Top South American Brokers for 2026

We found 11 online brokers that are appropriate for Trading South American.

Best South American Brokers Guide

Analysis by Andrew Blumer, Updated Last updated – December 30, 2025

South America Brokers

South America boasts a diverse and rapidly evolving financial landscape, with major exchanges like the B3 (Brasil Bolsa Balco) in Brazil, the Buenos Aires Stock Exchange (BCBA) in Argentina, and the Bolsa de Comercio de Santiago in Chile. Each countrys markets are overseen by local regulators such as Brazils CVM, Argentinas CNV, and Chiles CMF. This guide will help you find the best brokers for traders across South America whether you are trading Brazilian reais (BRL), Argentine pesos (ARS), or Chilean pesos (CLP)and highlight the key considerations unique to this region. Across the region, there are now well over 3 million retail traders active in a typical month (Brazil 1.6–1.7M; Argentina 1.2M), and total registered accounts exceed 13 million in Argentina alone. Over the last five years, retail participation has roughly doubled region-wide, led by Brazil’s surge in individual investors and continued growth in Argentina, Chile, and Colombia.

Best Brokers for Traders in South America

For traders in South America, choosing the right broker is crucial, especially when navigating local currency volatility, regional banking challenges, and cross border fund transfers. Below, I share some of the top brokers Ive used in Brazil, Argentina, Chile, and the wider region.

XP Investimentos (Brazil)

XP Investimentos leads Brazils brokerage market and is regulated by the CVM. Their platform provides direct access to B3 equities, BRL denominated futures, and local fixed income products. Integration with major banks like Banco do Brasil and Bradesco makes deposits and withdrawals efficient, eliminating long SWIFT delays.

Rava Burstil (Argentina)

Rava Burstil is a popular choice in Argentina, offering strong access to BCBA stocks and MEP dollar trades. With strict currency controls, their platform is ideal for switching between ARS and USD MEP ETFs, especially during volatile periods. Their advanced charting tools and low minimums allow me to trade small caps like YPF cost effectively.

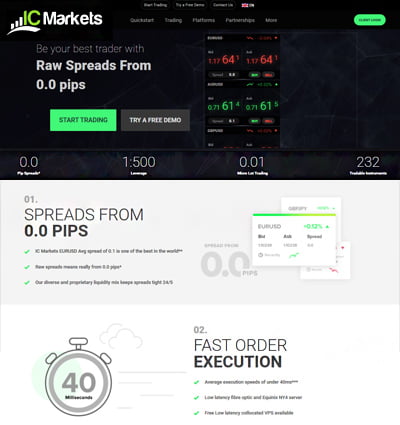

IC Markets (Global with Strong LATAM Presence)

From my own experience, IC Markets has been one of the easiest brokers to use in South America. I was able to fund my account in BRL, ARS, and CLP through local transfer options, which saved me a lot on conversion fees. Trading major markets like forex, indices, and commodities felt smooth thanks to their low spreads and fast execution. What stood out to me was how simple it was to manage withdrawals back to my local bank, and their Spanish-speaking support team made resolving issues much quicker compared to other brokers I’ve tried.

eToro (Global Social Trading Platform)

eToro is a social trading platform favored by Chilean and Peruvian investors. Following top traders, like Brazilian commodities specialists, I replicated a profitable iron ore trade during Vales Q2 earnings. Regulated by FCA and CySEC, eToro ensures fund security even for South America based users.

XM (Global Broker with LATAM Support)

XM offers MetaTrader 4 and 5 with localized support in Portuguese and Spanish. Ive executed EUR/BRL and USD/ARS grid strategies benefiting from tight spreads under 1 pip during So Paulo trading hours. Their low minimum deposits and regular bonuses (capped for South America) simplify account funding and trading.

Forex and CFD Brokers in South America

South Americas regulatory environment varies widely. For example, Argentina imposes currency purchase limits, while Brazil requires traders to register for offshore trading. Despite these challenges, many retail traders in the region prefer global CFD platforms to access Forex, indices, and commodity CFDs. Local brokers registered with authorities like CVM, CNV, or Colombias Superfinanciera often partner with these international firms to provide broader market access. When funding offshore accounts, traders should be cautious about Argentine peso repatriation rules and Brazilian real remittance limits, which can impact capital flow.

