Copy Trading for 2025

We found 11 online brokers that are appropriate for Trading Copy Brokers.

Copy Trading Brokers Guide

Analysis by Andrew Blumer, Updated and fact-checked by Senad Karaahmetovic, Last updated – June 24, 2025

Copy Trading Brokers

Copy trading brokers are platforms that allow individuals to automatically copy the trades of successful traders. This innovative approach enables beginners and those with limited time or knowledge to participate in trading by mirroring the strategies of experienced investors.

By selecting a trader to follow based on performance metrics, risk level, and investment style, users can diversify their portfolios and potentially enhance their returns. These brokers often provide a social trading environment, encouraging interaction and learning among community members. Key features include real-time trade replication, customizable risk management tools, and a variety of financial instruments.

However, it's important to remember that trading involves risks, including the possibility of losing the invested capital.

You can see the UK's Financial Conduct Authority defines copy trading here.

Best Copy Trading Platforms

eToro

eToro is a leader in social trading and copy trading it has many more millions of registered users than its nearest copy trading platform competitor, making it an excellent platform for those looking to trade financial markets like Forex, stocks, indices, commodities, and cryptocurrencies by copying the trades of successful investors. With its user-friendly interface and community-driven insights, eToro fosters a collaborative trading environment. Its CopyTrading feature allows traders to easily replicate the trades of top performers, while the vast network of over 33 million users provides a wealth of knowledge and trading strategies to follow, making it an ideal choice for those new to copy trading or looking to leverage the collective expertise of a global trading community.

IC Markets

IC Markets stands out for copy trading enthusiasts who require custom scripting and faster order execution, offering a range of advanced platforms like MT4, MT5, cTrader, and TradingView. These platforms are ideal for following and replicating the strategies of successful traders, especially in fast-paced markets such as Forex, stocks, and cryptocurrencies. The broker's low latency and quick execution, with an average of 40ms, ensure that copy traders can execute trades almost instantly, mirroring their chosen strategies accurately. Furthermore, IC Markets' extensive asset offerings, including commodities and ETFs, coupled with social trading features, make it a prime choice for those interested in diversifying their copy trading activities.

RoboForex

RoboForex excels in copy trading through its CopyFX platform, tailored for traders who aim to replicate the trades of seasoned investors. With competitive spreads and high leverage, RoboForex is suitable for those looking to maximize their copy trading returns across a variety of markets, including Forex, indices, and cryptocurrencies. The broker's support for popular platforms like MT4 and MT5 further enhances its appeal, offering a seamless experience for traders looking to follow and execute the strategies of their chosen professionals, all within a robust and intuitive trading environment.

XTB

XTB offers a conducive environment for copy trading with its sophisticated research tools and a plethora of educational resources, suitable for traders looking to mirror the strategies of the experienced. The platform's regulatory compliance ensures a safe trading environment, encouraging copy traders to explore various financial markets, including Forex, stocks, and ETFs. XTB's social trading features allow traders to engage with a community of like-minded individuals, exchange ideas, and follow expert traders, making it an attractive option for those who value community engagement alongside robust trading capabilities.

Zulu Trade

ZuluTrade presents a unique proposition in this competitive landscape. While it's true that ZuluTrade, with its 2.4 million registered users, doesn't match the vast user base of eToro, the market leader in copy trading, this doesn't detract from its value proposition. In fact, ZuluTrade's openness in sharing all performance data and ensuring there are no hidden fees is a testament to its commitment to transparency, a critical aspect for any trader looking to replicate the success of others.

ZuluTrade's emphasis on innovation is evident in how its in-house team continuously works to analyze traders' needs, providing new features and optimizing the trading experience. This forward-thinking approach, coupled with a robust regulatory framework across the EU, SA, Mauritius, and Japan, ensures that ZuluTrade remains a trustworthy and secure platform for engaging in copy trading.

ZuluTrade's social features and customer-oriented service set it apart. The platform offers 24/5 customer service via chat, phone, or email, which is highly rated by its users. This, combined with the opportunity for traders to learn by copying and engage with ZuluTrade Leaders through social tools, fosters a community-centric environment that is conducive to growth and learning.

Comparatively, eToro also offers a social trading platform but with a broader user base. However, ZuluTrade's unique selling points, such as the detailed sharing of leader strategies, the ability to interact directly with leaders, and the comprehensive filters for selecting the right match, provide a more personalized and interactive trading experience. The innovative features like Backtest, Watchlist, Risk-score, and ZuluGuard offer traders additional tools to make informed decisions and control their trades effectively.

Copy Trading Platforms Explained

Inexpeienced traders can take advantage of the utilities provided by by copy trading platforms to make money when trading CFDs or other financial instrument like copy trading stocks, currencies, commodities, or cryptocurrencies. Mimicking the trading strategies of experienced traders is can be a method new traders to generating income when one is not familiar with trading Forex or trading tools.

A quick search will reveal plenty of copy trading platforms but certain aspects must be considered first before the platform can be called the best. successful traders can be recognized based on the amount of funds they manage, the level of risk they take, and the profitability along with their returns. With all aspects in consideration, finding the best copy trading platforms should be easy task.

Why Traders Use Copy Trading

Many traders use the popular feature copy trading when trading the financial markets. Copy trading allows traders to benefit from the expertise of proffesional traders and copy their trades.

This allows for greater chance of profitable investment strategies, instead of investments that fall into losses. The copy trading portfolio management software finds other investors and traders who have a good track record of profitability in their trades.

Traders are able to monitor the strategies of experts and implement the same trades facilitated by copy trading brokerage platforms. Copy trading is mainly beneficial to traders who have less time to follow market trends and are interested in short term trading.

