Top Paypal Brokers for 2025

We found 11 online brokers that are appropriate for Trading Paypal.

Brokers That Accept PayPal Guide

Analysis by Andrew Blumer, Updated and fact-checked by Senad Karaahmetovic, Last updated – June 24, 2025

PayPal Brokers

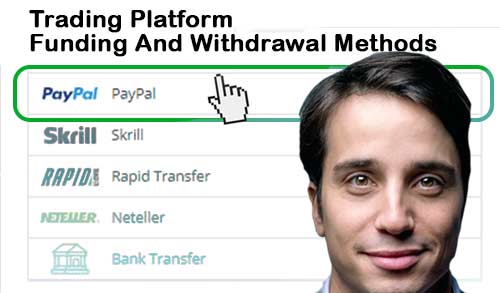

As a trader who values both speed and security when managing funds, I’ve found that PayPal worlds most popular payment methods for trading. Its integration into the trading world has made it increasingly popular, especially for those who prefer seamless online transactions without the need to disclose their card or banking information directly to brokers. In this guide on PayPal brokers, I’ll walk you through PayPal advantages and drawbacks for traders funding and withdrawals.

PayPal is one of the most recognisable and trusted online wallets globally. Known for its user-friendly interface and quick transaction capabilities, it allows traders to deposit and withdraw funds with ease. For example, you might fund a live USD trading account and by selecting “Deposit,” PayPal funding with PayPal will be an option, once confirming the payment typically credited within minutes after a nominal funding fee of around 2.5%.

When withdrawing, you simply choose “Withdraw,” request the amount you want to withdraw and the currency. Transactions are usually within 10 minutes but can take 1-2 business days, subject to a withdrawal fee of about 1.5%. PayPal also supports multicurrency balances, so even if your broker account is denominated in EUR or GBP, PayPal will automatically convert currencies at the current exchange rate plus a conversion fee (usually 3-4%). More importantly, PayPal adheres to strict compliance and anti-fraud measures, making it a secure choice for funding trading accounts. Whether you are trading Forex, stocks, or cryptocurrencies, many brokers now support PayPal as a primary payment method, further increasing its accessibility in global markets.

Why Traders Use PayPal

It is known that PayPal is the most prominent digital wallet globally and has about 431 million users. An estimated 27.5 billion in transactions went through PayPal accounts in 2022.

PayPal was launched in 1988. It was then named Confinity. In 2001, the company merged with the x.com of Elon Musk and was rechristened as the current name. In 2002, PayPal went public, and since then, it has progressed substantially with web-based and mobile-based technology to make transferring funds easier.

In 2007, PayPal moved from the United Kingdom to Luxembourg and is now licensed and registered here.

Although the PayPal payment platform was not initially developed specifically for trading, since its use as a trading platform funding and withdrawal method has grown, the involvement of traders wishing to trade has also grown. The growth of PayPal ultimately resulted in an increasing number of brokerages allowing PayPal.

Brokers That Accept PayPal

Some of the leading brokers that accept PayPal for both deposits and withdrawals include IC Markets, eToro, Pepperstone, FP Markets, and AvaTrade. These platforms not only offer seamless PayPal integration but are also regulated and reputable, providing traders with added peace of mind.

When selecting a PayPal broker, it"s essential to prioritize those that offer a diverse range of tradable instruments such as stocks, Forex, commodities, indices, cryptocurrencies, ETFs, and bonds. Regardless of the payment method, make sure the broker provides robust risk management tools, responsive customer support, and a comprehensive trading platform. After all, you"re operating in the live financial markets, where security and efficiency are critical.

Best PayPal Brokers Compared

IC Markets PayPal

As a trader with a fair share of market cycles under my belt, I understand the significance of aligning with a broker that not only meets our sophisticated trading needs but also supports convenient payment methods like PayPal. Lets dissect IC Markets Global, a platform that has been on my radar for its commendable efforts to cater to seasoned traders like us.

First off, IC Markets Global does not play around when it comes to spreads; they are razor-thin, often starting from 0.0 pips on their Raw Spread account, which is a game-changer for strategies dependent on tight spreads, such as scalping or high-frequency trading. They have achieved this by heavily investing in top-tier technology and forging robust relationships with premier liquidity providers, ensuring that we get the best possible price execution, regardless of market conditions.

Their operational backbone is impressive, with trade servers housed in the NY4 and LD5 data centers in New York and London, respectively. This setup, coupled with dedicated fiber optic connections to their pricing providers, minimizes latency, giving us the edge in trade execution speed.

The partnership with leading trading technology firms has brought forth an arsenal of advanced trading tools at our disposal, including Depth of Market (DoM), ladder trading, and sophisticated order templates, all designed to enhance our trading efficiency and precision.

Flexibility is another cornerstone of their offering, with support for scalping, hedging, and automated trading. Leverage options are generous, up to 1:1000, and the platform supports trades ranging from micro lots to substantial positions of up to 200 lots, facilitated by their advanced price sorting and ranking technology.

For those of us keen on keeping trading costs in check, their Raw Spread account is a standout, boasting an average EUR/USD spread of just 0.1 pips and a modest commission structure. The liquidity pool is vast, sourced from up to 25 institutional-grade providers, ensuring competitive pricing and deep liquidity around the clock.

Customer service is another area where IC Markets Global shines. With a team deeply entrenched in the forex industry, they seem to grasp the nuances of what traders like us need and expect, offering round-the-clock support to troubleshoot or assist with our queries.

For a seasoned trader eyeing a broker that supports PayPal, IC Markets Global seems to tick most boxes with its superior technology infrastructure, competitive pricing, flexible trading conditions, and robust customer support. It is worth a deeper dive to see how it aligns with your specific trading style and requirements.

