FTSE 100 Predictions for 2025

We found 11 online brokers that are appropriate for Trading FTSE 100 Investment Platforms.

FTSE 100 Predictions Guide

Analysis by Andrew Blumer, Updated Last updated – September 03, 2025

FTSE 100 Predictions

The FTSE 100 (UK100 index) gained almost 8% (Period 1 Jan >2021 to 15 April 2021). Since this index is only composed of the top 100 UK companies, it means that those company shares had gone up. Some of them may have declined since 2021, but the collective result of UK100 shows that the trend was bullish.

Looking forward to 2025 and 2026, analysts estimate modest growth for the FTSE 100, with projected annual gains of around 5-6%. However, the potential for volatility remains high due to ongoing global economic uncertainties and a rising number of UK companies choosing to delist from the FTSE to join American indexes such as the S&P 500 and Nasdaq. These companies are seeking higher valuations and greater access to U.S. investors. This trend could impact the FTSE 100's overall composition and performance.

The year 2020 was a challenging one for the FTSE 100 index. As soon as 2020 started, the index began falling, and at one point, it was down -37% (Mar 2020). From there, the index started recovering and eventually closed the year with -15%. In 2020, the UK100 index lost almost 15% - Considering that it is composed of blue-chip stocks, this was not a good signal for the entire stock market.

Although the index showed recovery in subsequent years, questions remain about whether this momentum will persist. With large UK-based companies like Unilever and Ferguson opting for American listings in recent years, this shift underscores concerns over the FTSE's ability to retain high-value enterprises. For 2025 and 2026, experts recommend keeping an eye on global macroeconomic trends and regulatory shifts affecting UK markets.

The Pandemic

Do you think that the COVID-19 pandemic is close to ending? Well, the statistics show otherwise. The virus is mutating and there is still uncertainty about the effectiveness of the coronavirus vaccine. If the vaccine proves to be less effective against new strains, this could weigh heavily on the stock market as well as FTSE 100 index.

Despite successful vaccination drive, U.K. Prime Minster still warned about 'rising cases & deaths'. Although the economy has started to open up, one can not discount the COVID factor altogether.

Another strange phenomenon happening right now is the direction of the pound sterling and FTSE. Usually these 2 moves in opposite directions. However, since the pandemic, they are moving in the same direction.

Brexit Saga

For the last few years, Brexit has been weighing heavily on the UK financial markets. Since FTSE 100 is composed of the top 100 blue-chip companies from the UK, it was badly affected by the whole Brexit saga.

Now that the deal between the EU and UK is done, it feels like Brexit is no longer going to be a dominant theme in the market. Negative consequences of Brexit are already priced in (mostly), so it is not going to affect the market a lot this year.

UK Interest Rates

Interest rates in the UK are at the lowest levels (almost close to 0). However, investors are closely looking at the next decision from The Bank of England. There is a chance that the central bank might decide to set the interest rates to negative. If the interest rate turns negative, it will stimulate the economy & a rising stock market as a result. If the stock market rises, the UK100 index will rise too since it tracks the performance of the top 100 companies.

FTSE 100 forecast for 2025 and 2026

Most analysts predict that the FTSE 100 will continue to rise in 2025 and 2026, closing both years with gains. This outlook depends on sustained economic recovery, reduced inflation, and geopolitical stability. Currently, concerns around global interest rates and energy prices pose potential risks to UK stock markets.

Capital Economics

This consultancy firm from the UK maintains a positive outlook for 2025 and 2026. They foresee steady economic growth, a stable interest rate environment, and supportive fiscal policies. Even with potential Brexit-related challenges, they predict resilience in financial markets.

Capital Economics forecasts the pound sterling to strengthen further, trading between $1.38 and $1.42 in 2025. Their projection for the UK100 index ranges from 7,000 to 7,500 for 2025 and could reach 7,800 by the end of 2026.

Investment Bank UBS

UBS analysts remain optimistic about the UK markets potential growth in 2025 and 2026. They highlight the FTSE 100's current valuation, which remains attractive relative to global equities. They also point to improving corporate earnings and the resolution of supply chain disruptions as key drivers.