Growth of Copy Trading

The advent and subsequent growth of copy trading platforms stand out as a significant evolution in this journey. Reflecting on the data, it's clear that the social trading platform market has burgeoned from a valuation of $311.5 million in 2021 to an anticipated $12.9 billion by 2028, marking a staggering compound annual growth rate (CAGR) of 64.7%. This explosive growth can be attributed to the rise of pioneering platforms like eToro, Zulutrade, and Collective2. These platforms have revolutionized trading by enabling the sharing of trade insights and strategies among traders and, more importantly, allowing investors to directly replicate the trades of their more experienced counterparts in real-time across various asset classes, including equities, foreign exchange, and cryptocurrencies. The appeal of these platforms is undeniable, with the trading community swelling to over 46.9 million online retail traders and still growing. eToro alone boasted over 33 million active users in the same year, many small-scale retail investors who can start trading with as little as $100 - $600.

Regulation plays a crucial role in the integrity and trustworthiness of these platforms. In the UK, for example, the Financial Conduct Authority (FCA) requires that traders on social platforms adhere to the MiFID II regulations to qualify as investment managers, ensuring transparency and protection for investors. From a market segmentation perspective, copy trading has been the dominant force, generating significant revenue and is projected to continue its upward trajectory. These platforms' global geographical spread covers major financial markets in Europe, Asia-Pacific, and North America.

Copy Trading Advantages Vs Disadvantages Compared

| Aspect | Advantages | Disadvantages |

|---|---|---|

| Learning & Strategy Development | Opportunity to observe and learn from experienced traders' strategies in real-time. | Over-reliance on others can hinder the development of personal trading strategies. |

| Time Investment | Efficient for those with limited time; allows participation in trading without constant market monitoring. | Potential disengagement from market dynamics and personal trading skill atrophy. |

| Risk Management | Access to diversified strategies and risk approaches from various traders. | Risk exposure linked to the copied trader's decisions, which may not always align with personal risk tolerance. |

| Profit Potential | Ability to earn profits based on the success of skilled traders. | Profits are often shared or subject to fees, reducing net gains. |

| Market Access | Exposure to a broader range of markets and assets through the experience of the copied trader. | Potential to be exposed to unfamiliar markets or assets, increasing complexity and risk. |

| Control & Flexibility | Can be a hands-off approach while retaining the ability to intervene and make adjustments. | Limited control over individual trades, reliance on the copied trader's actions. |

Copy Trading Advantages

As an adept copy trader, I've witnessed the ascendancy of copy trading, a strategy where you replicate the trading activities of seasoned traders. This approach has garnered popularity as investors increasingly opt for 'People-Based' portfolios, prioritizing the expertise of other traders over direct market engagement.

Let's delve into the key factors that have propelled copy trading to the forefront of investment strategies:

Efficiency in Time Management

Copy trading is a boon for those pressed for time, streamlining the trading process by eliminating the need for continuous market monitoring and decision-making. This convenience is particularly valued by traders who cannot dedicate extensive hours to market analysis.

Copy Trading Educational Opportunity

Novices in trading find copy trading an invaluable learning tool, offering insights into the tactical decisions of veteran traders. It fosters an environment of learning by observation, enabling newcomers to understand the rationale behind specific trades and to engage in informed discussions.

Copy Trading Global Market Access

The inherent limitations of individual expertise can restrict a trader's proficiency to a few markets. Copy trading software dismantles these barriers, offering a passport to international financial markets and broadening the trader's knowledge and experience on a global scale.

Risk Mitigation through Copy Trading Diversification

Diversification is a fundamental risk management tool, and copy trading facilitates this by allowing investors to mirror the trades of multiple seasoned traders. This strategy not only diversifies the portfolio but also paves the way for consistent returns, making it a staple recommendation among experienced traders in today's complex financial landscape.

Challenges in Copy Trading (Disadvantages)

The volatility of the market stands as the chief hurdle in copy trading, given the unpredictability of price shifts. Nonetheless, employing a strategic asset allocation approach can mitigate potential losses.

By adopting asset allocation, investments are spread across multiple strategies, enhancing diversification.

Copy Trading Exposure to Systematic Risks

Emerging market currencies often bear the brunt of systematic risks.

This can lead to funds becoming inaccessible, preventing traders from closing positions in a timely manner.

Liquidity Concerns in Copy Trading

In the realm of copy trading, liquidity presents a significant challenge.

Traders may find themselves unable to exit positions at desired points due to the copy trading algorithm's adherence to the original trader's strategies. The system replicates the expert trader's historical behavior, including their maximum drawdowns, limiting flexibility.

Best Way to Begin Copy Trading

Copy trading is one of the best ways to begin your career in the financial market. It helps in reducing risks and magnifying profits.

The first thing to do if you are new to trading is to open multiple demo accounts with multiple regulated copy trading brokers. This will allow you to experience the varying broker platforms. With a demo account you trade with virtual money and lose nothing while learning and gaining experience of the market.

Once you are confident to trade with real money, as your broker to open a live account.

Copy trading benefits who are new to financial markets or want to minimize losses by mimicking someone elses trade.

The knowledge and experience of expert traders are utilized to increase the probability of making a profit.

Most modern brokerages offer copy trading to clients through specific investment tools on their trading platforms. Copy trading tools are transparent and open. Historical trading records of experts can be analysed and usually low risk investment strategies are followed with copy trades.

Copy Trading Components

Successful copy trading depends on the components gathered. complex instruments related to the social trading platform must be considered first before diving into copy trading. not to mention important factors which should be considered as well. Below are the two more important aspects of copy trading.

Copy Trade Software

Copy trade software is one of the key components necessary to start trading Forex when it comes to replication. Trading software must be up-to-date on own computers or there will be repercussions related to lose. Having top-notch trading software is the first of many priorities. A key feature of trading software is automated copy trading which is a prominent innovative feature of social trading software. Active traders do not need to be around 24/7 when the automated copy trading feature is active and performs all the tasks themselves. It can give trading signals, making it a vital part of Forex trading.