IC Markets is a favorite among experienced traders who value tight spreads and fast execution. They provide access to a wide range of assets, including Forex, commodities, indices, and cryptocurrencies. Ideal for scalpers and day traders who rely on quick order execution but want the convenience of PayPal.

eToro PayPal

eToro is a unique platform that combines social trading with traditional brokerage services. It is great for traders who want to follow and copy the trades of successful investors (CopyTrading). eToro has over 30 million users, which is far more than most brokers offering PayPal funding and withdrawals. Perfect for traders who appreciate a user-friendly interface and community-driven trading insights. Regulated by CySEC and the FCA (UK), ensuring a high level of safety for PayPal traders.

Pepperstone PayPal

If you are on the hunt for a broker that is PayPal friendly, I have got to tell you about Pepperstone. Pepperstone account setup is quick and straight forward, especially for spread betting accounts. It is a huge plus for UK traders and Ireland since spread betting accounts come with tax-free profits, thanks to the capital gains tax exemption. Just a heads-up, though, tax rules can always shift, so it is something to keep an eye on.

But Pepperstone is not just about spread betting. They have got a massive lineup of over 1200 financial instruments – think Forex, Indices, Commodities, Share CFDs, even cryptocurrencies, and ETFs. It is pretty much a one-stop-shop for diversifying your portfolio, which, as you know, is key to managing risk and snagging opportunities across different markets.

For the tech-savvy more experienced trader, Pepperstone offers extensive trading tools allowing you craft your own Expert Advisors for automated trading. Platform-wise with Pepperstone you have got your pick of the litter with MT4, MT5, cTrader, and TradingView – all industry leaders.

Now, about cutting costs with your PayPal broker Pepperstones Razor Account is something else, offering raw spreads starting from 0 pip on FX Majors. And if you are not into that, their standard account runs with tight spreads and no commission, which is great for keeping more of those potential profits.

Regulation is tight with Pepperstone, regulated by a whole bunch of the big names like the FCA and ASIC, which means our investments have that extra layer of security. So, with all that said, I really think Pepperstone could be a solid pick, especially if PayPal convenience when trading is what you are looking for.

AvaTrade PayPal

AvaTrade stands out as a particularly compelling option for traders seeking a reliable broker that offers PayPal funding and withdrawal options.

AvaTrades appeal lies in its comprehensive suite of services tailored to meet the diverse needs of traders, whether they are just starting out or have years of trading experience. For novices, the platform offers intuitive trading apps designed specifically for AvaTrade users, as well as access to traditional platforms like MT4 and MT5, which are favored by seasoned traders for their advanced features and flexibility.

The AvaTradeGo app is a noteworthy highlight, offering an exceptional user experience as evidenced by its high ratings on both Google Play and the App Store. This makes trading accessible and convenient, even when on the move. For those who prefer not to download software, WebTrader provides a seamless web-based trading experience. Additionally, AvaTrades AvaSocial platform caters to the growing interest in social trading, allowing users to follow and replicate the strategies of experienced traders, fostering a collaborative trading environment.

AvaTrade has a extensive product offering, including CFDs on Forex, Stocks, Commodities, Cryptocurrencies, Indices, and Options, coupled with advanced tools and personalized support, make it a robust platform. The security measures in place, including tight spreads, no commissions, leverage up to 30:1, and instant execution, further enhance its appeal. The breadth of instruments available, with around 1000 options covering all major markets, provides traders with ample opportunities to diversify their portfolios.

The flexibility to trade across various devices, including desktop, tablet, mobile, and web, ensures that traders can operate in the manner most convenient for them, anytime and anywhere. AvaTrades support for automated trading platforms and compatibility with Expert Advisors (EAs) is particularly beneficial for those looking to automate their trading strategies, offering both efficiency and precision.

What truly distinguishes AvaTrade, however, is its commitment to trader education and support. The ongoing education provided through free videos, articles, e-books, and daily market analysis is an invaluable resource for traders looking to enhance their knowledge and skills. The webinars conducted in multiple languages are inclusive and cater to traders at all levels, demonstrating AvaTrade"s commitment to fostering an informed and engaged trading community.

AvaTrade"s comprehensive offerings, from its diverse trading platforms and extensive product range to its strong regulatory framework and commitment to education and support, make it an excellent choice for traders seeking a reliable broker with PayPal funding and withdrawal options. Its global reach, with trading websites in more than 20 languages and a robust base of 400,000 registered traders, attests to its reliability and the trust it has built within the trading community. For those reasons, I find AvaTrade to be a top-tier broker for traders of all levels.

FP Markets PayPal

For those of us looking for the convenience of PayPal funding and withdrawal options, FP Markets emerges as a compelling choice for several reasons.

Firstly, FP Markets commitment to performance-driven technology cannot be overstated. Their platforms, including the widely respected MetaTrader 4 and MetaTrader 5, along with TradingView, IRESS, cTrader, and user-friendly mobile apps, are equipped with advanced features that cater to both new and seasoned traders. This technological edge is crucial for executing trades efficiently, particularly in fast-moving markets.

The ultra-low spreads offered by FP Markets are a significant advantage, particularly for those of us who trade frequently and are sensitive to cost efficiencies. Trading on spreads from as low as 0.0 pips and benefiting from fast execution from an NY4 server facility means that traders can operate with minimal transaction costs, enhancing profitability over time.

Diversity in trading options is another factor where FP Markets excels. With access to forex currency pairs, more than 10,000 global stocks, indices, a broad range of commodities including coffee, natural gas, and corn, as well as bonds and an impressive selection of metals and digital currencies, traders have a rich palette of trading instruments at their fingertips. This diversity allows for a wide range of strategies, from traditional forex trading to exploring opportunities in commodities, bonds, and the burgeoning field of digital currencies.

Moreover, the educational resources provided by FP Markets are invaluable, particularly for traders who are keen to continuously improve their skills and stay ahead in the game. Access to top-tier liquidity and market-leading pricing 24/5, coupled with the ability to trade on the go with mobile apps, ensures that traders can seize opportunities whenever and wherever they arise.

