Top CFD Brokers - Contract for Difference (CFD) Brokers for 2026

We found 11 online brokers that are appropriate for Trading CFD.

CFD Brokers Guide

Analysis by Andrew Blumer, Updated and fact-checked by Senad Karaahmetovic, Last updated – February 03, 2026

CFD Brokers

I’ve spent considerable time exploring and trading CFDs (over 7/10 years although CFDs became really popular during COVID lockdown), and I want to share my honest insights with anyone new to this market. In my experience, CFD brokers are financial firms that let me and now you speculate on the price movements of various assets like stocks, indices, currencies, cryptocurrencies, ETFs, and commodities without owning them. With Contracts for Difference (CFDs), you can profit from both rising and falling markets by capturing the difference between an asset’s opening and closing prices.

When I open a CFD position, the broker facilitates the trade. If the market moves in my favor, I make a profit; if it moves against me, I incur a loss.

This is where leverage really proved powerful for me. During the recent market swings around major central bank rate decisions, I was able to open a $10,000 CFD position on gold with just about $500 in margin. When gold moved from $2,020 to $2,045, the profit felt significant relative to my capital. However, when the market quickly reversed the following week, losses increased just as fast. Different regions apply leverage limits, and from my experience, these limits can actually help reduce the impact of extreme volatility during unpredictable events.

CFD brokers usually make money through the spread, which is the difference between the buy and sell price. For example, when I traded EUR/USD recently, the buy price was 1.0942 while the sell price was 1.0940, meaning I started the trade slightly negative. Some brokers also charged commissions and overnight financing fees when I held positions on indices like the NASDAQ 100 overnight. After holding a position for several days, I noticed a few dollars deducted daily, which added up over time. From experience, understanding these costs upfront makes a big difference to long term trading results.

To be completely honest, while CFD trading offers flexibility and access to diverse markets, it also comes with very high significant risks. The use of leverage will rapidly magnify losses (not only potential gain), and in my own experience, CFD trading is not a trading method for everyone. I always carefully assess my experience level, risk tolerance, and trading objectives before jumping in. I encourage you to do the same and be aware of how the varying regulatory environments and leverage restrictions might impact your trades.

I’ve learned that different financial instruments offer varying leverage ranges. For forex, you might see from 30:1 up to 500:1, which can be very risky.

Stocks typically offer lower leverage, around 5:1 to 10:1, while indices usually fall between 20:1 and 50:1.

Commodities generally provide about 10:1 to 20:1, and cryptocurrencies can range from 20:1 up to 100:1 due to their high volatility.

Remember, higher leverage means higher potential gains but also larger losses. Always consider your risk tolerance and experience before trading.

I spoke to some very experienced CFD traders as to why CFD trading became so big, if you look some CFD brokers have seen huge growth of registered traders over the last 5/6 years. Basically when COVID lockdown became global, all live sports were effectively shutdown. This mean that gambling also shutdown. There was nothing to gamble on. You had lots of people at home which spare time. So they took to CFD trading various leveraged financial instruments. I've been around to see this huge growth in CFD brokers over the last 10 years.

As time has passed CFD brokers and trading has become very highly regulated. This is for good reason its really high risk of loss (80% upwards lose funded amounts to live CFD accounts) and CFD trading is not available in every country and each countries regulator has leverage limits on different financial instruments (to protect their retail traders from financial loss). This article is meant to give you insight into CFD brokers for you to understand if it fits with your investment strategy.

The content on a page is not intended for the residents and users in the USA.

Best CFD Brokers

IC Markets

When I first started scalping currency CFDs, I needed razor thin spreads and execution speeds that didn’t leave me waiting. That’s why I turned to IC Markets. Their spreads on EUR/USD regularly drop below 0.1 pips, and order fills happen in under 1 millisecond perfect for high frequency CFD traders like me. The platform’s deep liquidity and regulation by ASIC and CySEC give me confidence that my short term CFD strategies execute reliably and securely.

CFD Leverage at IC Markets

On IC Markets, the margin you can use depends on the CFD’s underlying asset and your regulatory status.

Retail Traders

Here’s what I see in my account for retail CFD trading:

- Major forex pairs (EUR/USD, USD/JPY): up to 500:1

- Minor forex pairs (AUD/NZD, EUR/CHF): up to 500:1

- Indices (S&P 500, FTSE 100): up to 200:1

- Commodities (Gold, Crude Oil): up to 500:1

- Equity CFDs: up to 20:1 (depending on the stock)

Professional Traders

After I qualified as a professional client, I unlocked even higher margin sometimes 500:1 or, in rare cases, 1,000:1 on select CFDs. Just remember, higher leverage amplifies both gains and losses.

eToro

As someone who learned CFD trading on the go, I love eToro for its CopyTrading feature. Watching top CFD traders and mirroring their positions taught me more in my first month than months of theory. Their community of 40 million investors means there’s always a strategy to explore, and the clean interface makes opening short or long CFD positions a breeze. Plus, with oversight from regulators like the FCA and CySEC, I feel my capital’s in safe hands.

eToro CFD Leverage Options

eToro’s margin levels adapt to each asset class and your residency.

Retail Traders

- Equity & ETF CFDs: up to 5:1

- Major Forex Pairs: up to 30:1

- Gold, Exotic Pairs, Major Indices: up to 20:1

- Other Commodities & Secondary Indices: up to 10:1

- CFD Cryptocurrencies: up to 2:1

Australian Professional Clients

My Aussie pro trader friends trade with similar margins but can sometimes negotiate higher leverage based on trading volume.

U.S. Market Restrictions

- No CFDs in the U.S.: eToro U.S. accounts trade crypto directly at 1:1 leverage.