History of B3 (Brasil Bolsa Balco)

The B3 was created in 2017 following the merger of BM&FBOVESPA and CETIP, but its heritage stretches back to the So Paulo Stock Exchange, established in 1890. Today, it ranks among the worlds largest derivatives markets by open interest, playing a critical role in hedging Brazils commodity dependent economy. The exchange continuously innovates to support diverse asset classes, including equities, futures, and options.

South America Brokers and Regulation

Brokers serving South American investors must comply with a complex regulatory landscape that includes Brazils CVM, Argentinas CNV, Chiles CMF, Colombias Superfinanciera, and Perus SMV. These regulators enforce standards such as client fund segregation, regular audits, and strict AML/KYC compliance. Many international brokers obtain local representative licenses to operate legally and build trust within these markets.

Trading with South America Brokers

Technology and Platform Quality

South American brokerages vary significantly in terms of technology and fee structures. The best brokers offer robust home market platforms alongside access to major global markets. Its essential to confirm that your broker is properly registered with the relevant regulatory authority in your country and that client funds are held in segregated accounts to protect your capital.

Testing multiple demo accounts can provide valuable insights, especially to assess order execution quality and latency. Pay particular attention to trading performance during key market hours in Braslia, Buenos Aires, and Santiago to ensure your broker can handle live market conditions smoothly before committing real funds.

Leverage Restrictions and Margin Considerations

Be cautious of brokers advertising unlimited leverage. For instance, Brazilian regulations cap retail Forex leverage at 30:1, while Argentinas CNV restricts margin trading on more volatile ARS currency pairs. Understanding these local leverage restrictions helps you manage risk effectively and avoid unexpected margin calls or forced liquidations.

South America Trading Opportunities

Commodity Driven Economies and Market Themes

South Americas combined population of over 430 million supports diverse and rapidly evolving economies primarily driven by commodity exports such as soybeans, copper, and oil. Brazils agricultural sector, Chiles abundant lithium reserves in the Atacama Desert, and Argentinas renewable energy projects create dynamic, high growth themes for traders.

Fintech Growth and Liquidity in Tech Stocks

The rise of fintech hubs in cities like So Paulo and Buenos Aires is driving increased liquidity and innovation in local technology stocks. These developments offer new opportunities for investors to gain exposure to emerging market sectors beyond traditional commodities, diversifying their portfolios within the South American landscape.

Challenges in the South American Financial Market

Inflation and Currency Volatility

South American markets face significant challenges such as high inflation, exemplified by Argentinas Argentine peso (ARS) losing around 70% of its value in the past year. Such volatility can dramatically impact investment returns and trading strategies, requiring investors to be vigilant about currency risk management.

Capital Controls and Fund Transfers

Periodic capital controls are common in countries like Argentina and Venezuela, restricting the movement of funds across borders. Additionally, cross border wire transfers often carry high feessometimes reaching 2.5% per transactionmaking efficient fund management critical for traders operating internationally.

Fragmented Clearing Systems and Regulatory Changes

The regions fragmented clearing and settlement infrastructure can delay trade executions or settlements, while sudden regulatory changes, like Perus overnight adjustments to trading rules, can catch investors off guard. Staying informed on local regulations and tax policies is vital to avoid unexpected disruptions when trading.

South America Financial Regulations

Country Specific Regulatory Frameworks

Each South American country enforces its own set of investment laws and regulations. Brazils brokers operate under CVM Instruction 505, Argentina follows the CNVs General Resolution 622, Chile implements CMF Circular 1125, and Colombia regulates through Decree 2555. These frameworks emphasize broker licensing, anti money laundering (AML) compliance, and investor protection disclosures.

Verifying Broker Licenses and Coverage

It is critical to confirm that your broker holds a valid license from your countrys financial authority. For example, in Brazil, check for registration with the CVM and membership in ANCORD; in Argentina, oversight by the CNV and access to Merval trading; in Chile, authorization from the CMF; and in Colombia, approval from the Superfinanciera. Remember that a license in one country may not cover all products, so ensure the broker is authorized for CFDs, Forex, and derivatives if you intend to trade these instruments.

Choosing a Broker in South America

Evaluating Regulation and Security

When selecting a broker in South America, one of the most important factors is ensuring the broker is properly regulated by the relevant local authority, such as Brazils CVM, Argentinas CNV, or Chiles CMF. A regulated broker offers a level of security for your funds, including client fund segregation and adherence to strict AML/KYC policies. Confirming the broker's licensing status and checking for any disciplinary history can protect you from potential fraud or insolvency.

