Top Managed Forex Accounts for 2025

We found 11 online brokers that are appropriate for Trading Managed Forex Accounts.

Best Managed Forex Accounts Guide

Analysis by Andrew Blumer, Updated Last updated – June 18, 2025

Managed Forex Accounts

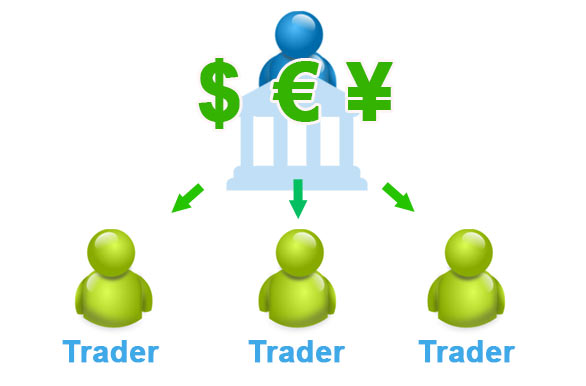

Managed Forex accounts are currency investment plans that are managed by financial professionals in banks, financial institutions, and other institutions. They can be traded online or over the telephone with an experienced broker. These accounts have a variety of benefits but also come with a few disadvantages. One of these disadvantages is that the rates tend to be very low for these Forex managed accounts. Many people do not know that they can get better rates via a Forex account.

A Forex account that is managed is where a currency manager manages the trades and investments on the behalf of their clients. They manage the clients' accounts by looking for Forex trading opportunities, setting the risk level, implementing their strategies, or taking advice from the client on how they want to trade. Once a trader executes successful trades with the broker, they will get a small fee from the account manager or bank that allows them to get a percentage of the profit.

Managed Forex Account Risk Management

The risk level of managed Forex accounts is usually very high. This is because the manager is investing a lot of money. One is less likely, however, to suffer a large loss than they would be if they were trading alone.

It is not uncommon for the account manager to suffer a loss during the first year of Forex trading, but they usually learn from their mistakes and start to increase the amount they invest each month.

Deep knowledge about Forex is important to successfully trade in currency pairs. The best managed Forex accounts at the hands of professionals usually yield more returns compared to more casual traders.

A managed account is an account that is managed by market professionals on behalf of a trader.

It is not like a regular account in which a trader has to make all decisions when buying and selling assets at their discretion.

Managed accounts are comparatively expensive. Higher fees and costs are levied with professionally managed accounts. Managed Forex accounts have higher minimum deposit requirements in most cases.

What Is Forex?

Forex is the acronym for foreign exchange. Many address it just as FX. It is a global marketplace for trading. It is open 24-hour a day for five days a week. It is not traded over the weekend. It is the largest financial market globally, and the daily average turnover is over $6 trillion. It is decentralised.

It means no single government, agency, or authority has complete control over it. It has the most liquidity compared to other financial markets and is volatile as the prices of most currencies fluctuate throughout the day. The factors that make the market volatile include the political condition of a country, public sentiments and breaking news related to finance and economics.

What Are Managed Forex Accounts?

Managed accounts are an exciting investment option for people who are ready to take on the risk involved in getting higher returns from more risky trading for example leveraged foreign currency trading.

They are for people who are ready to take real risks and wish for professionals to do the initial work of selection and trading. There are several different types of managed accounts available and choosing the best one for you depends on your circumstances. One of the most common types is a trading account.

This is the most simple and basic account, where you trade in 'real' money using an online transaction. You could choose from many different Forex brokerages offering this type of account, and it is fast and easy to set up.

You don't have to know a lot about the Forex market to start, but to be successful you need to use the tools provided by the broker to help you find and trade the right pairs of currencies.

Managed Forex Account Explained

It is an investment opportunity for high-risk attitude investors to earn potential returns from the leveraged trading and with the help of professionals to do all the trading.

In simple terms, it is like putting money in a Forex managed account and asking a professional to trade on his behalf. Investors opting for managed accounts usually look for large gains alongside severe losses that may occur.

The asset class offered in the account is different from that of stocks or bonds. It is not like the traditional securities that deliver returns like dividends. The return here is in value. Investments are either made by speculators or hedge risk in the market.

