Top Inside Day for 2025

We found 11 online brokers that are appropriate for Trading Inside Day.

Best Inside Day Guide

Analysis by Andrew Blumer, Updated Last updated – July 02, 2025

Inside Day

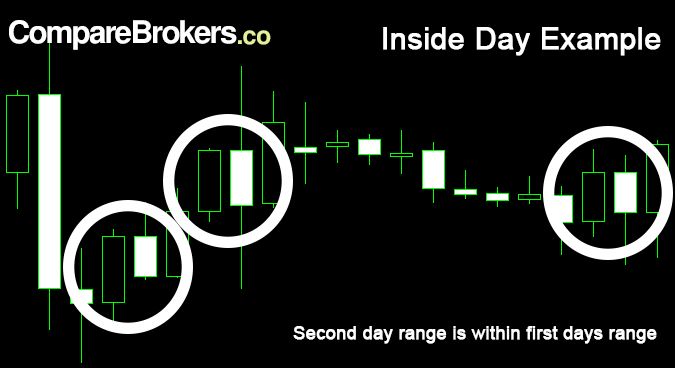

With an inside day, you can trade a security within a low and high range of the previous days. It may occur on a chart style that shows low and high data.

Remember, you can easily identify it with candlesticks. An inside day may become a signal for a trader that security is acting as a break from the main market trend.

Remember, an inside day means a two-day price pattern that occurs because of the range of the second day inside the price range of the first day.

The high of the second day may be low than the first day. Furthermore, the low of the second day can be higher than the initial day.

During inside days, you can see a contraction in volatility and continuation pattern. It means the price may consistently move in the direction of the old pattern.

The pattern can be insignificant and common.

Inside Days Trading

Inside days may not offer maximum probability odds to determine where security is heading over a particular period.

If an investor is interested in a trading system as per inside days, he may face losses. Remember, inside days, candlestick can be a neutral sign. You can’t control bears and bulls.

Traders should check the technical indicators and current market environment to choose between primary trends and anticipate counter moves.

Inside days have better odds of success in case of a strong trend.

A trader can look for relatively small inside days instead of retracing over 50% of the old days candlestick.

It may put a pause in trends because security odds may be consistent in the direction of primary trends.

Trading counter-movements with the use of inside days may be challenging.

A trader may increase the odds of counters by determining the spike trends in the volume as per the old days.

It may imply that the security is becoming low. Moreover, inside day must retrace over 50% of the old days candlestick body.

It may become a possible indication that bulls are getting steam.

Basics of the Inside Day

Remember, inside days frequently occur on a regular chart in several assets.

As a result, a trader can get some information from inside days. You may not notice any significant move in price through the patterns.

Volatility may drop from the previous days, and the market is vulnerable to pause. For this reason, a pattern may be considered as a continuance pattern. The price may move consistently in the same direction.

For the best results, you can trade inside days with the same pattern.

For instance, if you want to buy, it can be a bull market for stock trading and stock must tend higher for inside day.

The price must exit the pattern in an upside direction. It allows traders to buy as the price increases. Remember, the price must be the first candle of the two-bar pattern.

Moreover, traders can short-sell as the price dropped down the lowest pattern.

The short may align with bear markets, and price may move lower in the inside days. Moreover, the price must break the two-bar pattern.

A stop-loss may be an essential place in the opposite direction of the pattern and entry. By extending this situation, the occurrence of stop loss will increase.

The inside pattern may not have a target profit. Traders may use other methods for profit collection, including reward and risk ratio, sprawling stop loss, moving average or an indicator and looking for new candlestick patterns.

Trading Example of Inside Day

See the chart as an example to understand inside day. This chart is from the Dow Jones. The inside days are upward before the poorest selling week of the Dow Jones.

There was a 777 point massive down day and 3 inside days. For a few traders, it was a possible fluctuation in trends, but others consider it a breather in the major downtrend.

Moreover, everyone put their bets on the bear market and hit home runs.

