Libertex review

Libertex is a Multi-Assets Trading Platform with over 300+ Assets

Libertex is a multi asset platform with 300+ tradable Assets.

Assets available on Libertex include Forex trading, Cryptocurrency trading, Indices Trading, Stocks Trading, Commodities Trading, ETFs Trading, CFD Trading.

Libertex is a multi asset platform with 300+ tradable Assets.

Assets available on Libertex include Forex trading, Cryptocurrency trading, Indices Trading, Stocks Trading, Commodities Trading, ETFs Trading, CFD Trading.

Libertex trades in multiple financial asset types. A financial asset is any security or asset that has financial value attached, tangible or intangible. This means that Forex trading, Cryptocurrency trading, Indices Trading, Stocks Trading, Commodities Trading, ETFs Trading, CFD Trading are considered financial assets.

Features of Libertex

- Virtual Portfolio, or what is commonly known as a Demo Account

- Libertex offers Advanced Financial Chart comparison tools

- Libertex offers Research-backed analysis on financial markets and investments from top analysts

- The Libertex platform is available to use on multiple devices including Apple Mac computers, and online through a Web Browser.

- Libertex offers a trading platform with tools for both New Traders and Seasoned Experts

- Libertex users benefit from using the Libertex platform in over 15 different languages

Libertex review

What you should know

Libertex offer seven ways to trade: Forex trading, Cryptocurrency trading, Indices Trading, Stocks Trading, Commodities Trading, ETFs Trading, CFD Trading. The assets and products available to you on the Libertex trading platform depends on the region of the world, you are in and the Libertex entity you have an account.

With Libertex you will need a minimum deposit of $100. You can sign up for a demo account to acquaint yourself with Libertex platform.

Libertex are able to accommodate various levels of traders whether you are experienced or a beginner.

Are Libertex safe?

When considering Libertex for your trading activities, its financial regulatory status in your region is crucial. One of the primary considerations when evaluating a broker, such as Libertex, is to assess the broker's regulatory status and administrative body. Brokers operating without supervision from a regulatory authority are free to make their own rules, which may pose a risk to investors. Any capital you invest is at risk.

Established in 1997, and in operation for 29 years Libertex have a head office in Cyprus.

Libertex is regulated. This means Libertex are supervised by and is checked for conduct by the CySEC (Cyprus Securities and Exchange Commission) (164/12), CIF (Cyprus Investment Firm), BaFin (BaFin ID: 10161686 / Bak No.: 161686) regulatory bodies.

Libertex withdrawal requests will be honoured. Brokers that operate under the supervision of regulatory authorities like Libertex are subject to strict guidelines that prohibit them from manipulating market prices to their advantage. Regulatory oversight ensures brokers operate with integrity, fairness, and transparency, safeguarding investors' deposits. Libertex are held accountable for their actions and may face severe consequences if they violate any financial regulations. If you are a client of Libertex and wish to withdraw funds from your account, you can rest assured that your request will be processed promptly. Libertex has a reputation for efficient and reliable fund transfers, and adhere to the rules of the financial regulators they are regulated with. When you submit a withdrawal request, Libertex will verify your account details and process the payment within the stipulated timeframe, usually within a few business days. By partnering with a trustworthy broker like Libertex, you can enjoy peace of mind and focus on your trading activities. If Libertex violate any regulatory rules their regulated status could be stripped.

Your capital is at risk

Is my money safe with Libertex?

All payments made to Libertex by traders are securely held in a segregated bank account.

Libertex uses Tier 1 banks for increased security. These banks are deemed the most reliable for client capital due to their strong core capital reserves and ability to withstand losses.

What are Tier 1 banks and why should Libertex use them?

Libertex partnering with Tier 1 banks offers reliability, efficient payment processing, reduced counterparty risks, and better protection for client funds. These banks are the most financially stable and secure institutions globally, with robust financial strength and high-quality risk management practices. They hold substantial core capital reserves, making them capable of handling unexpected losses and market volatility without endangering their Libertex clients' funds.

Libertex clients can have greater confidence in their financial security when working with a Tier 1 bank because Libertex are subject to strict regulatory oversight and must adhere to stringent guidelines to maintain its Tier 1 status.

What does it mean to have your funds in Libertex deposited in a Tier 1 bank?

Depositing funds with Libertex ensures that your money is held in a secure bank account with sufficient capital to meet your withdrawal requirements, even if Libertex were to go out of business unexpectedly.

Based on the information presented, it is safe to conclude that Libertex is a secure and safe platform.

Please be aware that trading in financial assets with Libertex carries a risk of loss. Libertex trading risk can occur due to inadequate market research, lack of experience, or failure to use the platform tools. It is common to experience rapid losses when trading financial investments like Forex trading, Cryptocurrency trading, Indices Trading, Stocks Trading, Commodities Trading, ETFs Trading, CFD Trading due to market volatility. Therefore, you should only risk trading when you understand that your capital is at risk at any time.

Libertex emphasizes this risk on its platform and provides clear risk warnings - Your capital is at risk. After answering some important questions about Libertex, let's closely examine its features.

To better understand the Libertex trading platform, you can create two separate accounts - one with real money and the other a Libertex demo account. A Libertex demo account provides a risk-free environment for experimenting with the Libertex platform's features and trading strategies before risking your actual funds. This approach can help you gain experience and confidence in Libertex trading decisions.

Open a demo account Visit Libertex

Full disclosure: We may receive a commission if you sign up with a broker using one of our links.

How Libertex as a Company Compare Against Other Brokers

| Broker |

libertex

|

IC Markets

|

Roboforex

|

eToro

|

|---|---|---|---|---|

| Year Established | 1997 | 2007 | 2009 | 2007 |

| Head Office | Cyprus | Australia | Belize | Cyprus, UK |

| Regulation | CySEC (Cyprus Securities and Exchange Commission) (164/12), CIF (Cyprus Investment Firm), BaFin (BaFin ID: 10161686 / Bak No.: 161686) | International Capital Markets Pty Ltd (Australia) (ASIC) Australian Securities & Investments Commission Licence No. 335692, Seychelles Financial Services Authority (FSA) (SD018), IC Markets (EU) Ltd (CySEC) Cyprus Securities and Exchange Commission with License No. 362/18, Capital Markets Authority(CMA) Kenya IC Markets (KE) Ltd, Securities Commission of The Bahamas (SCB) IC Markets (Bahamas) Ltd | RoboForex Ltd is authorised and regulated by the Financial Services Commission (FSC) of Belize under licence No. 000138/32, under the Securities Industry Act 2021, RoboForex Ltd is an (A category) member of The Financial Commission, also RoboForex Ltd is a participant of the Financial Commission Compensation Fund | FCA (Financial Conduct Authority) eToro (UK) Ltd (FCA reference 583263), eToro (Europe) Ltd CySEC (Cyprus Securities Exchange Commission), ASIC (Australian Securities and Investments Commission) eToro AUS Capital Limited ASIC license 491139, CySec (Cyprus Securities and Exchange Commission under the license 109/10), FSAS (Financial Services Authority Seychelles) eToro (Seychelles) Ltd license SD076, eToro (ME) Limited (ADGM) Abu Dhabi (UAE) number 220073, eToro (Europe) Ltd (AMF) Autorité des marchés financiers as a digital assets provider France |

| Used By | 3,000,000+ Libertex users | 200,000+ IC Markets users | 730,000+ Roboforex users | 40,000,000+ eToro users |

| Negative balance protection | Yes | Yes | Yes | Yes |

| Guaranteed Stop Loss | No | No | No | No |

| Learn More | Visit Libertex | Visit IC Markets | Visit Roboforex | Visit eToro |

| Risk Warning | Your capital is at risk | Losses can exceed deposits | Losses can exceed deposits | 46% of retail investor accounts lose money when trading CFDs with this provider. |