The superior Virtual Private Server (VPS) solutions offered, which support Expert Advisors (EAs), scalping, and auto-trading, are a testament to FP Markets understanding of traders needs for reliable and uninterrupted trading environments. The option to engage in copy trading by following top-performing traders opens up avenues for learning and strategy development, which is especially beneficial for those looking to enhance their trading approach.

What truly sets FP Markets apart, however, is its reputation and reliability. Being a multi-regulated brand with segregated client funds, and having received over 40 international awards, speaks volumes about its credibility in the forex brokerage industry. The 24/7 multilingual customer support and personal account managers provide a level of service and assurance that is indispensable in today"s trading environment.

FP Markets combination of cutting-edge technology, diverse trading instruments, ultra-low spreads, and a strong regulatory framework makes it an excellent choice for traders seeking a broker that offers PayPal funding and withdrawal options. Its comprehensive offering caters to a wide spectrum of trading styles and strategies, making it a top contender for traders who demand excellence and reliability from their brokerage platform.

As seasoned traders well into our careers, we understand that our trading needs are distinct and multifaceted. Its unlikely that a single broker will tick all the boxes for us, leading many of us to engage with multiple platforms to fully align with our strategies. On the bright side, a significant number of brokers now integrate PayPal, offering a diverse array of platforms to suit various trading styles.

You will find that some brokers are more geared towards those just cutting their teeth in trading, providing robust customer support and a wealth of educational materials to ease their entry into the market. On the other end of the spectrum are brokers tailored for veterans like us, where the emphasis is on more competitive fees and a streamlined service, sans the beginners hand-holding.

When it comes down to choosing a broker, one of the paramount considerations should be their regulatory standing, particularly with European financial watchdogs. Opting for a broker under the stringent oversight of a top-tier regulator not only solidifies their legitimacy but also assures us of a safer and more transparent trading environment, especially when it comes to managing our funds through PayPal.

PayPal Brokers Advantages

PayPal brokers are advantageous compared to other payment methods. Below are some of the pros:

- It is free to open a PayPal account, and there are no fees for a dormant account. Example: A new trader creates a PayPal account at no cost and links it to their FX broker without worrying about inactivity fees.

- PayPal max transaction limit is $10,000 - $60,000 ($100,000 in some cases). Example: A day trader funds $15,000 via PayPal to their margin account instantly, staying well within the maximum limit.

- PayPal is known all over the world and potentially increases the reputation of the broker accepting PayPal. Example: A broker advertises “Trusted PayPal deposits,” attracting international clients who value PayPal’s brand recognition.

- PayPal is quick and easy for mobile and desktop applications. Example: Before market open, a trader uses the PayPal app on their phone to top up their trading account in under a minute.

- PayPal is good for trading Forex with online brokers that accept PayPal as it accepts 56 world currencies. Example: Converting GBP to USD in PayPal before funding a US-based Forex broker saves on conversion hassles.

- PayPal is available in 200 countries worldwide. Example: A trader in Brazil seamlessly withdraws profits from their CFD account into their local bank via PayPal.

- Transactions via PayPal are swift, dependable, and safeguarded. This is crucial in the fast-paced world of trading. Example: A futures trader receives a PayPal withdrawal in under an hour, allowing reinvestment before the next session.

- The user interface of PayPal is incredibly user-friendly. Whether on a desktop or mobile, it is a breeze for traders of any experience level. Example: A novice investor easily navigates the PayPal dashboard to deposit funds into their equity trading platform.

- Deposits and withdrawals through PayPal outpace conventional bank wire transfers in speed. Time is money, especially in trading. Example: A CFD trader funds their account via PayPal and begins trading within minutes, instead of waiting days for a bank wire.

- Integrating PayPal with multiple debit and credit cards, along with bank accounts, is straightforward. This flexibility is a boon for managing funds efficiently. Example: A swing trader links two credit cards and a checking account to PayPal, choosing the cheapest funding source each time.

- As a top-tier e-Wallet globally, PayPal’s reputation speaks for itself. It is a trusted name in financial transactions. Example: Choosing PayPal for deposits reassures a trader’s parents that their funds are handled by a well-known provider.

- PayPal’s stringent anti-money laundering protocols not only protect users but also bolster the credibility of PayPal brokers. Safety is paramount. Example: A broker leverages PayPal’s KYC checks to onboard clients faster, reducing manual document reviews.

- PayPal accommodates substantial transfer and withdrawal limits, up to $60,000. This is particularly advantageous for serious traders handling significant sums. Example: An experienced trader withdraws $50,000 of profits via PayPal to scale up a new algorithmic strategy.

- With a presence in over 200 countries and support for twenty-five currencies, PayPal’s global reach is unmatched. This is essential for international trading activities. Example: A London-based trader funds a Japanese equities account in JPY without separate FX conversion.

- Starting a PayPal account is cost-free, with no initial deposit required. This removes barriers to entry for traders. Example: A beginner opens PayPal, links to a broker, and deposits just $100 to start live trading.

- PayPal does not impose fees on dormant accounts. It’s economical for traders who might take breaks from trading. Example: A seasonal trader pauses activity for three months and returns without incurring any PayPal dormancy charges.

- Forex companies often prefer PayPal for its transactional efficiency, adding a layer of convenience for traders. This can streamline operations and save time. Example: A broker offers a 1% rebate on trade commissions when funded via PayPal due to processing efficiencies.

PayPal Uses For Traders

More people are beginning to use the PayPal trading service to help them make money. It is certainly easier than using a regular brokerage or market-making account, where you must wait for a Forex broker to trade for you. Also, with the PayPal trading account, you can place trades almost instantly, allowing you to be in and out of the Forex market quickly, taking advantage of any opportunities.