Online Trading Platforms

But trading signals are not enough, one needs to make an account with the best copy trading platforms they can find for Forex trading and more. Choose an online trading platform based on its innovative features, customer support services, useability, and profitability.

How to Select a Copy Trading Broker

Selecting the right copy trading broker is a critical decision that can significantly impact your trading success and experience. Here are key factors to consider when choosing a copy trading broker:

Regulation and Reputation: Ensure the broker is regulated by reputable financial authorities. This ensures transparency, reliability, and security of your investments. Check reviews and forums for user experiences and complaints.

Trader Selection and Performance: Look for platforms with a wide range of traders to follow, offering detailed performance history and risk metrics. This diversity allows for better risk management and alignment with your investment goals.

Fees and Costs: Understand all associated costs, including any commission on trades, subscription fees for using the platform, and spreads. Lower fees can significantly affect long-term returns.

Platform Usability and Features: The platform should be user-friendly, with intuitive navigation and tools for analyzing trader performance. Features such as risk management tools, customizable copy trading settings, and real-time monitoring are valuable.

Customer Support: Strong customer service is crucial, especially for beginners. Look for platforms offering comprehensive support through multiple channels (e.g., live chat, email, phone).

Financial Instruments and Markets: Ensure the broker offers a wide range of instruments (stocks, forex, commodities, cryptocurrencies) and markets that you're interested in trading.

Risk Management Tools: The ability to set stop-loss orders, choose the percentage of your funds to allocate to copy trading, and other risk management features are essential to protect your investment.

Social Trading Community: A vibrant community can provide additional insights, strategies, and support. Evaluate the quality of the community interaction and the availability of educational resources.

Demo Account: A demo or trial account allows you to test the platform and its features without risking real money. This is an excellent way to get a feel for copy trading and the broker's offering.

Withdrawal and Deposit Options: Check for convenient, fast, and affordable deposit and withdrawal options. Also, consider the minimum deposit requirements and how they align with your investment budget.

By carefully evaluating these factors, you can choose a copy trading broker that best fits your needs, investment goals, and risk tolerance, setting the stage for a potentially rewarding trading experience.

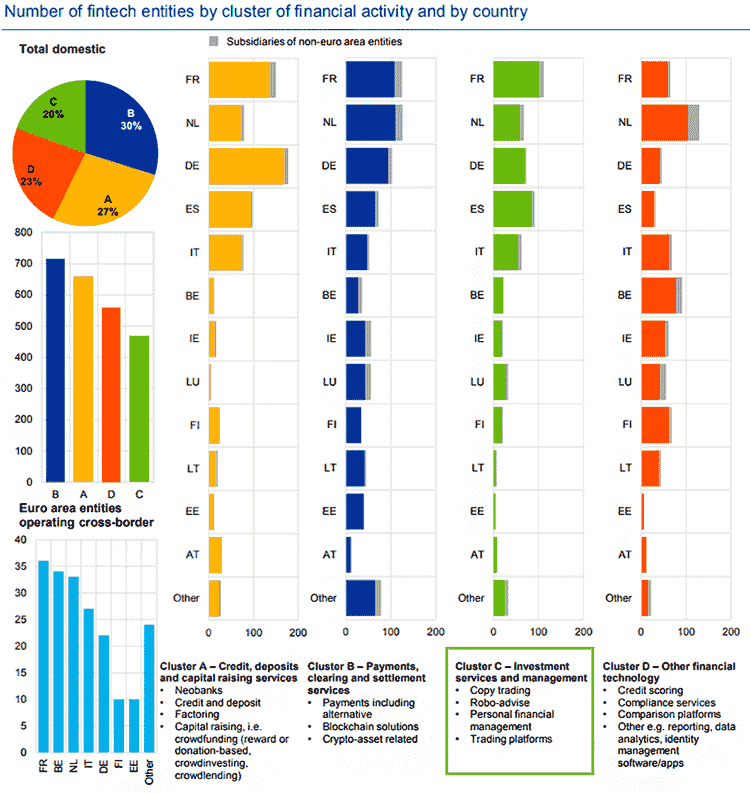

Copy Trading And Other Fintech Statistics

In 2020 data showed that over 190 million Euro of total traded assets were traded with the use of copy trading, according to data from the Publications Office of the European Union [Source].

A report from Bitget revealed that 44% of copy traders belong to Gen Z, indicating a strong interest from this demographic. The same report also highlighted an impressive success rate for futures contracts copy traded through their platform, with over 90% profitability in the first half of 2023.

Furthermore, data from ZuluTrade, a popular copy trading platform, shows that their users enjoy an average winning ratio of up to 80%, underscoring the potential effectiveness of copy trading strategies. This performance metric aligns with the broader trends observed in the industry, such as the significant revenue and user growth reported by platforms like NAGA and eToro. For instance, NAGA reported a revenue of €55.3 million in 2021, with an additional €18 million in the first quarter of 2022 alone. Similarly, eToro experienced a remarkable 85% year-over-year revenue increase in the last quarter of 2021, with a net trading income surge of 50%.

Despite these positive indicators, some experts suggest that the popularity of copy trading might be experiencing a slight decline. However, the industry's projected growth, with a market size expected to reach $3.77 billion by 2028, suggests that copy trading continues to be a significant and evolving component of the retail trading landscape. The technological advancements and the integration of automation, which now supports over 80% of the stock market, further emphasize the dynamic nature of this sector.