Direct Asset Trading

- 1:1 Leverage: If you prefer outright ownership without overnight CFD financing fees, you can buy shares or ETFs directly.

RoboForex

I chose RoboForex when I wanted the freedom to switch between MT4, MT5, and cTrader for my CFD orders. The execution is almost instant vital when you’re hedging equity CFD positions. With maximum forex leverage up to 1:2,000 on some accounts, I can scale my CFD exposure precisely. But I always remind myself: those sky high margins can cut both ways.

RoboForex CFD Leverage

Here’s the leverage I see across their account types:

| Account Type | Max Leverage (Forex CFDs) | Max Leverage (Other CFDs) |

|---|---|---|

| Pro, ProCent | 1:2000 | Varies by instrument |

| ECN | 1:500 | Varies by instrument |

| R Trader, Prime | 1:300 | Varies by instrument |

| Standard, Cent | 1:2000 | Varies by instrument |

Notes:

- Equity, index, and commodity CFD margins are lower check the RoboForex site for specifics.

- Higher leverage = higher risk. Always size your CFD positions carefully.

XTB

When I wanted to deepen my CFD strategy, XTB’s research tools became my go to. Their proprietary xStation platform gives me real time market heatmaps, CFD sentiment data, and one click hedging. I appreciate how XTB blends education webinars, tutorials and trading, so I’m always learning as I trade CFDs under FCA, KNF, and DFSA oversight.

XTB CFD Leverage Options

Depending on where you’re based, XTB sets these max margins:

| Region | Retail Clients | Professional Clients |

|---|---|---|

| EU/UK | Up to 1:30 | Up to 1:500* |

| Non EU | Up to 1:500 | |

| MENA | Up to 1:30 via DFSA regulated entity | |

Notes:

- * Professional leverage requires meeting certain balance and experience thresholds.

- Always factor in margin requirements before opening large CFD positions.

XM

For me, XM’s standout feature is the 24/5 support and its multilingual team crucial when I’m tweaking tight CFD spreads across global markets. Their educational webinars demystify margin calls and stop out levels on CFDs, helping me manage risk more confidently. With regulation across ASIC, CySEC, and the FCA, XM combines robust compliance with a broad CFD catalog.

XM CFD Leverage Options

Here’s how their margin levels break down for clients in Australia, the UK, Cyprus, and Dubai:

- Major Forex CFDs: up to 1:30

- Minor Forex, Gold, Major Indices: up to 1:20

- Other Commodities & Secondary Indices: up to 1:10

- Equity CFDs & Alternative Instruments: up to 1:5

Notes:

- Always monitor your used margin percentage to avoid forced liquidations.

- Regulators cap leverage to protect retail CFD traders from excessive risk.

AvaTrade

I appreciate AvaTrade’s no commission model when I’m opening multiple CFD positions throughout the day. Their AvaSocial feed keeps me in touch with other CFD traders’ insights, and the AvaTradeGo mobile app lets me manage positions on the move. Regulated by ASIC, CBI, and FSCA, AvaTrade balances cost efficiency with reliable execution on FX, commodities, indices, and more.

AvaTrade CFD Leverage Limits

Depending on your location and instrument, AvaTrade offers these maximum margins:

- Major Forex CFDs: up to 30:1

- Minor Forex, Gold, Major Indices: up to 20:1

- Other Commodities & Secondary Indices: up to 10:1

- Equity CFDs: up to 5:1

- Crypto CFDs: up to 2:1

Notes:

- AvaTrade fixes leverage per asset you can’t adjust it, so use stop losses wisely.

- Check local rules; some regulators impose tighter caps on CFD margin.

FP Markets

What drew me to FP Markets was its choice of platforms MT4, MT5, cTrader, and TradingView integration for trading CFDs across multiple asset classes. Competitive spreads on major forex CFDs (often under 0.1 pips) and ASIC regulation mean I can execute both short term and swing CFD trades with confidence.

FP Markets CFD Leverage Options

Here’s a quick look at their maximum margins by instrument:

- Major Forex CFDs: up to 500:1

- Minor Forex, Gold, Key Indices: up to 20:1

- Other Commodities & Secondary Indices: up to 10:1

- Equity CFDs: up to 5:1

- Crypto CFDs: up to 50:1

Professional Leverage

As a professional trader you can apply for up to 1,000:1 on select CFDs, but I’d caution that such leverage demands rigorous risk controls.

Risk Notes:

- Higher leverage amplifies both gains and losses size your CFD exposure responsibly.

- Use stop loss and take profit orders to manage margin calls.

- Regulatory caps may reduce available leverage in certain jurisdictions.

Pepperstone

When I needed ultra tight spreads and execution that could keep up with my automated CFD strategies, Pepperstone was my top pick. Their bridge to cTrader and MetaTrader means I never miss an arbitrage opportunity, and regulation by ASIC, FCA, and SCB gives me peace of mind.

Pepperstone CFD Leverage Overview

Leverage depends on your jurisdiction and asset all set by local regulators:

ASIC (Australia) & SCB (Bahamas)

- Major Forex CFDs: up to 30:1

- Indices, Precious Metals, Commodities: up to 20:1

- Equity CFDs: up to 5:1

EU/EEA (CySEC)

- Major Forex CFDs: up to 30:1

- Exotic Forex, Gold, Leading Indices: up to 20:1

- Other Commodities: up to 10:1

- Equity CFDs: up to 5:1

- Crypto CFDs: up to 2:1

DFSA (Dubai)

Clients trade under similar margins to ASIC/SCB, with local adjustments as required.

