IC Markets offers Forex, CFDs, Spread Betting, Share dealing, Cryptocurrencies

IC Markets was established in 2007 and is used by over 200000+ traders.

Funding methods

- Bank transfer

- Credit Card

- Paypal

Platforms

MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading CentralSpread type

- fixed spreads

- variable spreads

Customer support

- Live chat

- Phone support

- Email support

Roboforex offers Forex, CFDs

Roboforex was established in 2009 and is used by over 730000+ traders.

Funding methods

- Bank transfer

- Credit Card

- Paypal

Platforms

MT4, MT5, R Mobile Trader, R StocksTrader, WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), WindowsSpread type

- fixed spreads

- variable spreads

Customer support

- Live chat

- Phone support

- Email support

eToro offers Social Trading, Stocks, Commodities, Indices, Forex (Currencies), CFDs, Cryptocurrency, Exchange Traded Funds (ETF), Index Based Funds

eToro was established in 2007 and is used by over 40000000+ traders.

Funding methods

- Bank transfer

- Credit Card

- Paypal

Platforms

eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, WebSpread type

- fixed spreads

- variable spreads

Customer support

- Live chat

- Phone support

- Email support

XTB offers Forex, CFDs, Cryptocurrency

XTB was established in 2002 and is used by over 2000000+ traders.

Funding methods

- Bank transfer

- Credit Card

- Paypal

Platforms

MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play)Spread type

- fixed spreads

- variable spreads

Customer support

- Live chat

- Phone support

- Email support

XM offers Forex Trading, Stocks CFDs, Commodities CFDs, Equity Indices CFDs, Precious Metals CFDs, Energies CFDs

XM was established in 2009 and is used by over 15000000+ traders.

Funding methods

- Bank transfer

- Credit Card

- Paypal

Platforms

MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile AppsSpread type

- fixed spreads

- variable spreads

Customer support

- Live chat

- Phone support

- Email support

Pepperstone offers Forex, CFDs, Social Trading

Pepperstone was established in 2010 and is used by over 830000+ traders.

Funding methods

- Bank transfer

- Credit Card

- Paypal

Platforms

MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play)Spread type

- fixed spreads

- variable spreads

Customer support

- Live chat

- Phone support

- Email support

AvaTrade offers Forex, Cryptocurrencies, Commodities, Indices, Stocks, Bonds, Vanilla Options, ETFs, CFDs, Spread Betting, Social Trading

AvaTrade was established in 2006 and is used by over 400000+ traders.

Funding methods

- Bank transfer

- Credit Card

- Paypal

Platforms

MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play)Spread type

- fixed spreads

- variable spreads

Customer support

- Live chat

- Phone support

- Email support

FP Markets offers Forex, CFDs, Bonds

FP Markets was established in 2005 and is used by over 200000+ traders.

Funding methods

- Bank transfer

- Credit Card

- Paypal

Platforms

MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play)Spread type

- fixed spreads

- variable spreads

Customer support

- Live chat

- Phone support

- Email support

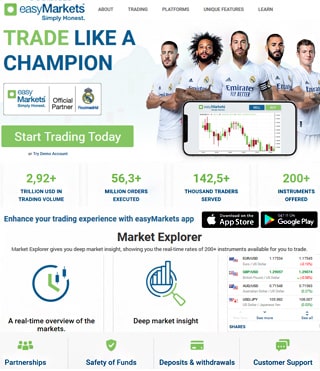

easyMarkets offers CFD, Forex, Commodities, Indices, Shares, Crypto

easyMarkets was established in 2001 and is used by over 250000+ traders.

Funding methods

- Bank transfer

- Credit Card

- Paypal

Platforms

easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5Spread type

- fixed spreads

- variable spreads

Customer support

- Live chat

- Phone support

- Email support

SpreadEx offers Forex, CFDs, and spread betting

SpreadEx was established in 1999 and is used by over 60000+ traders.

Funding methods

- Bank transfer

- Credit Card

- Paypal

Platforms

Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingViewSpread type

- fixed spreads

- variable spreads

Customer support

- Live chat

- Phone support

- Email support