of their own Lam Research Corp LRCX research. The broker only provides a trading platform and customer support when necessary.

Steps to Trading Lam Research Corp LRCX Stocks & Shares

How To Buy Sell Or Trade Lam Research Corp Stock Guide

How to buy Lam Research Corp Stocks & Shares Risks Trading Lam Research Corp LRCX

Investing in Lam Research Corp stocks can be risky, as there is always a potential for your investment not to perform as expected, resulting in lower returns or even loss of your original investment. Risk is increased, especially for leveraged trades on Lam Research Corp stock, which can result in losses exceeding your initial deposit.

Before investing in Lam Research Corp, it is important to conduct proper research on the company and its stock price history. Stocks are exposed to credit risk and fluctuations in the value of their investment portfolio, which can be influenced by factors such as Lam Research Corp credit deterioration, liquidity, political risk, financial results, interest rate fluctuations, market and economic conditions, and sovereign risk.

To mitigate some of these risks, it is recommended to review the documents that Lam Research Corp is required to file regularly, such as the annual reports (Form 10-K) and quarterly reports (Form 10-Q), which disclose detailed financial information. Monitoring your investments by following your established investment strategy and reviewing your Lam Research Corp position is also important.

If you plan on holding Lam Research Corp shares for the long term, attending the Lam Research Corp company's annual meeting and analyzing any news and information about the company can help you make informed decisions regarding your investment.

Lam Research Corp LRCX Trading Fees

Investors looking to trade Lam Research Corp stocks may be interested in taking advantage of current promotional offers from certain stock brokers. These Lam Research Corp stock brokers may offer low or no trading fees and may not require an account minimum. It's important to note that these offers can vary between brokers offering various Lam Research Corp financial instruments and may be subject to specific terms and conditions.

For example, eToro is currently offering commission-free Lam Research Corp stock trading for new users who sign up for a trading account. It's always a good idea to carefully review promotional offers and their terms before investing in Lam Research Corp stock or any other financial instrument.

How much does it cost to buy or sell Lam Research Corp LRCX Stock

At the time of writing LRCX is worth 690.46 USD per share.

How can I buy or sell Lam Research Corp LRCX Stock

If you want to buy or sell Lam Research Corp shares, you have two options available: placing a LRCX market order or a LRCX limit order. A LRCX market order is executed immediately at the prevailing market price, while a LRCX limit order allows you to specify the maximum price you are willing to pay.

Deciding how many Lam Research Corp shares to buy can be a challenging task, and will depend on various factors such as your Lam Research Corp investment strategy and budget. It is important to carefully consider these factors before placing a live Lam Research Corp stock order.

Trade Real Lam Research Corp Shares

Buying real Lam Research Corp shares means you are buy a 100% of each single Lam Research Corp LRCX share you buy. When you buy a real Lam Research Corp stock you own the Lam Research Corp stock in your name as an underlying asset. You will have to make sure your trading account has adequete funding to for your Lam Research Corp stock bid price.

When you purchase a share of stock in Lam Research Corp, you are effectively becoming a part owner of that company. Depending on the volume of Lam Research Corp shares you own it may entitle you to certain benefits offered by Lam Research Corp. Some companies may choose to pay dividends to shareholders or reinvest income in order to expand further.

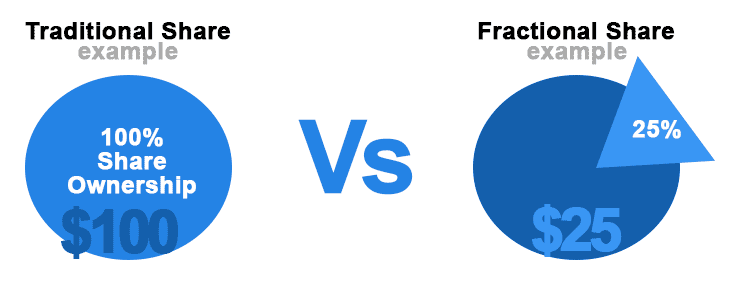

Trade Lam Research Corp Fractional Shares

When you buy real Lam Research Corp shares, you become a direct owner of the underlying asset. Trading real Lam Research Corp stock means that you own 100% of each Lam Research Corp LRCX share that you purchase, and it is held in your name. To buy the shares, you will need adequate funds in your trading account to cover the stock's bid price.

Owning a share of Lam Research Corp stock means you become a part-owner of the company. Depending on the number of shares you own, you may be entitled to certain benefits offered by Lam Research Corp. For example, some companies like Lam Research Corp may pay shareholders dividends to share profits, while others may reinvest income to expand their business further.

Pros and Cons of Investing in Lam Research Corp Fractional Shares

When considering investing in Lam Research Corp, fractional shares offer both advantages and disadvantages to investors.

Disadvantages of Lam Research Corp Fractional Shares

One potential disadvantage of buying Lam Research Corp fractional shares is that they can be more difficult to sell. Lam Research Corp fractional shares can only be sold within the same brokerage account they were purchased from, and demand for them may not always be high. Additionally, fractional shares come in various increments, which may make it harder to find a buyer for a specific fraction of Lam Research Corp stock.

Advantages of Lam Research Corp Fractional Shares

On the other hand, fractional shares offer investors increased control over their portfolios. By allowing investors to buy a portion of a stock based on a dollar amount rather than a whole share, fractional shares enable investors to diversify their portfolio even with small amounts of money. Affordability can help investors achieve the balance of different stocks, including Lam Research Corp and create a more diversified portfolio.

Fractional shares also offer the advantage of proportionate dividends. If you own a percentage of a Lam Research Corp share, you will receive a proportionate percentage of the dividends paid by the company. Finally, some brokers allow investors to start investing in Lam Research Corp with as little as $5 when using a fractional share investing strategy.

Additionally, fractional shares can also help investors to invest in high-priced stocks such as Lam Research Corp, which may otherwise be unaffordable. Fractional Lam Research Corp shares allow investors to benefit from these stocks' growth potential without committing to buying a full share. Fractional shares also provide flexibility, as investors can purchase or sell any amount they wish without being restricted to whole numbers of shares. Lam Research Corp, stock accessibility enables investors to fine-tune their portfolios and make smaller adjustments without committing to buying or selling whole shares.