UBS anticipates earnings growth of 30% in 2025, followed by a more moderate 20% in 2026. To capitalize on these opportunities, they recommend diversifying across sectors such as renewable energy, healthcare, and financials.

Investment Bank UBS projects the FTSE 100 to reach 7,600 points by the end of 2025 and 8,000 points in 2026. With UK-based companies showing improved profitability, they emphasize the potential for significant ROI in the coming years.

investment bank HSBC

This is also a popular investment bank & their view about FTSE 100 is bullish too. They are basing this bullish forecast based on recovery of the global economy & falling cases of COVID-19 due to vaccine immunization.

However, despite the optimistic view, analysts still warn of possible threats from the pandemic. If the situation worsens, things could get messy once again for the stock market.

FTSE 100 Trading Economics

This is a data platform and unlike others, they have a negative view of the market. Their first-quarter forecast for FTSE 100 in 2025 is around 6,825.50. Then they expect the market to fall again & touch the 6,456.80 level by the end of the year 2025. For 2026, their projection starts at 6,932.10 in the first quarter, with a potential decline to 6,542.30 by the end of the year.

Our FTSE 100 (UK 100) Forecast

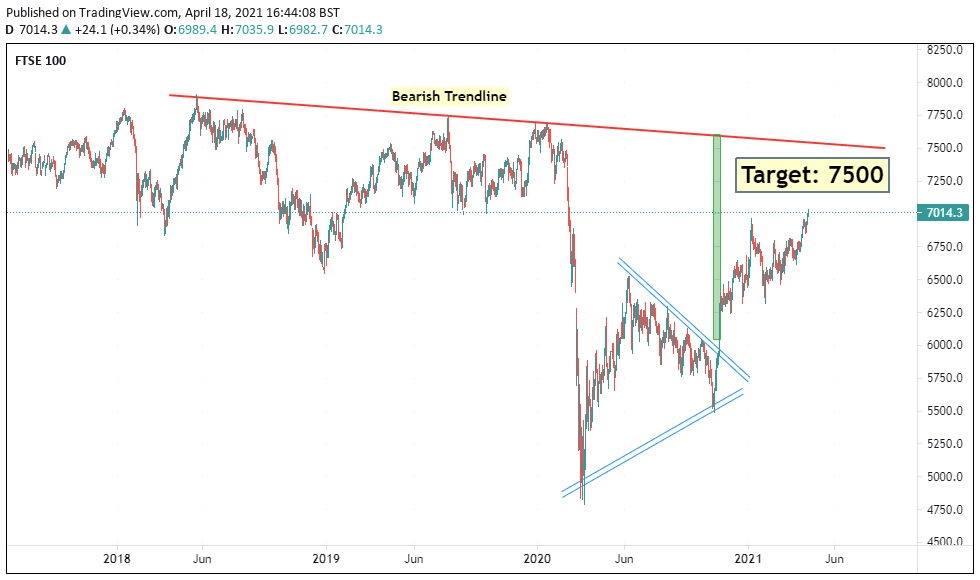

From 2018 to 2020, FTSE 100 traded inside a triangle pattern. We finally got a breakout below the triangle in Feb 2020 which was a bearish signal. The potential target for the fall was around 5780 but the price went way beyond that level and made a low of 4800 (approximately).

Since the target of the triangle pattern is achieved, that means the bearish signal is no longer in play.

The period between April 2020 and Nov 2020 saw the index trade inside a symmetrical triangle pattern. A breakout on the upside happened in the month of November. This is a bullish signal. We expect the price to reach the level of 7500 based on the measured target. At this level, we also have a trendline that is pushing the index lower since 2018.

So in the year 2025, we expect FTSE 100 index to reach 7700. If a strong break above the bearish trendline happens, we can see further upside reaching 8000 in 2026.

We have conducted extensive research and analysis on over multiple data points on FTSE 100 Predictions to present you with a comprehensive guide that can help you find the most suitable FTSE 100 Predictions. Below we shortlist what we think are the best FTSE 100 Investment Platforms after careful consideration and evaluation. We hope this list will assist you in making an informed decision when researching FTSE 100 Predictions.