Libertex review

Libertex Pros and Cons

Libertex review

Libertex Regulation and Licensing in more detail

Libertex is regulated by trusted organizations, providing recourse for any issues. Regulatory bodies protect traders through reimbursement schemes in case of Libertex going into insolvency. Libertex compliance with rules and criteria set by regulatory authorities is mandatory for brokerage firms like Libertex to maintain licenses and operate in certain jurisdictions. Financial regulation and licensing are crucial for creating a secure trading environment for Libertex traders.

- CySEC (Cyprus Securities and Exchange Commission) (164/12)

- CIF (Cyprus Investment Firm)

- BaFin (BaFin ID: 10161686 / Bak No.: 161686)

Libertex is regulated, governed and supervised by reputable financial regulatory bodies. Regulatory bodies monitor the brokers' behaviour, and they will take necessary action if things go wrong. Before trading online with a broker like Libertex you should be sure they're legitimate online agent.

Is Libertex Global?

No, Libertex is not global, Libertex is not available globally as Libertex is not available in some major trading countries.

Libertex is restricted in some major geo regions.

Libertex review

Libertex Awards

Libertex have won numerious industry awards over the 29 years they have been operating as a financial broker. We have listed the most notable awards and mentions for Libertex below.

- Best Global Broker 2025

- Best CFD Broker Europe 2025 (Global Forex Awards)

- CFD Broker of the Year – Global - PAN Finance - 2024

- Most Trusted Broker - European CEO Awards - 2024

Libertex review

Libertex Fees Explained

- Libertex doesn't charge withdrawal fees.

- Libertex does charge a fee for inactive accounts.

- Libertex doesn't charge deposit fees. A currency conversion fee may be applied as withdrawals and deposits from Libertex are conducted in USD. Any other currency will have to be converted to your local currency by your 3rd party payment provider.

Libertex Costs To Check

Modern brokers like Libertex provide advanced online trading platforms, mobile apps, financial analysis tools and educational resources. These services require significant investment, and in turn, Libertex may charge clients various fees for trading activities. Be mindful of these charges, impacting your overall Libertex trading profitability.

How Libertex Fees Compare Against Other Brokers

| Broker |

libertex

|

IC Markets

|

Roboforex

|

eToro

|

|---|---|---|---|---|

| Min Deposit | 100 | 200 | 10 | 50 |

| Withdrawal Fees | No | No | No | Yes |

| Inactivity Fees | Yes | No | No | Yes |

| Deposit Fees | No | No | No | No |

| CFD Commission Fees | Yes | Yes | No | Yes |

Libertex Minimum Deposit

Libertex requires a minimum deposit of 100 GBP/USD/EUR when opening an Libertex trading account.

A minimum deposit is the minimum amount of money required by Libertex to open a new online brokerage account with them.

Don't be scared off by brokers like Libertex charging a minimum deposit to open a trading account. Brokers charging higher minimum deposits may offer additional premium services on their platforms that are not free on other platforms.

In the trading world, brokers like Libertex, have different minimum deposit requirements based on the target audience they are trying to attract. Brokers with lower minimum deposit requirements typically cater to a more mainstream audience who don't require advanced research tools or features. On the other hand, brokers that require a larger minimum deposit often provide a greater range of trading features, more in-depth technical analysis, research tools, and better risk management features.

Some brokers may waive the minimum deposit requirement to attract new customers but may compensate for it by charging higher transaction commissions and trading fees. As the online trading market becomes more competitive, brokers have reduced their minimum deposit requirements to attract new clients.

However, it's important to note that depending on your trading account type, some brokers may require a higher minimum deposit of up to 10,000 GBP/USD. Therefore, it's essential to research and compares different brokers to determine which best suits your trading needs and budget.

Libertex Withdrawal Fees

Libertex doesn't charge withdrawal fees.

Libertex Withdrawal rules may vary across different brokers when it comes to transferring funds from your Libertex or other broker trading account. Each brokerage firm has its specific withdrawal methods. The payment provider associated with Libertex may have different transfer processing fees and processing times, affecting how long it takes to receive your funds.

In addition, currency conversion fees may apply if the Libertex withdrawal and receiving currencies differ, adding to the overall transaction costs. The currency conversion fee depends on your base currency, receiving currency, and the 3rd party payment provider that is separate from Libertex. Researching and comparing Libertex withdrawal policies and fees across different brokers is essential before choosing one, especially if you are withdrawing Libertex funds frequently or dealing with large sums of money. Awareness of these Libertex fees and policies can help you plan and budget accordingly and avoid any unpleasant surprises when transferring your Libertex funds.

For example, Libertex allows you to withdraw your funds to Debit Cards, Credit Cards, VISA, MasterCards, PayPal, Sofort, Deal, Trustly, Skrill, Neteller, GiroPay, SEPA International Bank Wire, MB MultiBanco, Przelewy42, Blik, eService.

Libertex Inactivity Fees

Libertex does charge a fee for inactive accounts.

When a trading account goes unused for a certain period, brokerage clients may be charged an account inactivity fee. To avoid such fees, clients may need to fulfill specific trading activity requirements outlined by Libertex terms and conditions. It's important to note that inactivity fees are not unique to online trading accounts, as many financial service companies may also charge them.

Make sure you're fully aware of all Libertex fees and services. It's recommended that you check the Libertex website before signing up. If you decide to close your Libertex account, it's important to do so with the Libertex broker customer support and obtain confirmation that no remaining Libertex fees are due.

Brokers like Libertex must disclose any inactivity fees as part of their regulations. The type of account and broker you sign up for, will determine whether or not you can be charged an inactivity fee under certain circumstances.

Certain brokers may levy inactivity fees to recoup the expenses associated with sustaining your account on their trading platforms when there is a shortage of commission fees earned from your trading activities.

Libertex Deposit Fees

Libertex does not charge deposit fees. Although bank / 3rd party merchant fees may apply.

Reviewing deposit fees before initiating a transaction is imperative, as certain brokers might impose a charge for depositing funds from your payment method to your trading account. The payment method employed for funding your account might also incur a fee.

Depositing funds into your trading account may incur a fee, which could vary depending on the fiat currency used. For instance, depositing funds from a credit card can attract high fees. Additionally, not all brokers accept credit card payments for account funding. It's crucial to review the funding options and associated fees the broker provides before depositing any funds.