Trading Histories of Available Traders

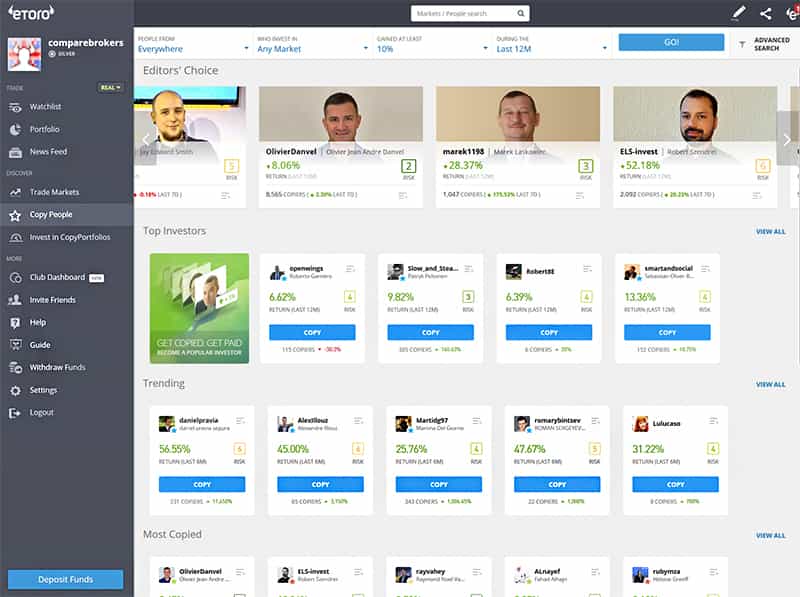

Verify the account and find traders by clicking on the 'Copy People' tab. Some traders will be featured here while you can find others from the search option.

The screen shot from copy trading broker eToro below shows you how copy trading brokers allow you to view summary profiles of expert traders based on attributes such as Editors Choice, Top Investors, Trending, Most Copied, Lower risk score and Medium risk score.

You can filter traders by country, what type of market they invest in currencies, indices, stocks, ETFs, Crypto for example. Most copy trading platforms also allow you to filter to show traders by percentage of gains over a set period.

Copy trading trader profiles can be further refined with the advanced search filter. Filter traders by time period, profile, social, performance, risk, portfolio and activity. We list these features below :