Reputable FTSE 100 Predictions Checklist

Selecting a reliable and reputable online FTSE 100 Investment Platforms trading brokerage involves assessing their track record, regulatory status, customer support, processing times, international presence, and language capabilities. Considering these factors, you can make an informed decision and trade FTSE 100 Investment Platforms more confidently.

Selecting the right online FTSE 100 Investment Platforms trading brokerage requires careful consideration of several critical factors. Here are some essential points to keep in mind:

- Ensure your chosen FTSE 100 Investment Platforms broker has a solid track record of at least two years in the industry.

- Verify that the FTSE 100 Investment Platforms broker has a customer support team of at least 15 members responsive to queries and concerns.

- Check if the FTSE 100 Investment Platforms broker operates under the regulatory framework of a jurisdiction that can hold it accountable for any misconduct or resolve disputes fairly and impartially.

- Ensure that the FTSE 100 Investment Platforms broker can process deposits and withdrawals within two to three days, which is crucial when you need to access your funds quickly.

- Look for FTSE 100 Investment Platforms brokers with an international presence in multiple countries, offering its clients local seminars and training programs.

- Ensure the FTSE 100 Investment Platforms broker can hire staff from diverse locations worldwide who can communicate fluently in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Compare Key Features of FTSE 100 Investment Platforms in Our Brokerage Comparison Table

When choosing a broker for FTSE 100 Investment Platforms trading, it's essential to compare the different options available to you. Our FTSE 100 Investment Platforms brokerage comparison table below allows you to compare several important features side by side, making it easier to make an informed choice.

- Minimum deposit requirement for opening an account with each FTSE 100 Investment Platforms broker.

- The funding methods available for FTSE 100 Investment Platforms with each broker.

- The types of instruments you can trade with each FTSE 100 Investment Platforms broker, such as forex, stocks, commodities, and indices.

- The trading platforms each FTSE 100 Investment Platforms broker provides, including their features, ease of use, and compatibility with your devices.

- The spread type (if applicable) for each FTSE 100 Investment Platforms broker affects the cost of trading.

- The level of customer support each FTSE 100 Investment Platforms broker offers, including their availability, responsiveness, and quality of service.

- Whether each FTSE 100 Investment Platforms broker offers Micro, Standard, VIP, or Islamic accounts to suit your trading style and preferences.

By comparing these essential features, you can choose a FTSE 100 Investment Platforms broker that best suits your needs and preferences for FTSE 100 Investment Platforms. Our FTSE 100 Investment Platforms broker comparison table simplifies the process, allowing you to make a more informed decision.

Top 15 FTSE 100 Investment Platforms of 2025 compared

Here are the top FTSE 100 Investment Platforms.

Compare FTSE 100 Investment Platforms brokers for min deposits, funding, used by, benefits, account types, platforms, and support levels. When searching for a FTSE 100 Investment Platforms broker, it's crucial to compare several factors to choose the right one for your FTSE 100 Investment Platforms needs. Our comparison tool allows you to compare the essential features side by side.

All brokers below are FTSE 100 Investment Platforms. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more FTSE 100 Investment Platforms that accept FTSE 100 Investment Platforms clients.