Assessing Fees and Trading Conditions In South America

From my own trading experience in Brazil, Argentina, and Chile, I quickly learned that fees can make or break profitability. Many brokers add hidden costs in the form of conversion fees when depositing in BRL, ARS, or CLP, and withdrawal charges can be even higher if not using a broker with proper local payment options. I also noticed that leverage rules differ across the region in Brazil and Argentina, for example, some brokers limit exposure much more than international ones. Choosing a broker with transparent spreads, no surprise withdrawal fees, and fair overnight financing rates has been key for me to stay consistent with my results.

Trading Platforms and Available Products

Using platforms in South America, I found reliability to be a bigger issue than expected, especially during high volatility periods when execution speed matters. A broker with MetaTrader 4/5 or cTrader gave me access to Forex, commodities, and global indices while still allowing me to manage deposits and withdrawals in my local currency. In Chile, I liked having access to U.S. stocks alongside the local Bolsa de Comercio de Santiago, while in Brazil, being able to trade B3-listed assets with real-time data was crucial. Educational resources in Spanish and Portuguese also made a big difference, since not every broker understands the challenges South American traders face, such as inflation, strict capital controls, and limited cross-border payment options.

Customer Support and Local Accessibility

Effective customer service is crucial, especially when trading across different time zones. Look for brokers offering support in your preferred language, typically Spanish or Portuguese. Local phone numbers or chat support can save time and reduce misunderstandings during critical trading moments.

International Brokers Serving South America

Advantages of International Brokers in South American

International brokers often provide South American traders with access to global markets beyond local exchanges, including U.S., European, and Asian markets. They typically offer sophisticated trading platforms, multi currency accounts, and a wider variety of financial instruments. Their large scale also often means more competitive pricing and better liquidity for Forex and CFD products.

Limitations Of Brokers in South America

While international brokers bring many benefits to traders in South America, they may not always provide localized services such as support in native languages or local payment options. Regulatory differences can also create complexities; for example, funding accounts in certain South American countries can be challenging due to capital controls or currency restrictions. Additionally, international brokers might not be registered with local regulators, which can impact investor protections.

Balancing Local South American and International Options

Many traders in South America choose a hybrid approach, maintaining accounts with both local brokers for domestic market access and international brokers for diversified global exposure. This strategy allows investors to leverage local expertise and regulation while benefiting from broader investment opportunities. When selecting an international broker, check for clear communication on fees, withdrawal processes, and regulatory compliance relevant to South American clients.

Cryptocurrency Trading in South America

Growing Popularity and Adoption

Cryptocurrency trading has surged across South America in recent years, fueled by economic instability, inflation concerns, and a desire for faster cross border payments. Countries like Argentina, Brazil, and Colombia have seen significant adoption of digital assets, with many investors turning to crypto as both a store of value and a speculative asset.

Regulation In South America

The regulatory environment for cryptocurrencies in South America varies widely by country. While some nations have embraced crypto with clear frameworks and licensing regimes, others maintain cautious or ambiguous stances. For example, Brazil has implemented specific regulations under the Central Bank and CVM, focusing on anti money laundering (AML) and investor protection. Argentina and Colombia are still developing comprehensive rules but have begun requiring crypto exchanges to comply with tax reporting and KYC regulations.

Popular Platforms and South American Brokers

South American traders access cryptocurrencies through a mix of local exchanges, international brokers, and global platforms that support regional currencies and payment methods. Platforms like Binance, Coinbase, and Mercado Bitcoin in Brazil offer broad crypto selections, often with localized customer support and payment options such as PIX in Brazil or Pago Fcil in Argentina. Some traditional brokers have also added crypto trading alongside stocks and CFDs, though with varying fees and platform sophistication.

South American Trading Challenges and Risks

Despite growing interest, cryptocurrency trading in South America faces challenges such as volatility, regulatory uncertainty, and risks related to security and fraud. The lack of uniform regulations means traders must conduct careful due diligence when selecting brokers or exchanges. Additionally, the high volatility of local currencies can amplify gains and losses, making risk management essential.

South America Brokers Verdict

Trading from South America requires a broker who truly understands the local market challenges, including currency controls, regional holidays, and occasional infrastructure limitations. Having navigated these markets myself, I know how crucial it is to partner with brokers that combine strong local expertise with seamless access to global financial markets.