One of the main advantages of using PayPal is the ability to receive and send funds to your account. PayPal has enabled many experienced traders worldwide to work from their homes. There is no need to worry about carrying large amounts of cash or other liquid assets. You will not need to worry about being robbed at any point, and you can withdraw as much money as you need at any time. The ease of use of PayPal is a big advantage that makes using a PayPal transaction service with a trading platform or broker one of the best available options for people who want to work from home.

Another advantage is that you can do all of your research. You will not have to rely on your Forex broker to tell you the best trades. Instead, you will be able to do this yourself. Forex brokers get paid for their services, and while they should be used for that, you will find that they often give you biased advice based on the information they receive from the trading commission. With the ability to do all of your research, you will be able to do just that and be much more independent from outside influences.

Many brokers will also give you a discount for using their services. You can take advantage of the discounts these companies offer and save even more money overall. You can trade all year round without worrying about finding an alternative Forex broker. Even if you have to travel a little bit, you should find that the commissions for trading online are very low compared to other options, and in most cases, you will not even have to pay tax.

PayPal Broker Drawbacks

PayPal does have some drawbacks and things to consider when using it with a broker. Here are some potential drawbacks of using PayPal with a trading platform:

- PayPal International and domestic transfer fees are high, ranging from 4% - 12%. Example: A $2,000 deposit to your CFD account costs up to $240 in fees when funding via PayPal.

- Not all brokers accept PayPal, although more and more brokers are adopting it for funding and withdrawal. Example: You try to fund Broker XYZ with PayPal, but the option is unavailable, forcing you to use a bank wire instead.

- Limited availability: Not all trading platforms support PayPal as a payment method, which may limit your options if you prefer to use PayPal. Example: Your preferred futures platform doesn’t offer PayPal deposits, so you must switch to an alternative.

- Transaction fees: PayPal charges fees for each transaction, which can add up over time, especially if you frequently buy and sell on a trading platform. Example: Daily scalpers may pay hundreds in cumulative fees if each small deposit incurs a 3.5% PayPal charge.

- Delayed access to funds: When you sell on a trading platform and receive payment via PayPal, it may take several days for the funds to be available in your PayPal account. This delay may impact your ability to quickly reinvest your profits or withdraw your funds. Example: A profitable trade settles, but the PayPal withdrawal isn’t usable for 3 business days, missing timely reinvestment opportunities.

- Security concerns: There have been instances of PayPal accounts being hacked or fraudulent transactions being made, which could potentially put your funds and personal information at risk. Example: A trader’s PayPal account is compromised, delaying access to their trading capital until the security breach is resolved.

- Disputed transactions: PayPal’s dispute resolution process can be time-consuming and may result in funds being frozen or held for an extended period of time, which could impact your ability to trade on a platform. Example: A payment dispute on a withdrawal hold prevents you from accessing funds for over a week.

- Inconsistent regulations: PayPal availability and policies may vary by country, which can lead to inconsistent experiences when trading on a global platform. Example: European traders pay different withdrawal fees than US traders when using PayPal on the same broker.

- PayPal charges on transactions, so no transaction is commission-free. Example: Every deposit and withdrawal, no matter how small, incurs at least a 2.9% + $0.30 fee.

- The Forex fee with PayPal is high. It is 4.5 per cent of the transaction amount. Example: Converting $10,000 into EUR via PayPal for a Forex trade costs $450 in fees alone.

- The PayPal fee is considered high. It is between 4 and 12 per cent. Example: A $5,000 transfer to your broker could cost up to $600 in PayPal fees.

- Although PayPal is popular, the best PayPal Forex brokers are relatively uncommon. Example: You research and find only 3 out of 20 top-rated Forex brokers that support PayPal deposits.

- PayPal chargeback protection does not count for financial derivatives. When trading CFDs and Forex, for example, these are not physical goods, so they are not covered by chargeback protection. Example: A failed CFD trade cannot be reversed via PayPal chargeback, leaving you liable for the loss.

PayPal Brokers Payment Speed

The payment is super fast with PayPal if funds are in the PayPal or bank account. Sometimes the fund transfer is not instant depending on the limitations of banks or cards, but the process is fast.

Security

It is claimed that PayPal is safer than other modes of payment like credit cards or debit cards, as all user data is stored in a vault, which means the information is never passed on to the other end of the transactions. In short, the company maintains a high level of privacy features.

However, the chargeback is only applicable to tangible goods. Forex or stock traders cannot claim chargeback.

PayPal Deposits/Withdrawals

Some countries do not allow payments from one PayPal account to another if both the account holders are from the same country. There is no such restriction for users in the United Kingdom and the United States. Some countries allow receiving funds through PayPal, and users cannot send them.

Trading PayPal Account

PayPal payments are convenient, fast and reliable. But creating a PayPal account is in order to utilise its trading tools or make deposits or withdrawals. There are no restrictions as mentioned, but it is important to read the fine print, the terms, and regulations before making PayPal retail investor accounts.

Depositing Money With PayPal

Once you have chosen your PayPal broker, you must deposit funds. After locating the deposit page: Open the "e-wallet" section. After choosing PayPal, enter the amount you want to be deposited. Remember that you will have to fulfil a minimum deposit amount to begin.

You will be asked to type in your login credentials with PayPal. Go with the financing source you wish to use, in this case, your PayPal balance. Be sure to check if the deposit amount is correct before moving forward. Once that is done, you should be able to see the funds in your trading PayPal account balance.

Withdrawing Money With PayPal

To withdraw your trading profits with PayPal, verify your identity first. After that, your chosen broker will authorise your first withdrawal request.

Once done, go to the brokers banking dashboard and choose PayPal. Next, enter the amount you want to withdraw money. Once the broker processes your cash-out request, which can take up to three days, the funds requested will be added to your PayPal account.

You can transfer your funds from PayPal to your bank account. This part of the process is normally very quick.