With managed Forex accounts you can start with lower returns, or just let your capital grow as you see fit. The key to making large profits in the Forex market is to understand that Forex profits are not just coming from direct sales of individual trades but the spread between two currencies. You make the profits when you spot a profitable trade, then you cover your spread, allowing you to sell your option at the difference to make a profit.

Some investors have used their funds to buy several different Forex pairs, allowing them to diversify their portfolios. However, some traders like to concentrate on only a few select currencies, so they have less chance of losing money. There are many investors out there who make a living trading only one or two particular pairs.

Whatever your chosen area of expertise, there are several opportunities available to you in the form of managed accounts, both online and off. If you want to invest in a specific pair or several, you need to be aware that you will need to learn how to trade that currency.

Managed Forex Account Key Highlights

- A managed Forex account means investing in Forex with the help of professionals.

- It helps expose different asset classes compared to bonds and stocks.

- It is a high-reward as well as a high-risk investment.

- Account managers usually charge a high fee for their trading service and it is somewhere between 20 and 30 percent of the earnings.

Understanding Managed Forex Accounts

Understanding managed Forex accounts is important for investors who are just starting with Forex. This type of account allows Forex traders to make trades without risking their own money. When looking for a managed funds provider, it's important to understand how you can track your funds through the account.

Most brokers have integrated directly with hedge fund managers to provide real-time information about current positions, transactions, and performance. Track how your money is doing with managed Forex accounts to see if you're getting the best returns and to control the risks.

Many investors start an account with just one specific type of investment. Some go for safe stocks while others get into risky options like commodity and bond funds. A managed Forex accounts service will let you invest in many different types of accounts. The best providers will let you track all of your investments so you can choose the ones that will give you the best return.

For a managed Forex accounts service to be of high quality, it must be visited by a lot of people used to managing currency. The more people who use the service, the better it is because more options are offered, and the account manager's skill level can be improved. Some brokers have managers that only handle accounts close to their lifetimes so it's important to find a broker with people who have access to their accounts during important times such as when expiration occurs.

The Safety Of Managed Forex Accounts

When you trade in the market, one of the issues that you will need to consider is the safety of your trades. This can be achieved through the use of managed Forex accounts. These are the best way of ensuring that your trades are safe and secure. Here is a look at how these types of accounts work.

When a trader opens a managed account, they will have the opportunity to trade in many different currencies. Traders then make decisions about which currencies to trade-in. The benefits here are that there is no interaction between the trader and the platform. There is also no risk to the trader in that their trades are not affected if another platform loses its money.

For a managed account to be opened by a trader there are certain requirements needed. The trader needs to be independent and able to make their own decisions on which currencies to trade-in. It also needs to be of a minimum amount. Once you have opened an account, you are not tied to it. You can change currencies whenever you like and when you wish. The platforms still hold the majority of the account balance.

Why Are Managed Forex Accounts Required?

The requirement depends on the involvement a trader wants to undertake in the market.

If traders prefer the advice from finance professionals and allow them to action and advise managed forex accounts are perfect.

If complete control is required with personal involvement, managed Forex accounts should not be considered.

Managed Forex Accounts Features

The priority feature of managed Forex accounts are consistent profitability and low maximum levels of drawdowns.

Let's understand the maximum drawdown level with an example. Suppose a trader starts his account with a fund of $10K.

The fund first increases to $20K and thereafter decreases to $9K. Next, it increases to $21K and again comes down to $6K. Later, again an increase is seen to $22K.

The equity high net worth here is $22K; the low is $6K. The maximum drawdown is as such:

($22K - $6K) / $22K = 72%

The calculation is considered a high maximum drawdown. The example above illustrates a risky investment.

In short, less risk is reflected with lower maximum drawdown.

Traders need to know the type of return on investment they are expecting. Moreover, which model of managed Forex account is suitable for them.

Below are the account models:

- Percentage Allocation Management Module (or PAMM).

- Multi-Account Management Module (or MAMM).

- Lot allocation management module (or LAMM).

- Ensure your chosen Managed Forex Accounts broker has a solid track record of at least two years in the industry.

- Verify that the Managed Forex Accounts broker has a customer support team of at least 15 members responsive to queries and concerns.

- Check if the Managed Forex Accounts broker operates under the regulatory framework of a jurisdiction that can hold it accountable for any misconduct or resolve disputes fairly and impartially.