Considerations When Investing in Lam Research Corp Fractional Shares

While Lam Research Corp, fractional shares can offer several advantages to investors, it's important to understand the potential downsides of trading Lam Research Corp as fractional shares as well. In addition to the difficulty in selling Lam Research Corp fractional shares, some brokers may charge higher fees for Lam Research Corp fractional share transactions, which could eat into your investment returns. Furthermore, fractional shares may not always be available for certain stocks, including Lam Research Corp, so checking with your broker before investing is important. Additionally, it's important to ensure that your broker is reputable and has a strong track record of providing reliable services to Lam Research Corp stock investors.

You can buy Lam Research Corp fractional shares with eToro. Your capital is at risk.

Buy Sell or Trade Lam Research Corp CFD Shares

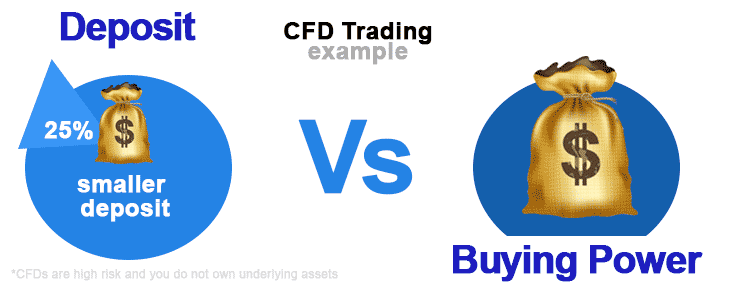

CFDs, or contracts for difference, are financial instruments that allow Lam Research Corp traders to speculate on the price movements of various markets, including Lam Research Corp stocks, Forex, indices, and commodities. Unlike traditional investments, CFDs do not require ownership of the underlying Lam Research Corp stock asset but instead offer traders the opportunity to profit from the price movements of these assets without physically owning them. With CFD trading, you can trade on Lam Research Corp share prices without buying or owning LRCX stock. However, it is important to note that CFDs are complex investment products with a high level of risk, as there is a potential for unlimited losses if Lam Research Corp stock price positions go wrong. Despite this risk, CFD trading can be advantageous for traders with a short-term outlook, enabling them to speculate on Lam Research Corp asset prices by going either long (buying) or short (selling).

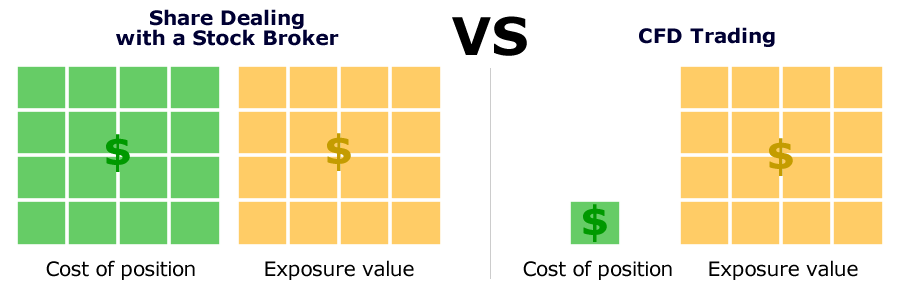

Lam Research Corp CFD Trading vs Traditional Share Dealing

What is CFD trading, and why would you buy Lam Research Corp as a CFD instead of a share? Let's explore the differences between the two methods of trading.

CFD trading, or contracts for difference, allows traders to speculate on the price movements of financial markets, including stocks, forex, indices, and commodities, without owning the underlying assets. When trading CFDs, traders have an agreement with their CFD broker and are speculating that the Lam Research Corp price will change up or down.

In contrast, when buying Lam Research Corp shares with a stock broker, you own a share of Lam Research Corp. If you bought 100 Lam Research Corp shares at 690.46 USD a share with a stock broker, you would own 69000 USD of Lam Research Corp.

The main difference between trading Lam Research Corp CFDs and buying Lam Research Corp shares is that contracts for difference offer increased leverage. Lam Research Corp CFDs are traded on margin, meaning you do not need to invest the full amount on Lam Research Corp upfront. Instead, you could invest a fraction of the amount on Lam Research Corp, known as the CFD margin, to hold a similar position in Lam Research Corp. Trading an Lam Research Corp CFD allows investors to hold larger positions than their invested amount. However, be aware that investing in an Lam Research Corp CFD amplifies potential profits but also exaggerates potential losses, which may exceed the amount invested.

Investing in an Lam Research Corp share with a stock broker means you would only lose the amount you invested, as you pay the total cost of your position to your broker upfront. There is no leverage.

CFD trading enables traders to profit from both upward and downward price movements of Lam Research Corp on the financial exchange. A long CFD position hopes to profit from a rise in the Lam Research Corp share price, while a short Lam Research Corp CFD position aims to profit from a fall in the Lam Research Corp share price. Trading Lam Research Corp CFDs allows traders to move with the financial markets in both directions, giving them greater chances to profit.

It's important to note that Lam Research Corp CFDs are complex investment products and present a high risk to any trader. There is an ever-present threat of very high losses for Lam Research Corp positions that go wrong. If you are a trader with a short-term outlook, buying Lam Research Corp as a CFD can be advantageous. However, it's crucial to thoroughly research and understand the risks involved before engaging in Lam Research Corp CFD trading.

If you invested in an Lam Research Corp share with a stock broker you would only lose the amount you invested as you pay the total cost of your position to your broker upfront. There is no leverage.

An Lam Research Corp CFD long hopes to profit from a rise in the Lam Research Corp share price. An Lam Research Corp CFD short would aim to profit from a fall in the Lam Research Corp stock price. Trading CFDs allows traders to profit from both directions of the Lam Research Corp price on the financial exchange. Giving traders a greater chance to move with the financial markets.With traditional Lam Research Corp shares you can only profit from a rise in the Lam Research Corp stock price. You can trade Lam Research Corp CFD stocks and tradional stocks with eToro or XTB. Your capital is at risk.