Libertex Commission Fees

Libertex does charge commission on CFD instruments.

Brokerage firms like Libertex may charge commission fees as compensation for executing trades on behalf of traders on their trading platforms. Commission fees can vary depending on the type of financial asset being traded and the Libertex trading account level held by the trader.

Libertex may charge commission fees for fulfilling, modifying, or canceling an order on behalf of its clients. However, if a market order is not fulfilled, no commission fee is usually charged. Reviewing Libertex terms and conditions to understand the commission fees and any other charges that may apply is essential.

Libertex review

What can you trade with Libertex?

It's essential to note that the trading instruments offered under the Libertex brand may vary depending on the customer account holder and country of residence due to regulatory restrictions. Besides, the trading platform the customer selects may also impact the available trading instruments. Therefore, before trading, verify the Libertex trading instruments available and the regulations governing them based on your account holder, location, and chosen platform.

You can trade a wide variety of instruments with Libertex over 300 instruments in fact.

If you want to trade currency pairs on global Forex markets, Libertex offer over 51 currency pairs.

Libertex Compared To Other Brokers

Compare Libertex with IC Markets and Roboforex below.

How Libertex Trading Options Compare Against Other Brokers

| Broker |

libertex

|

IC Markets

|

Roboforex

|

eToro

|

|---|---|---|---|---|

| Instruments Available | 300 | 2250 | 12000 | 7000 |

| Platforms | Libertex trading platform, MT5, MT4, PC, Mac, Mobile Apps, Android (Google Play), iOS (App Store), Web | MT5, MT4, MetaTrader WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), MetaTrader iPhone/iPad, MetaTrader Android Google Play, MetaTrader Mac, cTrader, cTrader Web, cTrader iPhone/iPad, cTrader iMac, cTrader Android Google Play, cTrader Automate, cTrader Copy Trading, TradingView, Virtual Private Server, Trading Servers, MT4 Advanced Trading Tools, IC Insights, Trading Central | MT4, MT5, R Mobile Trader, R StocksTrader, WebTrader, Mobile Apps, iOS (App Store), Android (Google Play), Windows | eToro Trading App, Mobile Apps, iOS (App Store), Android (Google Play), CopyTrading, Web |

| FX / Currencies | ||||

| Forex pairs offered | 51 | 65 | 40 | 65 |

| Major Forex pairs | Yes | Yes | Yes | Yes |

| Minor Forex pairs | Yes | Yes | Yes | Yes |

| Exotic Forex pairs | Yes | Yes | Yes | Yes |

| Cryptocurrencies (availability subject to regulation) | Yes | Yes | No | Yes |

| Commodity CFDs | ||||

| Commodities Offered | 16 | 28 | 100 | 67 |

| Metals | Yes | Yes | Yes | Yes |

| Energies | Yes | Yes | No | Yes |

| Agricultural | Yes | Yes | No | Yes |

| Indiced & Stock CFDs | ||||

| Stocks Offered | 100 | 2100 | 8484 | 7246 |

| UK Shares | No | Yes | Yes | Yes |

| US Shares | Yes | Yes | Yes | Yes |

| German Shares | No | Yes | Yes | Yes |

| Japanese Shares | No | Yes | Yes | Yes |

| Risk Warning |

Visit Libertex

Your capital is at risk |

Visit IC Markets

Losses can exceed deposits |

Visit Roboforex

Losses can exceed deposits |

Visit eToro

46% of retail investor accounts lose money when trading CFDs with this provider. |

Libertex review

Trading on Libertex web platforms and other applications

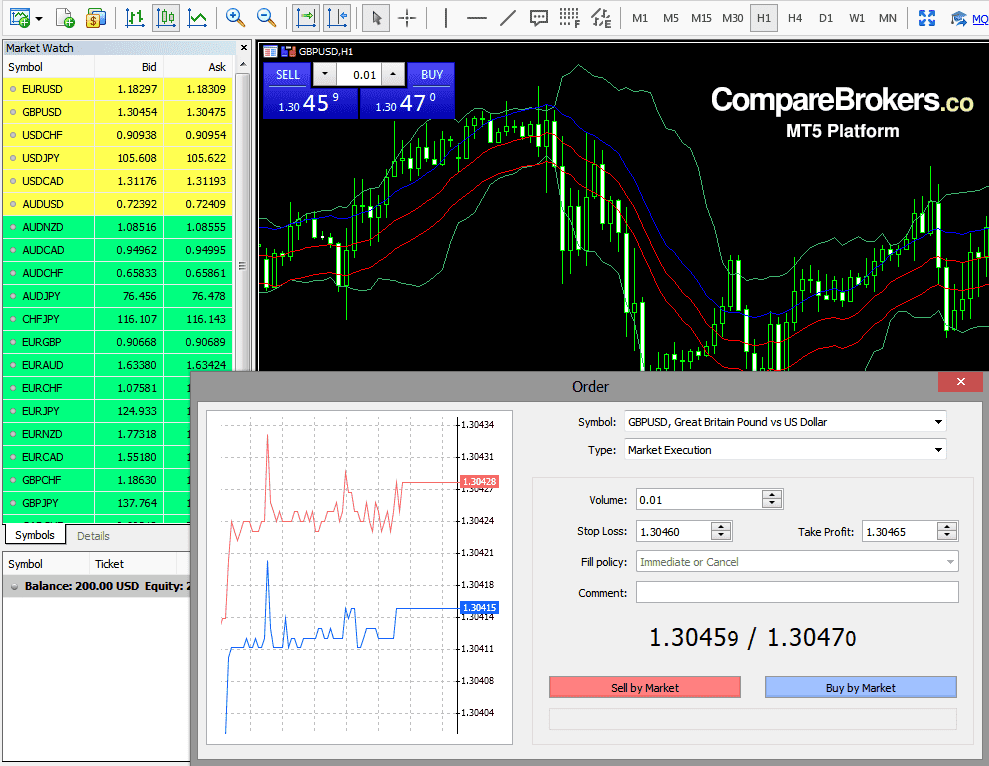

Libertex is one of the few brokers that offer both of the MetaTrader platforms; MT4 and MT5. To see how the two platforms compare, you can read our comparison of MT4 vs MT5 here.

A Libertex iOS or Android native App on your phone or tablet will Work quicker Than the Avatrade Website on the same device.

Libertex also offer mobile apps for Android and iOS trading apps help you stay on top of your trades and execute them on the go.

See Libertex's platformsIs the Libertex Trading Platform Secure?

You should take the security of your personal information seriously and check SSL encryption is enabled on the Libertex trading platform to protect you on PC and mobile Libertex platforms. To further enhance security, we encourage traders to always look for the lock sign on their browser when using Libertex web trading platforms.

Libertex Trading Platform Options

After logging into your Libertex account, you'll find a range of trading platform options available below.

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

Libertex does not support the cTrader trading platform. However, if you're looking for a broker that does offer cTrader, you can explore other options available through the provided link.

Let's explore each of these trading platforms in detail and what options Libertex gives you.