- Time period

- Status

- Country

- Name & Picture

- Copiers

- Copiers Change

- Copy AUM

- Profitable Months

- Profitable Trades

- Risk Score

- Daily Drawdown

- Weekly Drawdown

- Allocation

- Average Trade Size

- Active Weeks

- Trades

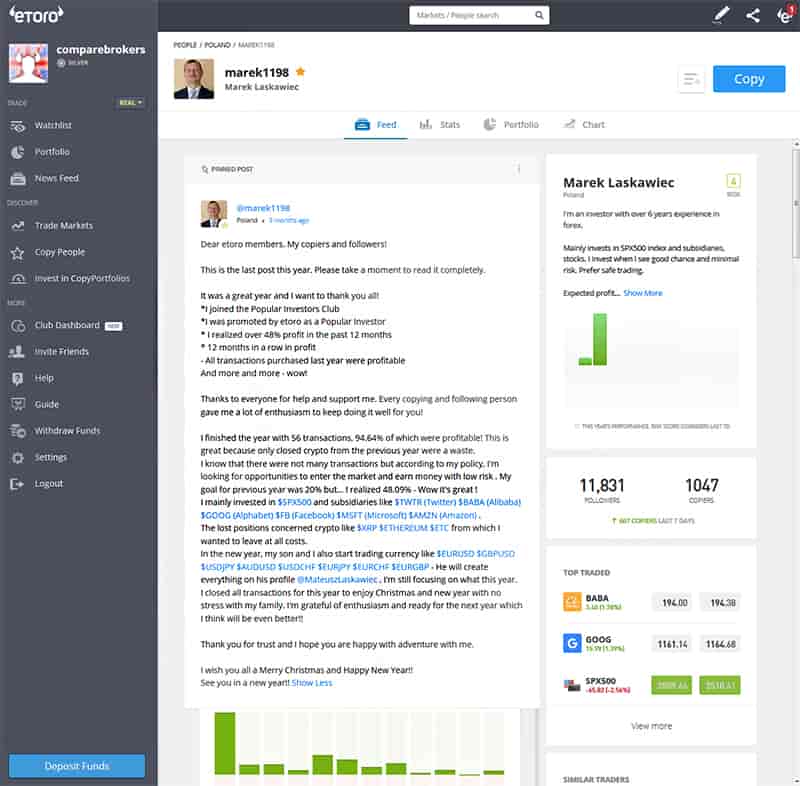

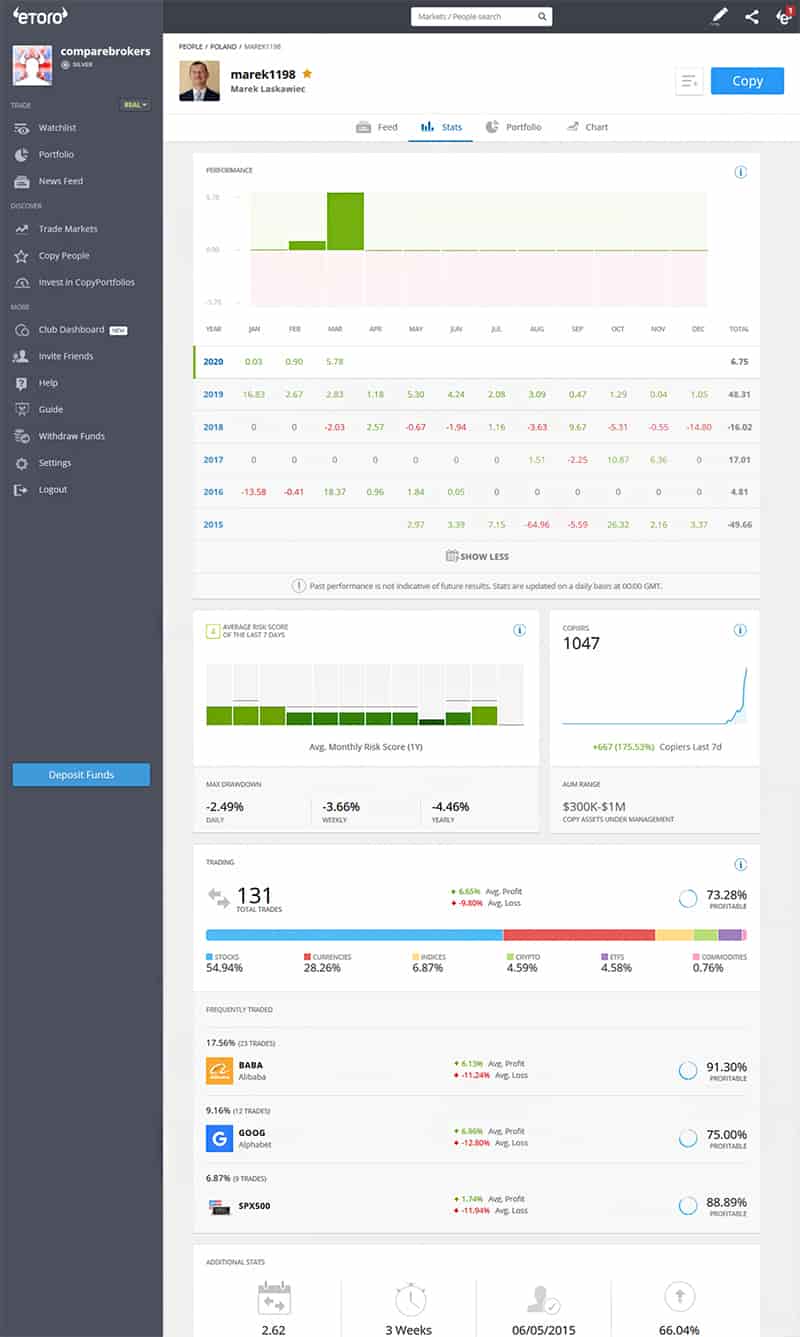

Once you click through to a trader profile you will be able to see that trader's historical performance and statistics in more detail.

Copy trading platforms allow you to check how many followers and copiers each trader has. You can view the top traded assets of that trader with live feed price data.

You can read updates and send messages and exchange notes as part of a community with copy trading platforms.

You can see the number of total trades and the percentage of trades that were profitable. The trading is broken down into percentage of stocks, currencies, indices, crypto, ETFs, Commodities.

Additional stats include number of trades per week, average holding time, date trader has been active since, and number of profitable weeks.

After you find traders that match your investment strategy you will need to fund your account to begin trading. Your account will thereafter automatically copy trades of your chosen trader.

It is important to note here that not all the traders earn money by copy trading. Copy trading is not risk free as with any investment.

ZuluTrade also offers copy trader current and historical trading data.

Copy Trading Research

Copy trading is not perfect and you should be aware of the risks before trading. A study published on the Harvard.edu website reveals people are risk-averse during gains and risk-seeking during losses.

This is called the reflection effect and proves that traders are more sensitive to losses compared to gains. The journal has compiled the research into a thesis called 'Prospect Theory' [Source].

Another study by Barcelona GSE Graduate School of Economics suggests copy trading provides an institutionalized framework for imitation, which may cause traders to undertake increased risk when copying trader then they would if they had traded on their own.

Traders should be aware high returns can sometimes result in high losses [Source].

Copy trading is a great addition to a traders investment strategy, but make sure you pick a well regulated copy trading broker and trading platform.

Copy Trading Risks

The allure of copy trading is understandable; platforms like ZuluTrade report enticing success rates, such as 79% of traders turning a profit by mimicking others' strategies from June to August 2023. This figure starkly contrasts with the grim reality that most traditional brokerage clients lose money, with reported losses in trading Contracts for Difference (CFDs) at 78% and 81.18%. Brokers often tout copy trading as a haven, particularly for newcomers to the trading world. Yet, this perception belies the inherent risks involved. The seduction of absolutes, the quest for the 'best' trade or the 'optimal' position management often ensnares novice traders. As noted by industry expert Battista, the initial wins and losses are a stark introduction to the market's inherent unpredictability and imperfections. This realization shows traders that blindly following others might not align with their unique risk profiles, financial constraints, or market outlooks. Gradually, they discern that the essence of trading lies not in the specific trades but in the underlying concepts and strategies, prompting a more discerning approach to copy trading.

However, beyond these individual learning curves lies a broader market risk associated with copy trading: the potential for market liquidity constraints. As Harry Turner, the founder of The Sovereign Investor, points out, copy trading can inadvertently lead to a significant number of trades leaning in the same direction. This mass movement can disrupt market equilibrium, resulting in price gaps and slippage that adversely affect all investors, not just those participating in copy trading. This phenomenon underscores the complex, interconnected nature of financial markets, where actions, even those seemingly benign or beneficial on a small scale, can ripple through the market with unforeseen consequences.

Copy Trading Regulation

I've seen firsthand how regulatory perspectives on innovative practices such as copy trading have evolved. Traditionally, regulators have treated copy trading akin to conventional trading activities, a standpoint significantly influencing operational frameworks within this domain.

The Financial Conduct Authority (FCA), a leading regulatory body, previously articulated that copy trading falls under the umbrella of portfolio or investment management, especially when the account holder's involvement is passive. This classification subjects copy trading to rigorous regulatory requirements akin to those authorised investment managers face. Such regulatory scrutiny ensures that the interests of retail traders are safeguarded, maintaining transparency and accountability within the industry.

The potential regulatory reclassification of copy trading strategy providers as unregulated investment entities by major regulators like the FCA, the Cyprus Securities and Exchange Commission (CySEC), or the Australian Securities and Investments Commission (ASIC) could pose significant challenges. A shift in regulatory stance could disrupt the industry's operational dynamics, potentially stymieing the growth of this innovative trading mechanism.