Trading Lam Research Corp Stocks and CFDs

If you're considering investing in Lam Research Corp It's important to know your options. You can choose to buy or sell traditional Lam Research Corp shares through one of our listed brokers, or you can trade Lam Research Corp using CFDs (contracts for difference).

It's worth taking the time to understand the difference between these two investment options. When buying Lam Research Corp shares with a broker, you own a physical share of the company and can profit if the value of the stock goes up. However, buying shares also involves paying the full cost of the share upfront.

On the other hand, CFD trading offers a way to speculate on the value of Lam Research Corp without actually owning the shares. CFDs are traded on margin, meaning you can hold a position with only a fraction of the total value, which offers increased leverage compared to buying shares outright.

Trading Lam Research Corp CFDs can be advantageous for traders with a short-term outlook as it enables you to speculate on the Lam Research Corp price of the asset by going long (buying) or going short (selling). However, it's important to note that CFDs are complex investment products and present a high risk to traders, as potential losses can exceed the initial Lam Research Corp investment.

In summary, whether you choose to buy traditional Lam Research Corp shares or trade Lam Research Corp using CFDs depends on your investment goals, risk tolerance, and trading strategy. Understanding the benefits and risks of each Lam Research Corp trading option can help you make an informed decision about which approach is right for you.

Example Cost of Buying Lam Research Corp as a CFD Trade and Shares Side by Side

*All values below are estimates and are for illustrative purposes only. Please visit a broker for correct prices. Your capital is at risk.

CFD and Share deals differ from broker to broker so check you are aware of the actual costs with your brokers.

| Lam Research Corp stock examples | Lam Research Corp CFD trade example | Lam Research Corp Share deal example |

|---|---|---|

| Market price | $690.46 | $690.46 |

| Broker Deal | Invest $138.092 at 1:5 Margin (20%) | Buy at $690.46 a share |

| Deal size | 100 shares | 100 shares |

| Initial outlay | $13809.2 (Margin = exposure x 20% margin factor) |

$69046 (100 shares at $690.46) |

| Stamp duty | No | £20 |

| Close price | Sell at $828.552 | Sell at $828.552 |

| Estimated Profit |

(138.092 point increase x 100 shares = $13809.2) *Not including commission fees and taxes |

($82855.2 - $69046 = $13809.2) *Not including commission fees and taxes |

| Trade Lam Research Corp CFDs now with XTB | Trade Lam Research Corp Shares now with eToro |

Your capital is at risk. Other fees apply.

Lam Research Corp CFD and Stock Market Times

Trading traditional Lam Research Corp shares is limited to the hours when the NASDAQ (National Association of Securities Dealers Automated Quotations) stock exchange is open, which is typically 9:30 a.m. and 4:00 p.m. ET on trading days. This means that you can only buy or sell shares through your broker during these hours. However, with CFD trading, you can deal 24/7, allowing you to trade Lam Research Corp shares around the clock.

Buying or Selling Lam Research Corp Shares with a Broker

When you buy Lam Research Corp shares through a broker, your risk is limited to your initial investment, as brokers require you to pay for the full amount of your investment upfront. Unlike CFD trading, brokers do not offer leverage or loans when buying Lam Research Corp shares, meaning that your risk is limited to the initial amount invested. Additionally, buying Lam Research Corp shares through a broker can make you eligible to receive company dividends if applicable. However, owning shares in Lam Research Corp through a CFD does not provide shareholder privileges, as you do not actually own any underlying assets in Lam Research Corp.

Another benefit of buying Lam Research Corp shares through a broker is the possibility of receiving shareholder perks and benefits, such as voting rights at Lam Research Corp shareholder general meetings. However, eligibility for these benefits may require you to own a certain amount of stock for a set period.

Lam Research Corp Shares and CFDs and Tax

It is important to confirm with your local tax office, but in the United Kingdom, CFDs are free from capital gains and stamp duty taxes. Additionally, when trading CFDs, losses can be offset against profits when submitting your tax return. In contrast, investment in Lam Research Corp stocks and shares is only exempt from tax if the shares were bought through an ISA (Individual Savings Accounts) or SIPP (Self Invested Personal Pensions).

Should I trade Lam Research Corp Stocks and Shares or Lam Research Corp CFDs?

There are pros and cons to both trading in Lam Research Corp stocks and shares and trading Lam Research Corp CFDs. The decision on which to choose depends on the individual investor and a few factors. For long-term investments, buying Lam Research Corp shares and stocks is typically better suited, as they historically provide better returns over a 10-year period. In contrast, Lam Research Corp CFD trading is more appropriate for intra-day and mid-term traders, who aim to profit on the fluctuating highs and lows of the Lam Research Corp price throughout the day or a few days.

Lam Research Corp CFD trading is more suited to intra day and mid term traders. Wth intra day trading on an Lam Research Corp share investors aim to profit on the fluctuating highs and lows of the Lam Research Corp price throughout the day. Day trading as you can imagine focuses on profiting from the daily Lam Research Corp stock price change.

Both types of Lam Research Corp trading have different benefits and risks. Make sure you have a good understanding of what you are doing before you invest in Lam Research Corp stocks.

With CFD trading as you can short or long an Lam Research Corp stock you can hedge a trade against another trade.

A hedge is an investment that protects the money you have invested from risk. Traders hedge to minimize or offset a loss in value of an Lam Research Corp share price for example to a known amount.

How Lam Research Corp LRCX Fits In Your Portfolio

If you are considering investing in Lam Research Corp stock, assessing the level of exposure it would give you to the company is essential. Investing a large percentage of your portfolio in a single stock can be risky, especially if the company's performance deteriorates. Furthermore, it is crucial to understand the benefits of diversification that come with investing in various equities, including stocks, bonds, funds, and alternative assets, if you are new to investing in Lam Research Corp or any financial market, it is advisable to develop a well-diversified portfolio.