Professional Clients

Under certain regulators, professional CFD traders can access up to 500:1 on forex. Always weigh the amplified risk before dialing up your margin.

Risk Considerations

- Leverage magnifies both profits and losses use risk controls like guaranteed stop orders.

- Margin requirements can shift with market volatility keep an eye on your used margin.

CFD Definition

CFDs (Contracts for Difference) are a leveraged trading strategy that lets you speculate on the price movements of stocks, forex, indices, commodities, and cryptocurrencies without owning them. Instead, you trade contracts based on the asset's value.

Leverage allows you to control larger positions with a smaller deposit. For example, a £1,000 deposit with 30:1 leverage gives you £30,000 in market exposure. However, CFD trading carries high risk profits are yours if the trade moves in your favor, but losses can exceed your deposit if it goes against you.

Experienced traders often use CFDs to hedge portfolio risks, but it's not beginner friendly. CFDs are purely speculative: you go short if you expect the price to fall and long if you expect it to rise. Remember, CFDs are contracts to exchange the difference between an asset’s opening and closing price you never own the asset itself.

What Is Leverage? How Does It Work?

Leverage allows traders to borrow funds from a broker to amplify their market exposure beyond their initial capital. It enables larger position sizes, increasing both potential profits and losses.

When using leverage, a trader deposits a margin collateral for the borrowed funds. The leverage ratio defines the multiple of exposure relative to the margin. For example, with 10:1 leverage, a trader controls £10,000 in assets with just £1,000 of their own capital.

While leverage can enhance profits, it also magnifies risk losses can exceed the initial investment. Effective risk management is essential, with tools like stop loss orders helping to limit downside exposure. Traders should align leverage with their risk tolerance, strategy, and a solid understanding of market dynamics.

What Are The Different Kinds Of Leveraged Products?

Leveraged trading relies on derivatives, allowing traders to speculate on asset price movements without owning the asset. The main leveraged products include:

Spread Betting

Spread betting in the CFD world lets you speculate on price movements without owning the underlying asset. For example, you might place a spread bet on a Gold CFD at £0.10 per ounce: if gold rises 8 ounces, you make £0.80 (8 × £0.10); if it falls, you lose the same amount.

Leveraged ETFs

CFDs on leveraged ETFs allow you to capture 2× or 3× daily index moves without buying the ETF itself. For instance, a 2× S&P 500 ETF CFD with 5% margin means a 1% index gain nets you 2% on your CFD stake.

Margin Trading

Margin trading underpins all CFD positions borrowing from your broker to increase exposure. If you use 20:1 margin on a EUR/USD CFD, £100 of equity controls £2,000 of currency; a 0.5% move equals a £10 gain or loss.

Options

Options on CFDs give you the right, but not the obligation, to open a CFD at a set price. For example, buying a call option on a Tesla CFD for a £3 premium lets you enter the CFD at $700 before expiry your maximum loss is the £3 premium.

Futures Contracts

Futures CFDs mirror standardised futures, requiring only a fraction of the notional as margin. A Crude Oil futures CFD with 5% margin lets you speculate on 1,000 barrels (worth $60,000) with just $3,000 upfront.

Which Markets Can Leverage Be Used On?

Leverage in CFD trading lets you control larger positions with a fraction of the capital. Here’s how it applies across different CFD markets, with quick trade examples:

CFD Indices

Index CFDs track baskets like the DAX 30, FTSE 100 or S&P 500.Example: Going long a DAX 30 CFD at 1:100 leverage means you control €10,000 of exposure with just €100 margin. Or you might short a FTSE 100 CFD at 1:200 if you expect a pullback.

CFD Shares

Share CFDs cover stocks from blue chips to small caps. Example: Buying 50 Meta (Facebook) CFDs at 1:20 lets you control $10,000 worth of stock with only $500 margin. Conversely, you could short 500 penny stock CFDs at 1:10 when you anticipate a drop.

Forex CFDs

Forex CFDs let you trade currency pairs like EUR/USD or GBP/JPY. Example: Scalping EUR/USD with 1:500 leverage allows you to open a $50,000 position with just $100 of margin, aiming for small pip gains. For swing trades, you might use 1:100 on GBP/JPY to manage risk over several days.

Commodity CFDs

Commodity CFDs include gold, crude oil, natural gas and more. Example: A gold CFD at 1:200 leverage lets you gain exposure to 10 oz (≈$18,000) with only $90 margin. Or you could trade a crude oil CFD at 1:100, speculating on a rise to $75/barrel.

Crypto CFDs

Crypto CFDs let you speculate on coins like Bitcoin and Ethereum without owning them. Note: Crypto CFDs are banned for UK retail clients under FCA rules but available in other regions. Example: Outside the UK, you might take a 1:20 leveraged long on Bitcoin CFD, controlling 0.5 BTC (€15,000) with €750 margin, while using tight stop losses to manage volatility.