Before registering for a PayPal account, check if a free-of-cost demo account is offered.

If you are not confident about using a brokers platform, you may not profit much from trading through them.

How Much Does PayPal Charge?

Opening a PayPal account is free, and many traders already have a PayPal account for online shopping. However, PayPal does charge for certain transactions, which is important to consider when using it for trading.

Withdrawing money from PayPal to your local bank is typically free as long as PayPal operates in your country. However, fees apply for international transactions, including cross-border transfers, which can be as high as 4%. In the UK, the fee for domestic transactions is around 10-30 pence, though this can vary by country.

If you use a debit card rather than your PayPal balance, additional fees may apply. The currency conversion fee typically ranges from 2.5% above the base currency rate.

In some countries, PayPal functionality may be limited. For instance, in Israel, you can only send money via PayPal, not receive it.

For Domestic Transactions (Within the Same Country):

PayPal charges 2.9% + USD 0.30 per transaction for amounts up to USD 10,000. For transactions exceeding USD 10,000, an additional 0.5% fee applies, with a maximum fee of USD 1,000.

PayPal Broker Fees for International Currencies

As a trader, dealing with PayPal fees especially when funding or withdrawing from trading accounts can be tricky. Here’s what you need to know:

PayPal applies a cross-border fee for international transactions. This fee is especially relevant when your broker account is in USD and your primary currency differs. Along with this, PayPal charges a currency conversion fee that usually ranges from 3% to 5%, depending on the currency exchange rate.

PayPal uses their own exchange rates for conversions, and these rates are not always the most favorable. They obtain a wholesale rate from their bank twice daily and add a markup, which results in a higher exchange rate for us. For instance, converting funds to USD incurs a 3.5% fee, while other currencies may incur a 4% to 5% fee.

What does all this mean for traders? PayPal’s fees particularly the cross-border and currency conversion fees can eat into trading profits. If you"re making frequent transactions or dealing with significant sums, it’s essential to account for these fees when calculating your potential margins.

Always check the latest fee schedule directly from PayPal or get in touch with their customer support to confirm the current rates. They do have different pricing plans for certain business types or high-volume transactions, so there might be ways to mitigate some of these costs.

PayPal Limits for Traders

PayPal is becoming an increasingly popular choice for traders, though it"s important to be mindful of potential high transfer fees. That said, more and more online brokers are integrating PayPal as a payment method due to growing demand from traders.

For most users, PayPal has a maximum transaction limit of $10,000. However, once your PayPal account is verified and trusted, this limit can rise to $60,000. In certain cases, limits can even go up to $100,000.

Understanding PayPal’s transaction limits is crucial for managing liquidity, especially when trading frequently or moving in and out of positions quickly. If you’re new to PayPal, the one-time send-off limit is capped at $4,000, which could be restrictive for larger trades. However, once your account is verified, you’ll find the limits become much more flexible and suited for bigger transactions.

What Countries is PayPal Available In?

PayPal is a payment method that supports sending and receiving payments in more than 200 countries and regions and supports 25 currencies.

PayPal is very specific to countries. In this case, users in any country may only link to a bank account available in their country. The only exception here is the US, where account holders can easily link to bank accounts in countries outside theirs.

You can see which countries PayPal is available by clicking on this link.

What Countries is PayPal NOT Available In?

If you want to use PayPal with your broker when trading, make sure PayPal is available in your country. The availability of PayPal may change over time and depend on various factors such as legal and regulatory requirements, economic sanctions, and business considerations.

PayPal is not available in the countries listed below :

| Country |

|---|

| Antarctica |

| Afghanistan |

| Bangladesh |

| Belarus |

| British Indian Ocean Territory |

| Central African Republic |

| Cuba |

| Crimea Region |

| Democratic Republic of the Congo |

| Equatorial Guinea |

| Iran |

| Iraq |

| Laos |

| North Korea |

| Libya |

| Myanmar |

| Pakistan |

| Sudan |

| Syria |

| Zimbabwe |

What Do I Look For In A PayPal Broker?

What to look for in a PayPal Trading Account depends on what you plan to do with the money in your account. If you intend to make large purchases with your money, you should go for a PayPal account with a larger maximum withdrawal limit. Several brokers on the internet offer high limits, but finding one that offers the best service for your needs will take time and effort.

What are the differences between normal e-commerce and PayPal trading accounts? Essentially the main difference is the way PayPal funds the transactions. Whereas with normal e-commerce trading accounts, your money goes into your bank, with a PayPal account, your money goes into your account.

First, you must know that many PayPal Brokers will charge a fee for their services. Usually, the fee is based on how much of your money you have in your account at any given time. So, if you have a large balance, you will probably have to pay more for your trading account with PayPal. Some of the more reputable brokerages will offer a free trial to their retail investor accounts so that you can get a feel for how they operate. Please take advantage of these opportunities, as they often reveal many pros and cons of the particular brokerage and the service you plan to use.

Once you have figured out how PayPal brokers work, your next step is to consider what platform you could sign up with. There are hundreds of brokers out there offering their services, but not all of them will accept PayPal.

After you have determined whether or not a broker accepts PayPal transactions, you must look at other factors discussed in further detail below:

PayPal Broker Spreads

Spreads hold a lot of importance in the forex trading space. Spreads are the variation between the buy and sell price of currency pairs. For instance, if the buy and sell price of GBP/EUR is 1.4100 and 1.4101, the spread is 1 pip (or price interest point). Cost-effectiveness goes up the "tighter" a spread gets.

PayPal Broker Regulation

Whether or not a broker accepts PayPal is a different story, as you must only sign up with a regulated platform. At the very least, most platforms hold one regulatory license; however, the more licenses they hold, the better. It is crucial for the license to be issued by a reputable regulatory body, e.g. FCA or ASIC.