Before investing in Lam Research Corp or other financial markets, ensure that you have an emergency fund that can cover at least three months of costs and have paid off any high-interest debt. It is also essential to remember that even the most successful stock stories, like Lam Research Corp, can turn sour. Consumer preferences can change, and competition can emerge, challenging the company's success.

Therefore, it is wise to focus on investing in the market rather than only picking individual stocks like Lam Research Corp. This approach has proven to be a successful long-term strategy. Lastly, it is important to remember that past performance does not always indicate future Lam Research Corp stock price performance. Seeking guidance from a financial expert before making significant changes to your portfolio or investing in Lam Research Corp is always a good idea.

Is Lam Research Corp A Buy Or Sell

Lam Research Corp total volume in the stock market refers to the number of shares, contracts, or lots traded on a given day. This Lam Research Corp volume is comprised of buying volume and selling volume.

The buying volume of Lam Research Corp refers to the cumulative amount of shares, contracts, or lots associated with purchasing trades, whereas selling volume refers to the total amount of shares, contracts, or lots associated with selling trades. The buying and selling volumes can provide investors with insights into the market demand and supply for Lam Research Corp, which can help make informed investment decisions.

When deciding to invest in Lam Research Corp stock, it is crucial to conduct appropriate research and analysis to determine whether the stock's price will rise in the short or long term. Investors should not base their decision solely on the Lam Research Corp stock's past performance but evaluate the company's financial health, Lam Research Corp management team, industry trends, and other relevant factors.

If an investor feels confident that the price of Lam Research Corp stock will increase, they may choose to buy the stock. However, it's important to note that the right time to buy Lam Research Corp stock may vary depending on the investor's strategy and investment goals. Some investors may hold the Lam Research Corp stock for a long time, while others may prefer to sell Lam Research Corp once they've made a profit.

Is Lam Research Corp Over or Under Valued?

One way to assess the valuation of Lam Research Corp stock is to use the P/E ratio. The profit-earning ratio is found by dividing Lam Research Corp stock price per share by per Lam Research Corp share earnings. A profit earning ratio that is high suggests that the stock may be overvalued, while a low P/E ratio may be undervalued. Before investing in Lam Research Corp stock, it is advisable to analyze its P/E ratio, which can provide valuable insights into the stock's current market valuation.

A Lam Research Corp stock may be considered overvalued if its current market price does not match its P/E ratio or forecast on earnings. For example, if Lam Research Corp stock price is 50 times higher than its earnings, it is likely to be an overvalued stock compared to one that is trading for 10 times its earnings. Other factors to consider when deciding whether Lam Research Corp stock is over or undervalued is the change in LRCX fundamentals, the amount of free cash flow that Lam Research Corp has, and their price to book ratio. Lam Research Corp has a P/E ratio of 20.79.

Lam Research Corp LRCX Financials 2025

Founded in 1989, Lam Research Corp has a 52 week high price of 726.53 and a 52 week low price of 299.59. Lam Research Corp has a marketcap of 92,036,249,548 and an average trading volume of 1,311,529. Lam Research Corp has 134,340,000 shares on the NASDAQ (National Association of Securities Dealers Automated Quotations). Lam Research Corp has a P/E ratio of 20.79 and a EPS of 33.21.

Lam Research Corp Stock P/E Ratio

The (PE) ratio helps in understand the Lam Research Corp stock value compared to Lam Research Corp earnings. A Lam Research Corp high (PE) ratio shows that a stock's price is higher than its earnings and may be overvalued. A Lam Research Corp low (PE), on the other hand, may imply that the present stock price is cheap compared to earnings.

To simplify, you can estimate how much the market may pay for Lam Research Corp stock based on previous and prospective Lam Research Corp earnings.

When looking at Lam Research Corp, its current share price of (690.46) divided by its per-share earnings (EPS 33.21) over a period of 12 months results in a 33.21 (trailing price / earnings ratio) of approximately 20.79. Meanin Lam Research Corp shares are trading at 20.79 times the recent declared 20.79 earnings.

Investors in Lam Research Corp often use the P/E ratio to determine the company's market value relative to its earnings. A high P/E ratio may suggest that Lam Research Corp is overvalued as the stock price exceeds the earnings. On the other hand, a low Lam Research Corp P/E ratio may indicate that the current Lam Research Corp stock price is cheaper than the Lam Research Corp earnings, which could be an opportunity for Lam Research Corp investors to buy. For comparison, the trailing 12-month P/E ratio for the NASDAQ 100 was around 23.72 at the end 2022.

Lam Research Corp Trading Volume and PE

Lam Research Corp currently has 134,340,000 active shares in circulation traded through the NASDAQ exchange.

Lam Research Corp market capitalization is $92,036,249,548 with an average daily trading volume of 1,311,529 shares.

Trading volume is the amount of security traded over a certain duration. Regarding shares, volume refers to the number of shares bought and sold during a given day.

Lam Research Corp has a Price Earning Ratio ( PE ) of 20.79 and earning per share ( EPS ) of 33.21. Generally speaking, Lam Research Corp having a high P/E ratio means that Lam Research Corp investors foresee increased growth with Lam Research Corp in the future. Companies that are losing money do not have a P/E ratio.

Lam Research Corp earnings per share is company profit allocated to every Lam Research Corp common stock. Earnings per share are calculated by taking the difference between Lam Research Corp's net earnings and dividends paid for preferred stock and dividing that amount by the average amount of Lam Research Corp shares outstanding.

Whats A Good Lam Research Corp P/E Ratio?

The P/E ratio for Lam Research Corp is not necessarily classified as "good" based solely on a high or low ratio. In fact, a higher Lam Research Corp P/E ratio than the market average could be considered unfavourable, while a lower Lam Research Corp P/E ratio may be positive.

Typically, average P/E ratio on financial markets ranges around 20 to 25. Therefore, a higher P/E ratio above this range with Lam Research Corp could be unfavourable, indicating that investors are willing to pay a premium for Lam Research Corp shares despite Lam Research Corp earnings. In contrast, a lower Lam Research Corp P/E ratio may be better, suggesting that the current Lam Research Corp stock price is more aligned with its earnings, making Lam Research Corp shares more attractive to potential investors.