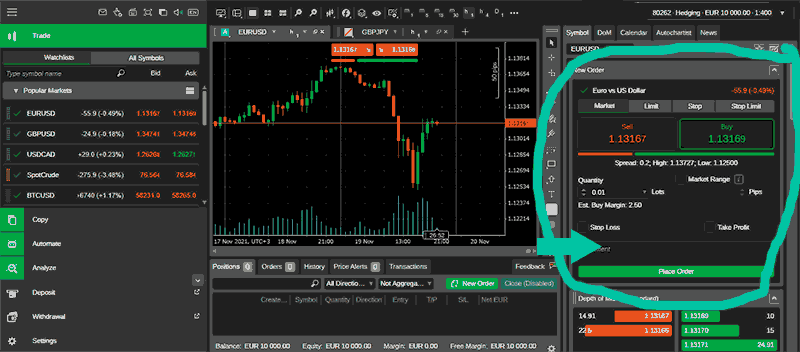

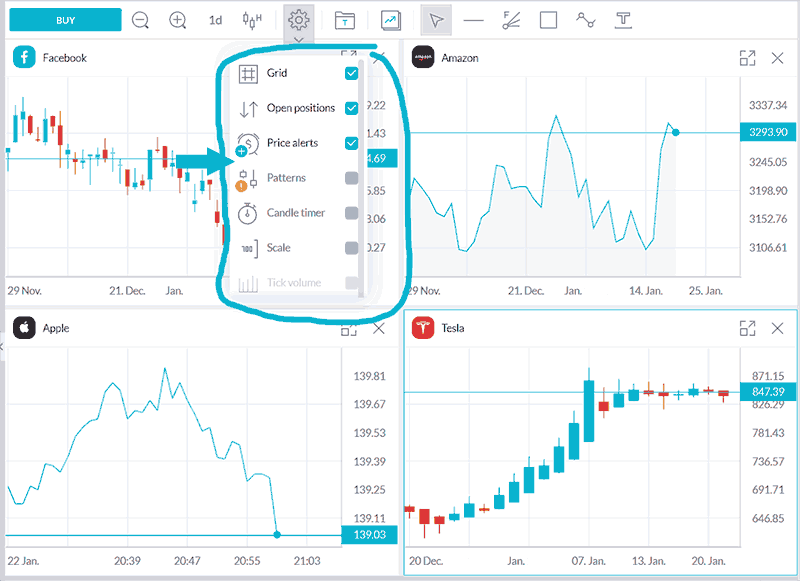

What Do CFD Trading Platforms Look Like?

CFD trading platforms are software applications that provide access to global financial markets, allowing traders to execute trades on stocks, indices, currencies, and commodities. These platforms, offered by brokers, are available on desktop and mobile devices, ensuring seamless market access. While their designs vary, most feature intuitive navigation, live data, and fast trade execution to meet the needs of both novice and experienced traders.

At their core, CFD platforms include a professional trading interface where users can manage accounts, monitor live market movements, and execute trades efficiently. They provide advanced charting tools with multiple timeframes, technical indicators, and drawing tools to analyze trends and identify trading opportunities. A built in market scanner lists tradable assets alongside live pricing, spreads, and relevant market insights. These features help traders make informed decisions quickly.

Risk management is a critical component of CFD trading platforms. They offer multiple order types, including market, limit, and stop loss orders, giving traders greater control over trade execution and risk exposure. Many platforms also integrate automated trading options through expert advisors or algorithmic strategies, helping traders optimize their approach.

Beyond execution tools, leading CFD platforms provide educational resources and customer support. These include video tutorials, webinars, and market analysis reports to help traders refine their skills. Live support is typically available via chat, phone, or email, ensuring traders receive assistance when needed.

Whether using MetaTrader, cTrader, or proprietary broker platforms, CFD traders rely on these tools to access global markets, manage positions, and execute trades efficiently. The right platform enhances trading precision, providing the necessary insights and functionality to navigate the fast paced world of CFDs.

What Kinds of Investors Deal in CFDs?

CFDs attract a wide range of investors, each with distinct strategies. Speculators trade CFDs to profit from price fluctuations without owning the underlying asset, relying on market analysis to anticipate movements. Hedgers use CFDs to protect their portfolios from potential losses, balancing exposure in volatile markets.

Day traders execute multiple trades within a single day, capitalizing on small price changes, while swing traders hold positions for days or weeks to profit from broader market trends. Arbitrageurs exploit price discrepancies between related assets, using CFDs to gain an edge in different markets.

Each investor type uses CFDs differently, leveraging their flexibility to align with risk tolerance and financial objectives. Whether for speculation, risk management, or shorter term trading, CFDs offer dynamic opportunities across global markets.

The Advantages and Disadvantages of CFD Trading

As experienced traders, we understand why CFDs remain a preferred choice: flexibility, diverse market access, and short term trading efficiency. Below are the key benefits of CFD trading:

| Advantage | Description & Quick Example |

|---|---|

| Profit from Falling Markets |

CFDs let you capitalize on both rising and falling markets. Short selling allows you to profit when prices decline, unlike traditional asset ownership. Example: Shorting a DAX CFD before a negative German PMI release and booking profit as the index falls 2%. |

| Leverage Your Capital |

Trade larger positions with a smaller deposit, increasing profit potential. However, higher leverage also amplifies risks, requiring disciplined risk management. Example: Using 10× leverage to open a €10,000 EUR/USD CFD position with only €1,000 margin. |

| Familiar Trading Structure |

CFDs mirror traditional trading by tracking asset prices without ownership. You buy or sell contracts, setting position sizes based on the number of contracts. Example: Buying a gold CFD to follow spot gold movements, just as you would buy physical bullion. |

| Access to Multiple Markets |

Trade various asset classes like indices, stocks, forex, and commodities from a single platform, ensuring diversified investment opportunities. Example: Simultaneously holding an S&P 500 CFD, a crude oil CFD, and a EUR/GBP CFD in your portfolio. |

| Hedging Opportunities |

Protect your portfolio by hedging against potential losses. A short CFD position can offset declining asset values, mitigating downside risks. Example: Holding a short FTSE 100 CFD to offset a long UK share portfolio during Brexit volatility. |

| Tax Efficiency |

CFDs are exempt from UK stamp duty, reducing trading costs. However, tax implications vary by jurisdiction, so professional tax advice is recommended. Example: Saving 0.5% stamp duty by trading a FTSE 250 CFD instead of buying the outright shares. |