Libertex review

Libertex MetaTrader 4 (MT4)

Libertex MetaTrader 4 (MT4) In Detail

MetaTrader 4, commonly known as MT4, has been a well-known and widely used trading platform in the financial markets since its inception in 2005. MT4 on Libertex offers traders comprehensive features and tools to enhance their trading performance. The Libertex MT4 user-friendly interface and highly customizable trading environment allow traders to tailor the Libertex platform to their needs. One of the standout features of MT4 is its charting functionality, which allows Libertex traders to analyze price movements and make informed trading decisions. Additionally, advanced order management tools give Libertex traders greater control over their trades, allowing them to manage risk better and optimize their trading strategies on the MT4 Libertex trading platform.

MetaTrader 4 (MT4) was created mainly for Forex trading, but it can also facilitate the trading of other financial instruments via CFDs and Spread Betting. You cannot trade real assets like stocks, shares, commodities, indices and ETF's on the Libertex MetaTrader 4 (MT4) trading platform. MT4 is a platform available with Libertex, that facilitates trading financial instruments in the form of CFD contracts or Spread bets. The Libertex MT4 platform does not provide access to physical assets such as stocks, commodities, or ETFs for trading. Libertex allows trading CFDs and Spread bets, which do not involve owning underlying assets but speculating on price movements, using high risk leverage. To gain more information about the MT4 Platform, click here.

You can start using the MetaTrader 4 platform with Libertex in multiple formats including through an online web platform, Through a downloadable application for Windows PCs and Apple Macintosh computers. Libertex MetaTrader 4 is compatible with the latest macOS. Libertex allows traders to trade on mobile devices through Android and iOS devices like the iPhone.

Metatrader 4 Webtrader on Libertex

MetaTrader 4 (MT4) is a widely used trading platform in the world, offering a range of advanced tools and features. Recently, MT4 has been made available as a web-based application through a web browser, enabling traders to access the platform from anywhere.

The web version of MT4 provides the same user-friendly interface and customizable trading environment as the desktop version. With MT4 web, traders can access advanced charting tools, online trading indicators, and a Dealing Desk-free trading environment.

Additionally, traders can enjoy Raw Pricing without any intervention from brokers. Overall, MT4 web is a convenient and efficient way for traders to access the platform and manage their trades.

Trade Libertex MetaTrader 4 on iOS Devices

You can download the Libertex app or trade with Libertex through the MetaTrader 4 application on the Apple app store.

Download the Metaquotes MetaTrader 4 Program free of charge from Apple's App Store. Libertex customers have instant access to the financial market and can completely manage a Portfolio on the go.

Trade Libertex MetaTrader 4 on Android Devices

Millions of people worldwide use Android mobile devices and tablets, and Libertex offers its clients access to the MetaTrader 4 platform on these devices. With the Libertex MetaTrader 4 Android application, traders can monitor the financial markets and execute trades directly from their Android-based smartphones and tablets. This app provides access to a range of advanced trading features, allowing Libertex traders to stay on top of their trades and react quickly to changes in the market. With the Libertex MetaTrader 4 Android app, traders can securely manage their trades on the go, making it a convenient and efficient way to stay connected to the market.

Trade Libertex MetaTrader 4 Trading Central

Trading Centrals Alpha Generation Indicators available on Libertex are a powerful bundle of three major indicators designed to help traders make informed decisions. Libertex MT4 Trading Central indicators include:

- Analyst Perspectives - A valuable resource for traders seeking leadership insights and key levels.

- Adaptive Candlesticks - This indicator is capable of identifying chart patterns that highlight significant changes in demand and supply.

- Adaptive Divergence Convergence (ADC) - Similar to MACD, but with greater utility at shorter lengths, this indicator provides more timely signals.

Trading Centrals Alpha Generation Indicators can help Libertex traders better understand market trends and patterns, enabling them to make more informed trading decisions. These indicators can provide valuable insights into market movements, allowing Libertex traders to potentially stay one step ahead.

Libertex MetaTrader 4 Advanced Trading Tools

The Libertex MetaTrader 4 trading platform has advanced tools that enhance the overall trading experience and give Libertex traders detailed market tools. With feature-rich trade execution and management programs, sophisticated notification alarms, messaging facilities, innovative market data, and more, Libertex provides traders with everything they need to succeed. The Libertex MT4 platform also includes a range of technical analysis tools, with 30 indicators built in, 2000 plus free indicators, and the availability of paid indicators, allowing Libertex traders to analyze the market at any level of complexity.

Trade Libertex MetaTrader 4 MultiTerminal

MetaTrader 4 MultiTerminal offers traders an intuitive and user-friendly dashboard to manage and monitor multiple trading accounts. This powerful tool allows traders to oversee over 128 accounts simultaneously, enabling them to place market and pending orders, view real-time market prices, and track all accounts and equity in real-time.

It's important to note that MultiTerminal only supports trading accounts on the same MetaTrader server and doesn't allow automated trading scripts such as Expert Advisors.

This tool is ideal for traders who manage several accounts simultaneously and require a more efficient and effective way to track and execute trades. You can have up to 10 demo accounts on MetaTrader 4 MultiTerminal.

Libertex MetaTrader 4 & MetaTrader 5 AutoChartist

Autochartist on the Libertex platform is a powerful tool designed to help traders find trading opportunities quickly and easily.

Available for Libertex MetaTrader 4 and MetaTrader 5 Autochartist can scan the market using an expert advisor script.

With Autochartist, Libertex traders can scan multiple markets and timeframes from a single graph, making it easy to keep track of all their preferred symbols without launching multiple graphs. Using Autochartist can save Libertex users time and makes the trading process more efficient.

The Autochartist interface is user-friendly and can be customized to suit individual trading preferences. Libertex traders can navigate the platform and find the information they need to make informed trading decisions.

Libertex Autochartist is a valuable tool for traders who want to stay ahead of the curve and identify trading opportunities quickly and easily. With its powerful features and easy-to-use interface, Autochartist is an essential tool for Libertex traders of all experience levels.

Libertex review

Libertex MetaTrader 5 (MT5)

Libertex MetaTrader 5 (MT5) In Detail

Libertex MetaTrader 5 (MT5) is a multi-asset trading platform with an extensive range of trading features and financial research tools. Besides the ability to trade Forex and CFDs, Libertex MT5 offers access to trade Futures, Stocks, Algorithmic Trading, ETFs, and Indices. MT5 was launched in 2010 and came with advanced charting tools, additional timeframes, and an updated version of MetaTrader 4.

MT5 on Libertex provides the convenience of using automated trading systems and copy trading, giving Libertex traders competitive research tools in the financial markets.

You can learn more about the MT5 Platform here. You can also learn more about the differences between MT5 and MT4 here.

Trade Libertex MetaTrader 5 WebTrader

Access your Libertex MetaTrader 5 accounts from any web browser. MT5 on Libertex features a massive range of tools like additional timeframes and the most up-to-date technical indicators to give you all the trading resources you need to trade on and analyze the financial markets.

