Currency Strength Index Table of Contents

- What is the Currency Strength Index?

- Strong Currency Implications

- Weak Currency Implications

- Currency Strength Index Verdict

- Currency Strength Index FAQ

- What is a currency strength index?

- Strong currency Implications

- Weak currency implications

Currency Strength Index In Detail

What is the Currency Strength Index?

The currency strength index helps traders and financial professionals understand whether a currency is gaining strength or becoming weaker.

A currency becomes strong when it gains value compared to another country’s currency and vice versa. when we talk about a currency becoming weaker its value declines against another countries currency.

There are several factors involved to make a currency strong or weak. These factors can be complicated, we discuss the primary ones below:

Interest rates

If the economic policy of a country offers higher interest rates, more foreign investors will make an investment in assets in that country. This process makes the currency stronger as the demand and price of the currency increases.

Economic policies

Inflationary monetary policies as well as a fiscal discipline helps in making the currency strong. Government debt and higher inflation make a currency weak.

Stability

Investors usually like investing in a country that has a well-established government. A stable government results in strengthening the currency.

Currency Strength Index Simplified

A simplified value used to calculated as a currencies purchasing power.

The currency strength index is an indicator of the value of the currency when compared to other currencies.

The idea behind the strength index is to help traders and financial professionals understand which currencies are a good investment.

The most commonly used currency strength indicators are relative and percentage based. Combining both these strength indexes is known as the Forex Flow indicator.

Strong Currency Implications

A strong currency can have major effects on the economy. A strong currency means export volume may become low as other countries find buying products from that country expensive.

When exports decrease, the revenue of the country also decreases.

However, a positive side of this is that importing goods will become cheaper. Foreign sourced products sold in the country will generally become cheaper.

Weak Currency Implications

A weak currency can cause exports to increase as prices are low.

If a countries currency becomes weak, importing goods becomes expensive and citizens will find the cost of foreign products in their country more expensive.

Similarly, the export will rise as other countries will find buying products cheaper. This results in greater revenue for the country, helping Economic growth.

Currency Strength Index Verdict

Currency strength indexes are a good measure for traders to know about the strength and weakness of a currency before speculating on currency investments.

There is a currency strength index for each currency and it is an indicator of the health of that currency.

Currency strength indexes are used during investment research, helping traders to know whether to buy, sell, avoid or hold a currency.

Currency Strength Statistics and Study’s

Understanding the nature and strength of currency is an important economic science.

Currency strength research is important for data mining, trading systems and Forex worldwide.

90% of all worldwide Forex exchanges are the below seven currencies.

- USD

- EUR

- JPY

- GBP

- CHF

- AUD

- CAD

- NZD

A recent 2018 study by the College of Engineering at Abu Dhabi University in UAE showed that currency strength indicators did have a huge effect of trading patterns of traders.

The study showed that when currencies are strong and their prices are going higher the majority of traders will sell. When currencies are weak ie their prices are declining the study showed an increase in buy trades of currency.

This shows the importance of currency strength indicators and how they can have very real effects on the volatility of currency markets.

You can read more on the study and its findings here [source].

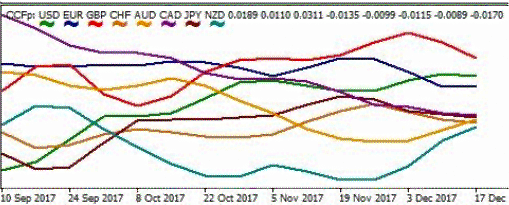

The below chart is from the Abu Dhabi College of Engineering study and illustrates the currency strength CCFP indicator showing relative strength of 8 currencies in 2017.

Currency Strength Index FAQ

What is a currency strength index?

The term is used in both Forex and futures to describe a completed buy or sell trade. When only half of the trade is completed it is known as a side.

Strong currency Implications

In the securities market, an offset means assuming the opposite position of investment with respect to the original opening position.

Weak currency Implications

A weak currency can cause exports to increase as prices are low.If a countries currency becomes weak, importing goods becomes expensive and citizens will find the cost of foreign products in their country more expensive.