PayPal Broker Forex Pairs

It also helps to see how broad the Forex division is regarding Forex pairs. For instance, although the platform may host all major Forex pairs, it might fall short on exotic and minor pairs. Fortunately, most brokers enable you to review their complete list of hosted currencies before registering.

PayPal Broker Commissions

Most PayPal brokers will charge traders a commission fee for the trades they conduct. The trading fees are applied as a certain percentage of the trade size. The percentage goes up when leverage is applied. For instance, a trader places a 3K USD buy order on the EUR/USD currency pair. If their broker happens to charge 0.5 per cent for every order, they would have to pay 15 USD in fees. The trader must pay a fee every time they exit their trade.

PayPal Broker Leverage

you should avoid leverage if you are a beginner in the online foreign exchange sector. However, at some point, you might approach a time when you want to raise the bar on your stakes. Once you do, you must guarantee that your broker provides leverage on the currency pairs you choose. The restrictions depend on where you live and what your chosen broker chooses to offer you.

PayPal Broker Trading Software

To deal in Forex pairs, your trades will be conducted via software. The most popular platforms in this regard are MT4 and MT5. Certain brokers may even choose to host their software, so it is crucial to be wary of that. You must also check whether your potential broker offers a proper mobile application if you buy and sell currencies while travelling.

PayPal Broker Customer Service

Sticking to payer brokers offering numerous customer service options is advised. PayPal customer service has to include phone calls, live chat, and email support. It is much better if the PayPal Forex broker offers twenty-four-hour support daily.

Buying PayPal Stock

Following are tips on how to invest in PayPal stock shares, as well as what to consider before buying:

Invest In PayPal Stock

After you have decided to invest in PayPal stock and have set up your brokerage account, you may initiate your order. When inputting your order, use the PayPal stock ticker symbol (PYPL).

Most of the best brokers have trade tickets at the end of every page for you to enter your order. Enter the symbol and the number of shares you can afford on the brokers order form.

Enter the order type, i.e., limit or market. A market order buys the stock at whatever the current price is. The limit order executes if the stock reaches the price specified by you.

If you are investing in a few shares and PayPal has gone up during the past year, stick with a market order. The long-term performance will not be impacted even if you invest more for a market order.

Investigate PayPal And Its Financials

Determining the competitive position and financials of a corporation has to be the trickiest part of investing in the stock; however, it is also highly important. It helps to start with the Form 10-K of a company, which refers to the yearly report that all publicly traded corporations are required to file with the SEC.

The 10-K helps with the following factors:

- The revenue of the company and its source.

- Its liabilities as well as its assets.

- The competitive landscape around the company.

- Its overall lucrativeness.

- The management team of the company and its incentives.

- The various risks the company faces.

Evaluating a corporations yearly report is a crucial initial learning step. You also must study how rival companies compete against the company in question, as this offers a broader perspective on the entire industry.

For instance, although PayPal is one of the most prominent payment corporations, it still has big competitors. Other companies like Mastercard and Visa have also initiated strategic deals with PayPal that can broaden the reach of PayPal regarding retailers, all the while allowing clients to transact funds with the methods most suitable to them.

Portfolio Compatibility

PayPal has performed excellently, and its revenue has grown significantly. If such growth continues, the stock should perform favourably as well. However, there are some risks to consider, such as new emerging competitors of PayPal. The nature of fintech corporations is linked to the disruption of established companies. With that in mind, even though PayPal has performed well, there is no guarantee for its future.

Traders and investors must consider multiple things, such as:

- If a growth corporation fits its requirements.

- If they can keep analysing the company as it evolves.

- If they can buy more stock or hold on if the stock of the company drops.

- If they find it acceptable that PayPal does not yield dividends.

Such considerations may not matter if you buy a bit of PayPal stocks as a beginner.

PayPal Trading Budget

The amount of stock or other available financial instrument a trader can afford to invest in does not have much to do with PayPal; rather, it is linked to the financial position and risk tolerance of the trader. Since stocks are prone to volatility, try to give your investment time to fruition. You may need to leave the funds in the stock for at three to five years, at least. You should be able to manage without those funds for at least that amount of time.

Holding the stock you invest in for at least three to five years is crucial. You want to avoid selling the stock when it is low because you may see it rebound a lot higher after exiting the position. You can deal with short term PayPal stock fluctuations if you stick to a long-term plan.

If you buy individual stocks, keep the percentage of every position strictly between three to five per cent. That way, you will not be exposed to just one investment affecting your portfolio. Go with an even lower percentage if the stock has more high risk of losing money rapidly.

Aside from that, instead of only committing to a one-off sum of funds to the stock, consider how to include funds into your position over time.

Sign Up For A Live Trading Broker Account That Accepts PayPal

Opening a brokerage account might seem tricky, but it is quite simple. You can set up an account in around 15 minutes.

Choose a Forex broker that fits your requirements. Consider how frequently you trade and if you require research or a considerable level of service. Also, determine if cost is the most crucial factor in your case. If you are investing in funds or buying a few stocks, many Forex brokers offer to trade for such funds.

Once you have set up your user account, consider funding it with sufficient funds to invest in PayPal stock. This simple step can be taken care of online.

PayPal Brokers Verdict

PayPal brokers have been gaining traction recently due to the widespread use of PayPal in financial markets. In this article, we"ve explored the advantages and disadvantages of using PayPal for trading, along with key insights on its functionality in the trading ecosystem.

As an investor, it"s essential to recognize that stock investments are rarely about instant gains. Patience is crucial, and a long-term strategy is the key to success. Dollar-cost averaging is a useful strategy for traders who believe PayPal stock will perform well over time, helping to mitigate risks during market fluctuations.

While PayPal continues to be one of the most secure and efficient payment options globally, its popularity is not surprising. Whether you’re new to trading or a seasoned pro, PayPal offers a simple, fast, and reliable way to handle transactions. Its convenience makes it an attractive option for traders and investors alike.