The economic viability of most copy trading services hinges on this classification, given the potential financial and operational burdens imposed by stringent investment management regulations.

Despite the inherent risks and fluctuating market conditions, copy trading continues captivating the retail trading community. Its sustained popularity and the remarkable performance of various platforms in recent years are testaments to the robustness and appeal of this trading approach. Moreover, the continuous influx of newcomers into the trading arena bodes well for the future expansion of this niche sector. As we move forward, the ability of copy trading platforms and strategy providers to navigate the regulatory landscape will be instrumental in shaping the trajectory of this innovative trading paradigm.

Traders Are Incentivised To Gain Followers By Copy Trading Platforms

The evolution of social trading platforms and the significant role signal providers play within them. These individuals, who share their trading strategies for others to follow, are often rewarded by platforms in a manner that reflects their performance and ability to attract a dedicated following. For instance, on platforms like eToro, the compensation model is quite innovative. Top-tier signal providers, classified as elite and elite pro, can earn commissions amounting to 1.5% annually on the total value of copy-traded assets based on their recommendations, provided the cumulative investment mimics their trades with at least $500,000. This compensation scheme, however, has not been without its critics. Some argue it may encourage signal providers to engage in high-risk trades to increase their visibility and follower count. Matthias Horn, a respected finance academic, posits that the allure of higher earnings can tempt signal providers into adopting a high-risk, high-reward strategy. While potentially lucrative, this approach can also lead to significant losses. However, the transient nature of digital identities allows for a quick recovery by simply starting anew under a different account.

Despite such concerns, eToro maintains that its system is designed with safeguards to mitigate undue risk-taking. According to Moczulski, a spokesperson for the platform, traders known as Popular Investors (PIs) are not just playing with others' money—they have skin in the game, investing their funds alongside their followers. Moreover, eToro's most followed PIs typically exhibit low-risk scores, a testament to the platform's stringent risk management protocols, including limitations on leverage and automated risk controls. Furthermore, eToro has instituted a policy requiring its most influential traders to obtain recognized chartered qualifications, underscoring the platform's commitment to professionalism and accountability. However, this rigorous standard is only sometimes adopted across all trading platforms. For example, ZuluTrade, based in Greece, allows traders to operate anonymously without mandating any formal qualifications or transparency regarding their real identities or credentials.

It's important to acknowledge that the journey of a signal provider can fluctuate dramatically, marked by periods of success and setbacks. A notable case is Jeppe Kirk Bonde, a former management consultant turned trading phenom, who boasts the largest following on eToro. With over 23,600 individuals replicating his trades and a broader audience of 262,800 followers, Bonde has demonstrated the potential for significant influence and financial success within this ecosystem. His portfolio, predominantly composed of public equities, including stakes in major corporations like NVIDIA, Apple, Tesla and Microsoft, showcases a strategy that, while predominantly mainstream, has garnered widespread adoption and emulation among eToro users.

Copy Trading VS Mirror Trading

We have summarized some Copy Trading and Mirror Trading differences in the table below so you can compare the two side by side.

Copy Trading |

Mirror Trading |

|

| Aimed at | Small scale individual investors often beginners | Large scale organisations |

| Assets Traded | Most asset classes are available on Copy Trading platforms including Stocks, ETFs, Currency Pairs, Indices and Commodities. | Stock and Forex Markets although more common in Forex markets. |

| Trading Volume | 100 shares or other assets on average per trade | 10000 blocks of shares or other assets per trade |

| Capital needed | Small - depending on the broker and your country currencies, commodities and indices can be traded with a minimum order size of $1000, ETFs, crypto and Stocks $10. [Source] | Very Large - Hundreds of thousands if not millions of dollars depending on the asset. |

| Average number of traders copied | 2+ | 100+ |

| Account monitoring | Easier due to fewer copied traders | It can be difficult to keep up with activity on a Mirror Trading account due to the volume of copied trades and amount of money going in and out of the account. |

| Trader Research | Easier - Copy trading platforms summarize copied traders portfolios, portfolios and trading histories. You can read updates and communicate with other traders. Its very easy on a Copy Trading platform to find traders with a high ROI. | The Mirror trader offers historical trade information but the platform offers no social interaction with other traders or strategy providers. |

| Best for | Beginners, Time constrained traders, Expert traders | Technically knowledgeable investors, Global Macro Investors, Expert traders with many years of experience. |

Copy Trading Verdict

Copy trading presents an attractive proposition for novice and time-constrained investors, offering a unique blend of accessibility, education, and potential for diversification. By leveraging the expertise of seasoned traders, individuals can navigate the complexities of financial markets with a guided approach. This strategy democratizes investing, breaking down traditional barriers to entry and fostering a community-oriented environment where knowledge and strategies are shared.

The success of one's investment relies heavily on the chosen trader's performance, which can fluctuate. Moreover, the risks of trading are not eliminated in anyway but shared, making it essential for users to conduct thorough research, set realistic expectations, and employ sound risk management practices.

While copy trading offers a compelling avenue for investment, it is not without its challenges and risks. As with any investment strategy, potential investors should carefully consider their financial goals, risk tolerance, and the reputation and regulatory compliance of the copy trading platform before committing funds.

We have conducted extensive research and analysis on over multiple data points on Copy Trading to present you with a comprehensive guide that can help you find the most suitable Copy Trading. Below we shortlist what we think are the best Copy Trading Brokers after careful consideration and evaluation. We hope this list will assist you in making an informed decision when researching Copy Trading.

Reputable Copy Trading Brokers Checklist

Selecting a reliable and reputable online Copy Trading Brokers trading brokerage involves assessing their track record, regulatory status, customer support, processing times, international presence, and language capabilities. Considering these factors, you can make an informed decision and trade Copy Trading Brokers more confidently.