- Ensure that the Managed Forex Accounts broker can process deposits and withdrawals within two to three days, which is crucial when you need to access your funds quickly.

- Look for Managed Forex Accounts brokers with an international presence in multiple countries, offering its clients local seminars and training programs.

- Ensure the Managed Forex Accounts broker can hire staff from diverse locations worldwide who can communicate fluently in your local language.

- Minimum deposit requirement for opening an account with each managed forex accounts broker.

- The funding methods available for managed forex accounts with each broker.

- The types of instruments you can trade with each managed forex accounts broker, such as forex, stocks, commodities, and indices.

- The trading platforms each managed forex accounts broker provides, including their features, ease of use, and compatibility with your devices.

- The spread type (if applicable) for each managed forex accounts broker affects the cost of trading.

- The level of customer support each managed forex accounts broker offers, including their availability, responsiveness, and quality of service.

- Whether each managed forex accounts broker offers Micro, Standard, VIP, or Islamic accounts to suit your trading style and preferences.

- Bank transfer

- Credit Card

- Paypal

- Bank transfer

- Credit Card

- Paypal

- Bank transfer

- Credit Card

- Paypal

- Bank transfer

- Credit Card

- Paypal

- Bank transfer

- Credit Card

- Paypal

- Bank transfer

- Credit Card

- Paypal

- Bank transfer

- Credit Card

- Paypal

- Bank transfer

- Credit Card

- Paypal

- Bank transfer

- Credit Card

- Paypal

- Bank transfer

- Credit Card

- Paypal

- Bank transfer

- Credit Card

- Paypal

- Allows scalping

- Allows hedging

- Low min deposit

- Offers Negative Balance Protection

- Allows scalping

- Allows hedging

- Offers STP

- Low min deposit

- Offers Negative Balance Protection

- Allows scalping

- Allows hedging

- Offers STP

- Offers Negative Balance Protection

- Low min deposit

- Allows scalping

- Allows hedging

- Low min deposit

- Guaranteed stop loss

- Offers Negative Balance Protection

- Low min deposit

- Allows hedging

- Offers STP

- Low min deposit

- Offers Negative Balance Protection

- Low min deposit

- Low min deposit

- Low min deposit

- Demo account

- Micro account

- Mini account

- Standard account

- Managed account

- Islamic account

- Demo account

- Micro account

- Mini account

- Standard account

- ECN account

- Managed account

- Islamic account

- Demo account

- Mini account

- Standard account

- ECN account

- Managed account

- Standard account

- Managed account

- Demo account

- Mini account

- Standard account

- ECN account

- Managed account

- Demo account

- Mini account

- Managed account

- Mini account

- Managed account

- Demo account

- ECN account

- Managed account

- Demo account

- ECN account

- Managed account

- Islamic account

- Demo account

- Mini account

- Managed account

- Islamic account

- Demo account

- Standard account

- Managed account

- Live chat

- Phone support

- Email support

- Live chat

- Phone support

- Email support

- Live chat

- Phone support

- Email support

- Live chat

- Phone support

- Email support

- Live chat

- Phone support

- Email support

- Live chat

- Phone support

- Email support

- Live chat

- Phone support

- Email support

- Live chat

- Phone support

- Email support

- Live chat

- Phone support

- Email support

- Live chat

- Phone support

- Email support

- Live chat

- Phone support

- Email support

Who Should Use Managed Forex Accounts?

Managed foreign exchange accounts work best for the following types of traders:

Traders Too Preoccupied To Monitor The Market

A lot of people do not have the time, resources, or experience to trade actively in the foreign exchange market. Keeping tabs on the market is a proper commitment and other factors like career or family responsibilities can distract you from trading. In such a case, a managed foreign exchange account allows you the liberty to indulge in other activities that would otherwise be harder for you if you had to keep tabs on the market yourself.

Traders Who Want To Hand Over Control To Someone Else

If you have some experience trading in the foreign exchange market, you must have somewhat of an idea of the uncertainties most traders go through, aside from the remarkable volatility that currency pairs can display. Be wary of your restrictions if you find yourself having issues with losses and employ an experienced professional to do the job for you.