| Broker |

IC Markets

|

Roboforex

|

eToro

|

XTB

|

XM

|

Pepperstone

|

AvaTrade

|

FP Markets

|

EasyMarkets

|

SpreadEx

|

FXPro

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rating | |||||||||||

| Regulation | Seychelles Financial Services Authority (FSA) (SD018) | RoboForex Lid is regulated by Belize FSC, License No. 000138/7, reg. number 000001272. RoboForex Ltd, which is an (A category) member of The Financial Commission, also is a participant of its Compensation Fund | FCA (Financial Conduct Authority) eToro (UK) Ltd (FCA reference 583263), eToro (Europe) Ltd CySEC (Cyprus Securities Exchange Commission), ASIC (Australian Securities and Investments Commission) eToro AUS Capital Limited ASIC license 491139, CySec (Cyprus Securities and Exchange Commission under the license 109/10), FSAS (Financial Services Authority Seychelles) eToro (Seychelles) Ltd license SD076 | FCA (Financial Conduct Authority reference 522157), CySEC (Cyprus Securities and Exchange Commission reference 169/12), FSCA (Financial Sector Conduct Authority), XTB AFRICA (PTY) LTD licensed to operate in South Africa, KPWiG (Polish Securities and Exchange Commission), DFSA (Dubai Financial Services Authority), DIFC (Dubai International Financial Center), CNMV (Comisión Nacional del Mercado de Valores), KNF (Komisja Nadzoru Finansowego), IFSC (Belize International Financial Services Commission license number IFSC/60/413/TS/19) | Financial Services Commission (FSC) (000261/4) XM ZA (Pty) Ltd, Cyprus Securities and Exchange Commission (CySEC) (license 120/10) Trading Point of Financial Instruments Ltd, Australian Securities and Investments Commission (ASIC) (number 443670) Trading Point of Financial Instruments Pty Ltd | Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of the Bahamas (SCB) number SIA-F217 | Australian Securities and Investments Commission (ASIC) Ava Capital Markets Australia Pty Ltd (406684), South African Financial Sector Conduct Authority (FSCA) Ava Capital Markets Pty Ltd (45984), Financial Services Agency (Japan FSA) Ava Trade Japan K.K. (1662), Financial Futures Association of Japan (FFAJ),, FFAJ, Abu Dhabi Global Markets (ADGM)(190018) Ava Trade Middle East Ltd (190018), Polish Financial Supervision Authority (KNF) AVA Trade EU Ltd, Central Bank of Ireland (C53877) AVA Trade EU Ltd, British Virgin Islands Financial Services Commission (BVI) BVI (SIBA/L/13/1049), Israel Securities Association (ISA) (514666577) ATrade Ltd, Financial Regulatory Services Authority (FRSA) | CySEC (Cyprus Securities and Exchange Commission) (371/18), ASIC AFS (Australian Securities and Investments Commission) (286354), FSP (Financial Sector Conduct Authority in South Africa) (50926), Financial Services Authority Seychelles (FSA) (130) | Cyprus Securities and Exchange Commission (CySEC) (079/07) Easy Forex Trading Ltd, Australian Securities and Investments Commission (ASIC) (Easy Markets Pty Ltd 246566), British Virgin Islands Financial Services Commission (BVI) EF Worldwide Ltd (SIBA/L/20/1135), Financial Sector Conduct Authority South Africa (FSA) EF Worldwide (PTY) Ltd (54018), FSC (Financial Services Commission) (SIBA/L/20/1135), FSCA (Financial Sector Conduct Authority) (54018) | FCA (Financial Conduct Authority) (190941), Gambling Commission (Great Britain) (8835) | FCA (Financial Conduct Authority) (509956), CySEC (Cyprus Securities and Exchange Commission) (078/07), FSCA (Financial Sector Conduct Authority) (45052), SCB (Securities Commission of The Bahamas) (SIA-F184), FSA (Financial Services Authority of Seychelles) (SD120) |

| Min Deposit | 200 | 10 | 50 | No minimum deposit | 5 | No minimum deposit | 100 | 100 | 25 | No minimum deposit | 100 |

| Funding |

|

|

|

|

|

|

|

|

|

|

|

| Used By | 200,000+ | 730,000+ | 35,000,000+ | 1,000,000+ | 10,000,000+ | 400,000+ | 400,000+ | 200,000+ | 250,000+ | 60,000+ | 7,800,000+ |

| Benefits |

|

|

|

|

|

|

|

|

|

|

|

| Accounts |

|

|

|

|

|

|

|

|

|

|

|

| Platforms | MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading Central | MT4, MT5, R Mobile Trader, R StocksTrader, WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), Windows | eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, Web | MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play) | MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile Apps | MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play) | easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5 | Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingView | MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play) |