Selecting the right online Copy Trading Brokers trading brokerage requires careful consideration of several critical factors. Here are some essential points to keep in mind:

- Ensure your chosen Copy Trading Brokers broker has a solid track record of at least two years in the industry.

- Verify that the Copy Trading Brokers broker has a customer support team of at least 15 members responsive to queries and concerns.

- Check if the Copy Trading Brokers broker operates under the regulatory framework of a jurisdiction that can hold it accountable for any misconduct or resolve disputes fairly and impartially.

- Ensure that the Copy Trading Brokers broker can process deposits and withdrawals within two to three days, which is crucial when you need to access your funds quickly.

- Look for Copy Trading Brokers brokers with an international presence in multiple countries, offering its clients local seminars and training programs.

- Ensure the Copy Trading Brokers broker can hire staff from diverse locations worldwide who can communicate fluently in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Compare Key Features of Copy Trading Brokers in Our Brokerage Comparison Table

When choosing a broker for Copy Trading Brokers trading, it's essential to compare the different options available to you. Our Copy Trading Brokers brokerage comparison table below allows you to compare several important features side by side, making it easier to make an informed choice.

- Minimum deposit requirement for opening an account with each Copy Trading Brokers broker.

- The funding methods available for Copy Trading Brokers with each broker.

- The types of instruments you can trade with each Copy Trading Brokers broker, such as forex, stocks, commodities, and indices.

- The trading platforms each Copy Trading Brokers broker provides, including their features, ease of use, and compatibility with your devices.

- The spread type (if applicable) for each Copy Trading Brokers broker affects the cost of trading.

- The level of customer support each Copy Trading Brokers broker offers, including their availability, responsiveness, and quality of service.

- Whether each Copy Trading Brokers broker offers Micro, Standard, VIP, or Islamic accounts to suit your trading style and preferences.

By comparing these essential features, you can choose a Copy Trading Brokers broker that best suits your needs and preferences for Copy Trading Brokers. Our Copy Trading Brokers broker comparison table simplifies the process, allowing you to make a more informed decision.

Top 15 Copy Trading Brokers of 2025 compared

Here are the top Copy Trading Brokers.

Compare Copy Trading Brokers brokers for min deposits, funding, used by, benefits, account types, platforms, and support levels. When searching for a Copy Trading Brokers broker, it's crucial to compare several factors to choose the right one for your Copy Trading Brokers needs. Our comparison tool allows you to compare the essential features side by side.

All brokers below are Copy Trading Brokers. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more Copy Trading Brokers that accept Copy Trading Brokers clients.

| Broker |

IC Markets

|

eToro

|

Pepperstone

|

AvaTrade

|

FP Markets

|

FXPrimus

|

forexmart

|

coinbase

|

binance

|

Ayondo

|

BlackBullmarkets

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rating | |||||||||||

| Regulation | Seychelles Financial Services Authority (FSA) (SD018) | FCA (Financial Conduct Authority) eToro (UK) Ltd (FCA reference 583263), eToro (Europe) Ltd CySEC (Cyprus Securities Exchange Commission), ASIC (Australian Securities and Investments Commission) eToro AUS Capital Limited ASIC license 491139, CySec (Cyprus Securities and Exchange Commission under the license 109/10), FSAS (Financial Services Authority Seychelles) eToro (Seychelles) Ltd license SD076 | Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217 | Australian Securities and Investments Commission (ASIC) Ava Capital Markets Australia Pty Ltd (406684), South African Financial Sector Conduct Authority (FSCA) Ava Capital Markets Pty Ltd (45984), Financial Services Agency (Japan FSA) Ava Trade Japan K.K. (1662), Financial Futures Association of Japan (FFAJ),, FFAJ, Abu Dhabi Global Markets (ADGM)(190018) Ava Trade Middle East Ltd (190018), Polish Financial Supervision Authority (KNF) AVA Trade EU Ltd, Central Bank of Ireland (C53877) AVA Trade EU Ltd, British Virgin Islands Financial Services Commission (BVI) BVI (SIBA/L/13/1049), Israel Securities Association (ISA) (514666577) ATrade Ltd, Financial Regulatory Services Authority (FRSA) | CySEC (Cyprus Securities and Exchange Commission) (371/18), ASIC AFS (Australian Securities and Investments Commission) (286354), FSP (Financial Sector Conduct Authority in South Africa) (50926), Financial Services Authority Seychelles (FSA) (130) | VFSC (Vanuatu Financial Services Commission) (14595), CySEC (Cyprus Securities and Exchange Commission) (261/14) | Instant Trading EU Ltd CySEC (Cyprus Securities and Exchange Commission) (266/15), Finateqs Corp (137723) Belize | FCA Financial Conduct Authority (1003842) Coinbase Institutional (UK) Limited, Listed As Having A Money Transmitters License in various states in the USA | AMF (Autorité des Marchés Financiers, France) (E2022-037), OAM (Organismo Agenti e Mediatori, Italy) (PSV5), FIU (Financial Intelligence Unit, Lithuania) (305595206), Bank of Spain (D661), Polish Tax Administration (RDWW – 465), SFSA (Swedish Financial Supervisory Authority) (66822), AFSA (Astana Financial Services Authority, Kazakhstan), FSR (Financial Services Regulatory Authority, Abu Dhabi), CBB (Central Bank of Bahrain), VARA (Dubai Virtual Asset Regulatory Authority), AUSTRAC (Australian Transaction Reports and Analysis Centre) (100576141-001), FIU-IND (Financial Intelligence Unit - India), Bappebti (Indonesia) (001/BAPPEBTI/CP-AK/11/2019), JFSA (Japan Financial Services Agency) (Kanto Local Finance Bureau 00031), FSP (New Zealand Financial Service Providers Register) (FSP1003864), SEC (Securities and Exchange Commission, Thailand), SAT (Tax Administration Service, Mexico), CNAD (Comisión Nacional De Activos Digitales, El Salvador) (PSDA/001-2003), FSCA (Financial Sector Conduct Authority, South Africa) | BaFin (Federal Financial Supervisory Authority ) (145765) | FSA (Financial Services Authority, Seychelles) (SD045) |