Lam Research Corp EPS (Earnings Per Share)

Investors are always looking for ways to measure the value of a stock. One widely used indicator is earnings per share (EPS), which measures a company's profitability. Lam Research Corp stock price is often evaluated using EPS as it is an indicator for the profit Lam Research Corp each share of its stock makes in potential profit. This information is useful for Lam Research Corp investors because they are willing to pay more for a Lam Research Corp share if they believe that Lam Research Corp is earning more than the stock price.

Currently, Lam Research Corp has an EPS value of 33.21. This information indicates how much profit Lam Research Corp has made for each share of its stock. EPS is a critical metric for investors as it helps them evaluate the company's financial health and potential for growth.

Lam Research Corp Investors also look for EPS growth rates to indicate the future potential of Lam Research Corp. An Lam Research Corp EPS growth rate of at least 25% over the previous year indicates that a Lam Research Corp products or services are in high demand. If the Lam Research Corp EPS growth rate has been increasing in recent quarters and years. It's even better. The increased EPS trend indicates that Lam Research Corp is on a path to greater profitability and could provide a good return on investment.

Lam Research Corp PEG Ratio

The Lam Research Corp PEG ratio, or Lam Research Corp (price / earnings to growth) ratio, is a measure that helps Lam Research Corp investors value the Lam Research Corp business by taking into consideration the Lam Research Corp stock market price, earnings, and future growth potential of Lam Research Corp as a business. The Lam Research Corp PEG ratio can show if Lam Research Corp stock is potentially over or under market value.

Lam Research Corp share price/earnings-to-growth ratio is computed by dividing its P/E ratio by its growth. A PEG ratio greater than one indicates that shares are overvalued at their current growth rate or that they may predict a faster growth rate.

The PEG ratio, rather just the P/E ratio, provides a more comprehensive picture of Lam Research Corp's potential profitability. It could also assist you in comparing the share prices of different high-growth firms by accounting for growth.

Lam Research Corp Trading Volume

Lam Research Corp stock trading volume can assist an investor in determining the strength of Lam Research Corp stock price momentum and confirming a trend. Lam Research Corp stock prices tend to move in the same direction as Lam Research Corp trade volume increases. If a Lam Research Corp stock price continues to rise in an uptrend, Lam Research Corp stock trading volume should rise, and vice versa.

Lam Research Corp has a trading volume of 1,311,529

The sentiment driving Lam Research Corp stock price movement is measured by Lam Research Corp trading volume. It informs you of the number of persons involved in the Lam Research Corp stock price movement. When Lam Research Corp stock trades on low volume, it signifies that only a small number of people are involved in Lam Research Corp stock buying and selling transactions. The market interest in Lam Research Corp stock can be measured by its trading volume.

Lam Research Corp Stock Price Volatility

The Lam Research Corp stock price has fluctuated in value during the last year, ranging from 299.59 USD to 726.53 USD. The larger the range between the 52 week low and 52 week high price is a prominent metric for determining its volatility.

Investing In Lam Research Corp Stocks

After selecting your preferred Lam Research Corp stock broker, opening an account, and funding it, you are now ready to start investing in Lam Research Corp stocks. You can do this by accessing the stock through your trading app or web browser, then indicating the number of shares or the amount you wish to invest with fractional shares. Additionally, you must select the type of order you prefer, such as market or limit order, then execute the trade.

If you desire greater control over your money and Lam Research Corp shares, using a limit order is advisable. This type of order allows you to specify the price you wish to pay for Lam Research Corp stock, while market orders execute automatically at prevailing Lam Research Corp prices. Limit orders could benefit thinly traded securities with large bid-ask spreads since executing Lam Research Corp market orders might increase prices.

To ensure that you get the best price possible, you can request to buy LRCX stock at the current best price on your brokerage platform or use a more advanced Lam Research Corp order type like limit or stop orders. These will help you purchase or sell Lam Research Corp shares once the stock price falls below a specified threshold. Investing in Lam Research Corp stocks requires patience and knowledge, but the potential rewards can be substantial.

Lam Research Corp is traded on the NASDAQ (National Association of Securities Dealers Automated Quotations) exchange meaning that it can be bought or sold between the NASDAQ (National Association of Securities Dealers Automated Quotations) trading hours which are 9:30 a.m. and 4:00 p.m. ET.

You can access this service through your online Lam Research Corp brokerage. The NASDAQ (National Association of Securities Dealers Automated Quotations) pre-market trading hours terms are 8:00 a.m. and 9:30 a.m. ET, and after-hours trading conditions are 4:00 p.m. to 8:00 p.m. ET. If you place an Lam Research Corp stock order outside of available NASDAQ (National Association of Securities Dealers Automated Quotations) trading hours it will be processed once NASDAQ (National Association of Securities Dealers Automated Quotations) trading resumes.

Why Lam Research Corp Stocks Fluctuate

In the world of finance, the law of supply and demand has a significant impact on the Lam Research Corp stock market. The simple concept is that when the demand for Lam Research Corp stock exceeds its supply, its price tends to increase. On the other hand, when there is an excess supply of Lam Research Corp stock that surpasses demand, the LRCX stock price typically goes down.

The severity of the demand-supply gap has a direct correlation with the Lam Research Corp stock price, with a more significant gap resulting in a higher price for Lam Research Corp stock. Consequently, when the number of Lam Research Corp stocks available for sale is less than the number of people wanting to buy them, the price of Lam Research Corp stock tends to rise.

Conversely, when there are more Lam Research Corp stocks than buyers, the Lam Research Corp stock price tends to fall. The Lam Research Corp stock price constantly fluctuates based on the number of buyers versus the available supply of Lam Research Corp stocks.

In addition to supply and demand, innovative and revenue-generating products or services released by Lam Research Corp can also impact the valuation of LRCX stock. Keeping an eye on such developments could provide insights into the future performance of Lam Research Corp stock and help investors make informed decisions.