Libertex review

Libertex MT5 Buying and Selling

Libertex MetaTrader 5 on iOS Devices

Libertex MetaTrader 5 Can Operate on newer iOS devices like the iPhone and iPad. MetaTrader 5 requires a mobile internet connection or a connection to Wi-Fi. You should upgrade the iOS MetaTrader 5 app regularly. New versions provide improved functionality and increased stability. Libertex MetaTrader 5 allows traders to look at market statistics of financial instruments traded in the market execution mode.

Libertex MetaTrader 5 on Android Devices

The Libertex MetaTrader 5 trading platform is available on Android smartphones or tablets powered by the Android 5.0 or higher operating system. Additionally, to connect to the Libertex trading server. Take the time to understand all of the Libertex Android MetaTrader 5 features. With Libertex MetaTrader 5 for Android, you can trade various financial instruments anytime, anywhere.

Libertex Metatrader Mobile Application Features

MetaQuotes, the developers of Metatrader, have listened to the feedback of their millions of users and have built what has become one of the most popular mobile trading platforms in the world. MetaTrader features include :

- Libertex Financial instrument quotes

- View in-depth price charts of financial instruments with Libertex MetaTrader

- Manage trades and open positions on Libertex MT4 & MT5

- View your Libertex trading history

- View market news

- MetaTrader internal messaging on Libertex

- View and research market statics of Libertex financial instruments

- Libertex Position opening and closing

- Lookup symbols in the Libertex MetaTrader quotes section

- Display of deals on Libertex graphs

- Libertex Timeframe selection for graphs and charts

- Additional vertical scaling of Libertex graphs

- Capability to transfer Libertex accounts to other devices using QR codes

- Information is available only if it's supplied by Libertex

- Access the OTP generator through FaceID or fingerprint with Libertex

Libertex MetaTrader 5 Advanced Trading Tools

Libertex MetaTrader 5 has many advanced trading tools for more advanced users. Understanding these tools can give you a competitive edge.

- Libertex MT5 Depth of market bids and asks

- Financial Price Data on Libertex

- Margin Calculation, Futures, Forex on Libertex

- Advanced Techincal Analysis on Libertex MT5

- One click trading on Libertex MT5

- Libertex Spreads

- Libertex Futures

- Libertex Trading Reports

Libertex Trading benefits

- Libertex Allows scalping

- Libertex Offers STP

- Libertex Low min deposit

- Libertex Offers Negative Balance Protection

Libertex Trading Accounts Offered

Below we give an overview of the account types that Libertex offer. Whatever you are looking to trade, the varying Libertex account types will be able to provide you with what you need.

- Libertex Demo account

- Libertex Standard account

- Libertex STP account

- Libertex Islamic account

Can I try Libertex?

Libertex provides a demo account that enables individuals to explore trading before investing their funds. By creating a Libertex practice account, users can gain experience and knowledge of how to trade effectively. Demo trading accounts like the Libertex demo account can help individuals to make informed decisions before investing their money.

Open a demo Libertex account to practice and trade.

Your capital is at risk

Libertex withdrawal and funding methods

It's essential to remember that the payment methods provided by Libertex vary based on the Libertex entity and the Libertex client's country of residence. To view the Libertex payment options available, you can log into your Libertex member's area.

Libertex offers various funding payment methods listed in your Libertex dashboard if available in your region. To learn more about the Libertex funding and withdrawal options available in your area, you can explore the Libertex website.

Libertex provides several payment methods for funding your Libertex account. You may utilize any of these deposit options if they are available in your region. Libertex ensures that users have multiple payment methods to choose from, making it more convenient for verified Libertex account holders to add funds to their accounts. However, it's important to note that the availability of payment methods may vary depending on the Libertex user's location. learn more about Libertex funding and withdrawal methods.Libertex Payment Methods

Some Libertex payment methods are local and are available only to specific regions. Libertex account holders should check which payment methods are provided in your region.- Libertex accepts Debit Cards

- Libertex accepts Credit Cards

- Libertex accepts VISA

- Libertex accepts MasterCards

- Libertex accepts PayPal

- Libertex accepts Sofort

- Libertex accepts Deal

- Libertex accepts Trustly

- Libertex accepts Skrill

- Libertex accepts Neteller

- Libertex accepts GiroPay

- Libertex accepts SEPA International Bank Wire

- Libertex accepts MB MultiBanco

- Libertex accepts Przelewy42

- Libertex accepts Blik

- Libertex accepts eService

| Broker |

libertex

|

IC Markets

|

Roboforex

|

eToro

|

|---|---|---|---|---|

| Bank transfer | Yes | Yes | Yes | Yes |

| Credit Cards | Yes | Yes | No | Yes |

| Paypal | Yes | Yes | No | Yes |

| Skrill | Yes | Yes | Yes | Yes |

| Payoneer | No | No | No | No |

| Neteller | Yes | Yes | Yes | Yes |

*please note available Libertex and other broker payment methods depend on the clients country of residence.

How can I start trading with Libertex?

To open a trading account with Libertex, individuals can sign up on the Libertex website. Upon completing the signup process, users will receive login details via email, which they can use to access their accounts.

The next step involves submitting identification documents for Libertex account validation and making a deposit. Once completed, Libertex users can download the trading platform of their choice.

It's important to note that Libertex requires users to provide essential documentation to verify their identity during onboarding and routine KYC identity checks. These checks are a standard practice that helps Libertex maintain a trustworthy financial environment for its 3,000,000 users. Detailed information on the Libertex trading platforms is available on their website.

Your capital is at risk

Performing trades with Libertex

When using Libertex, the minimum trade size is typically varies units of the base currency of the instrument being traded. However, this amount may vary based on the specific account a user has opened. Libertex have a max trade of varies. With STP execution on the Libertex platform, traders can anticipate tighter spreads and greater transparency when it comes to trade pricing.

Like other brokers, Libertex margin requirements can differ depending on the traded instrument.

CFD Trading on Libertex

We will show you an example of the basics of using Libertex leverage.

CFD trading on Libertex allows traders to speculate on the price movements of various financial instruments against the broker Libertex, without actually owning real assets. With CFDs, Libertex traders can profit from upward and downward price movements by going long (buying) or short (selling) on an asset.

Libertex provides CFDs which are leveraged products. For this example, let's assume a ten times leverage. So, if you have a $10,000 position, you only need to tie up $1,000 or a tenth of the value in your account. With high-risk leverage, a small sum controls a much bigger financial position.

The effect of leverage on profits and losses magnifies them in both directions. In other words, Libertex leverage profits and losses are magnified when trading. For instance, using CFDs, you use the Libertex trading platform to buy/sell $10,000 worth of Apple Computer Inc. If the stock rises by 10% due to positive results, your position is now worth $11,000, representing a $1,000 or 10% increase in value. This CFD trade has a 100% increase in the funds initially committed.

On the other hand, if Apple Computer Inc falls by 10%, your position worth $10,000 is now worth only $9,000, representing a $1,000 decrease. Therefore, Libertex leverage magnifies both profits and losses in trading.