CFDs also provide quick market entry and execution with lower costs than traditional brokerage services. However, comparing broker fees ensures the best trading conditions.

| Disadvantage | Description & Quick Example |

|---|---|

| High Risk and Leverage |

CFDs use leverage, which can amplify both profits and losses. In extreme cases, losses can exceed your initial investment. Example: A 5× leveraged crude oil CFD loses 20%, resulting in a 100% wipeout of your €2,000 margin. |

| Market Risk |

CFD markets are highly volatile. Sudden price movements can result in substantial losses, especially for unprotected positions. Example: A flash crash in forex wipes 3% off EUR/USD within seconds, hitting your stop loss before execution. |

| Overnight Margin Costs |

Holding CFD positions overnight incurs interest fees, making long term trades costly and reducing profitability over time. Example: Paying €15 in overnight financing on a leveraged Nasdaq CFD held for five nights. |

| Spread Costs |

The spread the difference between buy and sell prices can be wider than in traditional markets, affecting trade execution and costs. Example: A 1.5 point spread on a EUR/JPY CFD eats into small intraday gains. |

| Regulatory Risks |

CFD trading is banned or restricted in some countries. Traders must verify local regulations before engaging in CFD markets. Example: A U.S. trader cannot access CFDs due to SEC restrictions. |

| Counterparty Risk |

CFDs are traded over the counter (OTC), meaning traders rely on their broker’s financial stability. If a broker fails, funds may be at risk. Example: Funds frozen when a small offshore broker went insolvent. |

| Lack of Ownership |

Since CFDs don't involve asset ownership, traders miss out on benefits like dividends, voting rights, or shareholder privileges. Example: No dividend payout when holding a long UK bank CFD through its ex dividend date. |

| Psychological Risks |

The accessibility and leverage of CFDs can lead to overtrading and emotional decision making, increasing the risk of financial losses. Example: Overtrading a volatile Bitcoin CFD after a series of small wins, wiping out profits in one large loss. |

CFD Trading For Beginners

Starting with CFDs requires a solid understanding of the market. Many brokers provide educational resources to help beginners grasp CFD trading fundamentals.

Choosing a CFD Market

Selecting the right market commodities, currencies, or bonds is crucial. Trade assets you understand to minimize risk. CFDs allow leveraged trading without asset ownership, meaning you speculate on price movements without opening a share dealing account.

Leverage lets traders open larger positions with a small deposit. For example, a 10% margin allows a £100 balance to control a £1,000 trade. However, leverage magnifies both gains and losses.

Research Tools for Trading CFDs

Top CFD brokers offer financial analysis tools to research market trends. Conduct due diligence before buying or selling. CFD platforms display two prices: the first is the sell price, and the second is the buy price.

Trade Size and Margin

CFD brokers require a minimum margin. For instance, with a 5% margin, a £100 deposit supports a £2,000 position. Understanding margin requirements is essential to manage risk.

Stops and Limits

Risk management tools like stop loss and limit orders help protect your capital. A stop loss set at 5% below entry price limits losses to that percentage, while limit orders secure profits at predefined levels.

Choosing a Reliable CFD Broker

Regulated brokers ensure security. Platforms licensed by financial authorities, such as the Financial Conduct Authority (FCA), offer better protection, with client funds insured up to €85,000. Verify a broker’s credentials before depositing funds.

CFD Broker Customer Support

In a service focused industry, high quality customer support is essential for client retention. Well established brokers typically offer superior support compared to newer entrants. When evaluating a broker's customer service, consider the following factors:

- Service Hours: Check if support is available 24/5 or 24/7, especially if you trade global markets.

- Support Channels: Reliable brokers offer multiple contact options, including email, live chat, and phone support.

- Language Availability: Ensure the broker provides support in your preferred language for effective communication.

- Response Time: Test how quickly customer support responds to queries, especially during peak trading hours.

Strong customer support enhances the trading experience, ensuring timely assistance when issues arise.

Available Financial Instruments

CFD platforms offer varying asset selections. Ensure the broker supports the indices, forex pairs, stocks, or commodities you plan to trade. Check their website or contact support for detailed information.

Managing Your CFD Trading Budget

Trade only what you can afford to lose. CFDs are very high risk, and market volatility can lead to losses. Factor in trading costs, including:

- Commission – The CFD broker’s primary fee.

- Spread – The difference between the bid and ask price.

- Swap Rate – Overnight holding costs for open positions.

Trading Platform Interface and Features

A good CFD platform should be user friendly, fast, and feature rich. Look for platforms with live news feeds, analytical tools, and a clean interface. Beginners should test platforms using demo accounts before committing real funds.

How CFD Brokers Earn Revenue

When comparing CFD brokers, understanding their revenue model helps assess trading costs. Brokers primarily earn through spreads, commissions, financing fees, and hedging strategies.

Spreads and Commissions

Most brokers profit from spreads the difference between the market price and the quoted buy/sell price. This acts as an embedded fee for executing trades. Some brokers also charge commissions, taking a percentage of each transaction, though many have waived these fees to stay competitive.

Financing Fees

Leverage and margin trading involve borrowing funds from the broker, generating interest based income. Overnight positions often incur swap fees, adding to the broker’s revenue.

Hedging Strategies

Some brokers hedge against client positions to offset risk. When traders profit, the broker's hedged position helps balance potential losses.

Additional Fees

Other revenue sources include withdrawal fees, deposit fees, and inactivity charges, which vary by platform.

CFD Regulation

In the United Kingdom, CFD brokers are licensed by the Financial Conduct Authority (FCA). In July 2025 the FCA introduced tighter leverage caps on retail accounts to curb excessive risk, and in May 2024 it launched a consultation on enhanced reporting requirements for algorithmic trading.