Lam Research Corp Stock Market Capitalisation

The market capitalisation of a Lam Research Corp stock is a critical metric in finance. It is calculated by multiplying the total number of outstanding shares of Lam Research Corp stock by its current market price. For instance, if a company has one million outstanding shares priced at $50 per share, the market cap of that company would be $50 million. It's worth noting that Lam Research Corp has a market cap of 92,036,249,548.

Knowing the market cap of Lam Research Corp enables investors to analyse the company in the context of other similar-sized companies in the same industry. The Lam Research Corp market cap is considered more meaningful than the share price because it considers company's total value. For example, a small-cap firm with a market cap of $500 million should not be compared to a large-cap corporation with a market value of $10 billion. Therefore, understanding the market cap of Lam Research Corp can provide valuable insights for investors making informed investment decisions.

Lam Research Corp Stock Volume Explained

The Lam Research Corp stock's trading volume is the total number of shares bought and sold within a specified period, usually one trading day. It measures the overall market activity and liquidity of Lam Research Corp shares. However, remember that the same Lam Research Corp shares can be traded multiple times a day, so the trading volume counts each transaction.

The higher the volume of Lam Research Corp stocks traded, the more active the market is for that stock. It is usually viewed as a sign of financial strength when an increasing trading volume accompanies a rising market. On the other hand, low trading volume can indicate a lack of market interest in Lam Research Corp.

Volume is a crucial indicator of the money flow in Lam Research Corp stock. When Lam Research Corp stock appreciates on high volume, it shows that more investors are buying the stock, which is usually a good sign to invest in. However, if Lam Research Corp stock is appreciating on low volume, it could be a sign of weak market interest, and investing in it may not be wise. Therefore, paying attention to the trading volume of Lam Research Corp stock can help investors make more informed decisions about buying, selling, or holding Lam Research Corp shares.

Lam Research Corp Stock Splits

It is important to understand that the value of a company and the price of its Lam Research Corp stock are not necessarily the same thing. Simply looking at the Lam Research Corp share price does not provide a complete picture of its worth.

To truly determine whether a Lam Research Corp stock is overvalued or undervalued, investors should consider the relationship between its price-to-earnings ratio and net assets. Additionally, while some companies may artificially inflate their Lam Research Corp stock prices by avoiding stock splits, this does not necessarily reflect the true underlying value of the company. Therefore, it is important not to base investment decisions solely on Lam Research Corp stock pricing.

Lam Research Corp Dividends Explained

Lam Research Corp offers its shareholders a portion of the company's earnings, known as Lam Research Corp dividends. Investing in Lam Research Corp dividend stocks means investing in companies that pay regular dividends over time, providing a consistent source of passive income that can be beneficial during retirement.

However, Lam Research Corp investors should not solely rely on a company's dividend payments to make Lam Research Corp investment decisions. Sometimes companies may increase their dividend payouts to attract more Lam Research Corp investors, even when the company's financial stability is in question. Therefore, it's crucial to consider the financial health of Lam Research Corp, including factors such as earnings, assets, and liabilities, when making Lam Research Corp investment decisions.

Lam Research Corp Stock Value Vs Lam Research Corp Stock Price

The difference between the value and price of Lam Research Corp stock is significant and crucial to understand. The price of a stock is simply the current market value at which it trades between a buyer and a seller. However, the intrinsic value of Lam Research Corp is the actual worth of the company in dollars, which is often determined by factors such as its assets, liabilities, earnings, and growth prospects.

While Lam Research Corp price is essential for traders looking to buy and sell LRCX, the value of Lam Research Corp is more critical for investors who seek to hold onto the stock for an extended period. Understanding the intrinsic value of LRCX helps investors determine whether it is overvalued, undervalued, or fairly valued. A high stock price may not necessarily mean that Lam Research Corp is an excellent investment if its underlying fundamentals do not justify the price.

How Many Lam Research Corp Stocks Should I Own

While there is no definitive answer to how many Lam Research Corp stocks an investor should own, diversification is crucial in minimizing risk. Diversifying your portfolio across various asset classes, sectors, and regions can help mitigate losses due to fluctuations in Lam Research Corp stock prices and optimize returns. The number of Lam Research Corp stocks to hold in a portfolio will vary depending on individual preferences, investment objectives, and risk tolerance levels. A general rule of thumb is to own at least 20 to 30 stocks across diverse sectors and industries to ensure adequate diversification, which may or may not include Lam Research Corp stock. However, the specific number may differ based on the Lam Research Corp investor's financial situation and investment strategy.

Selling Lam Research Corp Stocks & Shares

When to sell Lam Research Corp stocks are just as important as when to buy them. While some investors opt for a "buy high, sell low" approach by selling when the market falls, savvy Lam Research Corp investors have a personalized plan based on their financial goals. It's important not to panic during market downturns such as Lam Research Corp corrections or crashes. These events are usually temporary, and historical trends suggest that the market may eventually recover. Instead of selling your Lam Research Corp assets, it's often wise to ride out the downturn and wait for them to increase over the long term.

Lam Research Corp Stock For Retirement

Stock market investments have historically provided much higher returns than savings accounts, making them the favoured method for increasing your retirement savings. Some stocks are more volatile than others, so if you want to buy a specific stock like Lam Research Corp as part of your retirement portfolio, you must research its long-term volatility. Stocks can provide tax-advantaged growth for your investment funds, but you can choose whether you want a tax cut now or later. Investing in any stock like Lam Research Corp as a retirement strategy in a long-term investment strategy. At least over 10 years.

Lam Research Corp Stock Order Types

To become an informed investor in Lam Research Corp stocks, understanding the different types of stock orders and their appropriate usage is crucial. Here are the primary Lam Research Corp stock orders you should know before buying or selling on live financial markets.

Lam Research Corp Stock Market order

A Lam Research Corp market order instructs the broker to purchase or sell a stock at the current best price available on the market. This order guarantees execution almost immediately but doesn't guarantee a specific price. It is the most efficient order type for executing Lam Research Corp trades when speed is the main priority.