Traders Who Do Not Think (Or Plan) Like Traders

Some individuals simply do not have the personality types ideally suited for trading. For instance, if you find it difficult to accept whenever you are wrong, sticking to a losing position may eliminate your trading account. Overtrading (which happens when you enjoy the thrill of trading) can also affect you financially, psychologically, and physically. Instead of taking risks yourself when you are not able to, it is best to opt for a Forex account manager to do the job for you.

Traders Who Keep Future Planning In Mind

If you aim to plan for the future, chances are you are holding assets for the long-term and need a custodian of sorts to take care of your assets and manage them. In that regard, you can benefit from a managed account aiming to achieve these objectives. Go with a broker who offers Forex accounts, let them know your objectives, and ensure you manage to achieve them. A managed Forex account lets you sideline your investments with the knowledge that they are going to continue gaining value and be taken care of properly.

Who Should Avoid Managed Accounts?

Managed Forex accounts may not be the best for traders in the following circumstances:

Traders Who Want Control Over Their Finances And Trading

If you have experience in trading and want complete control over your account and your assets, you may not be satisfied using a managed Forex account.

You Do Not Have Sufficient Risk Capital

The minimum required deposits needed to run a combined managed account normally begin at $2K. Individually managed accounts, on the other hand, require a deposit worth $10K. This may discourage traders from going with a managed Forex account.

Not For Those Only Interested In Earning Quick Money

While you can invest in the foreign exchange market to earn some quick money, you oftentimes need full control of your trading account to do such a thing. A managed foreign exchange account cannot offer instant money the way a seasoned investor would gain revenue from short-term investments. If you are planning on earning instant money, you will most probably need an individual account for that to manually operate.

You Want To Avoid The Required Process For Setting Up A Managed Account

Finding a good asset manager calls for a lot of research and paperwork, more so than trading using an account on your own. Obtaining a managed account requires signing an LPOA (or a limited power of attorney agreement), a legal record that confirms that you have allowed the account manager to conduct trades for you.

Bear in mind that you are still susceptible to losing capital via a managed Forex account and that widely depends on the risk level, asset manager, and market activity, aside from other existing terms of your contract.

Thus, you should carefully look through testimonials and track records for the account managers you are considering working with. Also, ensure that they are well-reputed in the trading community.

Advantages Of Managed Forex Accounts

Below are the advantages commonly associated with Forex managed accounts:

You Save Time

The Forex market is active twenty-four hours a day, five days a week. A majority of novice traders may not have the time to take advantage of all the opportunities offered by the foreign exchange market.

Appointing an experienced professional to carry out your trades for you, they will dedicate a majority of their time to finding the setups and growing your account for you, therefore ensuring you get the best out of your trading experience.

This is also a sure way to gain insight into how the foreign exchange market works and how you can trade using various types of Forex managed accounts.

Complete Control

One of the most obvious advantages of using managed accounts is that you have and maintain full control over when you want to invest or pull out of a deal. In certain cases, using a PAMM system will let you establish a stop-loss mechanism to avoid big losses.

Stop loss is a command to inform the broker to put a pause on copying a trader’s trades if your account ends up below a set level. This comes in handy plenty of times in case of drawdowns; that way you can safeguard your capital.

Security

Well-reputed Forex managed accounts will require you to deposit funds into an account with a thoroughly regulated broker. This is crucial because unregulated brokers lack regulatory oversight, and that may turn out to be disadvantageous for you as you want to keep your capital safe.

The fact that you are only required to deposit funds with a broker is one of the best features a managed account can offer. Note that the asset manager is not legally allowed to ask you to deposit funds into their Forex managed accounts.

LAMM, MAMM, and PAMM systems work through an LPOA, where you allow a trader to conduct trades on your behalf. They are not, however, allowed to withdraw your funds or move them.

Opting For A Managed Forex Fund

Investors often feel more at ease pooling their funds with other investors via a managed fund. If you have invested in a hedge fund or mutual fund in the past, you are most likely familiar with how a managed foreign exchange fund works.

Forex funds are normally run by corporations who appoint professional asset managers to manage and trade one or multiple trading portfolios. Managed foreign exchange fund portfolios usually comprise a basket of varying currencies.

Any managed fund you opt for investing in must have a track record of at least three to five years for traders to review for profitability, with a tolerable level of drawdowns.