Traders should always choose CFD brokers regulated by reputable authorities. Regulators protect users from fraud and maintain market integrity. In early 2025 several jurisdictions updated their rulebooks to include mandatory negative balance protection and live trade surveillance.

European Regulation

The European Securities and Markets Authority (ESMA) provides guidelines to national regulators like the UK’s FCA and Cyprus’ CySEC. In June 2025 ESMA published its latest product intervention measures, restricting certain very high risk CFD offerings. Other European regulators such as Germany’s BaFin and France’s Autorité des marchés financiers also issued new guidance in late 2024 on leverage limits and client suitability assessments.

Regulation in Other Regions

In Dubai, CFD brokers fall under the supervision of the Dubai Financial Services Authority (DFSA) and the UAE’s Central Bank. The DFSA rolled out a licensing update in March 2025 requiring all trading platforms to implement stress testing frameworks. Switzerland regulates brokers through the Swiss Financial Market Supervisory Authority (FINMA), which in January 2025 mandated quarterly disclosures of risk management practices.

CFD Trading in the United States

CFD trading remains highly restricted in the US, though a handful of offshore platforms continue to accept USA based clients under limited conditions. In April 2025 the US Commodity Futures Trading Commission (CFTC) issued a warning about unregistered CFD offerings. European and UK traders can trade CFDs on US listed stocks through regulated local brokers, but US residents often need to explore alternative derivatives or spread betting products.

Before choosing a broker, verify that they are regulated in your jurisdiction to ensure compliance and security.

CFD Brokers for Penny Stocks

CFD brokers offering penny stocks allow traders to speculate on the price movements of low priced shares without owning them. These platforms attract traders looking to capitalize on the high volatility of small cap and microcap stocks. However, trading penny stocks via CFDs amplifies both potential gains and risks due to the inherent volatility and leverage involved.

When selecting a CFD broker for penny stocks, consider key factors such as regulatory compliance, available stock range, trading fees, platform usability, and customer support quality. Given the very high risk nature of penny stocks and leveraged trading, conducting thorough due diligence is essential before engaging in these markets.

CFD Brokers Verdict

After more than ten years in CFD trading, I have learned that leverage is both the greatest advantage and the greatest danger. The ability to control a position many times larger than your deposit can turn a small move into a life changing gain, but it can just as easily wipe out your capital in hours. I have traded with 30:1 leverage in the UK, 500:1 in offshore accounts, and even 1,000:1 as a professional client. The higher the leverage, the smaller the margin required, but the less room you have for error. A one percent move against you with 100:1 leverage can clear an entire account.

Recent events have shown how leverage interacts with volatility. In April 2025, silver surged thirty percent in two days. Traders using 50:1 leverage who entered early multiplied their gains dramatically, but anyone entering late and holding overnight faced violent pullbacks that triggered margin calls. In June 2025, the UK’s approval of a Bitcoin ETF saw crypto CFDs move over ten percent within hours. With leverage of 20:1, that meant a swing of 200% on margin enough to double or wipe an account in a single session.

My advice is to view leverage as a precision instrument, not a gamble multiplier. Start with the lowest ratio that still fits your strategy, and scale only when your track record proves you can handle the swings. Always know your broker’s margin requirements, use stop losses, and never risk more than you can afford to lose. In my experience, the traders who last in CFDs are not the ones who take the biggest leverage — they are the ones who survive the bad days and compound on the good ones.

We have conducted extensive research and analysis on over multiple data points on CFD Brokers - Contract for Difference (CFD) Brokers to present you with a comprehensive guide that can help you find the most suitable CFD Brokers - Contract for Difference (CFD) Brokers. Below we shortlist what we think are the best CFD after careful consideration and evaluation. We hope this list will assist you in making an informed decision when researching CFD Brokers - Contract for Difference (CFD) Brokers.

Reputable CFD Brokers Checklist

Selecting a reliable and reputable online CFD trading brokerage involves assessing their track record, regulatory status, customer support, processing times, international presence, and language capabilities. Considering these factors, you can make an informed decision and trade CFD more confidently.

Selecting the right online CFD trading brokerage requires careful consideration of several critical factors. Here are some essential points to keep in mind:

- Ensure your chosen CFD broker has a solid track record of at least two years in the industry.

- Verify that the CFD broker has a customer support team of at least 15 members responsive to queries and concerns.

- Check if the CFD broker operates under the regulatory framework of a jurisdiction that can hold it accountable for any misconduct or resolve disputes fairly and impartially.

- Ensure that the CFD broker can process deposits and withdrawals within two to three days, which is crucial when you need to access your funds quickly.

- Look for CFD brokers with an international presence in multiple countries, offering its clients local seminars and training programs.

- Ensure the CFD broker can hire staff from diverse locations worldwide who can communicate fluently in your local language.

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Compare Key Features of CFD in Our Brokerage Comparison Table

When choosing a broker for CFD trading, it's essential to compare the different options available to you. Our CFD brokerage comparison table below allows you to compare several important features side by side, making it easier to make an informed choice.

- Minimum deposit requirement for opening an account with each CFD broker.

- The funding methods available for CFD with each broker.

- The types of instruments you can trade with each CFD broker, such as forex, stocks, commodities, and indices.

- The trading platforms each CFD broker provides, including their features, ease of use, and compatibility with your devices.

- The spread type (if applicable) for each CFD broker affects the cost of trading.

- The level of customer support each CFD broker offers, including their availability, responsiveness, and quality of service.