Brokers like XP Investimentos in So Paulo and Rava in Buenos Aires offer excellent local market coverage, while global platforms such as IC Markets or eToro provide diversified access across multiple countries and asset classes. The best brokers in the region balance robust regulation, user friendly platforms, transparent fee structures, and reliable customer support.

By selecting a broker that excels both locally and internationally, traders in South America can confidently navigate the regions complexities and seize the diverse opportunities it presents. Careful research and due diligence remain key to unlocking success in this dynamic market.

We have conducted extensive research and analysis on over multiple data points on South American Brokers to present you with a comprehensive guide that can help you find the most suitable South American Brokers. Below we shortlist what we think are the best south american brokers after careful consideration and evaluation. We hope this list will assist you in making an informed decision when researching South American Brokers.

Popular South American Countries For Trading Online

We list the most popular South American countries below and have more detailed articles for the best brokers for each specific country.

- Compare USA Brokers

- Compare Mexican Brokers

- Compare El Salvador Brokers

- Compare Argentinian Brokers

- Best Brazil Brokers

- Best Portuguese Brokers

- Best Colombian Brokers

- Best Chile Brokers

- Best Canadian Brokers

- Best Venezuela Brokers

- Best Puerto Rico Brokers

- Best Uruguay Brokers

- Best Peru Brokers

- Best Paraguay Brokers

- Best Nicaragua Brokers

- Best Honduras Brokers

- Best Guatemala Brokers

- Best Ecuador Brokers

- Best Bolivia Brokers

Reputable South American Brokers Checklist

Selecting a reliable and reputable online South American trading brokerage involves assessing their track record, regulatory status, customer support, processing times, international presence, and language capabilities. Considering these factors, you can make an informed decision and trade South American more confidently.

Selecting the right online South American trading brokerage requires careful consideration of several critical factors. Here are some essential points to keep in mind:

- Ensure your chosen South American broker has a solid track record of at least two years in the industry.

- Verify that the South American broker has a customer support team of at least 15 members responsive to queries and concerns.

- Check if the South American broker operates under the regulatory framework of a jurisdiction that can hold it accountable for any misconduct or resolve disputes fairly and impartially.

- Ensure that the South American broker can process deposits and withdrawals within two to three days, which is crucial when you need to access your funds quickly.

- Look for South American brokers with an international presence in multiple countries, offering its clients local seminars and training programs.

- Ensure the South American broker can hire staff from diverse locations worldwide who can communicate fluently in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Compare Key Features of South American Brokers in Our Brokerage Comparison Table

When choosing a broker for south american trading, it's essential to compare the different options available to you. Our south american brokerage comparison table below allows you to compare several important features side by side, making it easier to make an informed choice.

- Minimum deposit requirement for opening an account with each south american broker.

- The funding methods available for south american with each broker.

- The types of instruments you can trade with each south american broker, such as forex, stocks, commodities, and indices.

- The trading platforms each south american broker provides, including their features, ease of use, and compatibility with your devices.

- The spread type (if applicable) for each south american broker affects the cost of trading.

- The level of customer support each south american broker offers, including their availability, responsiveness, and quality of service.

- Whether each south american broker offers Micro, Standard, VIP, or Islamic accounts to suit your trading style and preferences.

By comparing these essential features, you can choose a south american broker that best suits your needs and preferences for south american. Our south american broker comparison table simplifies the process, allowing you to make a more informed decision.

Top 15 South American Brokers of 2026 compared

Here are the top South American Brokers.

Compare south american brokers for min deposits, funding, used by, benefits, account types, platforms, and support levels. When searching for a south american broker, it's crucial to compare several factors to choose the right one for your south american needs. Our comparison tool allows you to compare the essential features side by side.

All brokers below are south american brokers. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more south american brokers that accept south american clients.