Forex funds may also offer prospectuses with extra details about how their fund works and what their managerial style is.

Managed Forex Account Cost And Safety

Foreign exchange trading is for sophisticated traders as they can handle the borrowed money and simultaneously amplify the gains. The trades are faster as the Forex market has more liquidity than the stock and bond markets. Moreover, the transaction costs are reasonably lower.

However, Forex is dangerous for beginners and novice traders as they may not understand the leverage effects on returns. They may lack the perception of breaking news related to monetary policy or economic releases.

Ordinary investors can take the help of Forex managed accounts and benefit from the knowledge and experience of expertise. The drawback is a high fee charged by the professionals to trade on behalf of an investor. They take away about 20 or 30 per cent of the profits.

Managed Forex Account Consideration

An account manager's risk/reward profile should be considered while opening a managed Forex account.

A look at the performance gauge becomes important. Many look at the Calmar Ratio. If it is higher, the manager is better. Lower Calmar Ratio refers to bad risk-adjusted return results.

Account Management And Forex

An account manager trades the capital of several investors in a managed Forex account setup. Discretionary power is enjoyed in buying and selling currencies on behalf of the account holders.

Decisions are not consulted, and a performance fee is charged. It means the fee is paid when returns are positive.

Managed Forex Accounts Verdict

Managed Forex accounts play an important role in profitable trading when traders are busy with other things.

Investors should choose reputable Forex brokers who have good knowledge about the markets and who can have a proven portfolio.

Poor research when choosing a managed Forex account broker may increase the chances of a loss of investment.

The name defines a Forex account well managed by professionals. A managed Forex account is best suited for inexperienced traders looking for good returns from the investment. Account managers trade on behalf of the traders to help gain money and get performance fees.

This article briefly discussed the various aspects of a managed account and explained why it is helpful for beginners and novice traders. It is suggested to always deal with a regulated broker to avoid getting scammed.

We have conducted extensive research and analysis on over multiple data points on Managed Forex Accounts to present you with a comprehensive guide that can help you find the most suitable Managed Forex Accounts. Below we shortlist what we think are the best managed forex accounts after careful consideration and evaluation. We hope this list will assist you in making an informed decision when researching Managed Forex Accounts.

Reputable Managed Forex Accounts Checklist

Selecting a reliable and reputable online Managed Forex Accounts trading brokerage involves assessing their track record, regulatory status, customer support, processing times, international presence, and language capabilities. Considering these factors, you can make an informed decision and trade Managed Forex Accounts more confidently.

Selecting the right online Managed Forex Accounts trading brokerage requires careful consideration of several critical factors. Here are some essential points to keep in mind:

Our team have listed brokers that match your criteria for you below. All brokerage data has been summarised into a comparison table. Scroll down.

Compare Key Features of Managed Forex Accounts in Our Brokerage Comparison Table

When choosing a broker for managed forex accounts trading, it's essential to compare the different options available to you. Our managed forex accounts brokerage comparison table below allows you to compare several important features side by side, making it easier to make an informed choice.

By comparing these essential features, you can choose a managed forex accounts broker that best suits your needs and preferences for managed forex accounts. Our managed forex accounts broker comparison table simplifies the process, allowing you to make a more informed decision.

Top 15 Managed Forex Accounts of 2025 compared

Here are the top Managed Forex Accounts.

Compare managed forex accounts brokers for min deposits, funding, used by, benefits, account types, platforms, and support levels. When searching for a managed forex accounts broker, it's crucial to compare several factors to choose the right one for your managed forex accounts needs. Our comparison tool allows you to compare the essential features side by side.

All brokers below are managed forex accounts. Learn more about what they offer below.