Trading Strategy for Inside Day

The ID (inside day) candles signal a possible market move. You have to anticipate the direction of a price break.

If you depend on the inside bar while entering a market, you may face failure. Additional trading tools are available for your help to validate a trading decision.

A strategy may include Chaikin + ID + Stochastic RSI. Combine the candle pattern with SRSI and Chaikin (two oscillators). The Chaikin may prove helpful to recognize bearish and bullish divergence. You can close the position once the Chaikin line breaks to zero.

Inside Day Final Verdict

In inside days trading, the two indicators may give a signal, and the trader has to confirm the pattern of inside chart. Once the Chaikin breaks a zero line in the opposite direction, you can close the position. For inside days, some may be preceded by a decline or advance.

We have conducted extensive research and analysis on over multiple data points on Inside Day to present you with a comprehensive guide that can help you find the most suitable Inside Day. Below we shortlist what we think are the best inside day after careful consideration and evaluation. We hope this list will assist you in making an informed decision when researching Inside Day.

Reputable Inside Day Checklist

Selecting a reliable and reputable online Inside Day trading brokerage involves assessing their track record, regulatory status, customer support, processing times, international presence, and language capabilities. Considering these factors, you can make an informed decision and trade Inside Day more confidently.

Selecting the right online Inside Day trading brokerage requires careful consideration of several critical factors. Here are some essential points to keep in mind:

- Ensure your chosen Inside Day broker has a solid track record of at least two years in the industry.

- Verify that the Inside Day broker has a customer support team of at least 15 members responsive to queries and concerns.

- Check if the Inside Day broker operates under the regulatory framework of a jurisdiction that can hold it accountable for any misconduct or resolve disputes fairly and impartially.

- Ensure that the Inside Day broker can process deposits and withdrawals within two to three days, which is crucial when you need to access your funds quickly.

- Look for Inside Day brokers with an international presence in multiple countries, offering its clients local seminars and training programs.

- Ensure the Inside Day broker can hire staff from diverse locations worldwide who can communicate fluently in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Compare Key Features of Inside Day in Our Brokerage Comparison Table

When choosing a broker for inside day trading, it's essential to compare the different options available to you. Our inside day brokerage comparison table below allows you to compare several important features side by side, making it easier to make an informed choice.

- Minimum deposit requirement for opening an account with each inside day broker.

- The funding methods available for inside day with each broker.

- The types of instruments you can trade with each inside day broker, such as forex, stocks, commodities, and indices.

- The trading platforms each inside day broker provides, including their features, ease of use, and compatibility with your devices.

- The spread type (if applicable) for each inside day broker affects the cost of trading.

- The level of customer support each inside day broker offers, including their availability, responsiveness, and quality of service.

- Whether each inside day broker offers Micro, Standard, VIP, or Islamic accounts to suit your trading style and preferences.

By comparing these essential features, you can choose a inside day broker that best suits your needs and preferences for inside day. Our inside day broker comparison table simplifies the process, allowing you to make a more informed decision.

Top 15 Inside Day of 2025 compared

Here are the top Inside Day.

Compare inside day brokers for min deposits, funding, used by, benefits, account types, platforms, and support levels. When searching for a inside day broker, it's crucial to compare several factors to choose the right one for your inside day needs. Our comparison tool allows you to compare the essential features side by side.

All brokers below are inside day. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more inside day that accept inside day clients.