| Broker |

IC Markets

|

Roboforex

|

eToro

|

XTB

|

XM

|

Pepperstone

|

AvaTrade

|

FP Markets

|

EasyMarkets

|

SpreadEx

|

FXPro

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rating | |||||||||||

| Regulation | International Capital Markets Pty Ltd (Australia) (ASIC) Australian Securities & Investments Commission Licence No. 335692, Seychelles Financial Services Authority (FSA) (SD018), IC Markets (EU) Ltd (CySEC) Cyprus Securities and Exchange Commission with License No. 362/18, Capital Markets Authority(CMA) Kenya IC Markets (KE) Ltd, Securities Commission of The Bahamas (SCB) IC Markets (Bahamas) Ltd | RoboForex Ltd is authorised and regulated by the Financial Services Commission (FSC) of Belize under licence No. 000138/32, under the Securities Industry Act 2021, RoboForex Ltd is an (A category) member of The Financial Commission, also RoboForex Ltd is a participant of the Financial Commission Compensation Fund | FCA (Financial Conduct Authority) eToro (UK) Ltd (FCA reference 583263), eToro (Europe) Ltd CySEC (Cyprus Securities Exchange Commission), ASIC (Australian Securities and Investments Commission) eToro AUS Capital Limited ASIC license 491139, CySec (Cyprus Securities and Exchange Commission under the license 109/10), FSAS (Financial Services Authority Seychelles) eToro (Seychelles) Ltd license SD076, eToro (ME) Limited (ADGM) Abu Dhabi (UAE) number 220073, eToro (Europe) Ltd (AMF) Autorité des marchés financiers as a digital assets provider France | FCA (Financial Conduct Authority reference 522157) XTB Limited, CySEC (Cyprus Securities and Exchange Commission reference 169/12), DFSA (Dubai Financial Services Authority XTB MENA Limited licensed 8 July 2021), FSA (Financial Services Authority Seychelles license number SD148), FSCA (Financial Sector Conduct Authority XTB Africa (Pty) Ltd licensed 10 August 2021), KNF (Komisja Nadzoru Finansowego Polish Financial Supervision Authority) | Financial Sector Conduct Authority (FSCA) (49976) XM ZA (Pty) Ltd, Financial Services Commission (FSC) (000261/27) XM Global Limited, Cyprus Securities and Exchange Commission (CySEC) (license 120/10) Trading Point of Financial Instruments Ltd, Australian Securities and Investments Commission (ASIC) (number 443670) Trading Point of Financial Instruments Pty Ltd | Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of The Bahamas (SCB) number SIA-F217 | Australian Securities and Investments Commission (ASIC) Ava Capital Markets Australia Pty Ltd (406684), South African Financial Sector Conduct Authority (FSCA) Ava Capital Markets Pty Ltd (45984), Financial Services Agency (Japan FSA) Ava Trade Japan K.K. (1662), Financial Futures Association of Japan (FFAJ) Ava Trade Japan K.K. (1574), Abu Dhabi Global Markets (ADGM) / Financial Regulatory Services Authority (FRSA) Ava Trade Middle East Ltd (190018), Central Bank of Ireland (C53877) AVA Trade EU Ltd, Polish Financial Supervision Authority (KNF) AVA Trade EU Ltd (branch authorisation), British Virgin Islands Financial Services Commission (BVI) Ava Trade Markets Ltd (SIBA/L/13/1049), Israel Securities Authority (ISA) ATrade Ltd (514666577) | CySEC (Cyprus Securities and Exchange Commission) (371/18), ASIC AFS (Australian Securities and Investments Commission) (286354), FSP (Financial Sector Conduct Authority in South Africa) (50926), Financial Services Authority Seychelles (FSA) (SD 130) | Easy Forex Trading Ltd is regulated by CySEC (License Number 079/07). Easy Forex Trading Ltd is the only entity that onboards EU clients, easyMarkets Pty Ltd is regulated by ASIC (AFS License No. 246566), EF Worldwide Ltd in Seychelles is regulated by FSA (License Number SD056), EF Worldwide Ltd in the British Virgin Islands is regulated by FSC (License Number SIBA/L/20/1135) | FCA (Financial Conduct Authority) (190941), Gambling Commission (Great Britain) (8835), licence in Ireland as remote bookmaker for fixed odds betting licence number 1016176 | FCA (Financial Conduct Authority) (509956), CySEC (Cyprus Securities and Exchange Commission) (078/07), FSCA (Financial Sector Conduct Authority) (45052), SCB (Securities Commission of The Bahamas) (SIA-F184), FSA (Financial Services Authority of Seychelles) (SD120) |

| Min Deposit | 200 | 10 | 50 | No minimum deposit | 5 | No minimum deposit | 100 | 100 | 25 | No minimum deposit | 100 |

| Funding |

|

|

|

|

|

|

|

|

|

|

|

| Used By | 200,000+ | 730,000+ | 40,000,000+ | 2,000,000+ | 15,000,000+ | 750,000+ | 400,000+ | 200,000+ | 250,000+ | 60,000+ | 11,200,000+ |