You can scroll left and right on the comparison table below to see more managed forex accounts that accept managed forex accounts clients.

| Broker |

AvaTrade

|

FXPrimus

|

IB

|

binance

|

CMC Markets

|

zackstrade

|

nabtrade

|

templerfxbrokerage

|

fidelity

|

allyinvest

|

afluentaperusac

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rating | |||||||||||

| Regulation | Australian Securities and Investments Commission (ASIC) Ava Capital Markets Australia Pty Ltd (406684), South African Financial Sector Conduct Authority (FSCA) Ava Capital Markets Pty Ltd (45984), Financial Services Agency (Japan FSA) Ava Trade Japan K.K. (1662), Financial Futures Association of Japan (FFAJ),, FFAJ, Abu Dhabi Global Markets (ADGM)(190018) Ava Trade Middle East Ltd (190018), Polish Financial Supervision Authority (KNF) AVA Trade EU Ltd, Central Bank of Ireland (C53877) AVA Trade EU Ltd, British Virgin Islands Financial Services Commission (BVI) BVI (SIBA/L/13/1049), Israel Securities Association (ISA) (514666577) ATrade Ltd, Financial Regulatory Services Authority (FRSA) | VFSC (Vanuatu Financial Services Commission) (14595), CySEC (Cyprus Securities and Exchange Commission) (261/14) | NYSE (New York Stock Exchange), FINRA (Financial Industry Regulatory Authority), SIPC (Securities Investor Protection Corporation), CIRO (Canadian Investment Regulatory Organization), FCA (Financial Conduct Authority) (208159), CBI (Central Bank of Ireland), ASIC (Australian Securities and Investments Commission) (453554), SEHK (Securities and Futures Commission, Hong Kong), MAS (Monetary Authority of Singapore) (CMS100917) | AMF (Autorité des Marchés Financiers, France) (E2022-037), OAM (Organismo Agenti e Mediatori, Italy) (PSV5), FIU (Financial Intelligence Unit, Lithuania) (305595206), Bank of Spain (D661), Polish Tax Administration (RDWW – 465), SFSA (Swedish Financial Supervisory Authority) (66822), AFSA (Astana Financial Services Authority, Kazakhstan), FSR (Financial Services Regulatory Authority, Abu Dhabi), CBB (Central Bank of Bahrain), VARA (Dubai Virtual Asset Regulatory Authority), AUSTRAC (Australian Transaction Reports and Analysis Centre) (100576141-001), FIU-IND (Financial Intelligence Unit - India), Bappebti (Indonesia) (001/BAPPEBTI/CP-AK/11/2019), JFSA (Japan Financial Services Agency) (Kanto Local Finance Bureau 00031), FSP (New Zealand Financial Service Providers Register) (FSP1003864), SEC (Securities and Exchange Commission, Thailand), SAT (Tax Administration Service, Mexico), CNAD (Comisión Nacional De Activos Digitales, El Salvador) (PSDA/001-2003), FSCA (Financial Sector Conduct Authority, South Africa) | BaFin (Bundesanstalt für Finanzdienstleistungsaufsicht) (154814), FCA (Financial Conduct Authority) (173730) | FINRA (Financial Industry Regulatory Authority), SIPC (Securities Investor Protection Corporation) | WealthHub Securities Limited (ABN 83 089 718 249), AFSL (Australian Financial Services Licence) (230704) | FSP (Financial Service Provider) (161410), Financial Services Authority (FSA) of Saint Vincent and the Grenadines | Financial Industry Regulatory Authority (FINRA) (CRD#: 7784), Securities and Exchange Commission (SEC) (SEC#: 8-23292), Commodity Futures Trading Commission (CFTC) (NFA ID: 0308076) through National Futures Association (NFA) registration | FINRA (Financial Industry Regulatory Authority) (Member Firm ID #136131), SEC (Securities and Exchange Commission) (SEC File No: 8-66239), SIPC (Securities Investor Protection Corporation) | SMV (Superintendencia del Mercado de Valores) |

| Min Deposit | 100 | 15 | 10000 | No minimum deposit | No minimum deposit | 250 | 500 | 1 | No minimum deposit | No minimum deposit | No minimum deposit |

| Funding |

|

|

|

|

|

|

|

|

|

|

|

| Used By | 400,000+ | 300,000+ | 3,120,000+ | 200,000,000+ | 1,388,000+ | 720,000+ | 10,000+ | 10,000+ | 44,200,000+ | 11,000,000+ | 6,000,000+ |