We have conducted extensive research and analysis on over multiple data points on Paypal Brokers to present you with a comprehensive guide that can help you find the most suitable Paypal Brokers. Below we shortlist what we think are the best paypal brokers after careful consideration and evaluation. We hope this list will assist you in making an informed decision when researching Paypal Brokers.

Reputable Brokers That Accept PayPal Checklist

Selecting a reliable and reputable online Paypal trading brokerage involves assessing their track record, regulatory status, customer support, processing times, international presence, and language capabilities. Considering these factors, you can make an informed decision and trade Paypal more confidently.

Selecting the right online Paypal trading brokerage requires careful consideration of several critical factors. Here are some essential points to keep in mind:

- Ensure your chosen Paypal broker has a solid track record of at least two years in the industry.

- Verify that the Paypal broker has a customer support team of at least 15 members responsive to queries and concerns.

- Check if the Paypal broker operates under the regulatory framework of a jurisdiction that can hold it accountable for any misconduct or resolve disputes fairly and impartially.

- Ensure that the Paypal broker can process deposits and withdrawals within two to three days, which is crucial when you need to access your funds quickly.

- Look for Paypal brokers with an international presence in multiple countries, offering its clients local seminars and training programs.

- Ensure the Paypal broker can hire staff from diverse locations worldwide who can communicate fluently in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Compare Key Features of Paypal Brokers in Our Brokerage Comparison Table

When choosing a broker for paypal trading, it's essential to compare the different options available to you. Our paypal brokerage comparison table below allows you to compare several important features side by side, making it easier to make an informed choice.

- Minimum deposit requirement for opening an account with each paypal broker.

- The funding methods available for paypal with each broker.

- The types of instruments you can trade with each paypal broker, such as forex, stocks, commodities, and indices.

- The trading platforms each paypal broker provides, including their features, ease of use, and compatibility with your devices.

- The spread type (if applicable) for each paypal broker affects the cost of trading.

- The level of customer support each paypal broker offers, including their availability, responsiveness, and quality of service.

- Whether each paypal broker offers Micro, Standard, VIP, or Islamic accounts to suit your trading style and preferences.

By comparing these essential features, you can choose a paypal broker that best suits your needs and preferences for paypal. Our paypal broker comparison table simplifies the process, allowing you to make a more informed decision.

Top 15 Paypal Brokers of 2025 compared

Here are the top Paypal Brokers.

Compare paypal brokers for min deposits, funding, used by, benefits, account types, platforms, and support levels. When searching for a paypal broker, it's crucial to compare several factors to choose the right one for your paypal needs. Our comparison tool allows you to compare the essential features side by side.

All brokers below are paypal brokers. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more paypal brokers that accept paypal clients.

| Broker |

IC Markets

|

eToro

|

XTB

|

Pepperstone

|

AvaTrade

|

FP Markets

|

FXPro

|

Trading212

|

ForTrade

|

Forex.com

|

IG

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rating | |||||||||||

| Regulation | Seychelles Financial Services Authority (FSA) (SD018) | FCA (Financial Conduct Authority) eToro (UK) Ltd (FCA reference 583263), eToro (Europe) Ltd CySEC (Cyprus Securities Exchange Commission), ASIC (Australian Securities and Investments Commission) eToro AUS Capital Limited ASIC license 491139, CySec (Cyprus Securities and Exchange Commission under the license 109/10), FSAS (Financial Services Authority Seychelles) eToro (Seychelles) Ltd license SD076 | FCA (Financial Conduct Authority reference 522157), CySEC (Cyprus Securities and Exchange Commission reference 169/12), FSCA (Financial Sector Conduct Authority), XTB AFRICA (PTY) LTD licensed to operate in South Africa, KPWiG (Polish Securities and Exchange Commission), DFSA (Dubai Financial Services Authority), DIFC (Dubai International Financial Center), CNMV (Comisión Nacional del Mercado de Valores), KNF (Komisja Nadzoru Finansowego), IFSC (Belize International Financial Services Commission license number IFSC/60/413/TS/19) | Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217 | Australian Securities and Investments Commission (ASIC) Ava Capital Markets Australia Pty Ltd (406684), South African Financial Sector Conduct Authority (FSCA) Ava Capital Markets Pty Ltd (45984), Financial Services Agency (Japan FSA) Ava Trade Japan K.K. (1662), Financial Futures Association of Japan (FFAJ),, FFAJ, Abu Dhabi Global Markets (ADGM)(190018) Ava Trade Middle East Ltd (190018), Polish Financial Supervision Authority (KNF) AVA Trade EU Ltd, Central Bank of Ireland (C53877) AVA Trade EU Ltd, British Virgin Islands Financial Services Commission (BVI) BVI (SIBA/L/13/1049), Israel Securities Association (ISA) (514666577) ATrade Ltd, Financial Regulatory Services Authority (FRSA) | CySEC (Cyprus Securities and Exchange Commission) (371/18), ASIC AFS (Australian Securities and Investments Commission) (286354), FSP (Financial Sector Conduct Authority in South Africa) (50926), Financial Services Authority Seychelles (FSA) (130) | FCA (Financial Conduct Authority) (509956), CySEC (Cyprus Securities and Exchange Commission) (078/07), FSCA (Financial Sector Conduct Authority) (45052), SCB (Securities Commission of The Bahamas) (SIA-F184), FSA (Financial Services Authority of Seychelles) (SD120) | FCA (Financial Conduct Authority) (609146), ASIC (Australian Securities and Investments Commission) (541122), FSC (Financial Supervision Commission, Bulgaria) (RG-03-0237), CySEC (Cyprus Securities and Exchange Commission) (398/21) | FCA (Financial Conduct Authority) (609970), CIRO (Canadian Investment Regulatory Organization) (BC1148613), ASIC (Australian Securities and Investments Commission) (493520), CySEC (Cyprus Securities and Exchange Commission) (385/20), FSC (Financial Services Commission, Mauritius) (GB21026472), Investment Industry Regulatory Organization of Canada (IIROC) | CIRO (Canadian Investment Regulatory Organization), CySEC (Cyprus Securities & Exchange Commission), NFA (National Futures Association), CFTC (Commodities Futures Trading Commission), CIMA (Cayman Islands Monetary Authority) (25033), FCA (Financial Conduct Authority) (446717) StoneX Financial Ltd, FSA (Financial Services Agency, Japan), MAS (Monetary Authority of Singapore), ASIC (Australian Securities and Investments Commission)(345646) STONEX FINANCIAL PTY LTD | FCA (Financial Conduct Authority) (195355) IG Markets Limited, BaFin (German Federal Financial Supervisory Authority), CySEC (Cyprus Securities and Exchange Commission), FINMA (Swiss Financial Market Supervisory Authority), DFSA (Dubai Financial Services Authority), FSCA (Financial Sector Conduct Authority, South Africa), MAS (Monetary Authority of Singapore), JFSA (Japanese Financial Services Agency), ASIC (Australian Securities and Investments Commission), FMA (Financial Markets Authority, New Zealand), CFTC (Commodities Futures Trading Commission), BMA (Bermuda Monetary Authority) |