Trading CFD trades on the Libertex platform can provide more flexibility than traditional market trades, allowing access to CFD fractional shares, international markets, and short selling. They are commonly used for short to medium-term trades, such as intraday CFD trading, but are high-risk due to their separation from the financial markets.

Experienced Libertex traders can trade high risk CFD trades to hedge items in their portfolio.

Always be aware that CFDs are complex instruments with a high risk of losing money rapidly due to leverage. Your capital is at risk

Limiting Your Risk When Trading with Libertex Negative Balance Protection

Negative balance protection is important for traders using leverage on platforms like Libertex. In an unfavourable market move, leverage can result in a loss that exceeds the trader's account balance, leaving them with a negative account balance. If a Libertex trading position does not go in your favour, this is where negative balance protection comes in handy.

Brokers regulated by the Financial Conduct Authority (FCA) must offer negative balance protection as a standard feature. With negative balance protection, Libertex trading losses are always limited to the current balance of funds in the trader's account.

Even if an Libertex trader experiences a significant loss, they will never owe more money than what is available in their Libertex account balance.

It's important for Libertex traders to understand the potential risks of trading with leverage and to take advantage of features like negative balance protection to mitigate those risks. By doing so, traders can trade with peace of mind, knowing that Libertex losses are limited to the funds available in your Libertex account when negative balance protection is in place.

Education Resources at Libertex

Libertex offer educational resources which include Tutorials. Please bear in mind that these resources provided by Libertex do not guarantee any results when trading. When we checked on the Libertex website, these educational resources were not available in every language. Also some financial instruments mentioned in any Libertex educational resources may not be available in your region.

To trade effectively with Libertex, it's important to have a good understanding of the Libertex trading tools and the markets. Make sure you make full use of all education tools. Including educational tools with Libertex and externally.

Libertex . It's essential to take the time to learn about the financial markets and understand how they move before diving into trading with Libertex. Familiarizing yourself with the Libertex trading platform is crucial to use it effectively.

While learning, you can also use global trading times to practice making live buy or sell trades using Libertex. This hands-on experience can help you gain confidence and become more comfortable with trading.

Furthermore, learning how to mitigate and manage investment risk is crucial. Trading with Libertex involves developing a strategy considering risk management techniques such as stop-loss orders, diversification, and position sizing. By effectively managing risk, you can increase your chances of success in the markets.

Learning about the financial markets, trading platforms like Libertex, and risk management techniques can help you become a more confident and successful trader.

Take an analytical approach to trading with Libertex. Explore the Libertex platform and train yourself to think systematically and logically about the markets.

While it may be a new skill set for some, it is what the market requires for success. Developing your trading skills with Libertex, before live trading.

Customer Support at Libertex

As part of our Libertex review, we review customer service options, response times and problem resolution effectiveness on the Libertex trading platform. The Libertex trading platform supports multiple languages, which includes English, Spanish, Czech, Chinese, German, French, Italian, Polish, Portuguese, Romanian, Slovenian,Hindi, Hebrew, Arabic, Russian.

Libertex Available Support Types

Based on our experience, we have given Libertex a D grade for customer support. We encountered some slow response times or Libertex queries that were left unanswered.

Compared to other brokers, Libertex offers fewer customer support features. They do not provide live chat support, and their phone and email support can also be slow.

email support and supports a limited amount of Languages. Live chat support supports a limited amount of Languages. Phone support supports a limited amount of Languages.Livechat Support at Libertex

Our team tested the live chat support of Libertex and found it to be satisfactory. While we received a response within 25 minutes on most occasions, there were instances where we did not receive a response at all.

In addition, we tested Libertex support services in various countries and languages and found that Libertex were able to effectively resolve our customer issues.

Email Support at Libertex

We tested the email support of Libertex by sending 25 emails simultaneously, and our experience was mixed. While the answer times were generally excellent, with the fastest response being 3 hours, the slowest response was 6 days. We also encountered some instances where we did not receive any Libertex response.

The Libertex team did resolve and answer our queries, but the email support from Libertex was overall average compared to other brokers we have tested.

Phone Support at Libertex

We contacted Libertex via phone and received quick assistance within 10 minutes of our call.

The Libertex phone support team proved to be helpful and able to resolve our queries and issues over the phone. We also tested the multilingual support provided by Libertex and found that they could assist us in various languages.

While we found the Libertex phone support satisfactory, there is room for improvement in response time.

See how Libertex Support Compares Against Other Brokers

| Broker |

libertex

|

IC Markets

|

Roboforex

|

eToro

|

|---|---|---|---|---|

| Support |

|

|

|

|

| Languages | English, Spanish, Czech, Chinese, German, French, Italian, Polish, Portuguese, Romanian, Slovenian,Hindi, Hebrew, Arabic, Russian | English, Japanese, Chinese, Polish, Afrikans, Danish, Dutch, German and more | English, Chinese Simplified, Chinese Traditional, Indonesian, Malaysian, Portuguese, Spanish, Italian, Polish, Arabic, Thai, Russian, and Ukrainian | English, German, Spanish, French, Italian |

| Learn More | Visit Libertex | Visit IC Markets | Visit Roboforex | Visit eToro |

| Risk Warning | Your capital is at risk | Losses can exceed deposits | Losses can exceed deposits | 46% of retail investor accounts lose money when trading CFDs with this provider. |

What you will need to open an account with Libertex

As Libertex is regulated by CySEC (Cyprus Securities and Exchange Commission) (164/12), CIF (Cyprus Investment Firm), BaFin (BaFin ID: 10161686 / Bak No.: 161686).

As a new client of Libertex, you will be required to pass a few basic compliance checks to ensure that you fully understand the risks involved in trading and are permitted to trade with Libertex in your region. During the Libertex account opening process, you will be asked to provide Libertex with certain documents, including a scanned copy of your passport, driving license or national ID, as well as a utility bill or bank statement from the past three months to verify your address.

When registering with Libertex have the following documents available.

- Libertex require a scanned colour copy of your passport, driver's license or national ID card.

- A recent utility bill or bank statement that confirms your residential address for Libertex compliance. This must be dated within the last six months.

- If you plan to fund your Libertex account using a credit or debit card, you will need to provide a scanned copy of the front and back of your card. You can mask any sensitive information like the CVV code on the Libertex platform.

It's worth noting that the expiration date of the proof of address document may differ for different entities under Libertex Brand. Additionally, you will need to answer some basic compliance questions to confirm your level of trading experience. This process usually takes around 5 minutes, and once you've passed compliance, you can start exploring Libertex's platform.

However, remember that you won't be able to make trades on Libertex until you have passed compliance, which may take several days, depending on your circumstances. It's essential to complete the Libertex KYC compliance process as soon as possible to avoid any delays in accessing the Libertex platform's features.

It is important to note that Libertex may request additional documents or information to verify your identity or comply with regulations. The account opening process usually takes a few minutes to complete, and you can start exploring the Libertex platform and features immediately. However, you must pass the verification process to start live trading with Libertex, which can take up to a few business days.

To start the process of opening an account with Libertex you can visit the Libertex trading platform here.

Your capital is at risk

You should consider whether you can afford to take the high risk of losing your money.