Advantages of a Lam Research Corp Market Order

The most significant benefit of a Lam Research Corp market order is its ability to let an investor enter the market at any time without waiting for order fulfilment. This order has a high chance of being executed as long as buyers and sellers are in the market. It is an effective way to make fast trades.

Disadvantages of a Lam Research Corp Market Order

The biggest drawback of a Lam Research Corp market order is that it cannot specify the stock's price. If the stock price moves too fast, the trade could be executed at a price far from the intended amount. High volatility or low liquidity of Lam Research Corp stock can affect the order's outcome.

Lam Research Corp Stock Limit order

Lam Research Corp Limit Orders: What You Need to Know

Limit orders traders use to buy or sell a stock at a specific price or better. For example, a Lam Research Corp stock buy limit order executes only lower than or at the set Lam Research Corp order price. The Lam Research Corp sell limit order executes on limit order price or above. It's important to note that a Lam Research Corp limit order is not guaranteed to execute, and it will only be filled if the market reaches the trader's specified price.

A Lam Research Corp stock limit order is especially useful when trading in a thinly traded market, a highly volatile market, or a market with a wide Lam Research Corp bid-ask spread. In such markets, Lam Research Corp stock prices can move quickly, and a limit order helps to ensure that the trader's order is executed at a specific price or better.

Advantages of a Lam Research Corp Limit Order

A Lam Research Corp limit order is an effective way to ensure that the trader receives the desired price for their Lam Research Corp stock. It is also beneficial when the market is thinly traded or highly volatile and the Lam Research Corp bid-ask spread is wide. The order helps traders wait for their desired price and execute the trade on their terms.

Disadvantages of a Lam Research Corp Limit Order

The biggest disadvantage of a Lam Research Corp limit order is that the order may not execute. Limit orders may not execute if the Lam Research Corp stock never reaches the set limit price or if insufficient demand or supply exists to fill the order. It is more likely to occur for small and illiquid stocks than Lam Research Corp stock.

Lam Research Corp Stock Stop Order

Lam Research Corp Stop Orders: Minimizing Risk in the Stock Market

Lam Research Corp stop orders, also known as stop-loss orders, are instructions given to brokers to purchase or sell Lam Research Corp stock once the Lam Research Corp price is at a specific threshold. The stop order changes to a live Lam Research Corp market order, and the trade is executed.

Advantages of a Lam Research Corp Stop Order

The main advantage of using a stop order when purchasing or selling Lam Research Corp stock is that it provides you with the ability to enter or exit your Lam Research Corp stock trades at a future stop price which you can set. The primary benefit of a stop-limit order on your Lam Research Corp stock is that you can control the price at which the LRCX order can be executed. Investors should use a stop order to limit a loss on their Lam Research Corp stock or to protect a profit that they have sold short.

Disadvantages of a Lam Research Corp Stop Order

One of the most significant disadvantages of a Lam Research Corp stop order is that it does not guarantee the trade will be executed at the stop price. When the Lam Research Corp stop price is reached, the stop order becomes a market order, meaning the trade is executed at the current Lam Research Corp market price. The trade may be executed at a price significantly different from the Lam Research Corp stop price. Another disadvantage of stop orders is that they can be triggered by short-term market fluctuations or temporary Lam Research Corp price movements, resulting in an unnecessary trade execution and a potential loss for the Lam Research Corp trader. Therefore, it is important to set Lam Research Corp stop prices carefully and to monitor the market closely to avoid unnecessary trade executions.

Lam Research Corp Stock Buy Or Sell Stop Order

Understanding Buy and Sell Stop Orders for Lam Research Corp Stock

A buy-stop order for Lam Research Corp stock is an order that is placed at a price above the current market price. Using stop orders is a technique that investors often use to limit losses or protect profits on a stock they have sold short. In simpler terms, it is an order placed by a trader to buy Lam Research Corp stock at a certain price in the future.

On the other hand, a sell-stop order for Lam Research Corp stock is an order placed at a price below the current market price. Traders use stop orders to minimize potential losses on a stock they own. A sell-stop order is also the price level set by a trader when they wish to sell Lam Research Corp assets in the future.

Both buy and sell-stop orders are essential tools that traders use to protect their investments and limit potential losses. Understanding how they work and when to use them to make informed investment decisions is important.

Monitor Your Lam Research Corp Stock Portfolio

It is crucial to periodically review your Lam Research Corp investment portfolio and its performance. Once you have bought your Lam Research Corp stock alongside other suitable investments, you can use stock tracking apps to follow its progress over time.

Investors can assess the performance of their Lam Research Corp stock by analyzing its annual percentage return. This evaluation enables them to compare their Lam Research Corp investment's growth with other investments and determine their performance over time. Additionally, investors can revisit the earlier fundamental data to analyze how the Lam Research Corp stock has developed. Investors can compare their findings on Lam Research Corp stocks to other stocks or benchmarks like the S&P 500 and NASDAQ Index to gain more perspective on their investment. These tools allow investors to make informed decisions and optimize their Lam Research Corp stock in their investment portfolio.

Investors can gain insight into the performance of their Lam Research Corp investment by analyzing various benchmarks that reflect specific industries or the market as a whole. By doing so, investors can determine how well their Lam Research Corp investment performs relative to the broader market. Additionally, investors can participate in Lam Research Corp annual meetings to learn about any important news or upcoming developments related to the company. This approach is especially beneficial for investors who intend to hold Lam Research Corp shares for an extended period. By staying informed about the company's progress and strategy, investors can make informed decisions and adjust their Lam Research Corp investment strategy accordingly.

Investors who plan to sell their Lam Research Corp stock shortly after observing a price increase may utilize various position management tools to maximize their profits or minimize their losses. For example, investors can set a target price at which they aim to sell their Lam Research Corp share for financial gain or employ a limit order, to manage risk with Lam Research Corp stocks. Such risk management tools allow Lam Research Corp investors to make informed decisions and manage their Lam Research Corp positions effectively.