| Broker |

IC Markets

|

eToro

|

XTB

|

XM

|

Pepperstone

|

AvaTrade

|

FP Markets

|

EasyMarkets

|

SpreadEx

|

FXPro

|

Admiral

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rating | |||||||||||

| Regulation | Seychelles Financial Services Authority (FSA) (SD018) | FCA (Financial Conduct Authority) eToro (UK) Ltd (FCA reference 583263), eToro (Europe) Ltd CySEC (Cyprus Securities Exchange Commission), ASIC (Australian Securities and Investments Commission) eToro AUS Capital Limited ASIC license 491139, CySec (Cyprus Securities and Exchange Commission under the license 109/10), FSAS (Financial Services Authority Seychelles) eToro (Seychelles) Ltd license SD076 | FCA (Financial Conduct Authority reference 522157), CySEC (Cyprus Securities and Exchange Commission reference 169/12), FSCA (Financial Sector Conduct Authority), XTB AFRICA (PTY) LTD licensed to operate in South Africa, KPWiG (Polish Securities and Exchange Commission), DFSA (Dubai Financial Services Authority), DIFC (Dubai International Financial Center), CNMV (Comisión Nacional del Mercado de Valores), KNF (Komisja Nadzoru Finansowego), IFSC (Belize International Financial Services Commission license number IFSC/60/413/TS/19) | Financial Services Commission (FSC) (000261/4) XM ZA (Pty) Ltd, Cyprus Securities and Exchange Commission (CySEC) (license 120/10) Trading Point of Financial Instruments Ltd, Australian Securities and Investments Commission (ASIC) (number 443670) Trading Point of Financial Instruments Pty Ltd | Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217 | Australian Securities and Investments Commission (ASIC) Ava Capital Markets Australia Pty Ltd (406684), South African Financial Sector Conduct Authority (FSCA) Ava Capital Markets Pty Ltd (45984), Financial Services Agency (Japan FSA) Ava Trade Japan K.K. (1662), Financial Futures Association of Japan (FFAJ),, FFAJ, Abu Dhabi Global Markets (ADGM)(190018) Ava Trade Middle East Ltd (190018), Polish Financial Supervision Authority (KNF) AVA Trade EU Ltd, Central Bank of Ireland (C53877) AVA Trade EU Ltd, British Virgin Islands Financial Services Commission (BVI) BVI (SIBA/L/13/1049), Israel Securities Association (ISA) (514666577) ATrade Ltd, Financial Regulatory Services Authority (FRSA) | CySEC (Cyprus Securities and Exchange Commission) (371/18), ASIC AFS (Australian Securities and Investments Commission) (286354), FSP (Financial Sector Conduct Authority in South Africa) (50926), Financial Services Authority Seychelles (FSA) (130) | Cyprus Securities and Exchange Commission (CySEC) (079/07) Easy Forex Trading Ltd, Australian Securities and Investments Commission (ASIC) (Easy Markets Pty Ltd 246566), British Virgin Islands Financial Services Commission (BVI) EF Worldwide Ltd (SIBA/L/20/1135), Financial Sector Conduct Authority South Africa (FSA) EF Worldwide (PTY) Ltd (54018), FSC (Financial Services Commission) (SIBA/L/20/1135), FSCA (Financial Sector Conduct Authority) (54018) | FCA (Financial Conduct Authority) (190941), Gambling Commission (Great Britain) (8835) | FCA (Financial Conduct Authority) (509956), CySEC (Cyprus Securities and Exchange Commission) (078/07), FSCA (Financial Sector Conduct Authority) (45052), SCB (Securities Commission of The Bahamas) (SIA-F184), FSA (Financial Services Authority of Seychelles) (SD120) | Financial Conduct Authority (FCA) (595450), Cyprus Securities and Exchange Commission (CySEC)(310328), FSA (Financial Services Authority of Seychelles) (SD073) |

| Min Deposit | 200 | 50 | No minimum deposit | 5 | No minimum deposit | 100 | 100 | 25 | No minimum deposit | 100 | 1 |

| Funding |

|

|

|

|

|

|

|

|

|

|

|

| Used By | 200,000+ | 35,000,000+ | 1,000,000+ | 10,000,000+ | 400,000+ | 400,000+ | 200,000+ | 250,000+ | 60,000+ | 7,800,000+ | 30,000+ |

| Benefits |

|

|

|

|

|

|

|

|

|

|

|

| Accounts |

|

|

|

|

|

|

|

|

|

|

|

| Platforms | MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading Central | eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, Web | MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play) | MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile Apps | MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play) | easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5 | Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingView | MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play) | MT5, MT4, MetaTrader WebTrader, Admirals Mobile Apps, iOS (App Store), Android (Google Play), Admirals Platform, StereoTrader |