CFDs are leveraged products and can result in significant losses, excess of your invested capital. All trading involves risk. Only risk capital you're prepared to lose. Past performance does not guarantee future results.

This post is for educational purposes and should not be considered investment advice. All information collected from https://libertex.com on February 02, 2026.

Watch this Libertex Explainer Video

Is Libertex A Good Broker?

We have spent over 5 years examining Libertex in depth. Although we found some very useful aspects of the Libertex platform that would be useful to some traders. We feel that a alternative to Libertex may better suit you.

- Libertex have a good track record of offering Forex trading, Cryptocurrency trading, Indices Trading, Stocks Trading, Commodities Trading, ETFs Trading, CFD Trading.

- Libertex has a history of over 29 years.

- Libertex has a reasonable sized customer support of at least 10.

- Libertex are regulated by the CySEC (Cyprus Securities and Exchange Commission) (164/12), CIF (Cyprus Investment Firm), BaFin (BaFin ID: 10161686 / Bak No.: 161686). Libertex is subject to strict regulatory oversight from its respective jurisdiction, which holds Libertex (the broker) accountable for misconduct. This regulatory framework helps ensure that Libertex operates fairly and transparently and provides Libertex customers with a safe and secure trading environment. In any disputes, the regulatory body may also act as an arbitrator to help resolve issue between you and Libertex.

- Libertex have regulation from reputable regulators.

- One of the advantages of using Libertex is the quick processing time for deposits and withdrawals, which typically takes only 2 to 3 days. Fast withdrawals from Libertex are particularly important as Libertex traders want to receive their money quickly. With the efficient Libertex payment processing system, traders can enjoy faster access to their Libertex funds.

- Libertex have an international presence in multiple countries. Including local Libertex seminars and training.

- Libertex can hire people from various locations in the world who can better communicate in your local language.

Libertex Risk Disclosure

Your capital is at risk

Trading Risk Disclaimer

Trading financial instruments such as foreign currency markets and other financial instruments involves high risk and is unsuitable for everyone. When trading on leverage, the potential for loss is significantly higher than when dealing with just your funds. Risky trading leverage allows you to control larger positions with less capital, increasing both the potential for profit and loss.

You will be exposed to a high risk of loss regarding leverage and margin-based trading.

Furthermore, some off-exchange financial instruments and derivatives may offer varying leverage levels and may not be subject to the same regulatory protections as exchange-traded instruments. As a result, they may be subject to higher levels of market volatility and carry a higher degree of risk.

It is important to note that no investment product, technique, or strategy can guarantee profits, and past performance does not necessarily indicate future results. Any investment involves the possibility of financial loss, and it is important to carefully consider your investment objectives, risk tolerance, and financial situation before making any investment decisions.

Trading financial instruments is a high-risk activity that requires careful consideration and risk management. It is important to be aware of the potential for loss and to only invest what you can afford to lose.

Libertex not quite right?

If after reading this Libertex review, Libertex does not fulfill your needs check out these Libertex Alternatives.

Click here to view the best Libertex Alternatives

We have spent years researching the best alternatives to Libertex. Click the links below to learn more.

After extensive research over several years, we have compiled a list of the most effective Libertex alternatives available today. If you are unsatisfied with Libertex or want to explore other options, we recommend checking out our carefully curated list of highly-rated Libertex alternatives. Follow the links below to learn more about these Libertex broker alternatives and choose the one that best suits your trading needs.

- IC Markets Review

- Roboforex Review

- eToro Review

- XTB Review

- XM Review

- Pepperstone Review

- AvaTrade Review

- FP Markets Review

- easyMarkets Review

- SpreadEx Review

- FxPro Review

- Admiral Markets Review

- ThinkMarkets Review

- FXPrimus Review

- Trading 212 Review

- ForexMart Review

- Eightcap Review

- ForTrade Review

- Interactive Brokers Review

- Forex.com Review

- IG Review

- Coinbase Review

- Binance Review

- Oanda Review

- CMC Markets Review

- Hargreaves Lansdown Review

- Ayondo Review

- ATFX Global Markets Review

Related Libertex Vs Comparisons

Throughout our comprehensive Libertex review, we have covered a lot of ground and provided an in-depth analysis of the platform's features and functionality.

If you're interested in comparing Libertex against other popular brokers in the industry, check out our Libertex Vs pages. Our team has compiled a series of detailed Libertex comparison articles, pitting the Libertex platform against some of the best-rated Libertex competitors in the market. Dive into our informative Libertex Vs pages below to find out how Libertex stacks up against other leading brokers.

- Libertex vs ICMarkets

- Libertex vs Roboforex

- Libertex vs eToro

- Libertex vs XTB

- Libertex vs XM

- Libertex vs Pepperstone

- Libertex vs AvaTrade

- Libertex vs FPMarkets

- Libertex vs easyMarkets

- Libertex vs SpreadEx

- Libertex vs FxPro

- Libertex vs AdmiralMarkets

- Libertex vs ThinkMarkets

- Libertex vs FXPrimus

- Libertex vs Trading212

- Libertex vs ForexMart

- Libertex vs Eightcap

- Libertex vs ForTrade

- Libertex vs InteractiveBrokers

- Libertex vs Forex.com

- Libertex vs IG

- Libertex vs Coinbase

- Libertex vs Binance

- Libertex vs Oanda

- Libertex vs CMCMarkets

- Libertex vs HargreavesLansdown

- Libertex vs Ayondo

- Libertex vs ATFXGlobalMarkets

Libertex review

LIBERTEX Frequently Asked Questions

Read our detailed Libertex FAQ Section updated for 2026.

Can I try Libertex?

Libertex offer a demo account so you can try the Libertex platform with virtual trading before you put down a payment. Virtual trading with Libertex is zero risk. Learn more here

What funding methods do Libertex accept?

Please note that the list of payment methods below depends on the Libertex Entity and the client's Country of Residence.

Libertex offer the following funding payment methods Debit Cards, Credit Cards, VISA, MasterCards, PayPal, Sofort, Deal, Trustly, Skrill, Neteller, GiroPay, SEPA International Bank Wire, MB MultiBanco, Przelewy42, Blik, eService, among other payment methods.

Learn more here

Is Libertex safe?

Libertex have over 3,000,000 users. Libertex are considered reliable as they are regulated by and checked for conduct by the CySEC (Cyprus Securities and Exchange Commission) (164/12), CIF (Cyprus Investment Firm), BaFin (BaFin ID: 10161686 / Bak No.: 161686). Any payments funded to Libertex accounts by traders are held in a segregated bank account. For added security,Libertex use tier-1 banks for this. Tier 1 is the official measure of a bank's financial health and strength.Trading with Libertex is risky, and because the market is so volatile, losses could happen at any time. Do not invest with Libertex unless you are prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Your capital is at risk

Is Libertex trading good?

Libertex is considered good and reputable to trade with Libertex. Libertex is used by over 3,000,000 traders and Libertex users. Libertex offers Forex trading, Cryptocurrency trading, Indices trading, Stocks trading, Commodities trading, ETFs trading, and CFD trading. Minimum deposit with Libertex is 100.