- Whether each CFD broker offers Micro, Standard, VIP, or Islamic accounts to suit your trading style and preferences.

By comparing these essential features, you can choose a CFD broker that best suits your needs and preferences for CFD. Our CFD broker comparison table simplifies the process, allowing you to make a more informed decision.

Top 15 CFD of 2026 compared

Here are the top CFD.

Compare CFD brokers for min deposits, funding, used by, benefits, account types, platforms, and support levels. When searching for a CFD broker, it's crucial to compare several factors to choose the right one for your CFD needs. Our comparison tool allows you to compare the essential features side by side.

All brokers below are CFD. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more CFD that accept CFD clients.

| Broker |

IC Markets

|

Roboforex

|

eToro

|

XTB

|

XM

|

Pepperstone

|

AvaTrade

|

FP Markets

|

EasyMarkets

|

SpreadEx

|

FXPro

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rating | |||||||||||

| Regulation | International Capital Markets Pty Ltd (Australia) (ASIC) Australian Securities & Investments Commission Licence No. 335692, Seychelles Financial Services Authority (FSA) (SD018), IC Markets (EU) Ltd (CySEC) Cyprus Securities and Exchange Commission with License No. 362/18, Capital Markets Authority(CMA) Kenya IC Markets (KE) Ltd, Securities Commission of The Bahamas (SCB) IC Markets (Bahamas) Ltd | RoboForex Ltd is authorised and regulated by the Financial Services Commission (FSC) of Belize under licence No. 000138/32, under the Securities Industry Act 2021, RoboForex Ltd is an (A category) member of The Financial Commission, also RoboForex Ltd is a participant of the Financial Commission Compensation Fund | FCA (Financial Conduct Authority) eToro (UK) Ltd (FCA reference 583263), eToro (Europe) Ltd CySEC (Cyprus Securities Exchange Commission), ASIC (Australian Securities and Investments Commission) eToro AUS Capital Limited ASIC license 491139, CySec (Cyprus Securities and Exchange Commission under the license 109/10), FSAS (Financial Services Authority Seychelles) eToro (Seychelles) Ltd license SD076, eToro (ME) Limited (ADGM) Abu Dhabi (UAE) number 220073, eToro (Europe) Ltd (AMF) Autorité des marchés financiers as a digital assets provider France | FCA (Financial Conduct Authority reference 522157) XTB Limited, CySEC (Cyprus Securities and Exchange Commission reference 169/12), DFSA (Dubai Financial Services Authority XTB MENA Limited licensed 8 July 2021), FSA (Financial Services Authority Seychelles license number SD148), FSCA (Financial Sector Conduct Authority XTB Africa (Pty) Ltd licensed 10 August 2021), KNF (Komisja Nadzoru Finansowego Polish Financial Supervision Authority) | Financial Sector Conduct Authority (FSCA) (49976) XM ZA (Pty) Ltd, Financial Services Commission (FSC) (000261/27) XM Global Limited, Cyprus Securities and Exchange Commission (CySEC) (license 120/10) Trading Point of Financial Instruments Ltd, Australian Securities and Investments Commission (ASIC) (number 443670) Trading Point of Financial Instruments Pty Ltd | Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), Cyprus Securities and Exchange Commission (CySEC), Federal Financial Supervisory Authority (BaFin), Dubai Financial Services Authority (DFSA), Capital Markets Authority of Kenya (CMA), Pepperstone Markets Limited is incorporated in The Bahamas (number 177174 B), Licensed by the Securities Commission of The Bahamas (SCB) number SIA-F217 | Australian Securities and Investments Commission (ASIC) Ava Capital Markets Australia Pty Ltd (406684), South African Financial Sector Conduct Authority (FSCA) Ava Capital Markets Pty Ltd (45984), Financial Services Agency (Japan FSA) Ava Trade Japan K.K. (1662), Financial Futures Association of Japan (FFAJ) Ava Trade Japan K.K. (1574), Abu Dhabi Global Markets (ADGM) / Financial Regulatory Services Authority (FRSA) Ava Trade Middle East Ltd (190018), Central Bank of Ireland (C53877) AVA Trade EU Ltd, Polish Financial Supervision Authority (KNF) AVA Trade EU Ltd (branch authorisation), British Virgin Islands Financial Services Commission (BVI) Ava Trade Markets Ltd (SIBA/L/13/1049), Israel Securities Authority (ISA) ATrade Ltd (514666577), Financial Superintendence of Colombia (SFC 0261 of 2024), Investment Industry Regulatory Organization of Canada through Friedberg Direct (IIROC) | CySEC (Cyprus Securities and Exchange Commission) (371/18), ASIC AFS (Australian Securities and Investments Commission) (286354), FSP (Financial Sector Conduct Authority in South Africa) (50926), Financial Services Authority Seychelles (FSA) (SD 130) | Easy Forex Trading Ltd is regulated by CySEC (License Number 079/07). Easy Forex Trading Ltd is the only entity that onboards EU clients, easyMarkets Pty Ltd is regulated by ASIC (AFS License No. 246566), EF Worldwide Ltd in Seychelles is regulated by FSA (License Number SD056), EF Worldwide Ltd in the British Virgin Islands is regulated by FSC (License Number SIBA/L/20/1135) | FCA (Financial Conduct Authority) (190941), Gambling Commission (Great Britain) (8835), licence in Ireland as remote bookmaker for fixed odds betting licence number 1016176 | FCA (Financial Conduct Authority) (509956), CySEC (Cyprus Securities and Exchange Commission) (078/07), FSCA (Financial Sector Conduct Authority) (45052), SCB (Securities Commission of The Bahamas) (SIA-F184), FSA (Financial Services Authority of Seychelles) (SD120) |