| Min Deposit | 200 | 50 | No minimum deposit | 100 | 100 | 15 | 15 | 10 | No minimum deposit | 100 | No minimum deposit |

| Funding |

|

|

|

|

|

|

|

|

|

|

|

| Used By | 200,000+ | 35,000,000+ | 400,000+ | 400,000+ | 200,000+ | 300,000+ | 10,000+ | 9,500,000+ | 200,000,000+ | 250,000+ | 10,000+ |

| Benefits |

|

|

|

|

|

|

|

|

|

|

|

| Accounts |

|

|

|

|

|

|

|

|

|

|

|

| Platforms | MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading Central | eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, Web | MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play) | WebTrader, MT4, MT5, cTrader, Mobile Apps, iOS (App Store), Android (Google Play) | Web Trading, MT4, Mobile Apps, iOS (App Store), Android (Google Play) | Platform APIs, Wallets, Payments, Node, Paymaster, Onchain Data, Staking, Product APIs, Advanced Trade, Exchange, Prime, Commerce, Apple App iOS, Android Google Play, Mobile Apps | Apple App iOS, Android Google Play, MacOS, Windows, Linux, Desktop | ActivTrader, Apple App iOS, Android Google Play, MT4, MT5, WebTrader | MT4 ,MT5, TradingView, Mobile Apps, iOS (App Store), Android (Google Play), cTrader, BlackBull CopyTrader, BlackBull Invest |

| Support |

|

|

|

|

|

|

|

|

|

|

|

| Learn More |

Sign

Up with icmarkets |

Sign

Up with etoro |

Sign

Up with pepperstone |

Sign

Up with avatrade |

Sign

Up with fpmarkets |

Sign

Up with fxprimus |

Sign

Up with forexmart |

Sign

Up with coinbase |

Sign

Up with binance |

Sign

Up with ayondo |

Sign

Up with blackbullmarkets |

| Risk Warning | Losses can exceed deposits | 61% of retail investor accounts lose money when trading CFDs with this provider. | 75-95 % of retail investor accounts lose money when trading CFDs | 71% of retail investor accounts lose money when trading CFDs with this provider | Losses can exceed deposits | Losses can exceed deposits | Your capital is at risk | Your capital is at risk | Your capital is at risk | Losses can exceed deposits | Your capital is at risk |

| Demo |

IC Markets Demo |

eToro Demo |

Pepperstone Demo |

AvaTrade Demo |

FP Markets Demo |

FXPrimus Demo |

ForexMart Demo |

Coinbase Demo |

Binance Demo |

Ayondo Demo |

BlackBull Markets Demo |

| Excluded Countries | US, IR, CA, NZ, JP | ZA, ID, IR, KP, BE, CA, JP, SY, TR, IL, BY, AL, MD, MK, RS, GN, CD, SD, SA, ZW, ET, GH, TZ, LY, UG, ZM, BW, RW, TN, SO, NA, TG, SL, LR, GM, DJ, CI, PK, BN, TW, WS, NP, SG, VI, TM, TJ, UZ, LK, TT, HT, MM, BT, MH, MV, MG, MK, KZ, GD, FJ, PT, BB, BM, BS, AG, AI, AW, AX, LB, SV, PY, HN, GT, PR, NI, VG, AN, CN, BZ, DZ, MY, KH, PH, VN, EG, MN, MO, UA, JO, KR, AO, BR, HR, GL, IS, IM, JM, FM, MC, NG, SI, | AF, AS, AQ, AM, AZ, BY, BE, BZ, BT, BA, BI, CM, CA, CF, TD, CG, CI, ER, GF, PF, GP, GU, GN, GW, GY, HT, VA, IR, IQ, JP, KZ, LB, LR, LY, ML, MQ, YT, MZ, MM, NZ, NI, KP, PS, PR, RE, KN, LC, VC, WS, SO, GS, KR, SS, SD, SR, SY, TJ, TN, TM, TC, US, VU, VG, EH, ES, YE, ZW, ET | BE, BR, KP, NZ, TR, US, CA, SG | US, JP, NZ | AF, CI, CU, IQ, IR, LY, MM, KR, SD, PR, US, AU, SY, DZ, JP, EC. | RU | RU | RU | US, CA | BE, CA, IR, JP, KP, US, BA, ET, IQ, UG, VU, YE, AF, LA, TR, SY, IL |

All Copy Trading Brokers in more detail

You can compare Copy Trading Brokers ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options, regulation and account types side by side.

We also have an indepth Top Copy Trading Brokers for 2025 article further below. You can see it now by clicking here

We have listed top Copy Trading Brokers below.

Copy Trading Brokers List

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading CentralCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Funding methods

Bank transfer Credit Card PaypalPlatforms

eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, WebCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account Pro Account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

WebTrader, MT4, MT5, cTrader, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Web Trading, MT4, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Platform APIs, Wallets, Payments, Node, Paymaster, Onchain Data, Staking, Product APIs, Advanced Trade, Exchange, Prime, Commerce, Apple App iOS, Android Google Play, Mobile AppsCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Apple App iOS, Android Google Play, MacOS, Windows, Linux, DesktopCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

ActivTrader, Apple App iOS, Android Google Play, MT4, MT5, WebTraderCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4 ,MT5, TradingView, Mobile Apps, iOS (App Store), Android (Google Play), cTrader, BlackBull CopyTrader, BlackBull InvestCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Learn more

Losses can exceed deposits

Losses can exceed deposits

Losses can exceed deposits