| Support |

|

|

|

|

|

|

|

|

|

|

|

| Learn More |

Sign

Up with icmarkets |

Sign

Up with roboforex |

Sign

Up with etoro |

Sign

Up with xtb |

Sign

Up with xm |

Sign

Up with pepperstone |

Sign

Up with avatrade |

Sign

Up with fpmarkets |

Sign

Up with easymarkets |

Sign

Up with spreadex |

Sign

Up with fxpro |

| Risk Warning | Losses can exceed deposits | Losses can exceed deposits | 61% of retail investor accounts lose money when trading CFDs with this provider. | 69% - 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.12% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | 75-95 % of retail investor accounts lose money when trading CFDs | 71% of retail investor accounts lose money when trading CFDs with this provider | Losses can exceed deposits | Your capital is at risk | 65% of retail CFD accounts lose money | 75.78% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider |

| Demo |

IC Markets Demo |

Roboforex Demo |

eToro Demo |

XTB Demo |

XM Demo |

Pepperstone Demo |

AvaTrade Demo |

FP Markets Demo |

easyMarkets Demo |

SpreadEx Demo |

FxPro Demo |

| Excluded Countries | US, IR, CA, NZ, JP | AU, BE, BQ, BR, CA, CW, CZ, DE, ES, EE, EU, FM, FR, FI, GW, ID, IR, JP, LR, MP, NL, PF, PL, RU, SE, SJ, SS, SL, SI, TL, TR, DO, US, IT, AT, PT, BG, HR, CY, DK, FL, GR, IE, LV, LT, MT, RO, SK, CH | ZA, ID, IR, KP, BE, CA, JP, SY, TR, IL, BY, AL, MD, MK, RS, GN, CD, SD, SA, ZW, ET, GH, TZ, LY, UG, ZM, BW, RW, TN, SO, NA, TG, SL, LR, GM, DJ, CI, PK, BN, TW, WS, NP, SG, VI, TM, TJ, UZ, LK, TT, HT, MM, BT, MH, MV, MG, MK, KZ, GD, FJ, PT, BB, BM, BS, AG, AI, AW, AX, LB, SV, PY, HN, GT, PR, NI, VG, AN, CN, BZ, DZ, MY, KH, PH, VN, EG, MN, MO, UA, JO, KR, AO, BR, HR, GL, IS, IM, JM, FM, MC, NG, SI, | US, IN, PK, BD, NG , ID, BE, AU | US, CA, IL, IR | AF, AS, AQ, AM, AZ, BY, BE, BZ, BT, BA, BI, CM, CA, CF, TD, CG, CI, ER, GF, PF, GP, GU, GN, GW, GY, HT, VA, IR, IQ, JP, KZ, LB, LR, LY, ML, MQ, YT, MZ, MM, NZ, NI, KP, PS, PR, RE, KN, LC, VC, WS, SO, GS, KR, SS, SD, SR, SY, TJ, TN, TM, TC, US, VU, VG, EH, ES, YE, ZW, ET | BE, BR, KP, NZ, TR, US, CA, SG | US, JP, NZ | US, IL, BC, MB, QC, ON, AF, BY, BI, KH, KY, TD, KM, CG, CU, CD, GQ, ER, FJ, GN, GW, HT, IR, IQ, LA, LY, MZ, MM, NI, KP, PW, PA, RU, SO, SS, SD, SY, TT, TM, VU, VE, YE | US, TR | US, CA, IR |

All FTSE 100 Investment Platforms in more detail

You can compare FTSE 100 Investment Platforms ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options, regulation and account types side by side.

We also have an indepth Top FTSE 100 Investment Platforms for 2025 article further below. You can see it now by clicking here

We have listed top FTSE 100 Investment Platforms below.

FTSE 100 Predictions List

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading CentralCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, R Mobile Trader, R StocksTrader, WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), WindowsCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Copy trading is a portfolio management service, provided by eToro (Europe) Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Crypto investments are risky and highly volatile. Tax may apply. Understand the risks here.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Funding methods

Bank transfer Credit Card PaypalPlatforms

eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, WebCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile AppsCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account XM Swap-Free account (XM Ultra Low Account) VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account Pro Account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingViewCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Learn more

Losses can exceed deposits

Losses can exceed deposits

Losses can exceed deposits