Is Libertex trading Legit?

Libertex was founded in Cyprus in 1997. Libertex has been facilitating trade on the financial markets for over 29 years. Libertex offers clients Forex trading, Cryptocurrency trading, Indices trading, Stocks trading, Commodities trading, ETFs trading, and CFD trading. All funds deposited to Libertex are held in segregated bank accounts for security. Libertex is regulated by CySEC (Cyprus Securities and Exchange Commission) (164/12), CIF (Cyprus Investment Firm), BaFin (BaFin ID: 10161686 / Bak No.: 161686) so can be considered legit.

Is Libertex a good broker?

Libertex allows Forex trading, Cryptocurrency trading, Indices trading, Stocks trading, Commodities trading, ETFs trading, and CFD trading. Libertex is overseen by the top tier financial regulators CySEC (Cyprus Securities and Exchange Commission) (164/12), CIF (Cyprus Investment Firm), BaFin (BaFin ID: 10161686 / Bak No.: 161686) so can be considered a good broker.

Is Libertex trustworthy broker?

Libertex is a reliable platform that can be considered trustworthy due to its strict regulatory practices. When you fund money to Libertex, money is in a segregated bank account that is separate from Libertex company's funds. As a regulated broker, Libertex cannot directly access your funds, which minimizes the risk of misappropriation or fraudulent activity by Libertex. Instead, your Libertex funds are held securely in a separate account designated for your investments, providing protection and peace of mind when trading with Libertex. Also Libertex is regulated in its local jurisdictions including major financial regulators like CySEC (Cyprus Securities and Exchange Commission) (164/12), CIF (Cyprus Investment Firm), BaFin (BaFin ID: 10161686 / Bak No.: 161686).

What is the minimum deposit for Libertex?

The minimum deposit to trade with Libertex is 100.

How long do Libertex withdrawals take?

Withdrawing money from Libertex processing time varies depending on the method but averages 1-5 days.

Is Libertex regulated?

Libertex is regulated by the CySEC (Cyprus Securities and Exchange Commission) (164/12), CIF (Cyprus Investment Firm), BaFin (BaFin ID: 10161686 / Bak No.: 161686). Regulatory bodies conduct regular reviews and audits as part of Libertex maintaining their regulatory status. You can learn more about these reviews on the regulator websites.

Is Libertex a market maker?

Libertex is a market maker. Stocks, currency and other commodities and instruments will be brought or sold by Libertex even if no buyer or seller is lined up.

How can I start trading with Libertex?

When opening a trading account with Libertex, you will need to sign up here. After completing the necessary steps of receiving login details via email, submitting identification documents for account validation, and making a deposit, the next step is downloading the preferred trading platform. For detailed guidance on Libertex trading platforms, you can follow the link provided below: Learn more about signing up with the Libertex trading platform here. This will provide useful information and insights into the various trading platforms offered by Libertex, enabling you to make an informed decision about which platform to choose for your trading needs.

Is my money safe with Libertex?

Yes your money is safe with Libertex.

Overall, strict financial regulation is essential for ensuring that trading platforms like Libertex operate fairly, transparently, and responsibly, which ultimately benefits all Libertex stakeholders involved.

Trading platforms like Libertex must have strict financial regulation for several reasons:

- Protecting Libertex Investors: Strict financial regulation ensures that investors who use the Libertex trading platform are protected against fraudulent or unethical behavior by the Libertex platform or its employees. Financial regulation can help to prevent investors from losing their money due to dishonest practices by the Libertex platform.

- Maintaining Libertex Financial Stability: Strict regulation helps maintain the financial system's stability by preventing excessive risk-taking when using the Libertex trading platform. Regulatory procedures reduce the likelihood of the Libertex platform experiencing financial difficulties or failing, which could have ripple effects throughout the financial system.

- Enhancing Libertex Transparency: Regulations require trading platforms like Libertex to maintain detailed records and disclose Libertex client information. Financial regulatory requirements enhances transparency and helps to build trust between the Libertex platform and its investors.

Libertex is regulated by the CySEC (Cyprus Securities and Exchange Commission) (164/12), CIF (Cyprus Investment Firm), BaFin (BaFin ID: 10161686 / Bak No.: 161686). When selecting a broker such as Libertex, one of the most critical factors to consider is the broker's regulatory body and regulatory status. Unregulated brokers pose a direct risk to the security of their client's funds, as they operate without any oversight or regulation. In contrast, regulated brokers are subject to strict rules and regulations that prevent them from manipulating market prices or engaging in fraudulent activities. As a reputable broker, Libertex ensures that withdrawal requests are processed promptly, demonstrating its commitment to transparency and accountability. However, brokers that violate regulatory rules can face the consequences such as losing their regulatory status in specific regions, highlighting the importance of working with a trusted, regulated broker for your trading needs like Libertex.

Is Libertex a con?

Libertex is regulated and well established, having been in business for over 29 years. Libertex is not a con.

Can you make money with Libertex?

Although traders have had great success with Libertex, trading on the financial markets with Libertex is not a get-rich scheme. If you educate yourself, practise with a demo account and carefully plan your trading, your chance of success will greatly increase. Never trade with money you cannot afford to lose. Your capital is at risk.

Does Libertex have fees?

Libertex doesn't charge withdrawal fees. Libertex does charge a fee for inactive accounts. Libertex doesn't charge deposit fees.

When was Libertex founded?

Libertex was founded in 1997.

How many people use Libertex?

Libertex is used by over 3,000,000 registered Libertex users.

What is Libertex Headquarters country?

Libertex has its head quarters office in Cyprus .

Does Libertex offer negative balance protection?

Libertex offers negative balance protection. With Negative balance protection, traders cannot lose more money than they have deposited.

Does Libertex offer guaranteed stop loss?

Libertex does not offer guaranteed stop loss. With guaranteed stop loss protection, risk is managed. Traders are guaranteed to close your trade at your specified price. Stop Loss orders are guaranteed only during market hours and under normal trading conditions.

Does Libertex allow scalping?

Libertex offers scalping.

Does Libertex allow hedging?

Libertex does not offer hedging.

Does Libertex offer CFD trading?

Libertex offers CFD trading.

Does Libertex offer STP?

Libertex offers STP trading.

How many people use Libertex?

Libertex is used by over 3000000 Libertex users and traders.

Is Libertex an ECN broker?

Libertex does not offer ECN trading.

Does Libertex offer a demo account?

Libertex offers a demo account.

Does Libertex offer an Islamic account?

Libertex offers an Islamic account.

What are the funding methods for Libertex?

Please note that funding methods and options available with Libertex can be found in the Libertex Members area and depend on the Libertex client’s country of residence. Please check your specific available payment methods on the Libertex website. Libertex accept the following funding methods : Debit Cards, Credit Cards, VISA, MasterCards, PayPal, Sofort, Deal, Trustly, Skrill, Neteller, GiroPay, SEPA International Bank Wire, MB MultiBanco, Przelewy42, Blik, eService.