| Benefits |

|

|

|

|

|

|

|

|

|

|

|

| Accounts |

|

|

|

|

|

|

|

|

|

|

|

| Platforms | MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play) | WebTrader, MT4, MT5, cTrader, Mobile Apps, iOS (App Store), Android (Google Play) | IBKR GlobalTrader, IBKR Desktop, IBKR Mobile, Trader Workstation (TWS), IBKR APIs, IBKR ForecastTrader, IMPACT, Mobile Apps, iOS (App Store), Android (Google Play) | Apple App iOS, Android Google Play, MacOS, Windows, Linux, Desktop | MT4, Web Platfrom, Mobile Apps, iOS (App Store), Android (Google Play) | Mobile Apps, Android (Google Play), iOS (App Store), Zacks Trade Pro, Zack Trade App, Web | Desktop, Mobile apps, Android (Google Play), iOS (App Store), IRESS Viewpoint | Templer FX Trader, MT4, Templer FX for Blackberry, Linux, MacOS, Templer FX WebTrader, Web, Mobile Apps, iOS (App Store), Android (Google Play) | Fidelity Mobile, Android (Google Play), iOS (App Store), Trading Dashboard, Active Trader Pro | Mobile Apps, Web, iOS (App Store), Android (Google Play) | Web, Desktop, Mobile Apps, iPhone, iOS (App Store), Android (Google Play) |

| Support |

|

|

|

|

|

|

|

|

|

|

|

| Learn More |

Sign

Up with avatrade |

Sign

Up with fxprimus |

Sign

Up with interactivebrokers |

Sign

Up with binance |

Sign

Up with cmcmarkets |

Sign

Up with zackstrade |

Sign

Up with nabtrade |

Sign

Up with templerfxbrokerage |

Sign

Up with fidelity |

Sign

Up with allyinvest |

Sign

Up with afluentaperusac |

| Risk Warning | 71% of retail investor accounts lose money when trading CFDs with this provider | Losses can exceed deposits | Losses can exceed deposits | Your capital is at risk | Losses can exceed deposits | Your capital is at risk | Your capital is at risk | Your capital is at risk | Your capital is at risk | Your capital is at risk | Your capital is at risk |

| Demo |

AvaTrade Demo |

FXPrimus Demo |

Interactive Brokers Demo |

Binance Demo |

CMC Markets Demo |

Zacks Trade Demo |

NabTrade Demo |

Templer FX Brokerage Demo |

Fidelity Demo |

Ally Invest Demo |

Afluenta Peru SAC Demo |

| Excluded Countries | BE, BR, KP, NZ, TR, US, CA, SG | AF, CI, CU, IQ, IR, LY, MM, KR, SD, PR, US, AU, SY, DZ, JP, EC. | US | RU | US | US | US | US |

All Managed forex accounts in more detail

You can compare Managed Forex Accounts ratings, min deposits what the the broker offers, funding methods, platforms, spread types, customer support options, regulation and account types side by side.

We also have an indepth Top Managed Forex Accounts for 2025 article further below. You can see it now by clicking here

We have listed top Managed forex accounts below.

Managed Forex Accounts List

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, MT5, Web Trading, AvaTrade App, AvaOptions, Mac Trading, AvaSocial, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

WebTrader, MT4, MT5, cTrader, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

IBKR GlobalTrader, IBKR Desktop, IBKR Mobile, Trader Workstation (TWS), IBKR APIs, IBKR ForecastTrader, IMPACT, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Apple App iOS, Android Google Play, MacOS, Windows, Linux, DesktopCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

MT4, Web Platfrom, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Mobile Apps, Android (Google Play), iOS (App Store), Zacks Trade Pro, Zack Trade App, WebCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Desktop, Mobile apps, Android (Google Play), iOS (App Store), IRESS ViewpointCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Templer FX Trader, MT4, Templer FX for Blackberry, Linux, MacOS, Templer FX WebTrader, Web, Mobile Apps, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Fidelity Mobile, Android (Google Play), iOS (App Store), Trading Dashboard, Active Trader ProCustomer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Mobile Apps, Web, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Funding methods

Bank transfer Credit Card PaypalPlatforms

Web, Desktop, Mobile Apps, iPhone, iOS (App Store), Android (Google Play)Customer support

Live chat Phone support Email supportAccount Types

Micro account Standard account ECN accountIslamic account VIP account

Learn more

71% of retail investor accounts lose money when trading CFDs with this provider

71% of retail investor accounts lose money when trading CFDs with this provider

71% of retail investor accounts lose money when trading CFDs with this provider