| Min Deposit | 200 | 50 | No minimum deposit | No minimum deposit | 100 | 100 | 100 | 1 | 100 | 100 | No minimum deposit |

| Funding |

|

|

|

|

|

|

|

|

|

|

|

| Used By | 200,000+ | 35,000,000+ | 1,000,000+ | 400,000+ | 400,000+ | 200,000+ | 7,800,000+ | 3,000,000+ | 1,000,000+ | 454,000+ | 313,000+ |

| Benefits |

|

|

|

|

|

|

|

|

|

|

|

| Accounts |

|

|

|

|

|

|

|

|

|

|

|

| Platforms | MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading Central | eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, Web | MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play) | Web Trader, Mobile Apps, iOS (App Store), Android (Google Play) | Fortrader, MT4, Mobile Apps, iOS (App Store), Android (Google Play) | Mobile Apps, iOS (App Store), Android (Google Play), WebTrader, MT4, MT5, TradingView | MT4, ProRealTime, L2 Dealer, Mobile Trading APIs, Web Platform, Mobile Trading, Apple App iOS, Android Google Play |

| Support |

|

|

|

|

|

|

|

|

|

|

|

| Learn More |

Sign

Up with icmarkets |

Sign

Up with etoro |

Sign

Up with xtb |

Sign

Up with pepperstone |

Sign

Up with avatrade |

Sign

Up with fpmarkets |

Sign

Up with fxpro |

Sign

Up with trading212 |

Sign

Up with fortrade |

Sign

Up with forexcom |

Sign

Up with ig |

| Risk Warning | Losses can exceed deposits | 61% of retail investor accounts lose money when trading CFDs with this provider. | 69% - 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | 75-95 % of retail investor accounts lose money when trading CFDs | 71% of retail investor accounts lose money when trading CFDs with this provider | Losses can exceed deposits | 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Your capital is at risk | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. |

| Demo |

IC Markets Demo |

eToro Demo |

XTB Demo |

Pepperstone Demo |

AvaTrade Demo |

FP Markets Demo |

FxPro Demo |

Trading 212 Demo |

ForTrade Demo |

Forex.com Demo |

IG Demo |

| Excluded Countries | US, IR, CA, NZ, JP | ZA, ID, IR, KP, BE, CA, JP, SY, TR, IL, BY, AL, MD, MK, RS, GN, CD, SD, SA, ZW, ET, GH, TZ, LY, UG, ZM, BW, RW, TN, SO, NA, TG, SL, LR, GM, DJ, CI, PK, BN, TW, WS, NP, SG, VI, TM, TJ, UZ, LK, TT, HT, MM, BT, MH, MV, MG, MK, KZ, GD, FJ, PT, BB, BM, BS, AG, AI, AW, AX, LB, SV, PY, HN, GT, PR, NI, VG, AN, CN, BZ, DZ, MY, KH, PH, VN, EG, MN, MO, UA, JO, KR, AO, BR, HR, GL, IS, IM, JM, FM, MC, NG, SI, | US, IN, PK, BD, NG , ID, BE, AU | AF, AS, AQ, AM, AZ, BY, BE, BZ, BT, BA, BI, CM, CA, CF, TD, CG, CI, ER, GF, PF, GP, GU, GN, GW, GY, HT, VA, IR, IQ, JP, KZ, LB, LR, LY, ML, MQ, YT, MZ, MM, NZ, NI, KP, PS, PR, RE, KN, LC, VC, WS, SO, GS, KR, SS, SD, SR, SY, TJ, TN, TM, TC, US, VU, VG, EH, ES, YE, ZW, ET | BE, BR, KP, NZ, TR, US, CA, SG | US, JP, NZ | US, CA, IR | US, CA | US | BE | US, BE, FR, IN, IL, PL, ZW |

All Paypal brokers in more detail

You can compare Paypal Brokers ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options, regulation and account types side by side.

We also have an indepth Top Paypal Brokers for 2025 article further below. You can see it now by clicking here

We have listed top Paypal brokers below.

Brokers That Accept PayPal List

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading CentralCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Funding methods

Bank transfer Credit Card PaypalPlatforms

eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, WebCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account Pro Account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Web Trader, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Fortrader, MT4, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Mobile Apps, iOS (App Store), Android (Google Play), WebTrader, MT4, MT5, TradingViewCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, ProRealTime, L2 Dealer, Mobile Trading APIs, Web Platform, Mobile Trading, Apple App iOS, Android Google PlayCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Learn more

Losses can exceed deposits

Losses can exceed deposits

Losses can exceed deposits