Below, you will find a list of Lam Research Corp brokers that meet your requirements. Our team has compiled a comprehensive comparison table that summarizes all relevant Lam Research Corp brokerage data to assist you in making an informed decision. This table will provide a clear overview of the options, enabling you to select the most suitable Lam Research Corp broker that aligns with your investment objectives.Scroll down.

Lam Research Corp Financial Details

Financial Details

| Lam Research Corp Stock symbol | LRCX |

|---|---|

| Lam Research Corp Sector and Industry | Technology Semiconductors & Semiconductor Equipment |

| Lam Research Corp Exchange | NASDAQ |

| Current Lam Research Corp Stock Price (*delayed) | $690.46 |

| Stock Open Price | $693.36 |

| 52 Week High | $726.53 |

| 52 Week Low | $299.59 |

| Lam Research Corp Market Capitalisation | 92,036,249,548 |

| Lam Research Corp Average Volume | 1,311,529 |

| Lam Research Corp PE | 20.79 |

| Lam Research Corp EPS | 33.21 |

| Stock Currency | USD |

Overview of Lam Research Corp

Lam Research Corp is an American Technology Semiconductors & Semiconductor Equipment company currently traded on the NASDAQ.

Lam Research Corp trades under the stock symbol LRCX on the NASDAQ.

Lam Research Corp shares are exchanged in USD on the NASDAQ.

Lam Research Corp has a current share price of $690.46 USD dated 31/01/2020.

The highest Lam Research Corp share price over the last 52 weeks was $726.53 USD and its lowest price over the last 52 weeks was $299.59 USD. That is a 52 week price range of $299.59 - $726.53.

Lam Research Corp Information

Lam Research Corp Location & Information

| Lam Research Corp Employees | 14,100 |

|---|---|

| Year Founded | 1989 |

| Lam Research Corp IPO | |

| Lam Research Corp Head Quarters | 4650 Cushing Pkwy, FREMONT, CA, 94538-6401 US |

| Lam Research Corp Industry | Technology - Semiconductors & Semiconductor Equipment |

| Website URL | http://www.lamresearch.com |

Lam Research Corp Executives and Board Members

| CEO | Mr. Timothy Archer |

Compare Brokers: Lam Research Corp Shares and CFDs

Our table below lets you compare the features offered by brokers who trade Lam Research Corp shares and CFDs.

Compare the Lam Research Corp fees, commissions, and other essential aspects that may affect your Lam Research Corp trading experience with our easy-to-use table.

Make informed decisions on your trading strategies by comparing the various brokers' platforms and features.

- Minimum deposit requirement to open an account with each Lam Research Corp stock brokerage, helping you plan your initial investment.

- A comprehensive list of funding methods available with each Lam Research Corp stock broker, making it easier to deposit and withdraw funds according to your preferences.

- Details on the range of trading instruments available with each Lam Research Corp stock broker, including stocks, CFDs, and any other assets you can trade.

- Comparison of the trading platforms provided by each Lam Research Corp stock broker, such as web-based platforms, mobile apps, and downloadable software.

- Information on the spreads offered by each Lam Research Corp stock brokerage, whether they offer fixed spreads, variable spreads or both.

- An overview of the customer support channels provided by each Lam Research Corp stock broker, including email, phone, live chat, and other support options.

- We provide details on the types of trading accounts offered by each Lam Research Corp stock brokerage, including Micro, Standard, VIP, and Islamic accounts. Multiple account options makes choosing the account type that suits your Lam Research Corp trading needs and preferences easier.

How To Buy Lam Research Stock Table of Contents

- Steps To Buying Or Selling Lam Research Corp Stocks and Shares

- Buy Lam Research Corp (LRCX) Stock for 690.46 USD

- How To Buy or Sell Lam Research Corp LRCX Stocks & Shares

- Steps to Trading Lam Research Corp LRCX Stocks & Shares

- How To Buy Sell Or Trade Lam Research Corp Stock Guide

- Lam Research Corp LRCX Trading Fees

- How much does it cost to buy or sell Lam Research Corp LRCX Stock

- How can I buy or sell Lam Research Corp LRCX Stock

- Trade Real Lam Research Corp Shares

- Trade Lam Research Corp Fractional Shares

- Buy sell or trade Lam Research Corp CFD Shares

- Trading Lam Research Corp Stocks and CFDs

- Buying or selling Lam Research Corp Shares with a Broker

- Lam Research Corp Shares and CFDs Tax

- Should I trade Lam Research Corp Stocks and Shares or Lam Research Corp CFDs?

- How Lam Research Corp LRCX Fits In Your Portfolio

- Is Lam Research Corp A Buy Or Sell

- Is Lam Research Corp Over or Under Valued?

- Lam Research Corp LRCX Financials 2025

- Lam Research Corp Stock P/E Ratio

- Lam Research Corp Trading Volume and PE

- Lam Research Corp Stock Price Volatility

- Investing In Lam Research Corp Stocks

- Why Lam Research Corp Stocks Fluctuate

- Lam Research Corp Stock Market Capitalisation

- Lam Research Corp Stock Volume Explained

- Lam Research Corp Stock Splits

- Lam Research Corp Dividends Explained

- Lam Research Corp Stock Value Vs Lam Research Corp Stock Price

- How Many Lam Research Corp Stocks Should I Own

- Selling Lam Research Corp Stocks & Shares

- Lam Research Corp Stock For Retirement

- Lam Research Corp Stock Order Types

- Monitor Your Lam Research Corp Stock Portfolio

- Lam Research Corp Financial Details

- Overview of Lam Research Corp

- Lam Research Corp Information

- How To Buy Lam Research Stock Or Sell With A Broker

- 6 Factors to Consider when Choosing Lam Research Corp Stock Brokers

- How To Buy Lam Research Stock Frequently Asked Questions

- Brokers Reviews That You Can buy/sell Lam Research Corp With

- Alternative Brokers That You Can buy/sell Lam Research Corp With

- Lam Research Corp (NASDAQ) Related Guides

Learn more

Losses can exceed deposits

Losses can exceed deposits