| Min Deposit | 200 | 10 | 50 | No minimum deposit | 5 | No minimum deposit | 100 | 100 | 25 | No minimum deposit | 100 |

| Funding |

|

|

|

|

|

|

|

|

|

|

|

| Used By | 200,000+ | 730,000+ | 40,000,000+ | 2,000,000+ | 15,000,000+ | 830,000+ | 400,000+ | 200,000+ | 250,000+ | 60,000+ | 11,200,000+ |

| Benefits |

|

|

|

|

|

|

|

|

|

|

|

| Accounts |

|

|

|

|

|

|

|

|

|

|

|

| Platforms | MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading Central | MT4, MT5, R Mobile Trader, R StocksTrader, WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), Windows | eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, Web | MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play) | MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile Apps | MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play) | MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play) | easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5 | Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingView | MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play) |

| Support |

|

|

|

|

|

|

|

|

|

|

|

| Learn More |

Sign

Up with icmarkets |

Sign

Up with roboforex |

Sign

Up with etoro |

Sign

Up with xtb |

Sign

Up with xm |

Sign

Up with pepperstone |

Sign

Up with avatrade |

Sign

Up with fpmarkets |

Sign

Up with easymarkets |

Sign

Up with spreadex |

Sign

Up with fxpro |

| Risk Warning | Losses can exceed deposits | Losses can exceed deposits | 46% of retail investor accounts lose money when trading CFDs with this provider. | 70% - 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74.48% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. | 72-95 % of retail investor accounts lose money when trading CFDs | 57% of retail investor accounts lose money when trading CFDs with this provider | Losses can exceed deposits | Your capital is at risk | 62% of retail CFD accounts lose money | 74% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider |

| Demo |

IC Markets Demo |

Roboforex Demo |

eToro Demo |

XTB Demo |

XM Demo |

Pepperstone Demo |

AvaTrade Demo |

FP Markets Demo |

easyMarkets Demo |

SpreadEx Demo |

FxPro Demo |

| Excluded Countries | US, IR, CA, NZ, JP | AU, BE, BQ, BR, CA, CW, CZ, DE, ES, EE, EU, FM, FR, FI, GW, ID, IR, JP, LR, MP, NL, PF, PL, RU, SE, SJ, SS, SL, SI, TL, TR, DO, US, IT, AT, PT, BG, HR, CY, DK, FL, GR, IE, LV, LT, MT, RO, SK, CH | ZA, ID, IR, KP, BE, CA, JP, SY, TR, IL, BY, AL, MD, MK, RS, GN, CD, SD, SA, ZW, ET, GH, TZ, LY, UG, ZM, BW, RW, TN, SO, NA, TG, SL, LR, GM, DJ, CI, PK, BN, TW, WS, NP, SG, VI, TM, TJ, UZ, LK, TT, HT, MM, BT, MH, MV, MG, MK, KZ, GD, FJ, PT, BB, BM, BS, AG, AI, AW, AX, LB, SV, PY, HN, GT, PR, NI, VG, AN, CN, BZ, DZ, MY, KH, PH, VN, EG, MN, MO, UA, JO, KR, AO, BR, HR, GL, IS, IM, JM, FM, MC, NG, SI, | US, IN, PK, BD, NG , ID, BE, AU | US, CA, IL, IR | AF, AS, AQ, AM, AZ, BY, BE, BZ, BT, BA, BI, CM, CA, CF, TD, CG, CI, ER, GF, PF, GP, GU, GN, GW, GY, HT, VA, IR, IQ, JP, KZ, LB, LR, LY, ML, MQ, YT, MZ, MM, NZ, NI, KP, PS, PR, RE, KN, LC, VC, WS, SO, GS, KR, SS, SD, SR, SY, TJ, TN, TM, TC, US, VU, VG, EH, ES, YE, ZW, ET | BE, BR, KP, NZ, TR, US, CA, SG | US, JP, NZ | US, IL, BC, MB, QC, ON, AF, BY, BI, KH, KY, TD, KM, CG, CU, CD, GQ, ER, FJ, GN, GW, HT, IR, IQ, LA, LY, MZ, MM, NI, KP, PW, PA, RU, SO, SS, SD, SY, TT, TM, VU, VE, YE | US, TR | US, CA, IR |

All CFD in more detail

You can compare CFD ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options, regulation and account types side by side.

We also have an indepth Top CFD for 2026 article further below. You can see it now by clicking here

We have listed top CFD below.

CFD Brokers List

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading CentralCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, R Mobile Trader, R StocksTrader, WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), WindowsCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 46% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Crypto investments are risky and may not suit retail investors; you could lose your entire investment. Understand the risks here.

Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Funding methods

Bank transfer Credit Card PaypalPlatforms

eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, WebCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, Mirror Trader, Web Trader, Tablet, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT5, MT5 WebTrader, XM Apple App for iPhone, XM App for Android Google Play, Tablet: MT5 for iPad, MT5 for Android Google Play, XM App for iPad, XM App for iOS (App Store), Android (Google Play), Mobile AppsCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account XM Swap-Free account (XM Ultra Low Account) VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader,WebTrader, TradingView, Windows, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account Pro Account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, TradingView, cTrader, WebTrader, Mobile Trader, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

easyMarkets App, Mobile Apps, iOS (App Store), Android (Google Play), Web Platform, TradingView, MT4, MT5Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Web, Mobile Apps, iOS (App Store), Android (Google Play), iPad App, iPhone App, TradingViewCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, cTrader, FxPro WebTrader, FxPro Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Learn more

Losses can exceed deposits

Losses can exceed deposits

Losses can exceed deposits