| Benefits |

|

|

|

|

|

|

|

|

|

|

|

| Accounts |

|

|

|

|

|

|

|

|

|

|

|

| Platforms | MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading Central | MT4, MT5, R Mobile Trader, R StocksTrader, WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), Windows | eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, Web | MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play) | MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile Apps | MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play) | easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5 | Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingView | MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play) |

| Support |

|

|

|

|

|

|

|

|

|

|

|

| Learn More |

Sign

Up with icmarkets |

Sign

Up with roboforex |

Sign

Up with etoro |

Sign

Up with xtb |

Sign

Up with xm |

Sign

Up with pepperstone |

Sign

Up with avatrade |

Sign

Up with fpmarkets |

Sign

Up with easymarkets |

Sign

Up with spreadex |

Sign

Up with fxpro |

| Risk Warning | Losses can exceed deposits | Losses can exceed deposits | 46% of retail investor accounts lose money when trading CFDs with this provider. | 69% - 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75.99% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | 72-95 % of retail investor accounts lose money when trading CFDs | 57% of retail investor accounts lose money when trading CFDs with this provider | Losses can exceed deposits | Your capital is at risk | 62% of retail CFD accounts lose money | 74% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider |

| Demo |

IC Markets Demo |

Roboforex Demo |

eToro Demo |

XTB Demo |

XM Demo |

Pepperstone Demo |

AvaTrade Demo |

FP Markets Demo |

easyMarkets Demo |

SpreadEx Demo |

FxPro Demo |

| Excluded Countries | US, IR, CA, NZ, JP | AU, BE, BQ, BR, CA, CW, CZ, DE, ES, EE, EU, FM, FR, FI, GW, ID, IR, JP, LR, MP, NL, PF, PL, RU, SE, SJ, SS, SL, SI, TL, TR, DO, US, IT, AT, PT, BG, HR, CY, DK, FL, GR, IE, LV, LT, MT, RO, SK, CH | ZA, ID, IR, KP, BE, CA, JP, SY, TR, IL, BY, AL, MD, MK, RS, GN, CD, SD, SA, ZW, ET, GH, TZ, LY, UG, ZM, BW, RW, TN, SO, NA, TG, SL, LR, GM, DJ, CI, PK, BN, TW, WS, NP, SG, VI, TM, TJ, UZ, LK, TT, HT, MM, BT, MH, MV, MG, MK, KZ, GD, FJ, PT, BB, BM, BS, AG, AI, AW, AX, LB, SV, PY, HN, GT, PR, NI, VG, AN, CN, BZ, DZ, MY, KH, PH, VN, EG, MN, MO, UA, JO, KR, AO, BR, HR, GL, IS, IM, JM, FM, MC, NG, SI, | US, IN, PK, BD, NG , ID, BE, AU | US, CA, IL, IR | AF, AS, AQ, AM, AZ, BY, BE, BZ, BT, BA, BI, CM, CA, CF, TD, CG, CI, ER, GF, PF, GP, GU, GN, GW, GY, HT, VA, IR, IQ, JP, KZ, LB, LR, LY, ML, MQ, YT, MZ, MM, NZ, NI, KP, PS, PR, RE, KN, LC, VC, WS, SO, GS, KR, SS, SD, SR, SY, TJ, TN, TM, TC, US, VU, VG, EH, ES, YE, ZW, ET | BE, BR, KP, NZ, TR, US, CA, SG | US, JP, NZ | US, IL, BC, MB, QC, ON, AF, BY, BI, KH, KY, TD, KM, CG, CU, CD, GQ, ER, FJ, GN, GW, HT, IR, IQ, LA, LY, MZ, MM, NI, KP, PW, PA, RU, SO, SS, SD, SY, TT, TM, VU, VE, YE | US, TR | US, CA, IR |

All South american brokers in more detail

You can compare South American Brokers ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options, regulation and account types side by side.

We also have an indepth Top South American Brokers for 2026 article further below. You can see it now by clicking here

We have listed top South american brokers below.

South American Brokers List

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading CentralCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, R Mobile Trader, R StocksTrader, WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), WindowsCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 46% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Funding methods

Bank transfer Credit Card PaypalPlatforms

eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, WebCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile AppsCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account XM Swap-Free account (XM Ultra Low Account) VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account Pro Account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingViewCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Learn more

Losses can exceed deposits

Losses can exceed deposits

Losses can exceed deposits