| Support |

|

|

|

|

|

|

|

|

|

|

|

| Learn More |

Sign

Up with icmarkets |

Sign

Up with etoro |

Sign

Up with xtb |

Sign

Up with xm |

Sign

Up with pepperstone |

Sign

Up with avatrade |

Sign

Up with fpmarkets |

Sign

Up with easymarkets |

Sign

Up with spreadex |

Sign

Up with fxpro |

Sign

Up with admiralmarkets |

| Risk Warning | Losses can exceed deposits | 61% of retail investor accounts lose money when trading CFDs with this provider. | 69% - 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.12% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | 75-95 % of retail investor accounts lose money when trading CFDs | 71% of retail investor accounts lose money when trading CFDs with this provider | Losses can exceed deposits | Your capital is at risk | 65% of retail CFD accounts lose money | 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider | Losses can exceed deposits |

| Demo |

IC Markets Demo |

eToro Demo |

XTB Demo |

XM Demo |

Pepperstone Demo |

AvaTrade Demo |

FP Markets Demo |

easyMarkets Demo |

SpreadEx Demo |

FxPro Demo |

Admiral Markets Demo |

| Excluded Countries | US, IR, CA, NZ, JP | ZA, ID, IR, KP, BE, CA, JP, SY, TR, IL, BY, AL, MD, MK, RS, GN, CD, SD, SA, ZW, ET, GH, TZ, LY, UG, ZM, BW, RW, TN, SO, NA, TG, SL, LR, GM, DJ, CI, PK, BN, TW, WS, NP, SG, VI, TM, TJ, UZ, LK, TT, HT, MM, BT, MH, MV, MG, MK, KZ, GD, FJ, PT, BB, BM, BS, AG, AI, AW, AX, LB, SV, PY, HN, GT, PR, NI, VG, AN, CN, BZ, DZ, MY, KH, PH, VN, EG, MN, MO, UA, JO, KR, AO, BR, HR, GL, IS, IM, JM, FM, MC, NG, SI, | US, IN, PK, BD, NG , ID, BE, AU | US, CA, IL, IR | AF, AS, AQ, AM, AZ, BY, BE, BZ, BT, BA, BI, CM, CA, CF, TD, CG, CI, ER, GF, PF, GP, GU, GN, GW, GY, HT, VA, IR, IQ, JP, KZ, LB, LR, LY, ML, MQ, YT, MZ, MM, NZ, NI, KP, PS, PR, RE, KN, LC, VC, WS, SO, GS, KR, SS, SD, SR, SY, TJ, TN, TM, TC, US, VU, VG, EH, ES, YE, ZW, ET | BE, BR, KP, NZ, TR, US, CA, SG | US, JP, NZ | US, IL, BC, MB, QC, ON, AF, BY, BI, KH, KY, TD, KM, CG, CU, CD, GQ, ER, FJ, GN, GW, HT, IR, IQ, LA, LY, MZ, MM, NI, KP, PW, PA, RU, SO, SS, SD, SY, TT, TM, VU, VE, YE | US, TR | US, CA, IR | US, CA, JP, SG, MY, JM, IR, TR |

All Inside day in more detail

You can compare Inside Day ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options, regulation and account types side by side.

We also have an indepth Top Inside Day for 2025 article further below. You can see it now by clicking here

We have listed top Inside day below.

Inside Day List

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading CentralCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Funding methods

Bank transfer Credit Card PaypalPlatforms

eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, WebCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile AppsCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account XM Swap-Free account (XM Ultra Low Account) VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account Pro Account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingViewCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT4, MetaTrader WebTrader, Admirals Mobile Apps, iOS (App Store), Android (Google Play), Admirals Platform, StereoTraderCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Learn more

Losses can exceed deposits

Losses can exceed deposits

Losses can exceed deposits